Az MI megtakarítási terveket javasol

Az MI átalakítja a pénzmegtakarítás módját. A költési szokások elemzésével és személyre szabott megtakarítási stratégiák automatikus javaslatával az MI-alapú pénzügyi alkalmazások segítik a felhasználókat okosabban kezelni a pénzüket, könnyedén megtakarítani és gyorsabban elérni céljaikat.

A pénz megtakarítása ma kihívást jelent – az emelkedő költségek és a rohanó életmód megnehezítik a rendszeres félretételt. Szerencsére a mesterséges intelligencia (MI) forradalmasítja a személyes pénzügyeket okos alkalmazások és eszközök révén, amelyek elemzik költési szokásait, és személyre szabott megtakarítási stratégiákat kínálnak.

A modern, MI-alapú költségvetési platformok közvetlenül kapcsolódnak pénzügyi számláihoz, automatikusan követik a költési mintákat, és javasolják az optimális havi megtakarítási összegeket. A bevételek és kiadások elemzésével ezek az intelligens rendszerek dinamikus megtakarítási célokat állítanak be, amelyek alkalmazkodnak pénzügyi helyzetének változásaihoz.

Hogyan elemzi az MI pénzügyeit

Az MI-vezérelt pénzügyi alkalmazások biztonságosan kapcsolódnak bank- és hitelkártyaszámláihoz, majd átvizsgálják teljes tranzakciós előzményeit. Fejlett gépi tanulási algoritmusok segítségével ezek a rendszerek kategorizálják a költéseket több területen, és folyamatosan tanulnak pénzügyi mintáiból.

Számlaintegráció

Okos kategorizálás

Minta felismerés

Az MI-alapú költségvetési eszközök személyre szabott nyomon követést és betekintést nyújtanak a költési minták elemzésével, és ajánlásokat kínálnak a pénzügyek kezeléséhez.

— SoFi Pénzügyi Szolgáltatások

Személyre szabott ajánlások a gyakorlatban

Az MI az egyedi pénzügyi profilja alapján testreszabott javaslatokat ad. Például, ha a rendszer gyakori éttermi költést észlel, javasolhat otthoni főzést a kiadások csökkentésére. Hasonlóképpen felismeri, hogy a kis előfizetési szolgáltatások csökkentése idővel jelentős megtakarítást eredményezhet.

Előrejelző pénzügyi elemzés

A történeti elemzésen túl az MI-eszközök előrejelző modellezést alkalmaznak pénzügyi jövője megjóslására. Ezek a rendszerek képesek megmutatni, hogy jó úton halad-e konkrét célok elérésében – például lakásvásárlási előleg megtakarításában –, vagy szükségesek-e módosítások.

Cél előrejelzés

Az MI előre jelzi pénzügyi mérföldkövei elérésének előrehaladását, és figyelmeztet a lehetséges hiányokra, mielőtt azok bekövetkeznének.

Egyedi megtakarítási ütemtervek

Konkrét ajánlásokat kap, például „Takarítson meg heti 150 dollárt ebben a hónapban, hogy év végére elérje a vésztartalék célját.”

A bevételek, közelgő számlák és történeti költési adatok feldolgozásával az MI nyers pénzügyi információkat alakít dinamikus, személyre szabott megtakarítási útitervvé, amely alkalmazkodik élethelyzetéhez.

Valós AI megtakarítási eszközök

Rocket Money

| Fejlesztő | Rocket Money, Inc. (a Rocket Companies része) |

| Támogatott platformok |

|

| Nyelv és elérhetőség | Csak angol — amerikai lakosoknak amerikai bankszámlákkal |

| Árazási modell | Ingyenes letöltés, opcionális Prémium előfizetés ($3–$12/hó) a fejlett funkciókért |

Mi az a Rocket Money?

A Rocket Money egy személyes pénzügyi alkalmazás, amely segít irányítani kiadásaidat, kezelni előfizetéseidet, tárgyalni számláidról és automatizálni megtakarításaidat. Kapcsold össze bankszámláidat, hitelkártyáidat és befektetéseidet, hogy egy helyen átfogó képet kapj pénzügyeidről. Az ingyenes verzió követi a kiadásokat és azonosítja az ismétlődő díjakat, míg a Prémium előfizetés feloldja az előfizetéslemondási segítséget, számlatárgyalást, korlátlan költségvetéseket és automatizált megtakarítási átutalásokat.

Miért érdemes használni a Rocket Money-t?

Az ismétlődő kiadások és rejtett előfizetések észrevétlenül terhelhetik meg költségvetésedet. A Rocket Money leegyszerűsíti a pénzügyi menedzsmentet azzal, hogy összegyűjti az összes számládat, kiemeli az ismétlődő fizetéseket, és eszközöket biztosít a megtakarítások céljaid felé irányításához.

Több mint 10 millió taggal és több mint 2,5 milliárd dollár bruttó megtakarítással az alkalmazás bizonyította értékét. Miután összekapcsoltad folyószámláidat, megtakarításaidat, hitelkártyáidat és befektetéseidet, a Rocket Money kategorizálja kiadásaidat, figyelmeztet az ismétlődő fizetésekre, és segít reális megtakarítási célokat kitűzni.

A kiemelkedő funkció az automatizált megtakarítás: állíts be egy célt, kapcsold össze számláidat, és az alkalmazás automatikusan átutalja a pénzt egy FDIC által biztosított megtakarítási számlára, anélkül, hogy folyamatos figyelmet igényelne.

Főbb funkciók

Automatikusan kategorizálja az összes kapcsolt számlán végzett tranzakciókat, így tiszta képet kapsz arról, hová megy a pénzed.

Azonosítja az ismétlődő díjakat és segít lemondani a nem kívánt előfizetéseket. A Prémium tagok concierge lemondási segítséget kapnak.

Prémium funkció: a Rocket Money csapata alacsonyabb díjakat tárgyal ki jogosult számlákra, például kábel, internet és telefon szolgáltatásokra a nevedben.

Állíts be pénzügyi célokat, és az alkalmazás automatikusan átutalja a pénzt a készpénzforgalmad alapján, hogy gyorsabban elérd a kitűzött célokat.

Kövesd nyomon nettó vagyonodat (eszközök mínusz kötelezettségek) és a hitelpontszám változásait idővel, ha Prémium előfizető vagy.

Hozz létre korlátlan havi költségvetéseket kategóriánként (étkezés, szórakozás, vásárlás), és kapj értesítéseket, ha közeledsz a határokhoz.

Rocket Money letöltése

Hogyan kezdj hozzá a Rocket Money használatához

Töltsd le a Rocket Money-t az App Store-ból vagy a Google Play-ről, majd hozz létre egy ingyenes fiókot az email címeddel.

Kapcsold össze amerikai folyószámláidat, megtakarítási, hitelkártya- és befektetési számláidat. Az alkalmazás biztonságos partnereket, például a Plaid-et használ a banki összekapcsoláshoz.

Az alkalmazás kategorizálja kiadásaidat és felismeri az ismétlődő előfizetéseket. Nézd meg az „Előfizetések” fület az összes ismétlődő díj megtekintéséhez.

A Prémium tagok közvetlenül az alkalmazásban választhatják ki a lemondandó szolgáltatásokat. A concierge csapat intézi a lemondási folyamatot helyetted.

Lépj a „Pénzügyi célok” vagy „Okos megtakarítás” menüpontra, hozz létre egy célt (pl. „Vészhelyzeti alap — 3 000 dollár”), és válaszd ki az átutalás gyakoriságát és összegét.

Állíts be költségvetéseket kategóriánként (étkezés, szórakozás, vásárlás), és kövesd nyomon a kiadásokat az irányítópulton. A Prémium feloldja a korlátlan költségvetési kategóriákat.

A Prémium előfizetők bekapcsolhatják a számlatárgyalást. A Rocket Money áttekinti a jogosult számlákat (kábel, internet, telefon), és megpróbál alacsonyabb díjakat elérni. Ha sikeres, a megtakarítás egy részét szolgáltatási díjként fizeted.

Kövesd havi szinten nettó vagyonodat (eszközök mínusz kötelezettségek), és figyeld a hitelpontszám változásait, ha Prémium előfizető vagy.

Állíts be biztonságos egyenleg értesítéseket, nagy összegű tranzakciókra figyelmeztetéseket és közelgő megújítási figyelmeztetéseket, hogy mindig naprakész legyél pénzügyeidben.

Bármikor lemondhatod a Prémiumot az alkalmazás beállításaiban. Az ingyenes fiókod korlátozott funkciókkal továbbra is aktív marad.

Fontos korlátozások

- Prémium költségek: A fejlett funkciók havi vagy éves előfizetést igényelnek ($3–$12/hó). A számlatárgyalás a megtakarítás egy százalékát veszi igénybe szolgáltatási díjként.

- Harmadik fél függőségek: A számlák összekapcsolása olyan szolgáltatásoktól függ, mint a Plaid. Bizonyos bankokkal kapcsolatban előfordulhatnak csatlakozási problémák, és nem minden számlatípus támogatott.

- Változó eredmények: Bár a Rocket Money jelentős megtakarításokat ígér, az egyéni eredmények eltérőek. Egyes felhasználók minimális megtakarításról számolnak be a tárgyalások vagy automatizálás során.

- Valuta korlátozás: Az alkalmazás kizárólag amerikai dollárban működik, az amerikai szabályozási keretek között. Nem támogat nemzetközi valutákat és bankokat.

Gyakran ismételt kérdések

Igen, a Rocket Money banki szintű titkosítást használ, és biztonságos banki összekapcsoló szolgáltatókkal, például a Plaid-del működik együtt pénzügyi adataid védelmében. A fiókadataidat az alkalmazás soha nem tárolja közvetlenül.

Nem, a Rocket Money csak amerikai lakosok számára érhető el amerikai bankszámlákkal. Az alkalmazás nem támogat nemzetközi bankokat vagy valutákat.

Az ingyenes verzió lehetővé teszi a számlák összekapcsolását, a kiadások bontását, az előfizetések felismerését és korlátozott költségvetések beállítását. A Prémium funkciók, mint a lemondási concierge, automatizált megtakarítási átutalások, korlátlan költségvetések, számlatárgyalás és hitelfigyelés fizetős előfizetést igényelnek.

A Prémium ára általában 3 és 12 dollár között van havonta, a csomagtól és az aktuális akcióktól függően. Egyes csomagok éves számlázásúak. Ellenőrizd az alkalmazásban a helyi aktuális árakat.

Az ingyenes csomaggal megtekintheted az összes előfizetést. Az automatikus lemondási szolgáltatás — amikor a Rocket Money a szolgáltatóval lép kapcsolatba helyetted — azonban csak Prémium tagok számára érhető el.

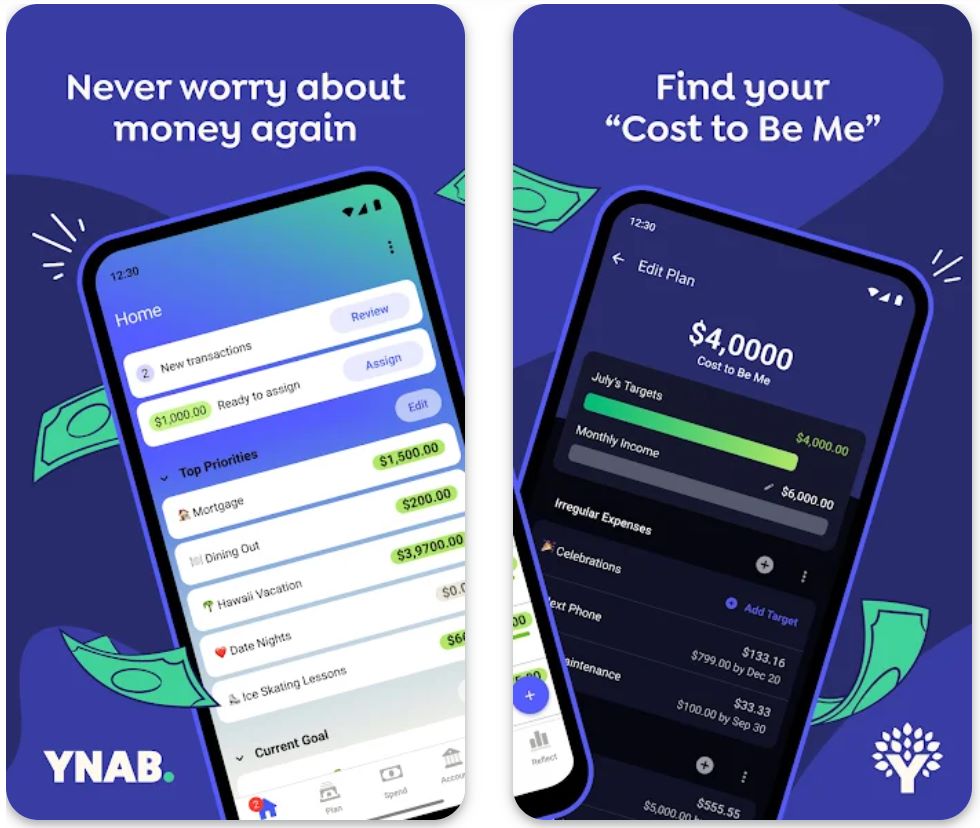

YNAB

Alkalmazásinformációk

| Fejlesztő | You Need a Budget, Inc., alapította Jesse Mecham |

| Támogatott platformok |

|

| Nyelvi támogatás | Elsősorban angol; elérhető olyan országokban, ahol bankkapcsolat és valutatámogatás van |

| Árazási modell | 34 napos ingyenes próbaidőszak, majd előfizetés szükséges a teljes hozzáféréshez |

Mi az a YNAB?

A YNAB (You Need a Budget) egy költségvetés-kezelő alkalmazás, amely azon az elven alapul, hogy minden dollárnak feladatot ad, nulla-alapú költségvetési módszert használva, hogy a felhasználók aktívan rendeljenek és kövessenek nyomon bevételeket, kiadásokat, megtakarításokat és célokat. Valós idejű szinkronizálással az eszközök között és egy dedikált költségvetési módszertannal a YNAB célja, hogy a felhasználókat a reaktív költésről a proaktív pénzgazdálkodásra terelje, csökkentve a stresszt és növelve a pénzügyi átláthatóságot.

Hogyan működik a YNAB?

Olyan korban, amikor sokan érzik úgy, hogy nem tudják, hová megy a pénzük, a YNAB egy strukturált megközelítést kínál a pénzügyek irányítására a puszta nyomon követés helyett. Ahelyett, hogy megvárnánk, mi marad a hónap végén, a YNAB arra ösztönöz, hogy minden bejövő dollárnak rendelj célt: kiadások, megtakarítás, adósságtörlesztés vagy tartalék. Ez elősegíti a tudatos költést és megtakarítást – a pénzügyeidet az életed prioritásaihoz igazítva.

Az alkalmazás felülete lehetővé teszi bank- és hitelszámlák összekapcsolását vagy a tranzakciók kézi bevitelét, a kiadások kategorizálását, valamint a célok és költségvetések előrehaladásának nyomon követését. A fejlesztő szerint a felhasználók átlagosan jelentős megtakarítást érnek el, és kevesebb stresszt éreznek a pénzügyek miatt.

Főbb jellemzők

Minden dollárnak konkrét feladatot rendelj, hogy a bevétel mínusz kiadások nulla legyen, biztosítva a tudatos költést.

Weben, iOS-en és Androidon is elérheted költségvetésed, automatikus frissítésekkel és szinkronizálással minden eszközön.

Tervezd meg a szabálytalan vagy közelgő nagyobb kiadásokat úgy, hogy létrehozol tartalékkategóriákat az „igazi kiadásokra”.

Ha túlköltekezel, vagy változnak a prioritások, mozgathatsz pénzt a költségvetési kategóriák között.

Beépített workshopok, támogató közösség és oktatóanyagok segítik a felhasználókat a költségvetési módszer hatékony elsajátításában.

Letöltési vagy hozzáférési link

Hogyan használd a YNAB-ot

Regisztrálj ingyenes próbaidőszakra a YNAB weboldalán vagy mobilalkalmazásában, és kapcsolj össze bank-, megtakarítási, hitelkártya számlákat (vagy válaszd a kézi bevitel lehetőségét).

Importáld vagy írd be aktuális számlaegyenlegeidet és a legutóbbi tranzakciókat, hogy naprakész legyen a költségvetésed.

Hozz létre költségvetési kategóriákat (pl. Lakbér, Élelmiszer, Szórakozás, Megtakarítás, Adósságtörlesztés), és rendelj minden elérhető pénzdollárt egy kategóriához.

Amikor költesz, írd be vagy engedd, hogy az alkalmazás importálja a tranzakciókat; nézd meg az egyes kategóriák „Elérhető” összegeit, hogy tudd, mennyit költhetsz még.

Közelgő kiadások, például biztosítás vagy éves előfizetések esetén hozz létre „igazi kiadás” kategóriákat, és havonta különíts el kis összegeket, hogy a költség már fedezett legyen a fizetéskor.

Ha egy kategóriában túlköltesz, használd az alkalmazás rugalmasságát, hogy pénzt mozgass át más kategóriából ahelyett, hogy összességében túlköltenél.

Törekedj arra, hogy „öregítsd a pénzed” – a cél, hogy a múlt havi bevételt költsd el a jelen hónapban, nem pedig a jelen hónap bevételét, így növelve a tartalékot és a stabilitást.

Rendszeresen nézd át költségvetésedet (napi gyors ellenőrzés, havi teljes áttekintés), hogy a kategóriák összhangban legyenek, finomítsd a kiadásokat és igazíts az élet változásaihoz.

A próbaidőszak lejárta után előfizethetsz, ha szeretnéd tovább használni a teljes funkcionalitást; különben lemondhatod az előfizetést a díjak felszámolása előtt.

Fontos korlátozások

- Aktív részvétel szükséges: A módszer akkor működik a legjobban, ha aktívan osztod el a pénzt és rendszeresen átnézed a költségvetést; kevésbé alkalmas passzív „beállít és felejtsd el” használatra.

- Bankkapcsolati problémák: Egyes felhasználók korlátozott automatikus import támogatásról vagy regionális bankkapcsolati problémákról számolnak be a fő piacokon kívül.

- Korlátozott befektetési funkciók: Az alkalmazás elsősorban a költségvetésre és kiadásokra fókuszál; kevesebb funkcióval rendelkezik befektetéskövetés, hitelpontszám-ellenőrzés vagy számlatárgyalás terén néhány versenytárshoz képest.

Gyakran Ismételt Kérdések

Igen – a YNAB 34 napos ingyenes próbaidőszakot kínál, teljes hozzáféréssel a funkciókhoz, hogy kipróbálhasd a módszert előfizetés előtt.

A próbaidőszak lejárta után előfizetés szükséges (havi vagy éves csomag), hogy továbbra is használhasd az alkalmazást teljes funkcionalitással.

Igen, sok bankból támogatja a közvetlen importot, de egyes felhasználók tapasztalhatnak tökéletlen összekapcsolást vagy szükség lehet kézi bevitelre.

Igen – de számíts rá, hogy időt és energiát kell fordítani a költségvetési kategóriák beállítására és a módszer megismerésére. Ha teljesen automatizált „pénzügyi autopilóta” eszközt keresel, el kell kötelezned magad a tanulási folyamat mellett.

Sok felhasználó számol be jobb pénzügyi kontrollról, csökkent stresszről és jobb megtakarítási szokásokról az aktív költségvetés-készítés révén. Az eredmények azonban a felhasználói elkötelezettségtől függnek.

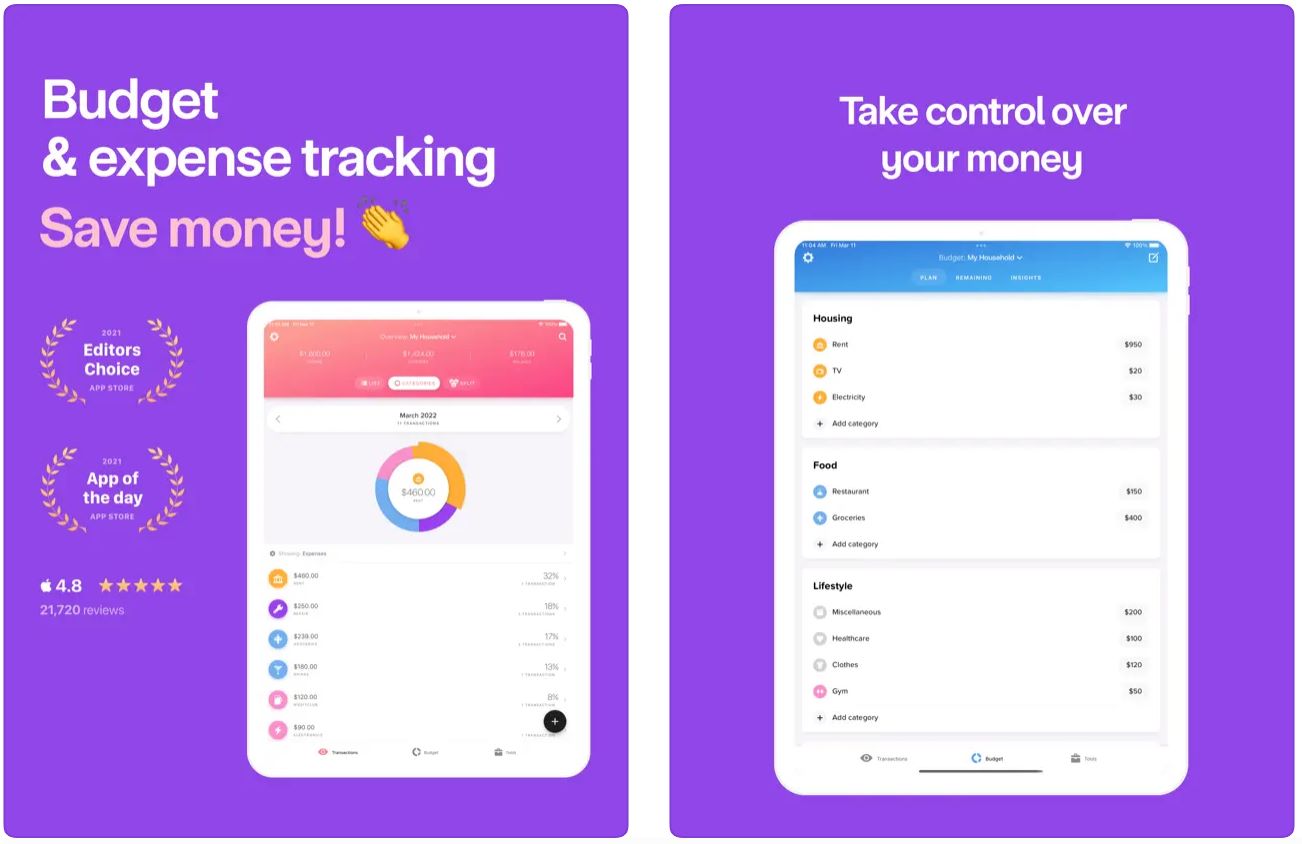

Buddy

| Fejlesztő | Buddy Budgeting AB |

| Támogatott platformok |

|

| Nyelvi támogatás | 12+ nyelv, többek között angol, dán, holland, francia, német, olasz, norvég bokmål, lengyel, portugál, orosz, spanyol, svéd, török |

| Elérhetőség | Elérhető Ausztráliában, Kanadában, az Egyesült Államokban és európai piacokon |

| Árazási modell | Ingyenesen letölthető alapfunkciókkal. Prémium előfizetés (havi vagy éves) szükséges a teljes funkcionalitáshoz |

| Felhasználói bázis | Több mint 2,5 millió felhasználó világszerte |

Mi az a Buddy Budget & Save Money?

A Buddy egy intuitív költségvetés- és megtakarítás-kezelő alkalmazás, amely egyszerűsíti a személyes és közös pénzügyeket együttműködési funkciókkal, vizuális költési betekintésekkel és könnyen használható költségvetés-tervező eszközökkel. Mint egy „örömteli költségvetés” társ, segít egyéneknek, pároknak és lakótársaknak, hogy átvegyék pénzügyeik irányítását, nyomon kövessék kiadásaikat, reális költségvetéseket állítsanak be, és zökkenőmentesen osszák meg a pénzügyi felelősséget.

Részletes áttekintés

A pénzügyek kezelése túlterhelővé válhat, ha több számlát, közös kiadásokat vagy rendszertelen bevételeket kell egyensúlyozni. A Buddy leegyszerűsíti ezt a bonyolultságot tiszta, felhasználóbarát kialakítással és áramvonalas munkafolyamattal, amely mindenki számára elérhetővé teszi a költségvetés-készítést.

Kezdje egyedi költségvetések létrehozásával kiadási kategóriákra, megtakarítási célokra és bevételkövetésre. Ezután figyelje az aktuális tranzakciókat, tekintse meg a fennmaradó egyenlegeket valós időben, és igazítsa az elosztásokat, ahogy pénzügyi helyzete a hónap során változik.

A Buddy különlegessége a közös költségvetés-készítés hangsúlya – hívja meg partnerét, lakótársát vagy családtagját, hogy osszák meg a költségvetéseket, átláthatóan osszák meg a kiadásokat, és tartsák fenn a pénzügyi felelősségvállalást együtt. Több mint 2,5 millió felhasználóval több piacon a Buddy hírnevét az élvezetes és könnyen elérhető költségvetés-készítés építésére alapozta, nem pedig bonyolult pénzügyi elemzések túlterhelésére.

Főbb jellemzők

Készítsen és testreszabott költségvetéseket kiadásokra, megtakarításokra, bevételekre és nettó vagyonra több számlán keresztül rugalmas kategóriakezeléssel.

Kövesse nyomon a kiadásokat manuálisan vagy banki importon keresztül (régiófüggő), azonnali betekintést nyújtva a költési mintákba és a költségvetés állapotába.

Hívjon meg partnereket vagy lakótársakat közös költségvetésekhez, közös kiadások nyomon követéséhez és átlátható költségmegosztáshoz.

Személyre szabhatja élményét témákkal, egyedi kategóriákkal, sötét móddal és több számlatípus támogatásával (megtakarítás, folyószámla, adósság).

Állítson be konkrét megtakarítási célokat, vizualizálja az előrehaladást intuitív diagramokkal, és kapjon értesítéseket, hogy a pénzügyi mérföldkövek felé haladjon.

Letöltési vagy hozzáférési link

Hogyan kezdje el a Buddy használatát

Töltse le a Buddy-t az App Store-ból vagy a Google Play-ről (ahol elérhető), majd hozza létre ingyenes fiókját a kezdéshez.

Válassza ki alapvalutáját, és hozzon létre egy vagy több „pénztárcát” vagy számlát (folyószámla, megtakarítás, adósság) pénzügyei rendszerezéséhez.

Építsen költségvetési kategóriákat bevétele és kiadási terve alapján (Lakhatás, Élelmiszer, Közlekedés, Megtakarítás). Használja az alapértelmezett kategóriákat vagy hozzon létre egyedi kategóriákat, amelyek illeszkednek életstílusához.

Adja meg a tranzakciókat manuálisan vagy kapcsolja össze bankszámláját (ahol támogatott). Rendelje hozzá minden tranzakciót a megfelelő kategóriához a pontos kiadáskövetés érdekében.

Hívja meg partnerét vagy lakótársát, hogy működjenek együtt közös költségvetéseken és osszák meg a tranzakciókat az átlátható háztartási pénzügyi menedzsment érdekében.

Rendszeresen ellenőrizze költségvetési műszerfalát, hogy lássa a fennmaradó egyenlegeket minden kategóriában, és kövesse nyomon a megtakarítási célok felé vezető előrehaladást.

Helyezzen át pénzeszközöket kategóriák között vagy módosítsa a költségvetési elosztásokat a hónap során, ahogy pénzügyi körülményei változnak.

Hónap végén tekintse át a költési jelentéseket, hogy azonosítsa a túlköltési területeket, felismerje a trendeket, és hatékonyabban tervezze meg a következő havi költségvetést.

Előfizetés a Buddy Prémiumra az alkalmazáson belüli vásárlással, hogy korlátlan számlákhoz, banki importokhoz (támogatott piacokon) és fejlett megosztási funkciókhoz férjen hozzá.

Kapcsolja be az értesítéseket, hogy időben frissítéseket kapjon a költségvetés állapotáról, túlköltési figyelmeztetésekről és a megosztott költségvetési tevékenységekről.

Fontos korlátozások, amelyeket figyelembe kell venni

- Prémium szükséges a teljes funkciókhoz: Az alap költségvetés-készítés ingyenes, de a fejlett funkciók, mint a megosztás, több számla és banki import fizetős Prémium előfizetést igényelnek.

- Korlátozott tranzakciómegosztás: Egyes felhasználók arról számoltak be, hogy nem tudnak egyetlen tranzakciót több költségvetési kategóriára bontani, ami kényelmetlen lehet összetett vásárlások esetén.

- Csak költségvetés-központú: A Buddy elsősorban költségvetés-készítésre és kiadáskövetésre specializálódott, nem befektetéskezelésre vagy professzionális pénzügyi tanácsadásra – mély elemzésekhez további eszközök szükségesek lehetnek.

- Ingyenes verzió korlátai: Az ingyenes verzió egyszerű költségvetésekhez jól működik, de a több számlát vagy közös háztartási pénzügyeket kezelő haladó felhasználóknak valószínűleg szükségük lesz a Prémium szintre az optimális érték érdekében.

Gyakran Ismételt Kérdések

Igen, a Buddy ingyenesen letölthető, és alapvető költségvetés- és kiadáskövetési funkciókat kínál díjmentesen. Azonban a teljes funkciókészlethez – beleértve a korlátlan számlákat, banki importokat és közös költségvetés-készítést – Prémium előfizetés szükséges (havi vagy éves előfizetés formájában).

A banki kapcsolódás elérhetősége régiófüggő. A Buddy támogatja az open bankinget és az automatikus tranzakcióimportot néhány országban, de sok piacon még mindig manuális tranzakcióbevitelt igényel. Ellenőrizze az alkalmazás támogatott funkcióit az adott helyszínén a banki kapcsolódási lehetőségek megerősítéséhez.

Természetesen! A közös költségvetés-készítés a Buddy egyik kiemelkedő funkciója. Meghívhat partnereket, lakótársakat vagy családtagokat, hogy csatlakozzanak költségvetéséhez, együtt kövessék nyomon a közös kiadásokat, és átláthatóan osszák meg a költségeket. Ez ideálissá teszi a háztartási pénzügyek vagy közös lakhatási helyzetek kezelésére.

A Buddy elérhető iOS-en (iPhone, iPad, iPod touch), macOS-en (M1 chip vagy újabb), valamint Androidon a Google Play-en keresztül kiválasztott piacokon. Az alkalmazás több mint 12 nyelvet támogat, többek között angolt, dánt, hollandot, franciát, németet, olaszt, norvég bokmålt, lengyelt, portugált, oroszt, spanyolt, svédet és törököt.

A Buddy elsősorban költségvetés-készítésre, kiadáskövetésre és megtakarítás-tervezésre fókuszál, nem befektetéskezelésre vagy számlatárgyalásra. Ha átfogó befektetési elemzésekre, portfóliókövetésre vagy automatikus számlatárgyalási szolgáltatásokra van szüksége, érdemes a Buddy-t egy dedikált befektetési vagy pénzügyi menedzsment platformmal kombinálni.

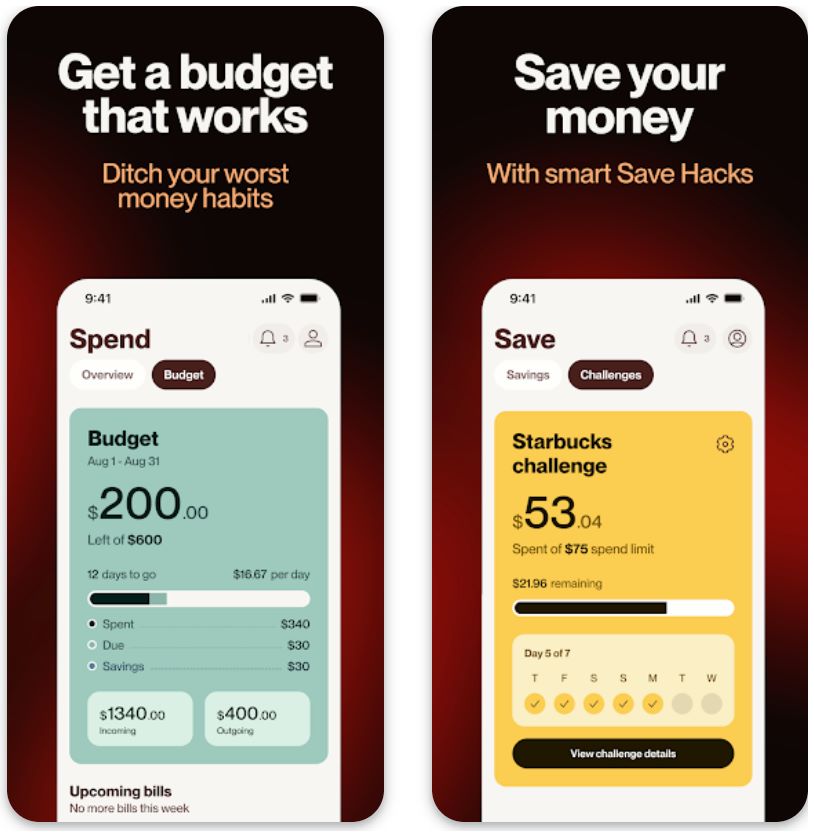

Cleo AI

| Fejlesztő | Cleo AI Ltd., alapította Barnaby Hussey-Yeo |

| Támogatott platformok |

|

| Nyelvi támogatás | Elsősorban angol nyelv |

| Elérhetőség | Amerikai Egyesült Államok (korábban elérhető az Egyesült Királyságban) |

| Árazási modell | Ingyenes alap költségvetés-készítés; fizetős előfizetés nyitja meg a készpénz előlegeket, hitelépítést és prémium elemzéseket |

Mi az a Cleo AI?

A Cleo egy mesterséges intelligenciával működő személyes pénzügyi alkalmazás, amely a költségvetés-készítést élvezetes beszélgetéssé alakítja. A bankszámládhoz csatlakozva ez az intelligens asszisztens követi a kiadásokat, felismeri a mintákat, és automatizált kihívásokkal, valamint személyre szabott elemzésekkel segít pénzt megtakarítani. A hagyományos pénzügyi alkalmazásokkal ellentétben a Cleo személyiségvezérelt chatbot felületet használ, amely kevésbé ijesztővé és interaktívabbá teszi a pénzkezelést.

Az alkalmazás egyesíti az alapvető költségvetési eszközöket opcionális rövid távú készpénz előlegekkel, így egy átfogó platformot kínál azoknak a felhasználóknak, akik egyszerre szeretnék nyomon követni pénzügyeiket és időnként sürgősségi finanszírozáshoz jutni. Akár azt szeretnéd megérteni, hová megy a fizetésed, akár jobb megtakarítási szokásokat építenél, a Cleo modern megközelítést kínál a személyes pénzügyi menedzsmenthez.

Miért válaszd a Cleo-t pénzügyi menedzsmenthez?

A mai digitális banki környezetben az automatikus fizetések és az érintéses fizetések megkönnyítik a kiadások nyomon követésének elvesztését. A Cleo ezt a kihívást úgy kezeli, hogy valós idejű rálátást biztosít pénzügyi szokásaidra egy közvetlen, mesterséges intelligencia alapú asszisztens segítségével.

Az alkalmazás beszélgetős felülete eltávolítja a költségvetési szoftverekhez általában kapcsolódó bonyolultságot. Több képernyő és diagram helyett egyszerűen felteszed a kérdést, például „Mennyit költöttem étteremben ezen a hónapon?”, és azonnali, hasznos válaszokat kapsz. Ez a természetes interakciós stílus elérhetővé teszi a pénzügyi tudatosságot azok számára is, akik hagyományos pénzügyi eszközök miatt túlterhelteknek érzik magukat.

Főbb jellemzők

Tegyél fel természetes nyelvű kérdéseket pénzügyeidről, és azonnal kapj személyre szabott költési elemzéseket.

- Beszélgetős pénzkezelés

- Kategória-specifikus költési bontások

- Barátságos, vonzó személyiség

Könnyedén építs megtakarításokat kerekítésekkel, kihívásokkal és okos átutalási funkciókkal.

- Vásárlások kerekítése a legközelebbi dollárra

- Személyre szabható megtakarítási kihívások

- Vizuális előrehaladás követése

Bevételek és kiadások automatikus kategorizálása testreszabható limitekkel és pénzügyi célokkal.

- Automatikus tranzakciók kategorizálása

- Kategóriánkénti egyedi költési limitek

- Bevétel- és számlakövetés

Jogosult előfizetők számára akár 250 dollárig terjedő rövid távú előlegek kamatmentesen.

- Akár 250 dolláros előlegkeret

- Nincs kamat

- Gyorsátutalási lehetőség elérhető

Prémium funkció, amely felelősségteljes használattal segít javítani a hitelpontszámot idővel.

- Hitelpontszám javító eszközök

- Elérhető fizetős előfizetéssel

- Régiófüggő elérhetőség

Opcionális megtakarítási számla versenyképes kamatokkal, hogy maximalizáld pénzed növekedési potenciálját.

- Versenyképes kamatok

- Régiótól és csomagtól függ

- Integrált a fő alkalmazással

Töltsd le a Cleo AI-t

Hogyan kezdj hozzá a Cleo használatához

Töltsd le a Cleo-t a Google Play Áruházból (Android) vagy az Apple App Store-ból (iOS), majd telepítsd az eszközödre.

Regisztrálj, és biztonságosan kösd össze elsődleges bankszámládat a Plaid vagy hasonló biztonságos banki kapcsolódási szolgáltatások segítségével.

Engedd, hogy a Cleo elemezze kiadási szokásaidat, bevételeidet és ismétlődő számláidat, hogy személyre szabott elemzéseket és költségvetési javaslatokat készítsen.

Használd a chatbot felületet, hogy kérdéseket tegyél fel pénzügyeidről, megtekintsd a kategóriánkénti költési bontásokat, és állíts be megtakarítási célokat vagy kihívásokat.

Ha szükséges, válts fizetős előfizetésre, majd kérj készpénz előlegeket a chat felületen keresztül. Válaszd ki a visszafizetési ütemezést és az átutalási módot (a gyorsátutalások további díjakat vonhatnak maguk után).

Kapcsold be a kerekítéseket vagy az automatikus átutalásokat a megtakarítási pénztárcádba. Kövesd vizuálisan az előrehaladást, és szükség szerint módosítsd a megtakarítási célokat.

Rendszeresen ellenőrizd a költségvetési irányítópultot, módosítsd a költési kategóriákat, tekintsd át az AI által generált elemzéseket, és reagálj a javaslatokra pénzügyi szokásaid javítása érdekében.

Ha már nincs szükséged prémium funkciókra, mond le vagy válts vissza az ingyenes szintre, miközben továbbra is használhatod az alapvető költségvetési és követési eszközöket.

Fontos korlátozások, amelyeket érdemes figyelembe venni

- Prémium funkciókhoz előfizetés szükséges: Az ingyenes verzió hasznos költségvetési képességeket kínál, de értékes funkciók, mint a készpénz előlegek, hitelépítő eszközök és magasabb előlegkeretek fizetős előfizetést igényelnek.

- Kötelező bankszámla összekapcsolás: A teljes funkcionalitáshoz bankszámla összekapcsolás szükséges. A nem támogatott bankokkal rendelkező vagy támogatott régión kívüli felhasználók korlátozott funkciókat tapasztalhatnak, vagy manuális bevitelre szorulhatnak.

- Korlátozott készpénz előleg keretek: Az előleg összegek viszonylag kicsik (új felhasználóknál általában legfeljebb 250 dollár vagy kevesebb), és visszafizetést igényelnek. Az azonnali átutalási lehetőségek további díjakat vonhatnak maguk után, amelyek csökkenthetik a „kamatmentes” előlegek előnyét.

- Az AI személyisége nem mindenkinek megfelelő: A chatbot szemtelen vagy „szúrós” hangvétele egyes felhasználóknak tetszik, másoknak viszont nem megfelelőnek vagy nem professzionálisnak tűnhet. A kiadások kategorizálása (alapvető vs. nem alapvető) időnként pontatlan lehet.

- Szabályozási aggályok: 2025 márciusában a Cleo megállapodott az Egyesült Államok Szövetségi Kereskedelmi Bizottságával (FTC) a készpénz előlegekkel és előfizetési feltételekkel kapcsolatos félrevezető állítások miatt, ami átláthatósági és üzleti gyakorlatokkal kapcsolatos aggályokat vethet fel.

Gyakran ismételt kérdések

Igen — a Cleo egy legitim pénzügyi technológiai vállalat, amely költségvetési, megtakarítási és készpénz előleg szolgáltatásokat kínál. Az alkalmazás biztonságos bankszámla összekapcsolási technológiát használ (például Plaid), és több független forrás is értékelte. Ugyanakkor a felhasználóknak tudomásul kell venniük a 2025 márciusi FTC megállapodást a félrevezető állítások kapcsán.

Igen — az ingyenes szint hozzáférést biztosít alapvető költségvetési, kiadáskövetési és megtakarítási eszközökhöz. Azonban a prémium funkciók, mint a készpénz előlegek, hitelépítő funkciók és gyors átutalások, fizetős előfizetést igényelnek.

A jogosultság és a limitek felhasználónként változnak. Az új felhasználók általában kisebb összegekre jogosultak (kb. 20–100 dollár), a limitek pedig a számla aktivitása és használati előzmények alapján növekednek. Egyes tapasztalt felhasználók akár 250 dollár előleghez is hozzáférhetnek, előfizetési csomagtól és pénzügyi szokásoktól függően.

Nem — a Cleo AI chatbotja automatizált költségvetési elemzésekre és megtakarítási mechanizmusokra készült, nem átfogó pénzügyi tervezésre. A tanácsok algoritmus alapúak, és hiányozhat belőlük a komplex pénzügyi helyzetekhez szükséges árnyaltság. Személyre szabott befektetési stratégiák vagy nagyobb pénzügyi döntések esetén fordulj képzett emberi pénzügyi tanácsadóhoz.

A Cleo elsősorban az Egyesült Államok piacát támogatja. A bankkompatibilitás változó, és a támogatott pénzintézeteken kívüli felhasználók korlátozott funkcionalitást tapasztalhatnak. Az alkalmazás korábban elérhető volt az Egyesült Királyságban, de jelenleg az USA piacára fókuszál. Mindig ellenőrizd a régiód és a bankod támogatottságát, mielőtt fejlettebb funkciókra támaszkodnál.

Copilot Money

| Fejlesztő | Copilot Money, Inc. |

| Támogatott platformok |

|

| Nyelvi támogatás | Csak angol |

| Elérhetőség | Csak amerikai pénzügyi intézmények |

| Árazási modell | Ingyenes próba elérhető. Fizetős előfizetés szükséges a teljes funkcionalitáshoz: kb. 13 USD/hó vagy 95 USD/év |

Prémium személyes pénzügyi menedzsment

A Copilot Money egy fejlett személyes pénzügyi alkalmazás, amely egy elegáns irányítópulton központosítja kiadásait, költségvetéseit, megtakarítási céljait és befektetéseit. Több ezer amerikai pénzügyi intézménnyel kapcsolódik, automatikusan kategorizálja a tranzakciókat, kiemeli az ismétlődő előfizetéseket, és segít vizualizálni a pénzforgalmat és a nettó vagyont. Az átláthatóságra és kontrollra tervezett Copilot prémium, reklámmentes élményt kínál, amely a felhasználók pénzügyi életének teljes körű megértését támogatja.

Miért válassza a Copilot Money-t?

Az olyan pénzügyi világban, ahol passzív nyomon követő eszközök és reklámokkal támogatott alkalmazások uralkodnak, a Copilot Money kiemelkedik kézzelfogható átláthatóságával és prémium élményével. A számlák összekapcsolása után az alkalmazás gépi tanulást használ a kiadások automatikus kategorizálására, az elfeledett ismétlődő költségek felismerésére, és a bevételek és kiadások világos, intuitív irányítópultokon történő megjelenítésére.

Vonzerője abban rejlik, hogy aktív pénzügyi felügyeletre ösztönöz, nem csupán passzív megfigyelésre. Az iPhone, iPad és Mac eszközök közötti többeszközös támogatás biztosítja, hogy költségvetése zökkenőmentesen szinkronizálódjon bárhol is legyen. Bár az előfizetés ára néhányak számára visszatartó lehet, sok felhasználó úgy véli, hogy a magasabb szintű felhasználói élmény és a hasznos betekintések megérik a befektetést.

Főbb jellemzők

Automatikus kategorizálás több mint 10 000 pénzügyi intézmény, beleértve befektetési és hitelszámlákat is, gépi tanulás segítségével.

Egyedi költségvetések beállítása, valós idejű előrehaladás követése és a kategóriánkénti fennmaradó egyenlegek vizualizálása.

Automatikusan azonosítja az ismétlődő fizetéseket és előfizetéseket, megjelenítve a jövőbeli kötelezettségeket, hogy segítsen kezelni a folyamatos költségeket.

Tekintse meg eszközeit, tartozásait és portfólió teljesítményét a költségvetési adatok mellett a teljes pénzügyi kép érdekében.

Zökkenőmentes szinkronizáció iPhone, iPad és Mac alkalmazások között, sötét mód, címkék és fejlett pénzforgalmi vizualizáció.

Letöltési vagy hozzáférési link

Kezdő útmutató

Töltse le a Copilot Money-t az App Store-ból iPhone, iPad vagy Mac készülékére.

Regisztráljon fiókot és fejezze be a beállítást. Kapcsolja össze amerikai bank-, hitelkártya- és befektetési számláit.

Engedélyezze az alkalmazásnak a legutóbbi tranzakciók importálását. Ellenőrizze és hagyja jóvá a kategorizálás pontosságát.

Nézze meg az Irányítópult fület, hogy lássa a bevételeket, kiadásokat, nettó jövedelmet, fennmaradó költségvetéseket és a közelgő ismétlődő fizetéseket.

Készítsen költségvetéseket olyan kategóriákra, mint élelmiszer, szórakozás és közlekedés. Állítson be megtakarítási célokat konkrét számlákhoz.

Használja az Ismétlődő szekciót a folyamatban lévő előfizetések és tervezett fizetések megtekintéséhez. Azonosítsa azokat, amelyeket módosítani vagy lemondani kell.

Kövesse nyomon nettó vagyonát és befektetési teljesítményét az Eszközök és Befektetések szekcióban. Ellenőrizze az időbeli előrehaladást.

Szükség szerint módosítsa a költségvetéseket és kategóriákat. Az alkalmazás alkalmazkodik kiadási szokásaihoz, és segít finomítani pénzügyi tervét.

Használja gyakran az alkalmazást, hogy azonosítsa a trendeket, a túlköltekezési mintákat és a megtakarítási lehetőségeket.

Ha a fizetős csomag nem felel meg igényeinek, mondja le az előfizetést a megújítás előtt. Korlátozott funkciók továbbra is elérhetők.

Fontos korlátozások

- Fizetős előfizetés szükséges: Az ingyenes próbaidőszak után előfizetés szükséges a teljes funkcionalitás eléréséhez. Nincs állandó ingyenes szint teljes körű funkciókkal.

- Prémium árképzés: Kb. havi 13 dolláros díj mellett az ár magasnak tűnhet az ingyenes alternatívákhoz képest, különösen alap költségvetési igények esetén.

- Fejlődő funkciók: Néhány felhasználó korlátozott támogatást tapasztal közös számlák, történeti tranzakcióimport és fejlett tervezési funkciók esetén.

Gyakran ismételt kérdések

Igen – a Copilot ingyenes próbaidőszakot kínál az előfizetés megkezdése előtt, így minden funkciót tesztelhet.

A Copilot iPhone (iOS 15.6+), iPad (iPadOS 15.6+) és Mac (macOS 12.5+) eszközökön működik, zökkenőmentes szinkronizációval minden platform között.

Jelenleg a Copilot csak amerikai felhasználók számára érhető el, kizárólag amerikai pénzügyi intézmények támogatásával. Android támogatás és nemzetközi elérhetőség még nem elérhető.

Számos ingyenes alkalmazással ellentétben a Copilot prémium, reklámmentes élményt nyújt fejlett felhasználói felülettel, automatikus tranzakciók kategorizálásával, befektetéskövetéssel és gépi tanulás alapú elemzésekkel – de előfizetéses díjért cserébe.

Ha több számlát is összekapcsol (beleértve a befektetéseket), értékeli a pénzügyek átláthatóságát, és fontos számára a kifinomult felhasználói élmény, sok felhasználó szerint az előfizetés kiváló értéket képvisel. Ugyanakkor egyszerű költségvetéshez olcsóbb alternatívák is elegendőek lehetnek.

Az MI-alapú megtakarítási tervek fő előnyei

Automatizált valós idejű nyomon követés

Okos kategorizálás

Személyre szabott betekintés

Előrejelző céltervezés

Az együttes hatás

Ezek az előnyök együttműködve teszik a megtakarítást kezelhetőbbé és kevésbé stresszessé. Nem kell többé kézzel frissítenie táblázatokat vagy becsülnie a megtakarítási összegeket – az MI végzi a bonyolult számításokat. Azáltal, hogy automatikusan felismeri a költségcsökkentési lehetőségeket és megkönnyíti az átutalásokat, ezek az eszközök elősegítik a következetes megtakarítási szokásokat anélkül, hogy találgatás vagy akadályok lennének.

Biztonsági intézkedések és legjobb gyakorlatok

Bár az MI erős pénzügyi szövetséges, a szakértők hangsúlyozzák, hogy ezeket az eszközöket bölcsen és biztonságosan kell használni. Az MI alkalmazásoknak kiegészíteniük kell – nem helyettesíteniük – a megalapozott pénzügyi ítélőképességet és a szakmai tanácsadást, ha szükséges.

Biztonsági szempontok

Az MI pénzügyi alkalmazások kiválasztásakor a biztonság legyen az elsődleges szempont. Válasszon megbízható szolgáltatásokat – ideális esetben olyanokat, amelyek ismert bankokhoz vagy elismert fintech márkákhoz kötődnek –, és aktiválja az összes elérhető adatvédelmi funkciót.

Az adatvédelem és biztonság alapvető fontosságú az MI-alapú költségvetési eszközök használatakor. A felhasználóknak engedélyezniük kell a többfaktoros hitelesítést fiókjaikon, hogy biztosítsák az adatok védelmét, miközben az MI hozzáfér a szükséges pénzügyi információkhoz.

— SoFi Biztonsági Irányelvek

Legjobb gyakorlatok a biztonságos és hatékony használathoz

- Válasszon megbízható alkalmazásokat: Olyan pénzügyi eszközöket válasszon, amelyek erős felhasználói értékelésekkel és robusztus biztonsági intézkedésekkel rendelkeznek, beleértve a titkosítást és a kétfaktoros hitelesítést

- Automatizáljon stratégiailag: Állítson be automatikus átutalásokat megtakarításra vagy adósságtörlesztésre, hogy először takarítson meg, és csak a maradékot költse el

- Vizsgálja felül az MI ajánlásait: Az MI tanácsait javaslatként kezelje, ne kötelező érvényű utasításként – ellenőrizze, hogy a javasolt megtakarítási arányok megfelelnek-e tényleges költségvetésének, és szükség szerint módosítsa céljait

- Folytassa a pénzügyi oktatást: Tartsa fenn pénzügyi műveltségét folyamatos tanulással – az MI útmutatást nyújt, de saját igényeinek megértése és időnként emberi tanácsadók felkeresése erősíti stratégiáját

- Rendszeresen ellenőrizze: Hetente vizsgálja át az MI által generált betekintéseket a pontosság biztosítása és a szokatlan minták vagy hibák felismerése érdekében

- Kezdje kicsiben: Kezdjen szerény automatizálással, és fokozatosan növelje, ahogy nő a rendszerbe vetett bizalma

Kockázatos megközelítés

- Az összes MI-javaslat vak követése

- Nem ellenőrzött alkalmazások használata gyenge biztonsággal

- Emberi felügyelet vagy ellenőrzés hiánya

- Adatvédelmi beállítások figyelmen kívül hagyása

Biztonságos stratégia

- Ellenőrzött ajánlások megbízható forrásokkal

- Megbízható alkalmazások erős titkosítással

- Rendszeres ellenőrzés és módosítások

- Maximális biztonsági funkciók engedélyezve

Ezeknek a legjobb gyakorlatoknak az alkalmazásával kihasználhatja az MI előnyeit, miközben teljes kontrollt tart pénzügyi döntései és adatbiztonsága felett.

Összefoglalás

A mesterséges intelligencia alapjaiban változtatja meg, hogyan terveznek és érnek el megtakarítási célokat az egyének. Minden pénzügyi tranzakció elemzésével az MI-alapú eszközök személyre szabott megtakarítási terveket kínálnak és automatizálják az átutalásokat – eltávolítva a költségvetés-tervezés nagy részének bonyolultságát. Ez a pénzügyi tanácsadás demokratizálása azt jelenti, hogy a fiatalabb felhasználók és azok, akik nem férnek hozzá fizetett pénzügyi tanácsadókhoz, most már személyre szabott útmutatást kaphatnak kis vagy semmilyen költség nélkül.

Elérhetőség

Automatizálás

Optimalizálás

A jövőbe tekintve ez a fejlett technológia és a körültekintő pénzügyi gyakorlatok kombinációja ígéri, hogy a személyes pénzügyeket mindenki számára hozzáférhetőbbé és hatékonyabbá teszi. Az MI a megtakarítást egy terhes feladatról személyre szabott, alkalmazkodó tervvé alakítja, amely együtt fejlődik életével.

Mindenki magabiztosan tervezheti jövőjét az MI-alapú pénzügyi eszközök demokratizálásával.

— Világgazdasági Fórum

No comments yet. Be the first to comment!