AI proponuje plany oszczędnościowe

Sztuczna inteligencja zmienia sposób, w jaki oszczędzamy pieniądze. Analizując nawyki wydatkowe i automatycznie sugerując spersonalizowane strategie oszczędzania, aplikacje finansowe oparte na AI pomagają użytkownikom zarządzać pieniędzmi mądrzej, oszczędzać bez wysiłku i szybciej osiągać cele.

Oszczędzanie pieniędzy może być wyzwaniem w dzisiejszym świecie – rosnące koszty i szybkie tempo życia utrudniają regularne odkładanie środków. Na szczęście sztuczna inteligencja (AI) rewolucjonizuje finanse osobiste dzięki inteligentnym aplikacjom i narzędziom, które analizują Twoje nawyki wydatkowe i dostarczają spersonalizowane strategie oszczędzania.

Nowoczesne platformy budżetowe oparte na AI łączą się bezpośrednio z Twoimi kontami finansowymi, automatycznie śledzą wzorce wydatków i rekomendują optymalne miesięczne kwoty oszczędności. Analizując Twoje źródła dochodów i wydatki, te inteligentne systemy ustalają dynamiczne cele oszczędnościowe, które dostosowują się do zmieniającej się sytuacji finansowej.

Jak AI analizuje Twoje finanse

Aplikacje finansowe oparte na AI działają poprzez bezpieczne połączenie z Twoimi kontami bankowymi i kartami kredytowymi, a następnie skanują pełną historię transakcji. Wykorzystując zaawansowane algorytmy uczenia maszynowego, systemy te kategoryzują wydatki w różnych obszarach i nieustannie uczą się na podstawie Twoich wzorców finansowych.

Integracja kont

Inteligentna kategoryzacja

Rozpoznawanie wzorców

Narzędzia budżetowe oparte na AI oferują spersonalizowane śledzenie i analizy poprzez analizę wzorców wydatków oraz rekomendacje pomagające użytkownikom zarządzać finansami.

— SoFi Financial Services

Spersonalizowane rekomendacje w praktyce

AI dostarcza dopasowane sugestie na podstawie Twojego unikalnego profilu finansowego. Na przykład, jeśli system wykryje częste wydatki na restauracje, może zasugerować gotowanie w domu, aby zmniejszyć koszty. Podobnie może wskazać, jak drobne cięcia w subskrypcjach kumulują się w znaczące oszczędności z czasem.

Predykcyjna analiza finansowa

Ponad analizę historyczną, narzędzia AI wykorzystują modelowanie predykcyjne do prognozowania Twojej przyszłości finansowej. Systemy te mogą przewidzieć, czy jesteś na dobrej drodze do osiągnięcia konkretnych celów – na przykład oszczędzania na wkład własny na dom – lub czy potrzebne są korekty.

Prognozowanie celów

AI przewiduje Twój postęp w osiąganiu kamieni milowych finansowych i ostrzega o potencjalnych niedoborach zanim się pojawią.

Spersonalizowane harmonogramy oszczędności

Otrzymuje konkretne rekomendacje, takie jak „Oszczędzaj 150 USD tygodniowo w tym miesiącu, aby osiągnąć cel funduszu awaryjnego do końca roku.”

Przetwarzając Twoje dochody, nadchodzące rachunki i dane historyczne wydatków, AI przekształca surowe informacje finansowe w dynamiczną, spersonalizowaną mapę oszczędności, która ewoluuje wraz z Twoimi życiowymi okolicznościami.

Narzędzia oszczędnościowe AI w praktyce

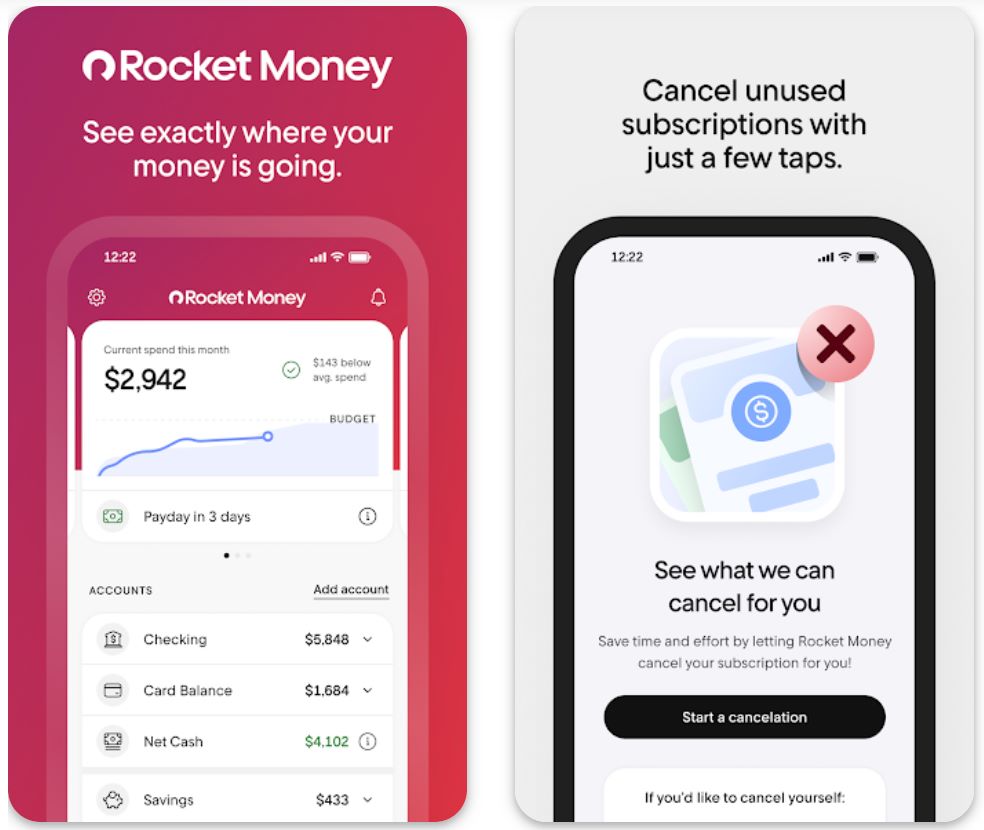

Rocket Money

| Deweloper | Rocket Money, Inc. (część Rocket Companies) |

| Obsługiwane platformy |

|

| Język i dostępność | Tylko angielski — mieszkańcy USA z kontami bankowymi w USA |

| Model cenowy | Darmowa do pobrania z opcjonalną subskrypcją Premium (3–12 USD/miesiąc) dla zaawansowanych funkcji |

Czym jest Rocket Money?

Rocket Money to aplikacja do finansów osobistych, która pomaga kontrolować wydatki, zarządzać subskrypcjami, negocjować rachunki i automatyzować oszczędności. Połącz swoje konta bankowe, karty kredytowe i inwestycje, aby uzyskać pełny obraz finansów w jednym miejscu. Darmowa wersja śledzi wydatki i identyfikuje powtarzające się opłaty, natomiast Premium odblokowuje pomoc w anulowaniu subskrypcji, negocjacje rachunków, nieograniczone budżety i automatyczne przelewy oszczędnościowe.

Dlaczego warto korzystać z Rocket Money?

Zarządzanie powtarzającymi się wydatkami i ukrytymi subskrypcjami może niepostrzeżenie uszczuplać Twój budżet. Rocket Money upraszcza zarządzanie finansami, agregując wszystkie Twoje konta, podkreślając powtarzające się płatności i oferując narzędzia do przekierowania oszczędności na Twoje cele.

Z ponad 10 milionami członków i ponad 2,5 miliarda dolarów zaoszczędzonych środków, aplikacja udowodniła swoją wartość. Po połączeniu kont bieżących, oszczędnościowych, kredytowych i inwestycyjnych, Rocket Money kategoryzuje Twoje wydatki, ostrzega o powtarzających się płatnościach i pomaga ustalać osiągalne cele oszczędnościowe.

Najważniejszą funkcją są automatyczne oszczędności: ustaw cel, połącz konta, a aplikacja przekaże środki na rachunek oszczędnościowy objęty ubezpieczeniem FDIC bez konieczności stałej kontroli.

Kluczowe funkcje

Automatycznie kategoryzuje transakcje na wszystkich powiązanych kontach, dając jasny obraz, na co wydajesz pieniądze.

Wykrywa powtarzające się opłaty i pomaga anulować niechciane subskrypcje. Użytkownicy Premium otrzymują pomoc konsjerża przy anulowaniu.

Funkcja Premium: zespół Rocket Money negocjuje niższe stawki za kwalifikujące się rachunki, takie jak telewizja kablowa, internet i telefon, w Twoim imieniu.

Ustaw cele finansowe, a aplikacja automatycznie przekaże środki na podstawie Twojego przepływu gotówki, aby szybciej osiągnąć cele.

Śledź swoją wartość netto (aktywa minus zobowiązania) oraz zmiany punktacji kredytowej w czasie dzięki funkcjom Premium.

Twórz nieograniczone miesięczne budżety według kategorii (restauracje, rozrywka, zakupy) i otrzymuj powiadomienia, gdy zbliżasz się do limitów.

Pobierz Rocket Money

Jak zacząć korzystać z Rocket Money

Zainstaluj Rocket Money z App Store lub Google Play, a następnie utwórz darmowe konto, używając swojego adresu e-mail.

Połącz swoje amerykańskie konta bieżące, oszczędnościowe, karty kredytowe i inwestycyjne. Aplikacja korzysta z bezpiecznych partnerów, takich jak Plaid, do łączenia banków.

Pozwól aplikacji kategoryzować Twoje wydatki i wykrywać powtarzające się subskrypcje. Sprawdź zakładkę „Subskrypcje”, aby zobaczyć wszystkie powtarzające się opłaty.

Użytkownicy Premium mogą wybierać usługi do anulowania bezpośrednio w aplikacji. Zespół konsjerża zajmuje się procesem anulowania za Ciebie.

Przejdź do „Cele finansowe” lub „Inteligentne oszczędności”, utwórz cel (np. „Fundusz awaryjny — 3000 USD”) i wybierz częstotliwość oraz kwotę przelewów.

Ustaw budżety według kategorii (restauracje, rozrywka, zakupy) i śledź wydatki na panelu. Premium odblokowuje nieograniczoną liczbę kategorii budżetowych.

Subskrybenci Premium mogą wyrazić zgodę na negocjacje rachunków. Rocket Money przegląda kwalifikujące się rachunki (kablówka, internet, telefon) i próbuje uzyskać niższe stawki. Jeśli negocjacje się powiodą, płacisz część zaoszczędzonych środków.

Śledź swoją wartość netto co miesiąc (aktywa minus zobowiązania) oraz zmiany punktacji kredytowej, jeśli masz subskrypcję Premium.

Skonfiguruj powiadomienia o bezpiecznym saldzie, alerty o dużych transakcjach oraz ostrzeżenia o nadchodzących odnowieniach, aby mieć kontrolę nad finansami.

Anuluj Premium w dowolnym momencie w ustawieniach aplikacji. Twoje darmowe konto pozostaje aktywne z ograniczonymi funkcjami.

Ważne ograniczenia

- Koszty Premium: Zaawansowane funkcje wymagają miesięcznej lub rocznej subskrypcji (3–12 USD/miesiąc). Negocjacje rachunków pobierają procent od zaoszczędzonych środków jako opłatę za usługę.

- Zależności od stron trzecich: Łączenie kont opiera się na usługach takich jak Plaid. Mogą wystąpić problemy z połączeniem z niektórymi bankami, a nie wszystkie typy kont są obsługiwane.

- Różne wyniki: Chociaż Rocket Money deklaruje znaczące oszczędności dla użytkowników, wyniki indywidualne mogą się różnić. Niektórzy użytkownicy zgłaszają minimalne oszczędności z negocjacji lub automatyzacji.

- Ograniczenie walutowe: Aplikacja działa wyłącznie w dolarach amerykańskich w ramach regulacji USA. Waluty i banki międzynarodowe nie są obsługiwane.

Najczęściej zadawane pytania

Tak, Rocket Money korzysta z szyfrowania na poziomie bankowym i współpracuje z bezpiecznymi usługami łączenia banków, takimi jak Plaid, aby chronić Twoje dane finansowe. Dane logowania do kont nigdy nie są przechowywane bezpośrednio przez aplikację.

Nie, Rocket Money jest dostępne tylko dla mieszkańców USA z kontami bankowymi w USA. Aplikacja nie obsługuje banków ani walut międzynarodowych.

Darmowa wersja pozwala na łączenie kont, przegląd podziału wydatków, wykrywanie subskrypcji oraz ustawianie ograniczonych budżetów. Funkcje Premium, takie jak konsjerż anulowania, automatyczne przelewy oszczędnościowe, nieograniczone budżety, negocjacje rachunków i monitorowanie kredytu, wymagają płatnej subskrypcji.

Ceny Premium zwykle wahają się od 3 do 12 USD miesięcznie, w zależności od planu i aktualnych promocji. Niektóre plany są rozliczane rocznie. Sprawdź aktualne ceny w aplikacji dla swojego regionu.

Możesz przeglądać wszystkie subskrypcje w darmowym planie. Jednak automatyczna usługa anulowania — gdzie Rocket Money kontaktuje się z dostawcą w Twoim imieniu — jest dostępna tylko dla użytkowników Premium.

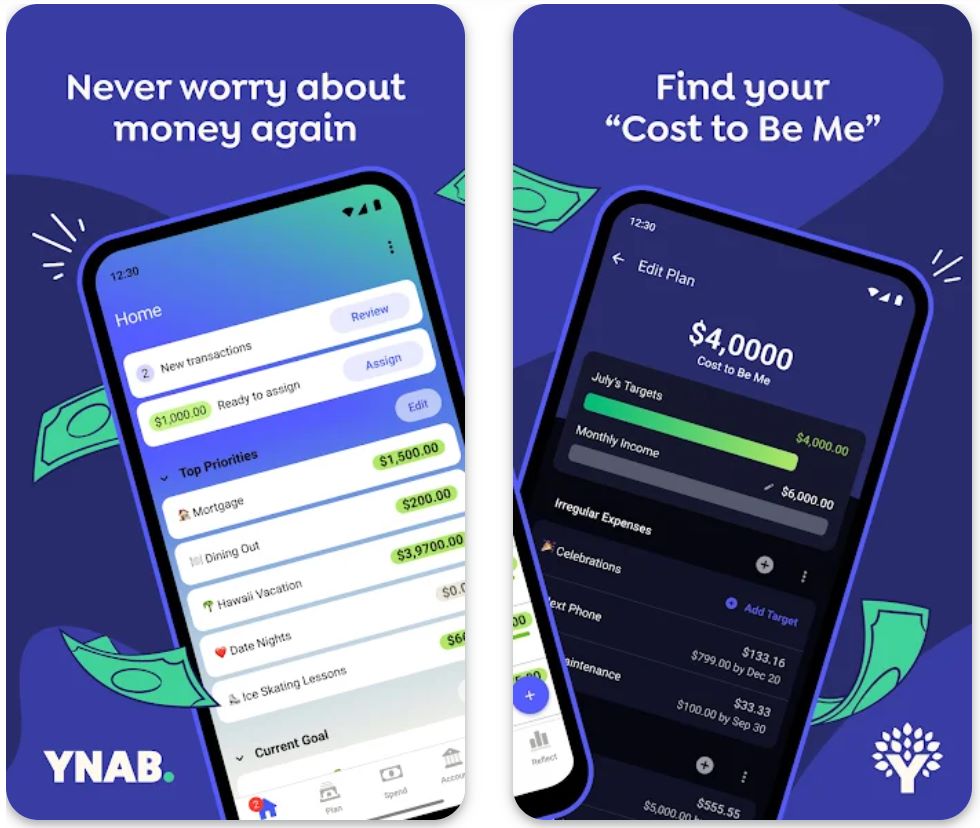

YNAB

Informacje o aplikacji

| Deweloper | You Need a Budget, Inc., założona przez Jesse Mecham |

| Obsługiwane platformy |

|

| Obsługa językowa | Głównie angielski; dostępna w krajach z obsługą łączenia banków i walut |

| Model cenowy | 34-dniowy darmowy okres próbny, następnie wymagana płatna subskrypcja dla pełnego dostępu |

Czym jest YNAB?

YNAB (You Need a Budget) to aplikacja do budżetowania oparta na zasadzie przypisywania każdej złotówce zadania, wykorzystująca metodę budżetowania zerobazowego, która pomaga użytkownikom aktywnie przypisywać i śledzić swoje dochody, wydatki, oszczędności i cele. Dzięki synchronizacji w czasie rzeczywistym między urządzeniami oraz dedykowanej metodologii budżetowania, YNAB ma na celu przekształcenie użytkowników z reaktywnego wydawania pieniędzy w proaktywne zarządzanie finansami, zmniejszając stres i zwiększając przejrzystość finansową.

Jak działa YNAB

W czasach, gdy wiele osób nie wie, na co dokładnie wydaje swoje pieniądze, YNAB oferuje uporządkowane podejście do kontroli finansów zamiast ich jedynie monitorowania. Zamiast czekać, co zostanie na koniec miesiąca, YNAB zachęca do przypisania każdej wpływającej złotówki do konkretnego celu: wydatków, oszczędności, spłaty długów lub bufora. To sprzyja świadomemu wydawaniu i oszczędzaniu — dostosowując finanse do życiowych priorytetów.

Interfejs aplikacji pozwala na powiązanie kont bankowych i kredytowych lub ręczne wprowadzanie transakcji, kategoryzowanie wydatków oraz śledzenie postępów w realizacji celów i budżetów. Według dewelopera, przeciętny użytkownik w ich badaniu oszczędza znacząco i odczuwa mniejszy stres związany z pieniędzmi.

Kluczowe funkcje

Przypisz każdej złotówce konkretne zadanie, tak aby dochody minus wydatki wynosiły zero, co zapewnia świadome wydawanie.

Dostęp do budżetu przez przeglądarkę, iOS i Android z automatycznymi aktualizacjami i synchronizacją na wszystkich urządzeniach.

Planuj nieregularne lub nadchodzące duże wydatki, tworząc kategorie buforowe na „prawdziwe wydatki”.

Przesuwaj środki między kategoriami budżetowymi, gdy dochodzi do przekroczenia wydatków lub zmieniają się priorytety.

Wbudowane warsztaty, społeczność wsparcia i samouczki pomagają użytkownikom skutecznie przyswoić metodę budżetowania.

Pobierz lub link do dostępu

Jak korzystać z YNAB

Zarejestruj się na bezpłatny okres próbny na stronie YNAB lub w aplikacji mobilnej i połącz swoje konta bankowe, oszczędnościowe, karty kredytowe (lub wybierz ręczne wprowadzanie).

Zaimportuj lub wprowadź aktualne salda kont i ostatnie transakcje, aby zaktualizować swój budżet.

Utwórz kategorie budżetowe (np. Czynsz, Zakupy, Rozrywka, Oszczędności, Spłata długów) i przypisz każdej złotówce dostępnych środków kategorię.

Podczas wydawania wprowadzaj lub pozwól aplikacji importować transakcje; sprawdzaj kwoty „Dostępne” w każdej kategorii, aby kontrolować, ile jeszcze możesz wydać.

Na nadchodzące wydatki, takie jak ubezpieczenia czy roczne subskrypcje, twórz kategorie „prawdziwych wydatków” i co miesiąc odkładaj niewielkie kwoty, aby koszt był już sfinansowany w terminie.

Jeśli przekroczysz wydatki w jednej kategorii, skorzystaj z elastyczności aplikacji, przesuwając środki z innej kategorii zamiast przekraczać budżet ogółem.

Pracuj nad „starzeniem się pieniędzy” — celem jest osiągnięcie momentu, w którym wydajesz dochód z poprzedniego miesiąca w bieżącym, co zwiększa bufor i stabilność.

Regularnie przeglądaj swój budżet (szybka codzienna kontrola, pełny miesięczny przegląd), aby utrzymać zgodność kategorii, dopracować wydatki i dostosować się do zmian życiowych.

Po zakończeniu okresu próbnego subskrybuj, jeśli chcesz kontynuować korzystanie z pełnych funkcji; w przeciwnym razie możesz anulować przed naliczeniem opłat.

Ważne ograniczenia

- Wymagane aktywne podejście: Metoda działa najlepiej, gdy aktywnie alokujesz środki i regularnie przeglądasz budżet; mniej odpowiednia dla pasywnego „ustaw i zapomnij”.

- Problemy z połączeniem bankowym: Niektórzy użytkownicy zgłaszają ograniczone wsparcie automatycznego importu lub problemy z łączeniem banków poza głównymi rynkami.

- Ograniczone funkcje inwestycyjne: Aplikacja skupia się na budżetowaniu i wydatkach; oferuje mniej funkcji do śledzenia inwestycji, monitorowania zdolności kredytowej czy negocjacji rachunków w porównaniu do niektórych konkurentów.

Najczęściej zadawane pytania

Tak — YNAB oferuje darmowy okres próbny (34 dni) z pełnym dostępem do funkcji, abyś mógł przetestować metodę przed subskrypcją.

Po zakończeniu darmowego okresu próbnego musisz wykupić subskrypcję (miesięczną lub roczną), aby kontynuować korzystanie z aplikacji z pełnymi funkcjami.

Tak, obsługuje bezpośredni import z wielu banków, ale niektórzy użytkownicy mogą zauważyć, że łączenie nie jest idealne lub nadal potrzebne jest ręczne wprowadzanie.

Tak — ale pamiętaj, że wymaga to pewnego wysiłku, aby ustawić kategorie budżetowe i zapoznać się z metodą. Jeśli wolisz w pełni zautomatyzowane narzędzie „finansowego autopilota”, musisz być gotów na krzywą uczenia się.

Wielu użytkowników zgłasza lepszą kontrolę nad pieniędzmi, zmniejszenie stresu i lepsze nawyki oszczędzania dzięki aktywnej metodzie budżetowania. Jednak wyniki zależą od zaangażowania użytkownika.

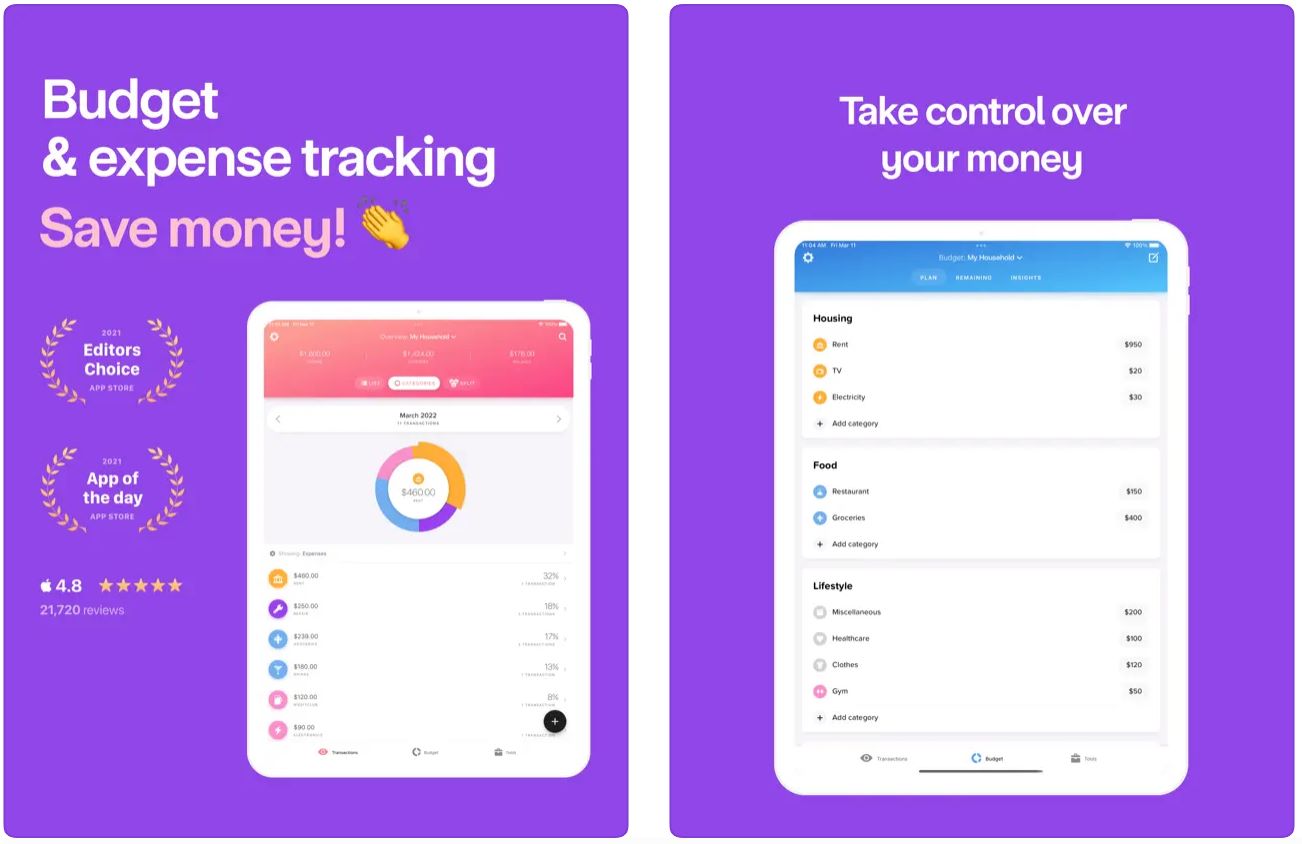

Buddy

| Twórca | Buddy Budgeting AB |

| Obsługiwane platformy |

|

| Obsługa języków | 12+ języków w tym angielski, duński, niderlandzki, francuski, niemiecki, włoski, norweski bokmål, polski, portugalski, rosyjski, hiszpański, szwedzki, turecki |

| Dostępność | Dostępna w Australii, Kanadzie, Stanach Zjednoczonych oraz na rynkach europejskich |

| Model cenowy | Bezpłatne pobranie z podstawowymi funkcjami. Subskrypcja premium (miesięczna lub roczna) wymagana dla pełnej funkcjonalności |

| Liczba użytkowników | Ponad 2,5 miliona użytkowników na całym świecie |

Czym jest Buddy Budget & Save Money?

Buddy to intuicyjna aplikacja do budżetowania i oszczędzania, która upraszcza zarządzanie finansami osobistymi i wspólnymi dzięki funkcjom współpracy, wizualnym analizom wydatków oraz łatwym w użyciu narzędziom do planowania budżetu. Zaprojektowana jako „radosny towarzysz budżetowania”, pomaga osobom, parom i współlokatorom przejąć kontrolę nad pieniędzmi, śledzić wydatki, ustalać realistyczne budżety i bezproblemowo dzielić odpowiedzialność finansową.

Szczegółowy przegląd

Zarządzanie finansami staje się przytłaczające, gdy trzeba ogarnąć wiele kont, wspólne wydatki lub nieregularne źródła dochodu. Buddy upraszcza tę złożoność dzięki przejrzystemu, przyjaznemu dla użytkownika interfejsowi i usprawnionemu procesowi, który sprawia, że budżetowanie jest dostępne dla każdego.

Zacznij od tworzenia spersonalizowanych budżetów dla kategorii wydatków, celów oszczędnościowych i śledzenia dochodów. Następnie monitoruj rzeczywiste transakcje, obserwuj pozostałe salda w czasie rzeczywistym i dostosowuj alokacje w miarę zmieniającej się sytuacji finansowej w ciągu miesiąca.

Co wyróżnia Buddy, to nacisk na wspólne budżetowanie — zaproś partnera, współlokatora lub członka rodziny do współpracy nad budżetami, transparentnego dzielenia wydatków i wspólnego utrzymania odpowiedzialności finansowej. Z ponad 2,5 milionami użytkowników na wielu rynkach, Buddy zbudowało swoją reputację na tym, że budżetowanie jest przyjemne i dostępne, a nie przytłaczające przez skomplikowane analizy finansowe.

Kluczowe funkcje

Twórz i dostosowuj budżety na wydatki, oszczędności, dochody i wartość netto na wielu kontach z elastycznym zarządzaniem kategoriami.

Śledź wydatki ręcznie lub przez import bankowy (w zależności od regionu) z natychmiastowym wglądem w wzorce wydatków i status budżetu.

Zaproś partnerów lub współlokatorów do współpracy nad wspólnymi budżetami, śledzenia wspólnych wydatków i transparentnego dzielenia kosztów.

Dostosuj swoje doświadczenie dzięki motywom, własnym kategoriom, trybowi ciemnemu oraz wsparciu dla różnych typów kont (oszczędnościowe, rozliczeniowe, zadłużenie).

Ustal konkretne cele oszczędnościowe, wizualizuj postępy za pomocą intuicyjnych wykresów i otrzymuj powiadomienia, aby pozostać na właściwej drodze do osiągnięcia finansowych kamieni milowych.

Link do pobrania lub dostępu

Jak zacząć korzystać z Buddy

Pobierz Buddy z App Store lub Google Play (gdzie dostępne), a następnie załóż bezpłatne konto, aby rozpocząć.

Wybierz walutę bazową i utwórz jedno lub więcej „portfeli” lub kont (rozliczeniowe, oszczędnościowe, zadłużenie), aby uporządkować swoje finanse.

Stwórz kategorie budżetowe na podstawie swoich dochodów i planu wydatków (Mieszkanie, Jedzenie, Transport, Oszczędności). Skorzystaj z domyślnych kategorii lub stwórz własne dopasowane do stylu życia.

Wprowadzaj transakcje ręcznie lub połącz swoje konto bankowe (tam, gdzie jest to obsługiwane). Przypisz każdą transakcję do odpowiedniej kategorii, aby dokładnie śledzić wydatki.

Zaproś partnera lub współlokatora do współpracy nad wspólnymi budżetami i dzielenia transakcji dla przejrzystego zarządzania finansami domowymi.

Regularnie sprawdzaj pulpit budżetu, aby zobaczyć pozostałe salda w każdej kategorii i śledzić postępy w realizacji celów oszczędnościowych.

Przesuwaj środki między kategoriami lub modyfikuj alokacje budżetowe w ciągu miesiąca, gdy zmieniają się Twoje okoliczności finansowe.

Na koniec miesiąca analizuj raporty wydatków, aby zidentyfikować obszary nadmiernych wydatków, rozpoznać trendy i lepiej zaplanować budżet na kolejny miesiąc.

Subskrybuj Buddy Premium przez zakup w aplikacji, aby odblokować nieograniczoną liczbę kont, importy bankowe (na obsługiwanych rynkach) oraz zaawansowane funkcje współdzielenia.

Aktywuj alerty, aby otrzymywać terminowe informacje o stanie budżetu, ostrzeżenia o przekroczeniu wydatków oraz aktywności w budżetach współdzielonych.

Ważne ograniczenia do rozważenia

- Wymagana subskrypcja Premium dla pełnych funkcji: Podstawowe budżetowanie jest darmowe, ale zaawansowane funkcje, takie jak współdzielenie, wiele kont i importy bankowe, wymagają płatnej subskrypcji Premium.

- Ograniczone dzielenie transakcji: Niektórzy użytkownicy zgłaszają brak możliwości podziału jednej transakcji na wiele kategorii budżetowych, co może być niewygodne przy złożonych zakupach.

- Skupienie na budżetowaniu: Buddy specjalizuje się w budżetowaniu i śledzeniu wydatków, a nie w zarządzaniu inwestycjami czy profesjonalnym doradztwie finansowym — użytkownicy potrzebujący zaawansowanych analiz mogą wymagać dodatkowych narzędzi.

- Ograniczenia wersji darmowej: Darmowa wersja dobrze sprawdza się przy prostych budżetach, ale zaawansowani użytkownicy zarządzający wieloma kontami lub wspólnymi finansami domowymi prawdopodobnie będą potrzebować wersji Premium dla optymalnej wartości.

Najczęściej zadawane pytania

Tak, Buddy jest darmowe do pobrania i oferuje podstawowe funkcje budżetowania oraz śledzenia wydatków bez opłat. Aby jednak uzyskać pełen zestaw funkcji — w tym nieograniczoną liczbę kont, importy bankowe i współdzielenie budżetów — należy wykupić subskrypcję Premium (dostępną w wariancie miesięcznym lub rocznym).

Dostępność łączenia z bankiem zależy od Twojego regionu. Buddy obsługuje open banking i automatyczny import transakcji w niektórych krajach, ale na wielu rynkach nadal konieczne jest ręczne wprowadzanie transakcji. Sprawdź w aplikacji dostępne funkcje dla swojego miejsca zamieszkania, aby potwierdzić opcje łączenia z bankiem.

Oczywiście! Wspólne budżetowanie to jedna z wyróżniających się funkcji Buddy. Możesz zaprosić partnerów, współlokatorów lub członków rodziny do dołączenia do Twojego budżetu, wspólnie śledzić wydatki i transparentnie dzielić koszty. To idealne rozwiązanie do zarządzania finansami domowymi lub wspólnym gospodarstwem.

Buddy jest dostępne na iOS (iPhone, iPad, iPod touch), macOS (procesor M1 lub nowszy) oraz Androida przez Google Play na wybranych rynkach. Aplikacja obsługuje ponad 12 języków, w tym angielski, duński, niderlandzki, francuski, niemiecki, włoski, norweski bokmål, polski, portugalski, rosyjski, hiszpański, szwedzki i turecki.

Buddy koncentruje się przede wszystkim na budżetowaniu, śledzeniu wydatków i planowaniu oszczędności, a nie na zarządzaniu inwestycjami czy negocjacjach rachunków. Jeśli potrzebujesz kompleksowych analiz inwestycyjnych, śledzenia portfela lub automatycznych usług negocjacji rachunków, warto rozważyć połączenie Buddy z dedykowaną platformą inwestycyjną lub finansową.

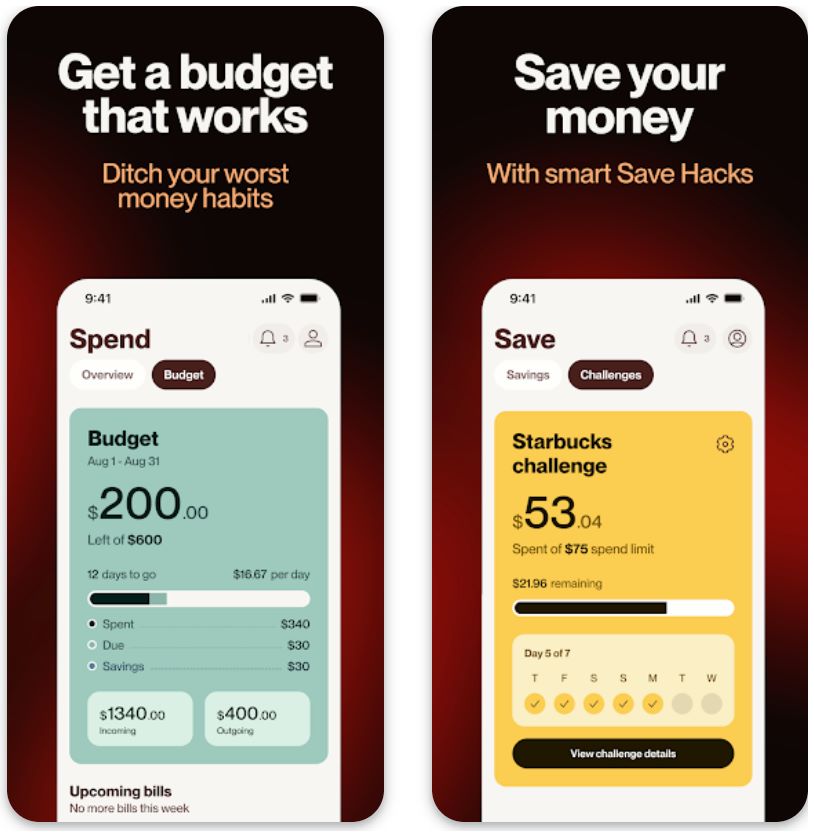

Cleo AI

| Twórca | Cleo AI Ltd., założona przez Barnaby’ego Hussey-Yeo |

| Obsługiwane platformy |

|

| Obsługa językowa | Głównie język angielski |

| Dostępność | Stany Zjednoczone (wcześniej dostępne w Wielkiej Brytanii) |

| Model cenowy | Darmowy poziom podstawowego budżetowania; płatna subskrypcja odblokowuje zaliczki gotówkowe, budowanie kredytu i zaawansowane analizy |

Czym jest Cleo AI?

Cleo to aplikacja do finansów osobistych zasilana sztuczną inteligencją, która zamienia budżetowanie w angażującą rozmowę. Łącząc się z Twoim kontem bankowym, ten inteligentny asystent śledzi wydatki, identyfikuje wzorce i pomaga oszczędzać pieniądze dzięki zautomatyzowanym wyzwaniom i spersonalizowanym wskazówkom. W przeciwieństwie do tradycyjnych aplikacji finansowych, Cleo korzysta z interfejsu chatbota opartego na osobowości, co sprawia, że zarządzanie pieniędzmi jest mniej onieśmielające i bardziej interaktywne.

Aplikacja łączy podstawowe narzędzia budżetowe z opcjonalnymi krótkoterminowymi zaliczkami gotówkowymi, tworząc kompleksową platformę dla użytkowników, którzy chcą zarówno śledzić finanse, jak i mieć dostęp do okazjonalnego finansowania awaryjnego. Niezależnie od tego, czy próbujesz zrozumieć, na co idzie Twoja wypłata, czy budujesz lepsze nawyki oszczędzania, Cleo oferuje nowoczesne podejście do zarządzania finansami osobistymi.

Dlaczego warto wybrać Cleo do zarządzania pieniędzmi?

W dzisiejszym cyfrowym świecie bankowości, automatyczne płatności i transakcje zbliżeniowe ułatwiają utratę kontroli nad wydatkami. Cleo rozwiązuje ten problem, zapewniając wgląd w Twoje nawyki finansowe w czasie rzeczywistym za pomocą przystępnego asystenta SI.

Konwersacyjny interfejs aplikacji eliminuje złożoność zwykle związaną z oprogramowaniem do budżetowania. Zamiast przeglądać wiele ekranów i wykresów, wystarczy zadać pytanie typu „Ile wydałem na jedzenie na mieście w tym miesiącu?” i otrzymać natychmiastowe, praktyczne odpowiedzi. Ten naturalny styl interakcji sprawia, że świadomość finansowa jest dostępna dla użytkowników, którzy mogą czuć się przytłoczeni tradycyjnymi narzędziami finansowymi.

Kluczowe funkcje

Zadaj pytania w naturalnym języku dotyczące swoich finansów i otrzymuj spersonalizowane analizy wydatków natychmiast.

- Zarządzanie pieniędzmi w formie rozmowy

- Szczegółowe rozbicie wydatków według kategorii

- Przyjazna, angażująca osobowość

Buduj oszczędności bez wysiłku dzięki zaokrąglaniu, wyzwaniom i inteligentnym przelewom.

- Zaokrąglanie zakupów do najbliższego dolara

- Dostosowywane wyzwania oszczędnościowe

- Wizualne śledzenie postępów

Automatyczna kategoryzacja przychodów i wydatków z możliwością ustawiania limitów i celów finansowych.

- Automatyczna kategoryzacja transakcji

- Dostosowywane limity wydatków według kategorii

- Śledzenie przychodów i rachunków

Dostęp do krótkoterminowych zaliczek do 250 USD bez odsetek dla uprawnionych subskrybentów.

- Limit zaliczki do 250 USD

- Brak opłat odsetkowych

- Dostępna opcja szybkiego przelewu

Funkcja premium zaprojektowana, aby pomóc poprawić Twój wynik kredytowy poprzez odpowiedzialne korzystanie.

- Narzędzia do poprawy oceny kredytowej

- Dostępne w ramach płatnej subskrypcji

- Dostępność zależna od regionu

Opcjonalne konto oszczędnościowe z konkurencyjnym oprocentowaniem, maksymalizujące potencjał wzrostu Twoich pieniędzy.

- Konkurencyjne stopy procentowe

- Zależne od regionu i planu

- Zintegrowane z główną aplikacją

Pobierz Cleo AI

Jak zacząć korzystać z Cleo

Pobierz Cleo z Google Play Store (Android) lub Apple App Store (iOS) i zainstaluj na swoim urządzeniu.

Zarejestruj się i bezpiecznie połącz swoje główne konto bankowe za pomocą Plaid lub podobnych bezpiecznych usług łączenia bankowego.

Pozwól Cleo analizować Twoje wzorce wydatków, przychody i powtarzające się rachunki, aby wygenerować spersonalizowane wskazówki i rekomendacje budżetowe.

Korzystaj z interfejsu chatbota, aby zadawać pytania o swoje finanse, przeglądać rozbicia wydatków według kategorii oraz ustawiać cele lub wyzwania oszczędnościowe.

Jeśli potrzebujesz, przejdź na płatną subskrypcję, a następnie zamów zaliczki gotówkowe przez interfejs czatu. Wybierz harmonogram spłat i metodę przelewu (szybkie przelewy mogą wiązać się z dodatkowymi opłatami).

Aktywuj zaokrąglanie lub automatyczne przelewy do portfela oszczędnościowego. Śledź postępy wizualnie i dostosowuj cele oszczędnościowe według potrzeb.

Regularnie sprawdzaj pulpit budżetu, dostosowuj kategorie wydatków, przeglądaj analizy generowane przez SI i reaguj na sugestie, aby poprawić swoje nawyki finansowe.

Jeśli nie potrzebujesz już funkcji premium, anuluj lub obniż poziom subskrypcji do darmowego, jednocześnie korzystając z podstawowych narzędzi do budżetowania i śledzenia wydatków.

Ważne ograniczenia do rozważenia

- Subskrypcja wymagana do funkcji premium: Choć wersja darmowa oferuje przydatne możliwości budżetowe, wartościowe funkcje takie jak zaliczki gotówkowe, narzędzia do budowania kredytu i wyższe limity zaliczek wymagają płatnej subskrypcji.

- Obowiązkowe łączenie konta bankowego: Pełna funkcjonalność wymaga połączenia konta bankowego. Użytkownicy z bankami nieobsługiwanymi lub spoza wspieranych regionów mogą mieć ograniczone funkcje lub muszą polegać na ręcznym wprowadzaniu danych.

- Skromne limity zaliczek gotówkowych: Kwoty zaliczek są stosunkowo niewielkie (zazwyczaj do 250 USD lub mniej dla nowych użytkowników) i wymagają spłaty. Opcje natychmiastowych przelewów wiążą się z dodatkowymi opłatami, które mogą zmniejszyć korzyści z „bezodsetkowych” zaliczek.

- Osobowość SI może nie odpowiadać wszystkim: Szyderczy lub „zgryźliwy” ton chatbota może przypaść do gustu niektórym użytkownikom, ale innym wydać się nieodpowiedni lub nieprofesjonalny. Kategoryzacja wydatków (niezbędne vs. nieistotne) może czasem być niedokładna.

- Obawy regulacyjne: W marcu 2025 roku Cleo zawarło ugodę z Federalną Komisją Handlu USA (FTC) dotyczącą wprowadzających w błąd informacji o zaliczkach gotówkowych i warunkach subskrypcji, co może budzić wątpliwości co do przejrzystości i praktyk biznesowych.

Najczęściej zadawane pytania

Tak — Cleo to wiarygodna firma technologii finansowej oferująca usługi budżetowania, oszczędzania i zaliczek gotówkowych. Aplikacja korzysta z bezpiecznej technologii łączenia kont bankowych (takiej jak Plaid) i była oceniana przez wiele niezależnych źródeł. Użytkownicy powinni jednak być świadomi ugody z FTC z marca 2025 roku dotyczącej wprowadzających w błąd informacji.

Tak — darmowy poziom zapewnia dostęp do podstawowego budżetowania, śledzenia wydatków i narzędzi oszczędnościowych. Jednak funkcje premium, takie jak zaliczki gotówkowe, budowanie kredytu i szybkie przelewy, wymagają przejścia na płatny plan subskrypcji.

Uprawnienia i limity różnią się w zależności od użytkownika. Nowi użytkownicy zazwyczaj kwalifikują się do mniejszych kwot (około 20–100 USD), a limity rosną w oparciu o aktywność konta i historię użytkowania. Niektórzy doświadczeni użytkownicy mają dostęp do zaliczek do 250 USD, w zależności od planu subskrypcji i wzorców finansowych.

Nie — chatbot SI Cleo jest zaprojektowany do automatycznych wskazówek budżetowych i mechanizmów oszczędzania, a nie do kompleksowego planowania finansowego. Porady są oparte na algorytmach i mogą nie mieć niuansów potrzebnych w skomplikowanych sytuacjach finansowych. W przypadku spersonalizowanych strategii inwestycyjnych lub ważnych decyzji finansowych należy skonsultować się z wykwalifikowanym doradcą finansowym.

Cleo obsługuje głównie rynek Stanów Zjednoczonych. Kompatybilność banków różni się, a użytkownicy spoza obsługiwanych instytucji finansowych mogą mieć ograniczoną funkcjonalność. Aplikacja była wcześniej dostępna w Wielkiej Brytanii, ale obecnie koncentruje się na rynku USA. Zawsze sprawdzaj swój region i wsparcie banku przed korzystaniem z zaawansowanych funkcji.

Copilot Money

| Deweloper | Copilot Money, Inc. |

| Obsługiwane platformy |

|

| Obsługiwany język | Tylko angielski |

| Dostępność | Tylko instytucje finansowe w USA |

| Model cenowy | Dostępny darmowy okres próbny. Pełna funkcjonalność wymaga płatnej subskrypcji: około 13 USD/miesiąc lub 95 USD/rok |

Zaawansowane zarządzanie finansami osobistymi

Copilot Money to zaawansowana aplikacja do zarządzania finansami osobistymi, która centralizuje Twoje wydatki, budżety, cele oszczędnościowe oraz inwestycje w jednym eleganckim panelu. Łączy się z tysiącami instytucji finansowych w USA, automatycznie kategoryzuje transakcje, wyróżnia subskrypcje cykliczne i pomaga wizualizować przepływy pieniężne oraz wartość netto. Zaprojektowany z myślą o przejrzystości i kontroli, Copilot oferuje premium, wolne od reklam doświadczenie, skupione na pełnym wglądzie w Twoje finanse.

Dlaczego warto wybrać Copilot Money

W świecie finansów pełnym pasywnych narzędzi śledzących i aplikacji wspieranych reklamami, Copilot Money wyróżnia się dzięki aktywnej przejrzystości i premium doświadczeniu. Po połączeniu kont aplikacja wykorzystuje uczenie maszynowe do automatycznej kategoryzacji wydatków, wykrywania cyklicznych kosztów, które mogłyby umknąć uwadze, oraz wizualizacji dochodów względem wydatków w przejrzystych, intuicyjnych panelach.

Jego atrakcyjność polega na zachęcaniu do aktywnego nadzoru finansowego, a nie tylko pasywnego monitorowania. Obsługa wielu urządzeń na iPhone, iPad i Mac zapewnia płynną synchronizację budżetu, gdziekolwiek jesteś. Choć koszt subskrypcji może budzić wątpliwości, wielu użytkowników uważa, że podniesiona jakość doświadczenia i praktyczne wskazówki uzasadniają tę inwestycję.

Kluczowe funkcje

Automatyczna kategoryzacja w ponad 10 000 instytucji finansowych, w tym kont inwestycyjnych i kredytowych, z wykorzystaniem uczenia maszynowego.

Ustalaj spersonalizowane budżety, śledź postępy w czasie rzeczywistym i wizualizuj pozostałe saldo dla każdej kategorii.

Automatycznie identyfikuje płatności i subskrypcje cykliczne, pokazując przyszłe zobowiązania, aby pomóc zarządzać bieżącymi kosztami.

Przeglądaj aktywa, zobowiązania i wyniki portfela obok danych budżetowych, aby uzyskać pełny obraz finansowy.

Płynna synchronizacja między aplikacjami na iPhone, iPad i Mac z trybem ciemnym, tagami i zaawansowaną wizualizacją przepływów pieniężnych.

Pobierz lub uzyskaj dostęp

Przewodnik rozpoczęcia

Pobierz Copilot Money z App Store na iPhone’a, iPada lub Maca.

Zarejestruj się i przejdź proces wprowadzający. Połącz swoje konta bankowe, karty kredytowe i inwestycyjne z USA.

Pozwól aplikacji zaimportować ostatnie transakcje. Sprawdź i zatwierdź kategoryzacje dla dokładności.

Sprawdź zakładkę Panel, aby zobaczyć dochody, wydatki, dochód netto, pozostałe budżety i nadchodzące płatności cykliczne.

Twórz budżety dla kategorii takich jak artykuły spożywcze, rozrywka i transport. Ustal cele oszczędnościowe dla konkretnych kont.

Użyj sekcji Płatności cykliczne, aby przeglądać bieżące subskrypcje i planowane płatności. Zidentyfikuj te, które wymagają korekty lub anulowania.

Monitoruj swoją wartość netto i wyniki inwestycji w sekcji Aktywa i inwestycje. Sprawdzaj postępy w czasie.

Dostosowuj budżety i kategorie według potrzeb. Aplikacja dostosowuje się do Twoich nawyków wydatkowych i pomaga udoskonalić plan finansowy.

Używaj aplikacji często, aby identyfikować trendy, wzorce nadmiernych wydatków i możliwości oszczędzania.

Jeśli płatny plan nie spełnia Twoich oczekiwań, anuluj subskrypcję przed odnowieniem. Dostępne są ograniczone funkcje.

Ważne ograniczenia

- Wymagana płatna subskrypcja: Po okresie próbnym konieczna jest subskrypcja, aby korzystać z pełnej funkcjonalności. Brak stałego darmowego poziomu z pełną funkcjonalnością.

- Wysoka cena: Koszt około 13 USD/miesiąc może wydawać się wysoki w porównaniu do darmowych alternatyw, zwłaszcza dla podstawowego budżetowania.

- Rozwijające się funkcje: Niektórzy użytkownicy zauważają ograniczone wsparcie dla kont wspólnych, importu historycznych transakcji oraz zaawansowanych funkcji planowania.

Najczęściej zadawane pytania

Tak — Copilot oferuje darmowy okres próbny przed koniecznością subskrypcji, pozwalając przetestować wszystkie funkcje.

Copilot działa na iPhone’ach (iOS 15.6+), iPadach (iPadOS 15.6+) oraz Macach (macOS 12.5+) z płynną synchronizacją między platformami.

Obecnie Copilot jest dostępny tylko dla użytkowników z USA i obsługuje wyłącznie amerykańskie instytucje finansowe. Obsługa Androida i dostępność międzynarodowa nie są jeszcze dostępne.

W przeciwieństwie do wielu darmowych aplikacji, Copilot oferuje premium, wolne od reklam doświadczenie z zaawansowanym interfejsem użytkownika, automatyczną kategoryzacją transakcji, śledzeniem inwestycji oraz analizami opartymi na uczeniu maszynowym — jednak wiąże się to z kosztem subskrypcji.

Jeśli łączysz wiele kont (w tym inwestycyjne), cenisz sobie przejrzystość finansów i doceniasz dopracowane doświadczenie użytkownika, wielu użytkowników uważa, że subskrypcja oferuje doskonałą wartość. Jednak dla prostego budżetowania mogą wystarczyć tańsze alternatywy.

Kluczowe korzyści z planów oszczędnościowych opartych na AI

Automatyczne śledzenie w czasie rzeczywistym

Inteligentna kategoryzacja

Spersonalizowane spostrzeżenia

Predykcyjne planowanie celów

Łączny wpływ

Te korzyści współdziałają, aby uczynić oszczędzanie łatwiejszym i mniej stresującym. Nie musisz już ręcznie aktualizować arkuszy kalkulacyjnych ani szacować kwot oszczędności – AI zajmuje się skomplikowanymi obliczeniami. Automatycznie identyfikując możliwości cięcia kosztów i ułatwiając przelewy, narzędzia te promują regularne nawyki oszczędzania bez zgadywania czy przeszkód.

Zabezpieczenia i najlepsze praktyki

Choć AI jest potężnym sojusznikiem finansowym, eksperci podkreślają znaczenie mądrego i bezpiecznego korzystania z tych narzędzi. Aplikacje AI powinny uzupełniać – a nie zastępować – rozsądne decyzje finansowe i profesjonalne porady, gdy jest to potrzebne.

Aspekty bezpieczeństwa

Wybierając aplikacje finansowe oparte na AI, bezpieczeństwo musi być Twoim priorytetem. Wybieraj renomowane usługi – najlepiej powiązane z uznanymi bankami lub markami fintech – i aktywuj wszystkie dostępne funkcje prywatności.

Prywatność i bezpieczeństwo są kluczowe podczas korzystania z narzędzi budżetowych AI. Użytkownicy powinni włączyć uwierzytelnianie wieloskładnikowe na swoich kontach, aby zapewnić ochronę danych, jednocześnie umożliwiając AI dostęp do niezbędnych informacji finansowych.

— Wytyczne bezpieczeństwa SoFi

Najlepsze praktyki dla bezpiecznego i skutecznego użytkowania

- Wybieraj zaufane aplikacje: Wybieraj narzędzia finansowe z dobrymi opiniami użytkowników i solidnymi zabezpieczeniami, w tym szyfrowaniem i uwierzytelnianiem dwuskładnikowym

- Automatyzuj strategicznie: Ustaw automatyczne przelewy na oszczędności lub spłatę długów, aby najpierw oszczędzać, a potem wydawać pozostałe środki

- Przeglądaj rekomendacje AI: Traktuj porady AI jako sugestie, a nie nakazy – sprawdzaj, czy proponowane stawki oszczędności pasują do Twojego budżetu i dostosowuj cele w razie potrzeby

- Kontynuuj edukację finansową: Utrzymuj swoją wiedzę finansową poprzez ciągłe uczenie się – AI dostarcza wskazówek, ale zrozumienie własnych potrzeb i okazjonalne konsultacje z doradcami wzmacniają Twoją strategię

- Regularnie monitoruj: Przeglądaj cotygodniowo spostrzeżenia generowane przez AI, aby zapewnić ich dokładność i wychwycić nietypowe wzorce lub błędy

- Zacznij od małych kroków: Rozpocznij od umiarkowanej automatyzacji i stopniowo zwiększaj ją, gdy nabierzesz pewności w systemie

Ryzykowne podejście

- Ślepe podążanie za wszystkimi sugestiami AI

- Korzystanie z niezweryfikowanych aplikacji o słabym zabezpieczeniu

- Brak nadzoru lub weryfikacji przez człowieka

- Ignorowanie ustawień prywatności

Bezpieczna strategia

- Zweryfikowane rekomendacje z zaufanych źródeł

- Renomowane aplikacje z silnym szyfrowaniem

- Regularne monitorowanie i dostosowania

- Włączone maksymalne funkcje bezpieczeństwa

Stosując te najlepsze praktyki, wykorzystujesz zalety AI, zachowując pełną kontrolę nad swoimi decyzjami finansowymi i bezpieczeństwem danych.

Podsumowanie

Sztuczna inteligencja zasadniczo zmienia sposób, w jaki ludzie planują i osiągają swoje cele oszczędnościowe. Analizując każdą transakcję finansową, narzędzia oparte na AI dostarczają spersonalizowane plany oszczędnościowe i automatyzują przelewy – eliminując wiele złożoności budżetowania. Ta demokratyzacja porad finansowych oznacza, że młodsi użytkownicy i osoby bez dostępu do płatnych doradców mogą teraz otrzymywać dopasowane wskazówki za niewielką lub żadną opłatą.

Dostępność

Automatyzacja

Optymalizacja

Patrząc w przyszłość, to połączenie zaawansowanej technologii i rozsądnych praktyk finansowych obiecuje uczynić finanse osobiste bardziej dostępnymi i skutecznymi dla wszystkich. AI przekształca oszczędzanie z uciążliwego obowiązku w spersonalizowany, adaptacyjny plan, który ewoluuje wraz z Twoim życiem.

Każdy może pewnie planować swoją przyszłość dzięki demokratyzacji narzędzi finansowych opartych na AI.

— Światowe Forum Ekonomiczne

No comments yet. Be the first to comment!