AI Suggests Savings Plans

AI is transforming the way we save money. By analyzing spending habits and automatically suggesting personalized savings strategies, AI-powered finance apps help users manage money smarter, save effortlessly, and achieve their goals faster.

Saving money can be challenging in today's world – rising costs and busy lifestyles make it difficult to set aside funds consistently. Fortunately, artificial intelligence (AI) is revolutionizing personal finance through smart apps and tools that analyze your spending habits and deliver personalized savings strategies.

Modern AI-powered budgeting platforms connect directly to your financial accounts, automatically track spending patterns, and recommend optimal monthly savings amounts. By analyzing your income streams and expenses, these intelligent systems set dynamic savings targets that adapt as your financial situation evolves.

How AI Analyzes Your Finances

AI-driven finance applications operate by securely linking to your bank and credit card accounts, then scanning your complete transaction history. Using sophisticated machine learning algorithms, these systems categorize spending across multiple areas and continuously learn from your financial patterns.

Account Integration

Smart Categorization

Pattern Recognition

AI budgeting tools provide personalized tracking and insights by analyzing spending patterns and offering recommendations to help users manage their finances.

— SoFi Financial Services

Personalized Recommendations in Action

The AI delivers tailored suggestions based on your unique financial profile. For instance, if the system detects frequent restaurant spending, it might recommend home cooking to reduce expenses. Similarly, it can identify how small cuts in subscription services accumulate into significant savings over time.

Predictive Financial Analysis

Beyond historical analysis, AI tools employ predictive modeling to forecast your financial future. These systems can project whether you're on track to meet specific goals – such as saving for a house down payment – or if adjustments are needed.

Goal Forecasting

AI predicts your progress toward financial milestones and alerts you to potential shortfalls before they occur.

Custom Savings Schedules

Receives specific recommendations like "Save $150 per week this month to reach your emergency fund goal by year-end."

By processing your income, upcoming bills, and historical spending data, AI transforms raw financial information into a dynamic, personalized savings roadmap that evolves with your life circumstances.

Real-World AI Saving Tools

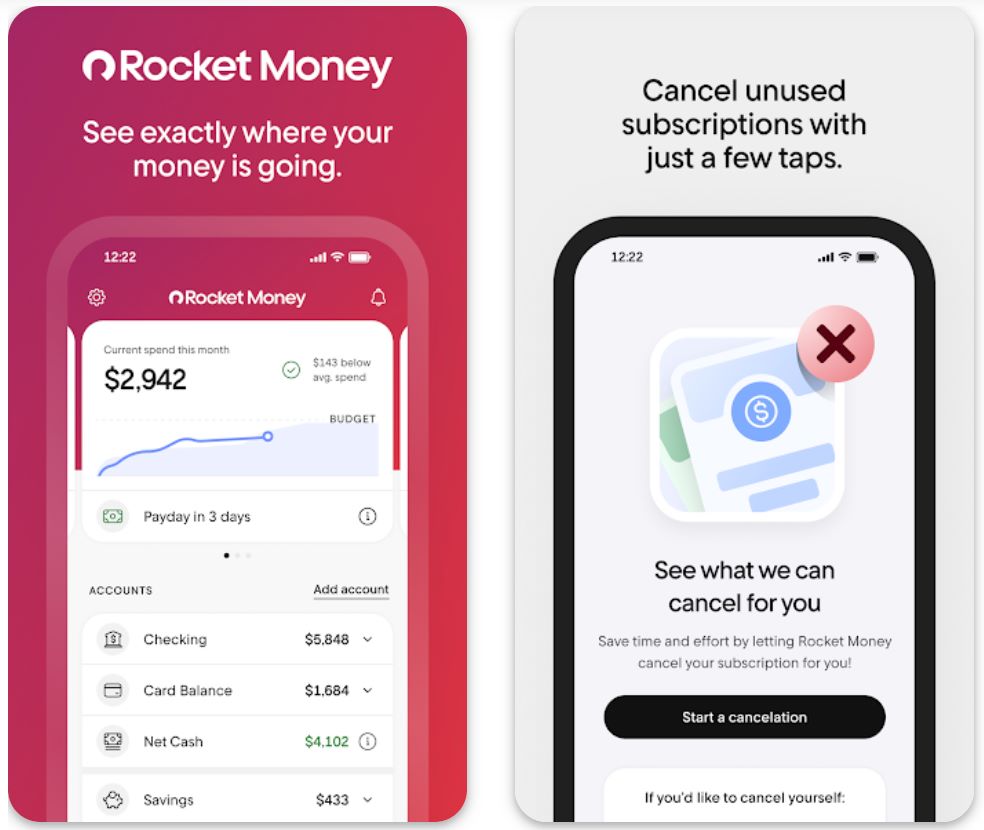

Rocket Money

| Developer | Rocket Money, Inc. (part of Rocket Companies) |

| Supported Platforms |

|

| Language & Availability | English only — U.S. residents with U.S.-based bank accounts |

| Pricing Model | Free to download with optional Premium subscription ($3–$12/month) for advanced features |

What is Rocket Money?

Rocket Money is a personal finance app that helps you take control of your spending, manage subscriptions, negotiate bills, and automate savings. Link your bank accounts, credit cards, and investments to get a complete view of your finances in one place. The free version tracks spending and identifies recurring charges, while Premium unlocks subscription cancellation assistance, bill negotiation, unlimited budgets, and automated savings transfers.

Why Use Rocket Money?

Managing recurring expenses and hidden subscriptions can drain your budget without you realizing it. Rocket Money simplifies financial management by aggregating all your accounts, highlighting recurring payments, and providing tools to redirect savings toward your goals.

With over 10 million members and more than $2.5 billion in gross savings generated, the app has proven its value. Once you link your checking, savings, credit, and investment accounts, Rocket Money categorizes your spending, alerts you to recurring payments, and helps you set achievable savings goals.

The standout feature is automated savings: set a goal, link your accounts, and the app moves funds into an FDIC-insured savings account without requiring constant attention.

Key Features

Categorizes transactions across all linked accounts automatically, giving you a clear view of where your money goes.

Identifies recurring charges and helps you cancel unwanted subscriptions. Premium members get concierge cancellation assistance.

Premium feature: Rocket Money's team negotiates lower rates on eligible bills like cable, internet, and phone services on your behalf.

Set financial goals and let the app automatically transfer funds based on your cash flow to help you reach targets faster.

Track your net worth (assets minus liabilities) and monitor credit score changes over time with Premium.

Create unlimited monthly budgets per category (dining, entertainment, shopping) and receive alerts when you're approaching limits.

Download Rocket Money

How to Get Started with Rocket Money

Install Rocket Money from the App Store or Google Play, then create a free account using your email address.

Connect your U.S. checking, savings, credit card, and investment accounts. The app uses secure partners like Plaid for bank linking.

Let the app categorize your spending and detect recurring subscriptions. Check the "Subscriptions" tab to see all recurring charges.

Premium members can select services to cancel directly in-app. The concierge team handles the cancellation process for you.

Navigate to "Financial Goals" or "Smart Savings," create a goal (e.g., "Emergency fund — $3,000"), and choose transfer frequency and amount.

Set budgets per category (Dining, Entertainment, Shopping) and track spending through the dashboard. Premium unlocks unlimited budget categories.

Premium subscribers can opt in to bill negotiation. Rocket Money reviews eligible bills (cable, internet, phone) and attempts to secure lower rates. You pay a portion of the savings if successful.

Track your net worth monthly (assets minus liabilities) and monitor credit score fluctuations if you're subscribed to Premium.

Configure safe-balance notifications, large transaction alerts, and upcoming renewal warnings to stay on top of your finances.

Cancel Premium anytime via app settings. Your free account remains active with limited features.

Important Limitations

- Premium costs: Advanced features require a monthly or annual subscription ($3–$12/month). Bill negotiation takes a percentage of savings as a service fee.

- Third-party dependencies: Account linking relies on services like Plaid. Connection issues may occur with certain banks, and not all account types are supported.

- Variable results: While Rocket Money claims significant savings for users, individual results vary. Some users report minimal savings from negotiations or automation.

- Currency limitation: The app operates exclusively in U.S. dollars within U.S. regulatory frameworks. International currencies and banks are not supported.

Frequently Asked Questions

Yes, Rocket Money uses bank-level encryption and partners with secure bank-linking services like Plaid to protect your financial data. Your account credentials are never stored directly by the app.

No, Rocket Money is only available to U.S. residents with U.S.-based bank accounts. The app does not support international banks or currencies.

The free version allows you to link accounts, view spending breakdowns, detect subscriptions, and set limited budgets. Premium features like cancellation concierge, automated savings transfers, unlimited budgets, bill negotiation, and credit monitoring require a paid subscription.

Premium pricing typically ranges from $3 to $12 per month, depending on the plan and current promotions. Some plans are billed annually. Check the app for current pricing in your area.

You can view all subscriptions with the free plan. However, the automated cancellation service — where Rocket Money contacts the provider on your behalf — is only available for Premium members.

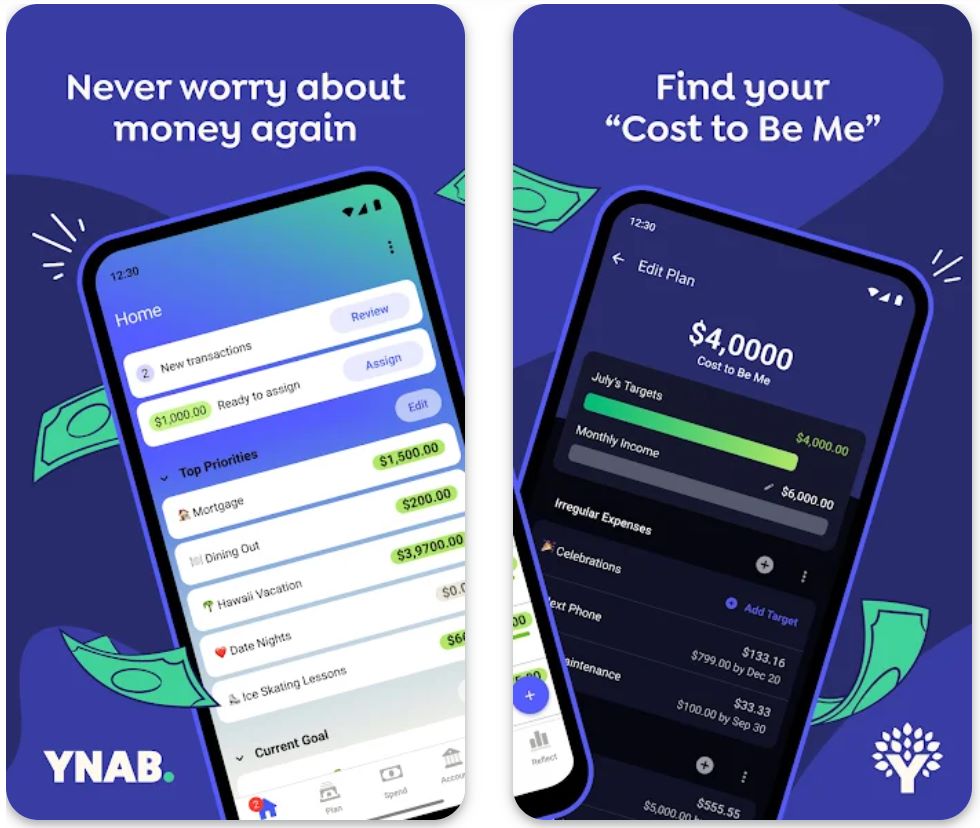

YNAB

Application Information

| Developer | You Need a Budget, Inc., founded by Jesse Mecham |

| Supported Platforms |

|

| Language Support | Primarily English; available in countries with bank-linking and currency support |

| Pricing Model | 34-day free trial, then paid subscription required for full access |

What is YNAB?

YNAB (You Need a Budget) is a budgeting application built around the principle of giving every dollar a job, using a zero-based budgeting method to help users actively assign and track their income, expenses, savings and goals. With real-time syncing across devices and a dedicated budgeting methodology, YNAB aims to shift users from reactive spending to proactive money management, reducing stress and increasing financial clarity.

How YNAB Works

In an era where many people feel they don't know where their money is going, YNAB offers a structured approach to controlling finances rather than simply monitoring them. Instead of waiting to see what's left at the end of the month, YNAB prompts you to assign each incoming dollar toward a purpose: expenses, savings, debt payoff or buffer. This fosters intentional spending and savings—aligning your finances with your life priorities.

The app's interface allows linking bank and credit accounts or entering transactions manually, categorising spending, and tracking the progress of goals and budgets. According to the developer, the average user in their survey saves significantly and feels less stress about money.

Key Features

Assign every dollar a specific job so income minus expenses equals zero, ensuring intentional spending.

Access your budget on web, iOS, and Android with automatic updates and syncing across all devices.

Plan for irregular or upcoming large costs by creating buffer categories for "true expenses."

Move money between budget categories when overspending occurs or priorities change.

Built-in workshops, support community, and tutorials help users adopt the budgeting method effectively.

Download or Access Link

How to Use YNAB

Sign up for a free trial via YNAB's website or mobile app and link your bank, savings, credit-card accounts (or choose manual entry).

Import or enter your current account balances and recent transactions to bring your budget up to date.

Create budget categories (e.g., Rent, Groceries, Entertainment, Savings, Debt Repayment) and assign each dollar of your available money to a category.

As you spend, enter or let the app import transactions; review the "Available" amounts in each category to track how much you may still spend.

For upcoming expenses like insurance or annual subscriptions, create "true expense" categories and allocate small amounts monthly so the cost is already funded when due.

If you overspend in one category, use the app's flexibility to move funds from another category rather than overspending overall.

Work toward "ageing your money"—the goal is to reach a point where you are spending last month's income this month rather than this month's income, increasing buffer and stability.

Review your budget regularly (daily quick check, monthly full review) to keep categories aligned, refine spending, and adjust for life changes.

After the trial ends, subscribe if you wish to continue using full-feature access; otherwise, you can cancel before charges apply.

Important Limitations

- Hands-on approach required: The method works best if you actively allocate funds and review your budget regularly; less suited for passive "set-and-forget" use.

- Bank connection issues: Some users report limited automatic import support or regional bank connection issues outside major markets.

- Limited investment features: The app focuses strongly on budgeting and spending; fewer features for investments tracking, credit-score monitoring or bill negotiation compared to some rivals.

Frequently Asked Questions

Yes—YNAB offers a free trial (34 days) with full access to features so you can test the method before subscribing.

After the free trial ends, you must subscribe (monthly or annual plan) to continue using the app with full features.

Yes, it supports direct import from many banks, but some users may find linking is not perfect or manual entry may still be needed.

Yes—but note it takes some effort to set up budget categories and get familiar with the method. If you prefer a fully automated "financial autopilot" tool, you may need to commit to the learning curve.

Many users report improved control over their money, reduced stress and better savings habits through the method of budgeting actively. However, results depend on user engagement.

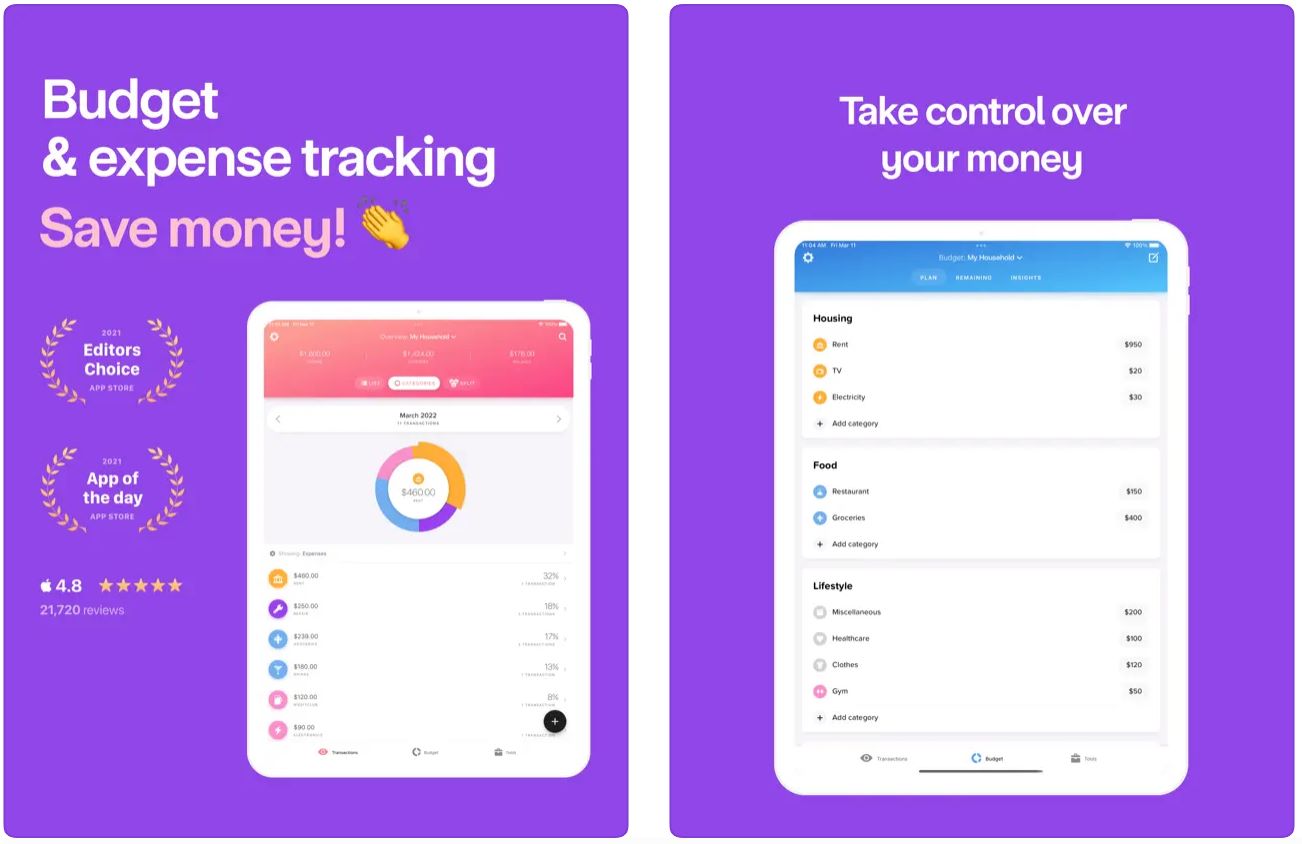

Buddy

| Developer | Buddy Budgeting AB |

| Supported Platforms |

|

| Language Support | 12+ languages including English, Danish, Dutch, French, German, Italian, Norwegian Bokmål, Polish, Portuguese, Russian, Spanish, Swedish, Turkish |

| Availability | Available in Australia, Canada, United States, and European markets |

| Pricing Model | Free to download with basic features. Premium subscription (monthly or annual) required for full functionality |

| User Base | Over 2.5 million users worldwide |

What is Buddy Budget & Save Money?

Buddy is an intuitive budgeting and savings app that simplifies personal and shared finances through collaborative features, visual spending insights, and easy-to-use budget planning tools. Designed as a "joyful budgeting" companion, it helps individuals, couples, and roommates take control of their money, track expenses, set realistic budgets, and share financial responsibility seamlessly.

Detailed Overview

Managing finances becomes overwhelming when juggling multiple accounts, shared expenses, or irregular income streams. Buddy simplifies this complexity with a clean, user-friendly design and streamlined workflow that makes budgeting accessible to everyone.

Start by creating customized budgets for spending categories, savings goals, and income tracking. Then monitor actual transactions, view remaining balances in real-time, and adjust allocations as your financial situation evolves throughout the month.

What sets Buddy apart is its emphasis on collaborative budgeting—invite your partner, roommate, or family member to share budgets, split expenses transparently, and maintain financial accountability together. With over 2.5 million users across multiple markets, Buddy has built its reputation on making budgeting enjoyable and accessible rather than overwhelming users with complex financial analytics.

Key Features

Create and customize budgets for spending, savings, income, and net worth across multiple accounts with flexible category management.

Track expenses manually or via bank import (region-dependent) with instant insights into spending patterns and budget status.

Invite partners or roommates to collaborate on joint budgets, track shared expenses, and split costs transparently.

Personalize your experience with themes, custom categories, dark mode, and support for multiple account types (savings, checking, debt).

Set specific savings goals, visualize progress with intuitive charts, and receive alerts to stay on track toward financial milestones.

Download or Access Link

How to Get Started with Buddy

Download Buddy from the App Store or Google Play (where available), then create your free account to begin.

Choose your base currency and create one or more "wallets" or accounts (checking, savings, debt) to organize your finances.

Build budget categories based on your income and spending plan (Housing, Food, Transport, Savings). Use default categories or create custom ones that match your lifestyle.

Input transactions manually or link your bank account (where supported). Assign each transaction to the appropriate category to track spending accurately.

Invite your partner or roommate to collaborate on shared budgets and split transactions for transparent household finance management.

Check your budget dashboard regularly to see remaining balances in each category and track progress toward savings goals.

Move funds between categories or modify budget allocations throughout the month as your financial circumstances change.

At month-end, review spending reports to identify overspending areas, recognize trends, and plan next month's budget more effectively.

Subscribe to Buddy Premium via in-app purchase to unlock unlimited accounts, bank imports (in supported markets), and advanced sharing features.

Turn on alerts to receive timely updates about budget status, overspending warnings, and shared budget activity.

Important Limitations to Consider

- Premium Required for Full Features: While basic budgeting is free, advanced functionality like sharing, multiple accounts, and bank imports requires a paid Premium subscription.

- Limited Transaction Splitting: Some users report the inability to split a single transaction across multiple budget categories, which can be inconvenient for complex purchases.

- Budgeting Focus Only: Buddy specializes in budgeting and expense tracking rather than investment management or professional financial advising—users needing deep analytics may require additional tools.

- Free Tier Restrictions: The free version works well for simple budgets, but power users managing multiple accounts or shared household finances will likely need the Premium tier for optimal value.

Frequently Asked Questions

Yes, Buddy is free to download and offers essential budgeting and expense tracking features at no cost. However, to access the complete feature set—including unlimited accounts, bank imports, and collaborative budgeting—you'll need to subscribe to the Premium plan (available as monthly or annual subscription).

Bank linking availability depends on your region. Buddy supports open banking and automatic transaction imports in some countries, but many markets still require manual transaction entry. Check the app's supported features for your specific location to confirm bank connectivity options.

Absolutely! Collaborative budgeting is one of Buddy's standout features. You can invite partners, roommates, or family members to join your budget, track shared expenses together, and split costs transparently. This makes it ideal for managing household finances or shared living situations.

Buddy is available on iOS (iPhone, iPad, iPod touch), macOS (M1 chip or later), and Android via Google Play in select markets. The app supports 12+ languages including English, Danish, Dutch, French, German, Italian, Norwegian Bokmål, Polish, Portuguese, Russian, Spanish, Swedish, and Turkish.

Buddy focuses primarily on budgeting, expense tracking, and savings planning rather than investment management or bill negotiation. If you need comprehensive investment analytics, portfolio tracking, or automatic bill negotiation services, you should consider pairing Buddy with a dedicated investment or financial management platform.

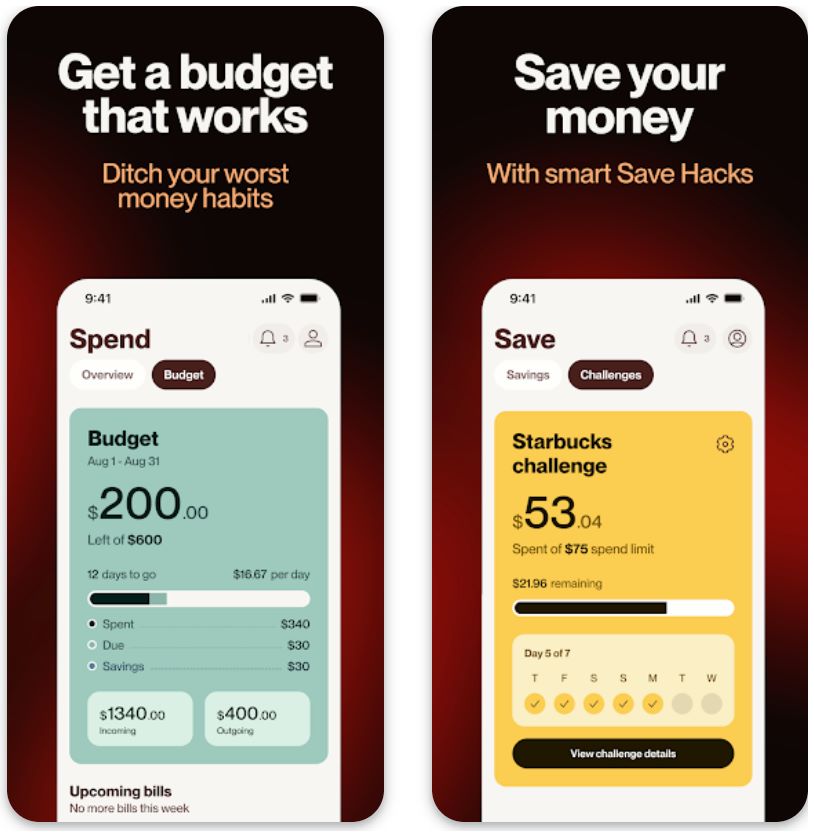

Cleo AI

| Developer | Cleo AI Ltd., founded by Barnaby Hussey-Yeo |

| Supported Platforms |

|

| Language Support | Primarily English language |

| Availability | United States (previously available in UK) |

| Pricing Model | Free tier for basic budgeting; paid subscription unlocks cash advances, credit building, and premium insights |

What is Cleo AI?

Cleo is an AI-powered personal finance app that transforms budgeting into an engaging conversation. By connecting to your bank account, this intelligent assistant tracks spending, identifies patterns, and helps you save money through automated challenges and personalized insights. Unlike traditional finance apps, Cleo uses a personality-driven chatbot interface that makes money management feel less intimidating and more interactive.

The app combines essential budgeting tools with optional short-term cash advances, creating an all-in-one platform for users who want both financial tracking and occasional emergency funding. Whether you're trying to understand where your paycheck goes or building better saving habits, Cleo offers a modern approach to personal finance management.

Why Choose Cleo for Money Management?

In today's digital banking landscape, automatic payments and tap-to-pay transactions make it easy to lose track of spending. Cleo addresses this challenge by providing real-time visibility into your financial habits through an approachable AI assistant.

The app's conversational interface removes the complexity typically associated with budgeting software. Instead of navigating through multiple screens and charts, you simply ask questions like "How much did I spend on dining out this month?" and receive instant, actionable answers. This natural interaction style makes financial awareness accessible to users who might feel overwhelmed by traditional finance tools.

Key Features

Ask natural language questions about your finances and receive personalized spending insights instantly.

- Conversational money management

- Category-specific spending breakdowns

- Friendly, engaging personality

Build savings effortlessly through round-ups, challenges, and smart transfer features.

- Round-up purchases to nearest dollar

- Customizable savings challenges

- Visual progress tracking

Automatic categorization of income and expenses with customizable limits and financial goals.

- Automatic transaction categorization

- Custom spending limits by category

- Income and bill tracking

Access short-term advances up to $250 with no interest charges for eligible subscribers.

- Up to $250 advance limit

- No interest charges

- Express transfer option available

Premium feature designed to help improve your credit score over time through responsible usage.

- Credit score improvement tools

- Available with paid subscription

- Region-dependent availability

Optional savings account with competitive interest rates to maximize your money's growth potential.

- Competitive interest rates

- Depends on region and plan

- Integrated with main app

Download Cleo AI

How to Get Started with Cleo

Download Cleo from Google Play Store (Android) or Apple App Store (iOS) and install it on your device.

Sign up and securely link your primary bank account using Plaid or similar secure banking connection services.

Allow Cleo to analyze your spending patterns, income, and recurring bills to generate personalized insights and budget recommendations.

Use the chatbot interface to ask questions about your finances, view spending breakdowns by category, and set savings goals or challenges.

Upgrade to a paid subscription if needed, then request cash advances through the chat interface. Choose your repayment schedule and transfer method (express transfers may incur additional fees).

Activate round-ups or automatic transfers to your savings wallet. Track your progress visually and adjust savings goals as needed.

Regularly check your budget dashboard, adjust spending categories, review AI-generated insights, and respond to prompts to improve your financial habits.

If you no longer need premium features, cancel or downgrade to the free tier while continuing to use basic budgeting and tracking tools.

Important Limitations to Consider

- Subscription Required for Premium Features: While the free version offers useful budgeting capabilities, valuable functions like cash advances, credit-builder tools, and higher advance limits require a paid subscription.

- Mandatory Bank Linking: Full functionality requires connecting your bank account. Users with unsupported banks or those outside supported regions may face limited features or need to rely on manual entry.

- Modest Cash Advance Limits: Advance amounts are relatively small (typically up to $250 or less for new users) and require repayment. Instant transfer options incur additional fees, which can reduce the benefit of "no-interest" advances.

- AI Personality May Not Suit Everyone: The chatbot's sassy or "roasting" tone appeals to some users but may feel inappropriate or unprofessional to others. Expense categorization (essential vs. non-essential) may occasionally be inaccurate.

- Regulatory Concerns: In March 2025, Cleo settled with the U.S. Federal Trade Commission (FTC) over misleading claims about cash advances and subscription terms, which may raise concerns about transparency and business practices.

Frequently Asked Questions

Yes — Cleo is a legitimate financial technology company offering budgeting, savings, and cash-advance services. The app uses secure bank-linking technology (such as Plaid) and has been reviewed by multiple independent sources. However, users should be aware of the March 2025 FTC settlement regarding misleading claims.

Yes — the free tier provides access to basic budgeting, spending tracking, and savings tools. However, premium features like cash advances, credit-builder functionality, and express transfers require upgrading to a paid subscription plan.

Eligibility and limits vary by user. New users typically qualify for smaller amounts (approximately $20–$100), with limits increasing based on account activity and usage history. Some established users report access to advances up to $250, depending on their subscription plan and financial patterns.

No — Cleo's AI chatbot is designed for automated budgeting insights and savings mechanics, not comprehensive financial planning. The advice is algorithm-based and may lack the nuance required for complex financial situations. For personalized investment strategies or major financial decisions, consult a qualified human financial advisor.

Cleo primarily supports the United States market. Bank compatibility varies, and users outside supported financial institutions may experience limited functionality. The app was previously available in the UK but currently focuses on the U.S. market. Always verify your region and bank support before relying on advanced features.

Copilot Money

| Developer | Copilot Money, Inc. |

| Supported Platforms |

|

| Language Support | English only |

| Availability | U.S. financial institutions only |

| Pricing Model | Free trial available. Paid subscription required for full features: ~$13/month or ~$95/year |

Premium Personal Finance Management

Copilot Money is an advanced personal finance app that centralizes your spending, budgeting, savings goals, and investments in one elegant dashboard. It connects to thousands of U.S. financial institutions, automatically categorizes transactions, highlights recurring subscriptions, and helps you visualize cash flow and net worth. Designed for clarity and control, Copilot offers a premium, ad-free experience focused on helping users gain complete insight into their financial life.

Why Choose Copilot Money

In a financial world filled with passive tracking tools and ad-supported apps, Copilot Money stands out for its hands-on clarity and premium experience. After linking your accounts, the app uses machine learning to auto-categorize your spending, detect recurring costs you might forget, and visualize income versus spending in clear, intuitive dashboards.

Its appeal lies in encouraging active financial oversight rather than purely passive monitoring. Multi-device support across iPhone, iPad, and Mac ensures your budget stays seamlessly synced wherever you are. While the subscription cost may give some pause, many users find the elevated user experience and actionable insights justify the investment.

Key Features

Automatic categorization across 10,000+ financial institutions, including investment and credit accounts using machine learning.

Set customized budgets, track progress in real-time, and visualize remaining balances for each category.

Identifies recurring payments and subscriptions automatically, showing future commitments to help you manage ongoing costs.

View assets, debts, and portfolio performance alongside budgeting data for a complete financial picture.

Seamless sync across iPhone, iPad, and Mac apps with dark mode, tags, and advanced cash-flow visualization.

Download or Access Link

Getting Started Guide

Download Copilot Money from the App Store on your iPhone, iPad, or Mac.

Sign up for an account and complete onboarding. Link your U.S.-based bank accounts, credit cards, and investment accounts.

Allow the app to import recent transactions. Review and approve categorizations for accuracy.

Check the Dashboard tab to see income, spending, net income, remaining budgets, and upcoming recurring payments.

Create budgets for categories like groceries, entertainment, and transportation. Set savings goals for specific accounts.

Use the Recurring section to view ongoing subscriptions and planned payments. Identify any that need adjusting or canceling.

Monitor your net worth and investment performance via the Assets & Investments section. Check progress over time.

Adjust budgets and categories as needed. The app adapts to your spending habits and helps you refine your financial plan.

Use the app frequently to identify trends, overspending patterns, and opportunities to save money.

If the paid plan doesn't meet your needs, cancel the subscription before renewal. Limited features remain available.

Important Limitations

- Paid subscription required: After the free trial, you must subscribe to access full features. No permanent free tier with complete functionality.

- Premium pricing: At approximately $13/month, the cost may seem steep compared to free alternatives, especially for basic budgeting needs.

- Evolving features: Some users note limited support for joint accounts, historical transaction imports, and advanced planning features.

Frequently Asked Questions

Yes — Copilot offers a free trial period before the subscription is required, allowing you to test all features.

Copilot works on iPhone (iOS 15.6+), iPad (iPadOS 15.6+), and Mac (macOS 12.5+) devices with seamless synchronization across all platforms.

As of now, Copilot is available only for U.S. users and supports U.S. financial institutions exclusively. Android support and international availability are not yet available.

Unlike many free apps, Copilot provides a premium, ad-free experience with advanced user interface, automatic transaction categorization, investment tracking, and machine learning insights — but at a subscription cost.

If you link multiple accounts (including investments), value clarity across all finances, and appreciate a refined user experience, many users believe the subscription offers excellent value. However, for simple budgeting only, cheaper alternatives may suffice.

Key Benefits of AI-Driven Saving Plans

Automated Real-Time Tracking

Smart Categorization

Personalized Insights

Predictive Goal Planning

The Combined Impact

These benefits work together to make saving more manageable and less stressful. You no longer need to manually update spreadsheets or estimate savings amounts – AI handles the complex calculations. By automatically identifying cost-cutting opportunities and facilitating transfers, these tools promote consistent saving habits without guesswork or friction.

Safeguards and Best Practices

While AI serves as a powerful financial ally, experts emphasize the importance of using these tools wisely and securely. AI applications should complement – not replace – sound financial judgment and professional advice when needed.

Security Considerations

When selecting AI financial apps, security must be your top priority. Choose reputable services – ideally those affiliated with established banks or recognized fintech brands – and activate all available privacy features.

Privacy and security are essential when using AI budgeting tools. Users should enable multi-factor authentication on their accounts to ensure data protection while allowing AI access to necessary financial information.

— SoFi Security Guidelines

Best Practices for Safe and Effective Use

- Choose Trusted Apps: Select financial tools with strong user reviews and robust security measures including encryption and two-factor authentication

- Automate Strategically: Set up automatic transfers to savings or debt payments so you save first and spend what remains

- Review AI Recommendations: Treat AI advice as suggestions rather than mandates – verify that proposed savings rates align with your actual budget and adjust goals as needed

- Continue Financial Education: Maintain your financial literacy through ongoing learning – AI provides guidance, but understanding your unique needs and occasionally consulting human advisors strengthens your overall strategy

- Monitor Regularly: Review your AI-generated insights weekly to ensure accuracy and catch any unusual patterns or errors

- Start Small: Begin with modest automation and gradually increase as you build confidence in the system

Risky Approach

- Blindly following all AI suggestions

- Using unverified apps with weak security

- No human oversight or verification

- Ignoring privacy settings

Secure Strategy

- Verified recommendations with trusted sources

- Reputable apps with strong encryption

- Regular monitoring and adjustments

- Maximum security features enabled

By implementing these best practices, you harness AI's benefits while maintaining full control over your financial decisions and data security.

Conclusion

Artificial intelligence is fundamentally transforming how individuals plan and achieve their savings goals. By analyzing every financial transaction, AI-powered tools deliver personalized savings plans and automate transfers – removing much of the complexity from budgeting. This democratization of financial advice means younger users and those without access to paid financial advisors can now receive tailored guidance at little or no cost.

Accessibility

Automation

Optimization

Looking ahead, this combination of advanced technology and prudent financial practices promises to make personal finance more accessible and effective for everyone. AI is transforming saving from a burdensome chore into a customized, adaptive plan that evolves with your life.

Everyone can plan confidently for their future with the democratization of AI-powered financial tools.

— World Economic Forum

No comments yet. Be the first to comment!