AI建议储蓄计划

人工智能正在改变我们的储蓄方式。通过分析消费习惯并自动推荐个性化储蓄策略,AI驱动的理财应用帮助用户更聪明地管理资金,轻松储蓄,更快实现目标。

在当今社会,储蓄变得越来越具有挑战性——不断上涨的生活成本和忙碌的生活节奏使得持续存钱变得困难。幸运的是,人工智能(AI)正在通过智能应用和工具革新个人理财,这些工具能够分析您的消费习惯并提供个性化的储蓄策略。

现代AI驱动的预算平台可直接连接您的金融账户,自动跟踪消费模式,并推荐最佳的月度储蓄金额。通过分析您的收入来源和支出,这些智能系统设定动态储蓄目标,随着您的财务状况变化而调整。

AI如何分析您的财务状况

AI驱动的理财应用通过安全连接您的银行和信用卡账户,扫描完整的交易历史。利用先进的机器学习算法,这些系统将支出分类到多个领域,并持续学习您的财务模式。

账户整合

智能分类

模式识别

AI预算工具通过分析消费模式并提供建议,为用户提供个性化的跟踪和洞察,帮助管理财务。

— SoFi金融服务

个性化建议实操

AI根据您的独特财务状况提供量身定制的建议。例如,如果系统检测到您频繁在餐厅消费,可能会建议您在家做饭以减少开支。同样,它还能识别订阅服务的小额削减如何随着时间积累成显著储蓄。

预测性财务分析

除了历史分析,AI工具还采用预测建模来预估您的财务未来。这些系统可以预测您是否能按计划实现特定目标——例如为购房首付储蓄——或是否需要调整策略。

目标预测

AI预测您实现财务里程碑的进度,并在潜在不足发生前提醒您。

定制储蓄计划

提供具体建议,如“本月每周储蓄150美元,以年底前达到紧急基金目标”。

通过处理您的收入、即将到期的账单和历史支出数据,AI将原始财务信息转化为动态的个性化储蓄路线图,随着您的生活状况不断演变。

现实中的AI储蓄工具

Rocket Money

| 开发商 | Rocket Money, Inc.(隶属于 Rocket Companies) |

| 支持平台 |

|

| 语言及可用性 | 仅支持英语 — 仅限美国居民,需拥有美国银行账户 |

| 价格模式 | 免费下载,提供可选的 高级订阅(每月3至12美元)以解锁高级功能 |

什么是 Rocket Money?

Rocket Money 是一款个人理财应用,帮助您掌控支出、管理订阅、协商账单并自动储蓄。关联您的银行账户、信用卡和投资账户,集中查看财务状况。免费版可跟踪支出并识别定期扣费,高级版解锁订阅取消协助、账单协商、无限预算和自动储蓄转账功能。

为什么使用 Rocket Money?

管理定期支出和隐藏订阅可能在您不知情的情况下消耗预算。Rocket Money 通过整合所有账户,突出显示定期付款,并提供工具将节省资金导向您的目标,简化财务管理。

拥有超过 1000万会员,累计节省超过 25亿美元,该应用已证明其价值。关联您的支票、储蓄、信用和投资账户后,Rocket Money 会分类您的支出,提醒定期付款,并帮助您设定可实现的储蓄目标。

其突出功能是自动储蓄:设定目标,关联账户,应用会自动将资金转入 联邦存款保险公司(FDIC)保障的储蓄账户,无需您频繁操作。

主要功能

自动对所有关联账户的交易进行分类,让您清晰了解资金流向。

识别定期扣费,帮助您取消不需要的订阅。高级会员享有礼宾取消协助服务。

高级功能:Rocket Money 团队代表您协商降低有资格的账单费用,如有线电视、互联网和电话服务。

设定财务目标,应用根据您的现金流自动转账资金,帮助您更快达成目标。

通过高级功能跟踪您的净资产(资产减负债)及信用评分变化。

为各类别(餐饮、娱乐、购物)创建无限月度预算,并在接近限额时收到提醒。

下载 Rocket Money

如何开始使用 Rocket Money

从 App Store 或 Google Play 安装 Rocket Money,然后使用您的电子邮件地址创建免费账户。

连接您的美国支票、储蓄、信用卡和投资账户。应用通过 Plaid 等安全合作伙伴进行银行关联。

让应用自动分类您的支出并检测定期订阅。查看“订阅”标签页,查看所有定期扣费。

高级会员可直接在应用内选择取消服务。礼宾团队将为您处理取消流程。

进入“财务目标”或“智能储蓄”,创建目标(例如“应急基金 — 3000美元”),并选择转账频率和金额。

为各类别(餐饮、娱乐、购物)设定预算,通过仪表盘跟踪支出。高级会员可解锁无限预算类别。

高级订阅用户可选择参与账单协商。Rocket Money 审核有资格的账单(有线电视、互联网、电话),尝试争取更低费率。成功后,您需支付节省金额的一部分作为服务费。

如果订阅高级服务,可每月跟踪净资产(资产减负债)并监控信用评分波动。

配置安全余额通知、大额交易提醒和即将续订警告,随时掌控财务状况。

可随时通过应用设置取消高级订阅。免费账户仍可使用有限功能。

重要限制

- 高级费用: 高级功能需月度或年度订阅(每月3至12美元)。账单协商服务收取节省金额的一定比例作为服务费。

- 第三方依赖: 账户关联依赖 Plaid 等服务。部分银行可能存在连接问题,且并非所有账户类型均支持。

- 结果差异: 虽然 Rocket Money 宣称用户可显著节省,但实际效果因人而异。有用户反馈协商或自动化节省有限。

- 货币限制: 应用仅在美国监管框架内以美元运作,不支持国际货币和银行。

常见问题

是的,Rocket Money 采用 银行级加密,并与 Plaid 等安全银行关联服务合作,保护您的财务数据。应用不会直接存储您的账户凭证。

不可以,Rocket Money 仅面向拥有美国银行账户的美国居民开放。应用不支持国际银行或货币。

免费版允许您关联账户、查看支出明细、检测订阅并设定有限预算。取消礼宾、自动储蓄转账、无限预算、账单协商和信用监控等高级功能需付费订阅。

高级订阅价格通常在 每月3至12美元,具体取决于套餐和当前促销。有些套餐按年计费。请查看应用内当前价格。

您可以通过免费计划 查看所有订阅。但自动取消服务——即 Rocket Money 代表您联系服务提供商取消——仅对高级会员开放。

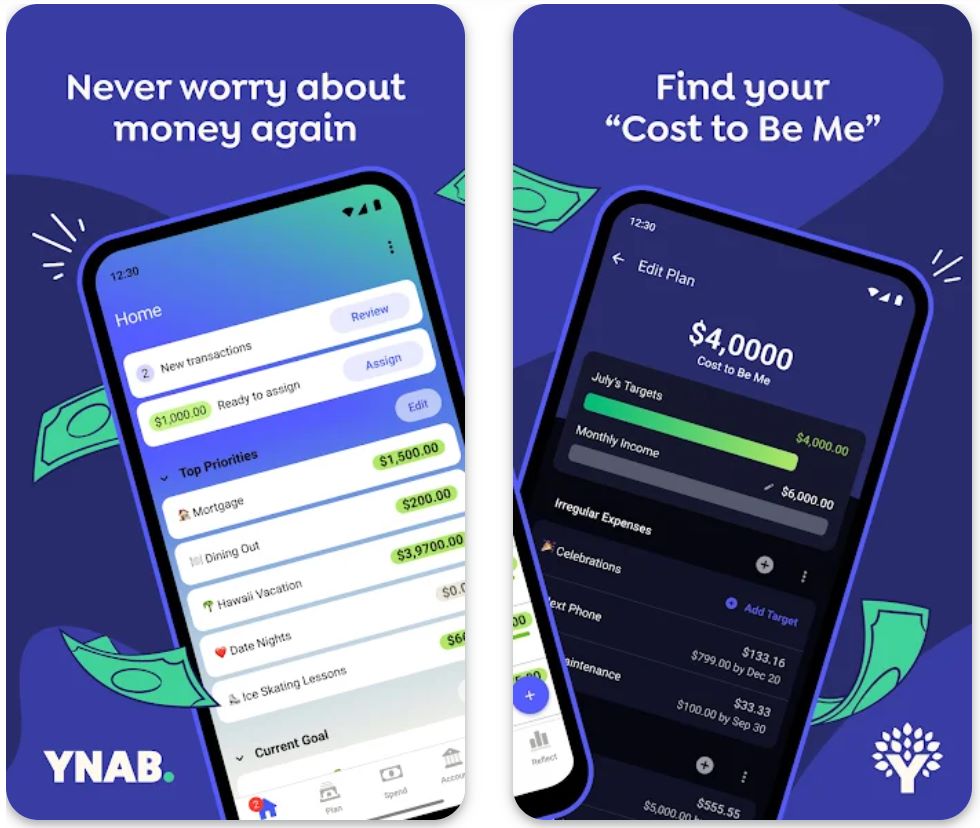

YNAB

应用信息

| 开发者 | You Need a Budget, Inc.,由 Jesse Mecham 创立 |

| 支持平台 |

|

| 语言支持 | 主要为英语;在支持银行关联和货币的国家可用 |

| 价格模式 | 34天免费试用,之后需付费订阅以获得完整访问权限 |

什么是 YNAB?

YNAB(You Need a Budget)是一款基于“为每一美元分配任务”原则构建的预算应用,采用零基预算方法,帮助用户主动分配和跟踪收入、支出、储蓄及目标。通过设备间的实时同步和专门的预算方法,YNAB旨在将用户从被动消费转变为主动理财,减轻压力并提升财务清晰度。

YNAB 如何运作

在许多人感到不清楚钱花到哪里去的时代,YNAB提供了一种结构化的财务控制方法,而不仅仅是监控。它不是等到月底看剩余多少,而是促使您为每一笔收入分配用途:支出、储蓄、还债或缓冲。这种方式促进了有意图的消费和储蓄,使财务与生活优先事项保持一致。

应用界面允许关联银行和信用账户或手动录入交易,分类支出,并跟踪目标和预算的进展。根据开发者的调查,平均用户显著增加储蓄并减少财务压力。

主要功能

为每一美元分配具体任务,使收入减去支出等于零,确保有意图的消费。

通过网页、iOS 和安卓设备访问预算,自动更新并跨所有设备同步。

通过创建“真实支出”缓冲类别,为不定期或即将到来的大额支出做准备。

当某类别超支或优先级变化时,可在预算类别间调动资金。

内置工作坊、支持社区和教程,帮助用户有效采用预算方法。

下载或访问链接

如何使用 YNAB

通过 YNAB 网站或移动应用注册免费试用,关联您的银行、储蓄、信用卡账户(或选择手动录入)。

导入或手动输入当前账户余额和近期交易,使预算保持最新。

创建预算类别(如房租、杂货、娱乐、储蓄、还债),并为每一美元分配到相应类别。

消费时输入或让应用自动导入交易;查看各类别“可用”金额,掌握剩余可支配资金。

针对保险或年度订阅等即将到来的支出,创建“真实支出”类别,每月分配少量资金,确保到期时已有资金准备。

若某类别超支,可利用应用的灵活性从其他类别调拨资金,避免整体超支。

努力实现“资金老化”——目标是本月花费上个月的收入,而非本月收入,提升缓冲和稳定性。

定期检查预算(每日快速检查,月度全面复查),保持类别对齐,优化支出,适应生活变化。

试用结束后,如需继续使用完整功能,需订阅;否则可在收费前取消。

重要限制

- 需要积极参与: 该方法最佳效果需主动分配资金并定期复查预算;不适合被动“设定后忘记”使用。

- 银行连接问题: 部分用户反映自动导入支持有限,或在主要市场外存在地区银行连接问题。

- 投资功能有限: 应用重点在预算和支出管理,投资跟踪、信用评分监控或账单协商功能较少,较竞争对手有限。

常见问题

可以——YNAB 提供34天免费试用,全面开放功能,方便您在订阅前测试该方法。

免费试用结束后,您必须订阅(月付或年付计划)才能继续使用完整功能。

会,支持从多家银行直接导入,但部分用户可能发现关联不完美,仍需手动录入。

适合——但需要一定时间设置预算类别并熟悉方法。如果您偏好完全自动化的“理财自动驾驶”工具,可能需要投入学习成本。

许多用户反馈通过主动预算方法更好地掌控资金,减轻压力,养成储蓄习惯。但效果取决于用户的参与度。

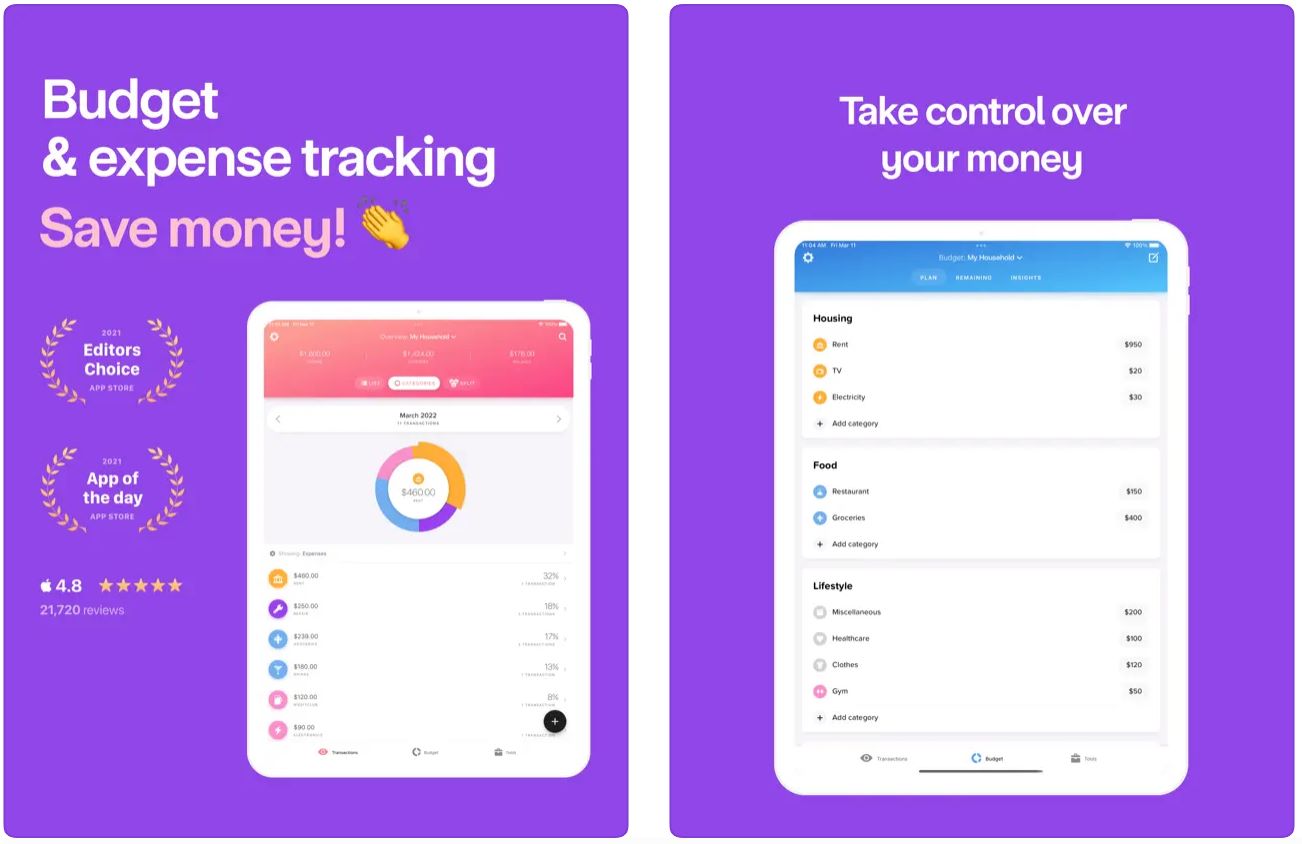

Buddy

| 开发商 | Buddy Budgeting AB |

| 支持平台 |

|

| 语言支持 | 12种以上语言,包括英语、丹麦语、荷兰语、法语、德语、意大利语、挪威博克mål语、波兰语、葡萄牙语、俄语、西班牙语、瑞典语、土耳其语 |

| 可用地区 | 澳大利亚、加拿大、美国及欧洲市场可用 |

| 价格模式 | 免费下载,基础功能免费。高级订阅(月度或年度)解锁全部功能 |

| 用户规模 | 全球超过250万用户 |

什么是 Buddy 预算与储蓄?

Buddy 是一款直观的预算与储蓄应用,通过协作功能、可视化消费洞察和易用的预算规划工具,简化个人及共享财务管理。作为“快乐预算”伴侣,它帮助个人、情侣和室友掌控资金,跟踪支出,设定合理预算,并无缝分担财务责任。

详细介绍

当管理多个账户、共享支出或不规则收入时,财务管理可能变得复杂。Buddy 以简洁、用户友好的设计和流畅的工作流程简化这一复杂性,让预算变得人人可及。

首先为支出类别、储蓄目标和收入跟踪创建个性化预算。然后监控实际交易,实时查看余额,并根据月度财务状况调整分配。

Buddy 的独特之处在于强调协作预算——邀请伴侣、室友或家庭成员共享预算,透明分摊支出,共同维护财务责任。凭借超过250万用户遍布多个市场,Buddy 致力于让预算变得轻松愉快,而非用复杂的财务分析压倒用户。

主要功能

为支出、储蓄、收入和净资产跨多个账户创建并自定义预算,灵活管理分类。

手动或通过银行导入(视地区而定)跟踪支出,实时洞察消费模式和预算状态。

邀请伴侣或室友协作管理联合预算,跟踪共享支出,透明分摊费用。

通过主题、自定义分类、暗黑模式及支持多账户类型(储蓄、支票、债务)个性化体验。

设定具体储蓄目标,使用直观图表展示进度,并接收提醒保持财务目标。

下载或访问链接

如何开始使用 Buddy

从 App Store 或 Google Play(支持地区)下载 Buddy,创建免费账户开始使用。

选择基础货币,创建一个或多个“钱包”或账户(支票、储蓄、债务)以组织财务。

根据收入和支出计划建立预算分类(住房、食品、交通、储蓄)。使用默认分类或创建符合生活方式的自定义分类。

手动输入交易或链接银行账户(支持地区)。将每笔交易分配到相应分类,准确跟踪支出。

邀请伴侣或室友协作管理共享预算,分摊交易,实现透明的家庭财务管理。

定期查看预算仪表盘,了解各分类剩余额度,跟踪储蓄目标进展。

根据财务状况变化,在月内调整分类资金或预算分配。

月末查看支出报告,识别超支区域,发现趋势,更有效规划下月预算。

通过应用内购买订阅 Buddy 高级版,解锁无限账户、银行导入(支持市场)及高级共享功能。

开启提醒,及时获取预算状态、超支警告及共享预算活动更新。

重要限制须知

- 完整功能需高级订阅:基础预算免费,高级功能如共享、多账户和银行导入需付费订阅高级版。

- 交易拆分有限:部分用户反馈无法将单笔交易拆分至多个预算分类,复杂购买时不便。

- 专注预算管理:Buddy 专注于预算和支出跟踪,不提供投资管理或专业财务咨询,需深度分析者建议搭配其他工具。

- 免费版限制:免费版适合简单预算,管理多账户或共享家庭财务的高级用户建议升级高级版以获得最佳体验。

常见问题

是的,Buddy 可免费下载,提供基本预算和支出跟踪功能免费使用。但若需访问完整功能集——包括无限账户、银行导入和协作预算——需订阅高级版(支持月度或年度订阅)。

银行链接功能取决于您的所在地区。Buddy 在部分国家支持开放银行和自动交易导入,但许多市场仍需手动录入交易。请查看应用支持的功能以确认您所在地区的银行连接选项。

当然可以!协作预算是 Buddy 的核心特色之一。您可以邀请伴侣、室友或家庭成员加入预算,共同跟踪共享支出,透明分摊费用,非常适合管理家庭或合租财务。

Buddy 支持 iOS(iPhone、iPad、iPod touch)、macOS(M1芯片及以上)以及部分市场的 Android(通过 Google Play)。支持12种以上语言,包括英语、丹麦语、荷兰语、法语、德语、意大利语、挪威博克mål语、波兰语、葡萄牙语、俄语、西班牙语、瑞典语和土耳其语。

Buddy 主要专注于预算、支出跟踪和储蓄规划,不涉及投资管理或账单谈判服务。如需全面的投资分析、投资组合跟踪或自动账单谈判,建议搭配专门的投资或财务管理平台使用。

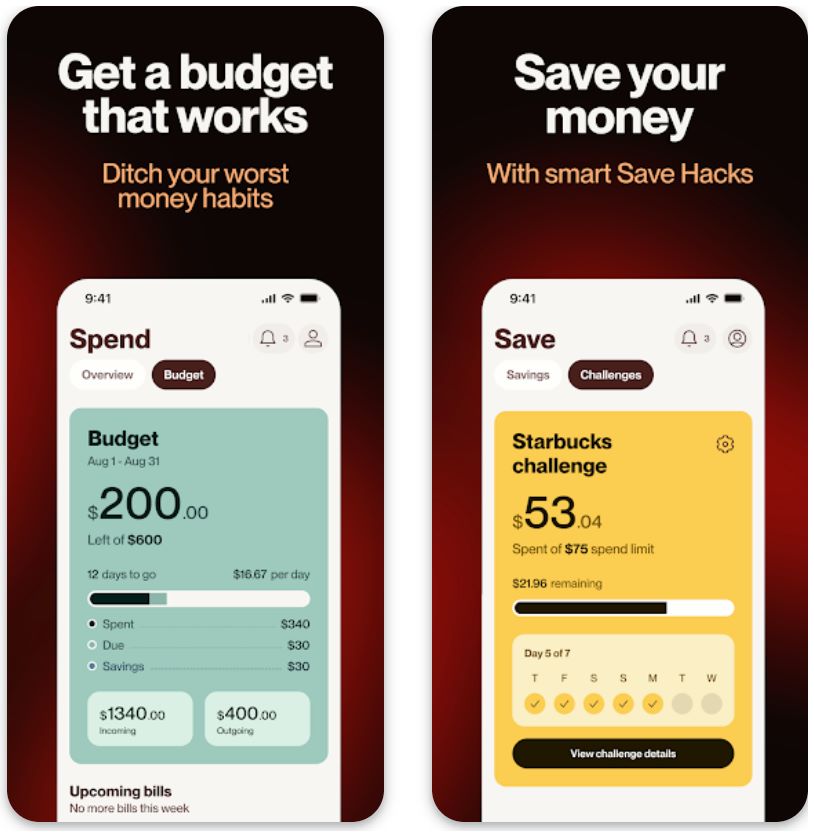

Cleo AI

| 开发者 | Cleo AI Ltd.,由Barnaby Hussey-Yeo创立 |

| 支持平台 |

|

| 语言支持 | 主要支持英语 |

| 可用地区 | 美国(此前曾在英国提供) |

| 价格模式 | 基础预算免费;付费订阅解锁现金预支、信用建设和高级洞察 |

什么是Cleo AI?

Cleo是一款由人工智能驱动的个人理财应用,将预算管理转变为有趣的对话体验。通过连接您的银行账户,这个智能助手跟踪支出,识别消费模式,并通过自动化挑战和个性化洞察帮助您储蓄。与传统理财应用不同,Cleo采用个性化聊天机器人界面,让理财变得不再令人生畏,更加互动。

该应用结合了基本的预算工具和可选的短期现金预支,打造一个集财务跟踪与应急资金于一体的平台。无论您是想了解工资去向,还是培养更好的储蓄习惯,Cleo都提供了现代化的个人理财管理方式。

为什么选择Cleo进行理财?

在当今数字银行环境中,自动支付和刷卡支付让人们很容易忽视消费。Cleo通过一个亲切的AI助手,实时展现您的财务习惯,帮助您应对这一挑战。

该应用的对话式界面消除了预算软件通常带来的复杂性。您无需浏览多个界面和图表,只需提问“我这个月外出就餐花了多少钱?”即可获得即时且可操作的答案。这种自然的交互方式让那些被传统理财工具弄得不知所措的用户也能轻松掌握财务状况。

主要功能

用自然语言提问您的财务问题,立即获得个性化的消费洞察。

- 对话式理财管理

- 按类别细分的消费明细

- 友好且富有趣味的个性

通过零钱凑整、挑战和智能转账功能轻松积累储蓄。

- 购物金额凑整至最接近的整数美元

- 可定制的储蓄挑战

- 可视化进度跟踪

自动分类收入和支出,支持自定义限额和财务目标。

- 自动交易分类

- 按类别设定消费限额

- 收入和账单跟踪

符合条件的订阅用户可获得最高250美元的短期预支,无利息。

- 最高250美元预支额度

- 无利息费用

- 提供快速转账选项

高级功能,旨在通过负责任的使用帮助提升您的信用评分。

- 信用评分提升工具

- 需付费订阅

- 地区可用性不同

可选储蓄账户,提供有竞争力的利率,最大化资金增长潜力。

- 有竞争力的利率

- 视地区和计划而定

- 与主应用集成

下载Cleo AI

如何开始使用Cleo

从Google Play商店(Android)或苹果应用商店(iOS)下载Cleo并安装到您的设备上。

注册并通过Plaid或类似的安全银行连接服务,安全绑定您的主要银行账户。

允许Cleo分析您的消费模式、收入和定期账单,生成个性化洞察和预算建议。

使用聊天机器人界面提问财务相关问题,查看按类别划分的消费明细,设定储蓄目标或挑战。

如有需要,升级至付费订阅,通过聊天界面申请现金预支。选择还款计划和转账方式(快速转账可能产生额外费用)。

激活零钱凑整或自动转账至储蓄钱包。可视化跟踪进度,并根据需要调整储蓄目标。

定期查看预算仪表盘,调整消费类别,审阅AI生成的洞察,并响应提示以改善财务习惯。

如果不再需要高级功能,可取消或降级至免费版本,同时继续使用基础预算和跟踪工具。

重要限制须知

- 高级功能需订阅:免费版本提供基础预算功能,但现金预支、信用建设工具和更高预支额度等重要功能需付费订阅。

- 必须绑定银行账户:完整功能需连接银行账户。使用不支持银行或处于非支持地区的用户可能功能受限,需依赖手动输入。

- 现金预支额度有限:预支金额较小(新用户通常最高250美元或更少),且需还款。即时转账选项会产生额外费用,降低“免息”预支的优势。

- AI个性不适合所有人:聊天机器人的调侃或“吐槽”风格吸引部分用户,但对其他人可能显得不合适或不专业。消费分类(必要与非必要)偶尔可能不准确。

- 监管问题:2025年3月,Cleo因现金预支和订阅条款的误导性声明与美国联邦贸易委员会(FTC)达成和解,可能引发对透明度和商业行为的关注。

常见问题解答

是的——Cleo是一家合法的金融科技公司,提供预算、储蓄和现金预支服务。该应用采用安全的银行连接技术(如Plaid),并经过多家独立机构评审。但用户应注意2025年3月与FTC达成的关于误导性声明的和解。

可以——免费版本提供基础预算、消费跟踪和储蓄工具。但现金预支、信用建设功能和快速转账等高级功能需升级至付费订阅计划。

资格和额度因用户而异。新用户通常可获得较小额度(约20至100美元),额度会根据账户活动和使用历史增加。一些资深用户报告可获得最高250美元的预支,具体取决于订阅计划和财务状况。

不会——Cleo的AI聊天机器人旨在提供自动化的预算洞察和储蓄机制,而非全面的财务规划。其建议基于算法,可能缺乏处理复杂财务状况所需的细致入微。对于个性化投资策略或重大财务决策,建议咨询专业理财顾问。

Cleo主要支持美国市场。银行兼容性存在差异,非支持金融机构的用户可能功能受限。该应用曾在英国提供,但目前专注于美国市场。使用高级功能前,请务必确认您的地区和银行支持情况。

Copilot Money

| 开发者 | Copilot Money, Inc. |

| 支持平台 |

|

| 语言支持 | 仅支持英语 |

| 可用性 | 仅支持美国金融机构 |

| 价格模式 | 提供免费试用。完整功能需付费订阅:约13美元/月或95美元/年 |

高级个人理财管理

Copilot Money 是一款先进的个人理财应用,将您的支出、预算、储蓄目标和投资集中在一个优雅的仪表盘中。它连接数千家美国金融机构,自动分类交易,突出显示定期订阅,帮助您直观了解现金流和净资产。Copilot 设计注重清晰与掌控,提供高级无广告体验,助力用户全面洞察财务状况。

为什么选择 Copilot Money

在充斥被动追踪工具和广告支持应用的理财世界中,Copilot Money 以其主动清晰和高级体验脱颖而出。连接账户后,应用利用机器学习自动分类支出,检测您可能遗忘的定期费用,并在清晰直观的仪表盘中展示收入与支出对比。

其吸引力在于鼓励主动财务管理,而非单纯被动监控。支持 iPhone、iPad 和 Mac 多设备同步,确保您的预算无缝更新。虽然订阅费用可能让部分用户犹豫,但许多用户认为其优质体验和实用洞察物有所值。

主要功能

通过机器学习,自动对超过10,000家金融机构的交易进行分类,包括投资和信用账户。

设定个性化预算,实时跟踪进度,直观显示各类别剩余额度。

自动识别定期付款和订阅,展示未来承诺,帮助管理持续支出。

查看资产、负债及投资组合表现,与预算数据并列,呈现完整财务全貌。

支持 iPhone、iPad 和 Mac 应用无缝同步,具备暗黑模式、标签及高级现金流可视化功能。

下载或访问链接

入门指南

在您的 iPhone、iPad 或 Mac 的 App Store 下载 Copilot Money。

注册账户并完成入门流程。关联您的美国银行账户、信用卡和投资账户。

允许应用导入近期交易。审核并确认分类准确性。

查看仪表盘标签,了解收入、支出、净收入、剩余预算及即将到期的定期付款。

为食品杂货、娱乐和交通等类别创建预算。为特定账户设定储蓄目标。

使用“定期”部分查看持续订阅和计划付款。识别需要调整或取消的项目。

通过“资产与投资”部分监控净资产和投资表现。查看时间进展。

根据需要调整预算和类别。应用会适应您的消费习惯,帮助优化财务计划。

频繁使用应用,识别趋势、超支模式及节省机会。

如果付费计划不符合需求,请在续订前取消订阅。部分功能仍可使用。

重要限制

- 需付费订阅: 免费试用后,必须订阅才能使用全部功能。无永久免费完整功能版本。

- 高级定价: 约13美元/月的费用相比免费替代品可能较高,尤其是仅需基础预算功能时。

- 功能持续完善: 部分用户指出对联合账户、历史交易导入及高级规划功能支持有限。

常见问题

可以——Copilot 提供免费试用期,试用结束后需订阅,您可在试用期间体验所有功能。

Copilot 支持 iPhone(iOS 15.6及以上)、iPad(iPadOS 15.6及以上)和 Mac(macOS 12.5及以上)设备,且在所有平台间实现无缝同步。

目前,Copilot 仅面向美国用户,且仅支持美国金融机构。尚未支持安卓系统及国际市场。

与许多免费应用不同,Copilot 提供高级无广告体验,具备先进用户界面、自动交易分类、投资追踪及机器学习洞察,但需订阅费用。

如果您关联多个账户(包括投资账户),重视全面财务清晰度并欣赏精致用户体验,许多用户认为订阅物有所值。但若仅需简单预算,可能有更便宜的替代方案。

AI驱动储蓄计划的主要优势

自动实时跟踪

智能分类

个性化洞察

预测性目标规划

综合影响

这些优势协同作用,使储蓄变得更易管理且压力更小。您无需再手动更新电子表格或估算储蓄金额——AI处理复杂计算。通过自动识别削减成本的机会并促进转账,这些工具推动持续储蓄习惯,无需猜测或摩擦。

保障措施与最佳实践

虽然AI是强大的财务助手,专家强调明智且安全地使用这些工具的重要性。AI应用应作为补充——而非替代——理性财务判断和必要时的专业建议。

安全考虑

选择AI理财应用时,安全必须是首要考虑。请选择信誉良好的服务——最好是与知名银行或认可的金融科技品牌合作的产品——并启用所有可用的隐私功能。

使用AI预算工具时,隐私和安全至关重要。用户应启用账户的多因素认证,确保数据保护,同时允许AI访问必要的财务信息。

— SoFi安全指南

安全有效使用的最佳实践

- 选择可信应用:挑选用户评价良好且具备强大安全措施(包括加密和双因素认证)的理财工具

- 策略性自动化:设置自动转账至储蓄或还债账户,确保先储蓄后消费

- 审查AI建议:将AI建议视为参考而非命令——核实建议的储蓄比例是否符合实际预算,并根据需要调整目标

- 持续财务教育:通过不断学习保持财务素养——AI提供指导,但理解自身需求并偶尔咨询人工顾问能强化整体策略

- 定期监控:每周审查AI生成的洞察,确保准确无误,及时发现异常模式或错误

- 循序渐进:从小规模自动化开始,随着对系统的信任逐步增加

风险做法

- 盲目遵循所有AI建议

- 使用未经验证且安全性差的应用

- 缺乏人工监督或核实

- 忽视隐私设置

安全策略

- 经过验证且来源可信的建议

- 具备强大加密的知名应用

- 定期监控和调整

- 启用最大安全功能

通过实施这些最佳实践,您可以充分利用AI的优势,同时保持对财务决策和数据安全的完全控制。

结论

人工智能正在从根本上改变个人规划和实现储蓄目标的方式。通过分析每笔财务交易,AI驱动的工具提供个性化储蓄计划并自动转账——大大简化了预算管理。这种理财建议的民主化意味着年轻用户和无法负担专业理财顾问的人群也能以极低成本获得量身指导。

可及性

自动化

优化

展望未来,这种先进技术与审慎理财实践的结合,有望让个人理财变得更易接近、更高效。AI正将储蓄从繁重的任务转变为随着生活变化而调整的个性化计划。

随着AI驱动理财工具的普及,每个人都能自信规划未来。

— 世界经济论坛

No comments yet. Be the first to comment!