AI in personal finance management

Discover how artificial intelligence (AI) is transforming personal finance management: from smart budgeting and automated saving to robo-advisors and virtual assistants. This article provides clear, complete, and practical insights to help you spend smarter.

Modern personal finance management is being reshaped by artificial intelligence (AI) and machine learning. These technologies power apps and platforms that automate budgeting, saving, investing and even fraud detection, providing personalized money guidance much like having a digital financial coach.

This adoption means AI is becoming a routine part of personal money management, handling everything from tracking spending to optimizing investments.

AI-Powered Budgeting and Expense Tracking

AI excels at analyzing financial data. Smart budgeting apps like Mint, PocketGuard or Copilot Money automatically categorize your transactions and learn your habits. Using machine learning, these tools sort expenses in real time and spot patterns you might miss.

Automatic Categorization

AI reads transactions and assigns categories (food, rent, travel, etc.) without manual input, learning from each transaction.

Real-Time Insights

As soon as you spend, the app updates your budget, making it easy to spot trends or unnecessary expenses instantly.

Continuous Learning

The more you use the app, the smarter it gets. Its algorithms refine the budget based on your unique spending habits.

Predictive Alerts

Forecasting features warn you if you might run low on cash or suggest optimal timing for large purchases.

Automated Saving and Spending Management

Beyond budgeting, AI helps automate saving and trim waste. Modern money apps can identify money-drains and take action on your behalf, eliminating unnecessary expenses and optimizing your spending patterns.

Traditional Approach

- Manually track subscriptions

- Miss forgotten recurring charges

- Time-consuming bill reviews

- Overlook savings opportunities

Automated Solution

- Auto-detect all subscriptions

- Cancel unused services

- Find better deals automatically

- Save $80-$500 annually

Key Automation Features

- Subscription management: Apps like Rocket Money use AI to list all recurring charges and will even negotiate or cancel those you don't use

- Deal optimization: AI scans bills and transactions for potential savings, applying cash-back offers or recommending cheaper plans

- Adaptive budgets: Based on spending patterns, the app adjusts your saving goals and suggests channeling extra money into savings or investments

AI-powered savings tools can save users on average $80 to $500 annually by automating subscription management and finding better deals.

— Bankrate Financial Research

In effect, these tools act like an automated "financial autopilot," implementing savings strategies tailored to your lifestyle. They work quietly in the background – setting aside tiny amounts into savings each week or reallocating bills – so you steadily build an emergency fund without thinking about it.

Robo-Advisors and Investment Planning

AI's impact extends to investing. Robo-advisors are platforms that use algorithms to create and manage investment portfolios with little or no human guidance. They take your goals and risk tolerance as input, then automatically build a diversified portfolio of stocks, bonds or ETFs.

Automated Portfolio Management

AI assesses market conditions and your personal profile to optimize asset allocation. For example, if the stock market is booming, it might increase equities; if a downturn is predicted, it could shift to safer bonds.

- Continuous portfolio rebalancing

- Dynamic asset allocation based on market conditions

- Automatic dividend reinvestment

- Tax-loss harvesting optimization

AI-Powered Market Analysis

Some platforms use generative AI to analyze news and financial data, forecasting trends to guide investment decisions. These tools can even simulate "what if" scenarios.

- Real-time market sentiment analysis

- Historical performance simulations

- Benchmark comparison (e.g., S&P 500)

- Predictive modeling for future returns

Intelligent Risk Management

AI helps mitigate risk by diversifying your portfolio across many assets and by alerting you to market downturns early.

- Automatic portfolio diversification

- Early warning alerts for market volatility

- Risk-adjusted return optimization

- Personalized risk tolerance assessment

Long-Term Planning Features

AI services assist with retirement planning and long-term goals by projecting how much you need to save for retirement or major purchases, adjusting for inflation and investment returns. Some combine automated investing with human advisors: an app might use AI for day-to-day decisions but also let you schedule calls with a certified planner for complex questions.

Chatbots and Virtual Financial Advice

Conversational AI (chatbots) have emerged as a new way to get finance help. Virtual assistants like ChatGPT or purpose-built chatbots (e.g., Cleo's chatbot) can answer questions about budgeting, debt or investing on demand. You can literally ask your phone, "How much should I save for a vacation?" or "Is it better to pay off my credit card or take an extra payment on my loan?", and get immediate guidance.

Current Adoption Landscape

Trust and Limitations

Emotional Understanding Gap

Human Preference

Best Practices for Using AI Chatbots

Use as First-Stop Assistant

Treat AI chatbots as a starting point for quick insights or to flag obvious mistakes, such as overlooked loan interest.

Verify Recommendations

Double-check any AI advice, especially for complex calculations or tax details, with reliable sources or professionals.

Combine AI with Human Expertise

Run questions through a chatbot to explore options, then confirm plans with a certified financial advisor for major decisions.

Benefits of AI in Money Management

AI brings several clear advantages to personal finance, transforming how individuals manage their money with data-driven insights and automation.

Data-Driven Insight

AI can sift through thousands of transactions in seconds, revealing spending trends and savings opportunities that humans might miss.

- Detect unusual bills or charges

- Precise spending category breakdowns

- Pattern recognition across time periods

Personalization

AI systems learn from your data, making advice increasingly tailored to your unique habits and financial situation.

- Customized savings plans

- Adaptive budget recommendations

- Income-adjusted strategies

Convenience and Speed

Mundane tasks like expense tracking, subscription management or tax preparation are automated, saving time and effort.

- Real-time financial updates

- Background monitoring 24/7

- Instant transaction categorization

Lower Costs

Unlike traditional financial advisors with high fees or account minimums, most AI-driven finance apps are free or very low-cost.

- Average savings: $80-$500/year

- No account minimums

- Democratized expert guidance

AI serves as a digital financial coach – readily available, objective, and data-driven. It can notice you're about to miss a savings goal and gently adjust your budget, or propose moving cash to a high-yield account automatically.

Challenges and Considerations

Despite the promise of AI, there are important cautions to keep in mind when using these tools for personal finance management.

Accuracy and Bias

AI is not infallible. Its recommendations depend on the quality of data and algorithms. Academic testing of tools like ChatGPT has found that while the advice can be useful, it is often general and sometimes incorrect.

- May miscalculate complex financial formulas

- Can gloss over important tax details

- Sometimes provides generic advice

Privacy and Data Security

AI finance apps require sensitive data (bank account details, spending history, income, etc.) to work effectively. This raises significant privacy concerns.

Security Best Practices

- Choose reputable platforms with strong encryption

- Review privacy policies carefully

- Confirm how data is stored and shared

- Enable two-factor authentication

- Monitor accounts regularly for unusual activity

Trust and Emotional Factors

Money management often involves emotions (e.g., anxiety about debt, excitement about a purchase). AI lacks genuine understanding of feelings, creating a significant trust gap.

Canadian Perspective

American Perspective

This "human touch" gap means AI should complement, not replace, personal judgment and professional guidance. For instance, an AI app might remind you of savings goals, but a trusted advisor or family member might best help resolve anxiety about cutting expenses.

Awareness and Accessibility

A significant portion of the population simply isn't aware of these tools yet. Surveys show many have never heard of robo-advisors or finance chatbots.

Digital Divide Challenges

- Older adults may find AI apps intimidating

- Less tech-savvy users face learning curves

- Limited awareness slows adoption rates

- Interface complexity can be a barrier

Recommended Approach: Human-in-the-Loop

By understanding these limitations, you can use AI more safely. Experts recommend always keeping a human "in the loop": treat AI as one advisor among many.

AI Analysis

Use AI to analyze your budget for quick insights

Human Review

Schedule a call with a financial counselor

Combined Strategy

Develop long-term plans with expert guidance

Combining the efficiency of AI with human oversight is currently the most effective approach to personal finance management.

Looking Ahead

AI's role in personal finance is set to grow significantly. Market analysts predict continued expansion of AI-fintech tools in the coming years, as algorithms get smarter and regulatory frameworks evolve.

Emerging AI Finance Features

Voice Control

Cross-Platform Integration

Automated Negotiation

Predictive Cash Flow

Smarter Algorithms

Regulatory Evolution

The Path Forward

Ultimately, AI promises to make money management more proactive and personalized. It can break down complex financial goals into bite-sized, automated tasks, nudging us toward better habits. Still, the human element will remain crucial.

Most consumers, especially younger ones, view AI as a powerful tool to augment their financial decisions, not replace their judgment. By using AI wisely—leveraging its data crunching and automation while staying critically engaged—you can enjoy smarter budgeting, smarter saving, and smarter investing, all tailored to your life.

Top AI-Powered Personal Finance Apps

Cleo - AI Money Coach

Application Information

| Developer | Developed by Cleo AI Ltd, a UK-based fintech company founded in 2016, specializing in AI-driven personal finance management tools. |

| Supported Devices | Available for iOS and Android devices, plus web access via official platform. |

| Languages / Countries | Primarily supports English | Available in United Kingdom, United States, and Canada with expanding global reach. |

| Pricing Model | Free Premium — Basic budgeting and tracking free | Cleo Plus and Cleo Builder subscriptions unlock credit-building, cash advances, and cashback rewards. |

General Overview

Cleo is an AI-powered money management app that helps users take control of their finances through intelligent budgeting, expense tracking, and personalized financial education. Acting as your AI financial assistant, Cleo delivers actionable insights, savings strategies, and spending advice through an engaging conversational chat interface.

The app gamifies personal finance by using humor and interactive challenges, making budgeting less stressful and more enjoyable. With features like cashback offers, overdraft protection, and credit score monitoring, Cleo empowers users to build lasting financial confidence.

Detailed Introduction

Cleo revolutionizes personal finance management through conversational AI that communicates naturally with users. By securely connecting to your bank account, the app analyzes your income, expenses, and spending patterns to deliver personalized insights and actionable recommendations.

The AI chat interface serves as both a financial guide and motivator. Ask Cleo questions like "How much did I spend on food last week?" or "Can I afford this purchase?" and receive instant responses with visual breakdowns and smart suggestions.

For users committed to improving their financial habits, Cleo offers budget challenges, goal tracking, and cashback rewards. The Cleo Plus plan adds powerful tools for credit building, salary advances, and emergency cash — helping you stay financially secure during unexpected situations.

The platform emphasizes financial literacy by providing practical advice, progress tracking, and motivation delivered in an engaging, friendly tone that makes money management accessible to everyone.

Key Features

Interact with Cleo's intelligent chatbot to get instant insights about your spending habits, savings progress, and financial health.

Automatically categorize expenses and track budgets in real time with visual breakdowns and spending alerts.

Access small, interest-free advances to prevent overdraft charges and maintain financial stability.

Build or improve your credit score using Cleo's secured credit-building tools with progress tracking.

Set up smart savings pots with automated transfers and visual progress tracking to reach your financial goals faster.

Earn cashback on purchases made through Cleo's partnered merchants and maximize your savings.

Receive customized recommendations and actionable advice to improve your financial health over time.

Bank-level encryption and read-only access ensure your data and transactions remain completely secure.

Download or Access Link

User Guide

Download the Cleo app from the App Store or Google Play, or access via browser at the official web platform.

Create your Cleo account and securely link your bank accounts using bank-grade encryption for AI-driven financial insights.

Use the AI chat interface to ask questions about spending, set budgets, or get personalized financial advice instantly.

Cleo automatically categorizes transactions and highlights spending trends with visual breakdowns and alerts.

Create custom savings goals or enable automatic savings through Cleo's smart algorithm to build wealth effortlessly.

Unlock advanced tools including salary advances, credit building, and cashback rewards for enhanced financial management.

Receive regular updates and personalized reports to stay on track with your financial goals and celebrate milestones.

Notes / Limitations

- Cash advances and credit builder features are limited to paid subscribers (Cleo Plus/Builder).

- Requires a bank account connection to deliver accurate insights and personalized recommendations.

- Some features, such as cashback or rewards, may vary by region and merchant availability.

- While highly secure, Cleo depends on third-party banking APIs for data access, which may occasionally affect sync times.

Frequently Asked Questions

Yes, Cleo offers a free version with budgeting and AI chat features. However, premium features are available under Cleo Plus and Cleo Builder subscriptions.

Yes, Cleo uses bank-grade encryption and read-only access, ensuring your money and credentials remain completely secure. Your financial data is protected with industry-standard security protocols.

Yes. The Cleo Builder feature helps users build credit through a secured credit account while tracking progress within the app, making credit building accessible and transparent.

Cleo Plus costs around $5.99 per month (pricing may vary by region) and includes credit-building tools, cash advances, and cashback rewards.

Currently, Cleo is only available in these three countries, with potential global expansion planned for the future.

No, Cleo is not a bank. It's a financial assistant app that helps users manage money across multiple bank accounts by providing insights and tools for better financial decision-making.

Cleo uses a friendly, humorous chatbot style and gamified financial challenges to keep users engaged while learning good money habits. The conversational approach makes finance management feel less intimidating and more enjoyable.

Yes. Through the Cleo Cover feature, users can access small, interest-free advances to avoid overdraft fees and maintain financial stability.

Yes, Cleo is also accessible through its web platform, allowing you to manage your finances from any browser.

Yes, Cleo provides customer support through its in-app chat and help center for both free and premium users, ensuring assistance when you need it.

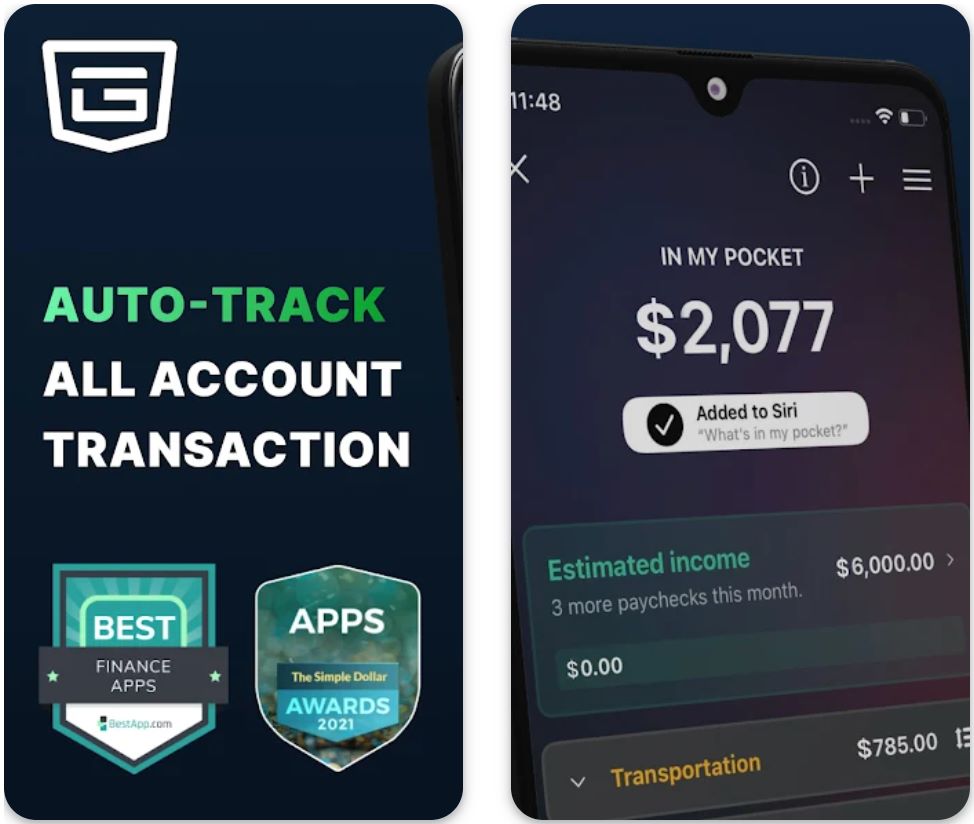

PocketGuard — Simple AI Budgeting

Application Information

| Author / Developer | PocketGuard, Inc. |

| Supported Devices | iOS, Android, and web browsers |

| Languages / Countries | English (United States, Canada, and select global regions) |

| Pricing | Free plan with core budgeting tools + PocketGuard Plus premium subscription |

General Overview

PocketGuard — Simple AI Budgeting is a personal finance management app designed to simplify budgeting and money tracking using AI technology. The app helps users take control of their spending by automatically analyzing income, bills, and expenses to show how much money is safe to spend.

PocketGuard's intelligent budgeting system eliminates financial stress by automatically creating budgets, tracking subscriptions, and identifying saving opportunities. With a clean interface and advanced analytics, it serves as an all-in-one financial companion for anyone aiming to manage money smarter.

Detailed Introduction

PocketGuard uses AI-driven financial insights to help users understand their cash flow and make better spending decisions. By connecting securely to your bank and credit accounts, the app provides real-time tracking of your income, bills, and transactions.

Its "In My Pocket" feature instantly calculates how much disposable income you have after covering all essential expenses, ensuring you never overspend. The app automatically categorizes expenses, detects recurring payments, and helps you identify unnecessary costs or duplicate subscriptions.

With PocketGuard Plus, users gain access to advanced features like custom categories, debt payoff tracking, and detailed spending reports — empowering users to build financial discipline and long-term savings habits.

Key Features

Automatically creates personalized budgets based on spending and income patterns.

Calculates your available spending money after accounting for bills and savings.

Organizes transactions automatically for better visibility.

Monitors due dates and recurring payments to prevent missed bills.

Identifies active subscriptions and helps you cancel unwanted ones.

Allows users to set financial goals, such as debt repayment or emergency funds.

Visual analytics display how your money is spent and where it can be saved.

Uses bank-level encryption to protect user data and privacy.

Unlocks premium tools like custom budgets, cash tracking, and exportable reports.

Download or Access Link

User Guide

Get the PocketGuard app from the App Store, Google Play, or visit the web version.

Sign up using your email address or continue with Google/Apple for quick access.

Securely connect your financial accounts to import transaction data automatically.

Define your savings goals, budget categories, and spending limits.

Let PocketGuard automatically categorize and monitor your daily spending.

Check how much safe-to-spend money you have left after covering essentials.

Access premium budgeting tools for detailed insights and advanced control.

Notes & Limitations

- Some features like custom categories and debt tracking require a PocketGuard Plus subscription.

- Currently supports bank accounts primarily from US and Canada.

- May take 24–48 hours to sync transactions depending on your bank.

- Limited currency and language support.

- Requires an internet connection for real-time data synchronization.

Frequently Asked Questions

Yes, the app offers a free version with essential budgeting features. Premium features are available via PocketGuard Plus.

PocketGuard uses secure, read-only connections through trusted financial aggregators, ensuring your data remains private and protected.

Yes, users can link multiple checking, savings, and credit accounts.

Its AI-driven "In My Pocket" feature provides real-time disposable income tracking, making it easier to avoid overspending.

While primarily designed for US and Canadian users, limited functionality may be available internationally.

PocketGuard employs bank-level 256-bit SSL encryption and read-only access to keep user data safe.

The app helps identify active subscriptions and provides guidance for cancellation, though actual cancellation depends on the service provider.

Premium users get access to custom categories, cash tracking, debt payoff planning, and exportable financial reports.

Yes, users can monitor multiple accounts, including shared ones, under a single dashboard.

Yes. The app suggests saving opportunities and helps you allocate funds toward your financial goals effectively.

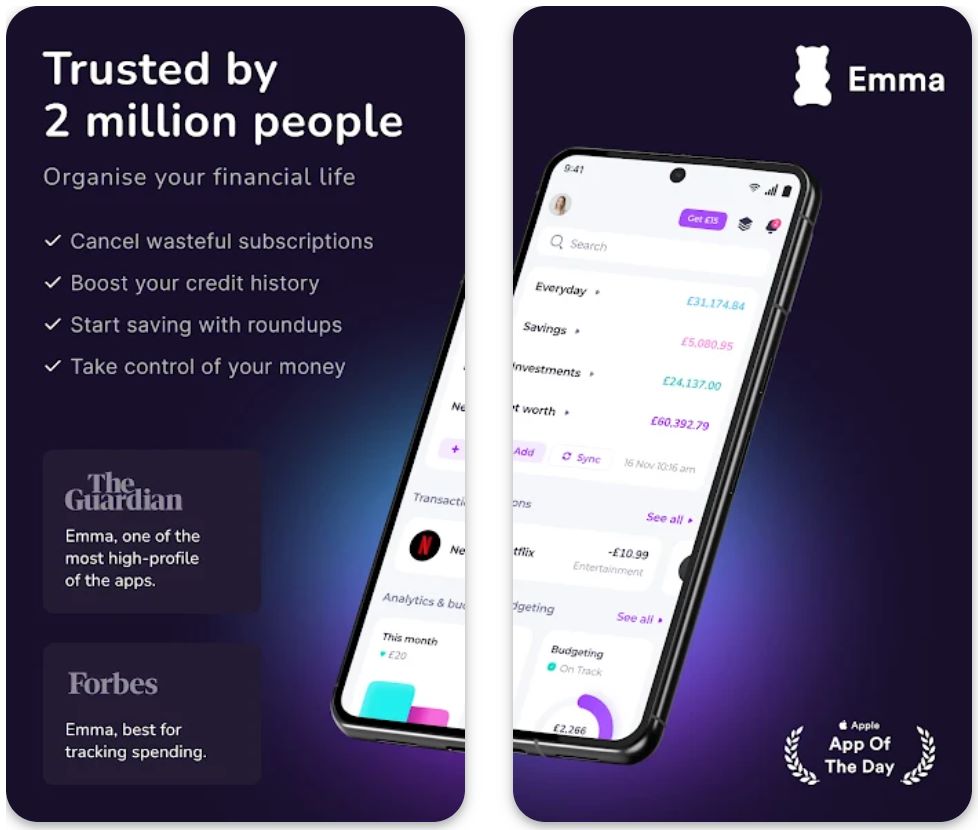

Emma — European Budget & Subscription Manager

Application Information

| Author / Developer | Emma Technologies Ltd. |

| Supported Devices | Compatible with iOS and Android devices; also accessible via web dashboard |

| Languages / Countries | Available in English; supports users in the UK, EU, US, and Canada |

| Free or Paid | Offers a free version with essential features and a premium plan (Emma Pro) for advanced financial insights and customization |

General Overview

Emma — European Budget & Subscription Manager is a smart personal finance app that helps users manage money, track spending, and control subscriptions effortlessly. Designed for modern users in Europe and beyond, Emma connects securely to bank accounts, credit cards, and investment platforms to deliver a unified view of your financial health.

The app uses intelligent insights to detect wasteful spending, prevent overdrafts, and identify recurring subscriptions you might have forgotten. Whether you're trying to save more, plan your monthly budget, or keep tabs on multiple accounts, Emma provides a clean and automated solution to financial management.

Detailed Introduction

Launched by Emma Technologies Ltd., this innovative budgeting app aims to make personal finance simple and transparent. The app integrates with over 600 financial institutions across Europe, the UK, and North America, allowing users to see all their accounts in one place.

Emma automatically categorizes transactions, detects bills and subscriptions, and provides alerts for unusual spending patterns. Its AI-based analysis helps users understand where their money goes and how they can optimize expenses.

With Emma Pro, users can unlock advanced features such as custom categories, data exports, and smart budgeting tools, turning the app into a powerful financial assistant. Trusted by thousands of users across Europe, Emma is often referred to as "your best financial friend" for its friendly design and accuracy.

Key Features

View bank accounts, credit cards, and investments in one unified dashboard for complete financial visibility.

Automatically detects recurring payments and helps identify unwanted subscriptions to save money.

Intelligently groups spending into categories for easy budget tracking and analysis.

AI-based analytics highlight saving opportunities and spending trends to optimize your finances.

Set spending limits by category and receive alerts when approaching your budget threshold.

Prevents overspending by tracking account balances in real time with proactive alerts.

Works seamlessly with accounts in different currencies, ideal for European users.

Unlock advanced features like custom categories, transaction editing, and data exports.

Uses 256-bit SSL encryption and read-only access to protect sensitive financial data.

Download or Access Link

User Guide

Get the app from the App Store or Google Play, or use the web dashboard for desktop access.

Sign up using your email or continue with Google/Apple for quick registration.

Securely link your financial accounts for real-time tracking and analysis.

Review categorized spending, subscription summaries, and AI-generated insights.

Define monthly budgets and track progress automatically.

View recurring charges, cancel unwanted services, and stay on top of bills.

Unlock premium tools such as custom budgets, export options, and data filters.

Notes & Limitations

- Some banks or financial institutions may have limited integration in certain regions

- The Emma Pro plan is subscription-based and renews monthly or annually

- Currency conversion may vary slightly for multi-currency accounts

- Requires an active internet connection for syncing financial data

- Currently, the app supports English only

Frequently Asked Questions

Yes, Emma offers a free plan with essential budgeting and subscription tracking features. Users can upgrade to Emma Pro for enhanced tools.

Emma uses 256-bit SSL encryption and read-only bank connections, ensuring user data remains private and secure.

Emma is available in the UK, European Union, United States, and Canada.

Yes, Emma detects all recurring payments and helps you identify unwanted subscriptions for cancellation.

Yes. Emma supports connecting multiple accounts and credit cards for consolidated tracking.

Emma Pro offers advanced features such as custom categories, data exports, transaction editing, and more personalized budgeting options.

Yes, Emma integrates with various financial platforms to monitor investment accounts and savings goals.

Emma analyzes your spending habits, identifies wasteful expenses, and suggests ways to cut unnecessary costs.

Yes, multiple accounts can be linked under a single profile for comprehensive financial tracking.

No. Emma does not sell or share your personal or financial data with third parties.

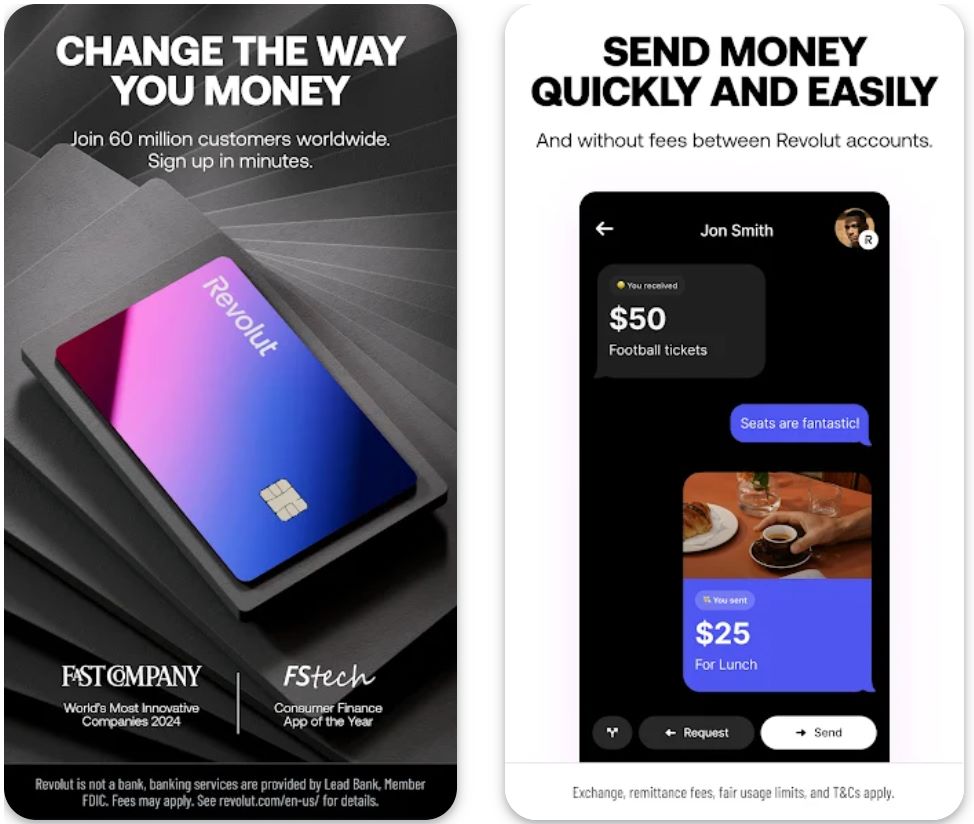

Revolut — Neobank with Expanding AI Assistant

Application Information

| Author / Developer | Revolut Ltd. |

| Supported Devices | iOS, Android, and web browsers |

| Languages / Countries | Supports over 30 languages and available in more than 200 countries and regions worldwide |

| Free or Paid | Free plan available, plus multiple premium tiers (Plus, Premium, Metal, and Ultra) with advanced financial and AI features |

General Overview

Revolut — Neobank with Expanding AI Assistant is a cutting-edge digital banking platform that combines financial management, international transfers, savings, investments, and advanced AI-driven tools in one app. Founded in 2015, Revolut has evolved from a simple currency exchange service into one of the world's leading neobanks, offering users the ability to manage all aspects of their finances globally.

Revolut's latest innovation is its AI-powered assistant, designed to help users analyze spending, detect unusual transactions, and provide personalized financial insights — making money management smarter and more secure than ever.

Detailed Introduction

Revolut is not just a banking app — it's a full financial ecosystem. Users can hold and exchange over 30 currencies, send international transfers at competitive rates, and access tools for budgeting, investing, and trading.

The platform's AI assistant represents a significant leap in personal finance automation. Leveraging machine learning, the assistant can track user spending habits, predict future expenses, and offer tailored recommendations to improve savings or reduce unnecessary costs. It also provides real-time fraud detection and instant alerts for enhanced account safety.

With continuous updates, Revolut integrates modern banking with next-gen AI to deliver a seamless, all-in-one financial experience suitable for individuals, freelancers, and businesses worldwide.

Key Features

Get real-time spending insights, savings suggestions, and personalized alerts powered by machine learning.

Hold and exchange 30+ currencies at interbank rates with zero hidden fees.

Automatically categorize spending and track budgets efficiently with visual analytics.

Invest in cryptocurrencies, ETFs, and stocks directly from the app with competitive rates.

Send and receive money internationally with minimal fees and real-time exchange rates.

Create automated savings goals and earn interest on your balance with flexible terms.

Use secure, disposable cards for online and offline purchases with instant card freeze options.

Track, manage, and cancel subscriptions easily through the intuitive dashboard.

AI monitors transactions for unusual activity and alerts users instantly for maximum security.

Higher limits, travel insurance, cashback, and exclusive Metal or Ultra perks for premium members.

Download or Access Link

User Guide

Get the Revolut app from Google Play, App Store, or access via the web platform.

Register using your phone number and verify your identity for security compliance.

Link your bank account or card to add money instantly to your Revolut account.

Use tabs for spending analysis, currency exchange, savings, and investing features.

Enable the built-in AI assistant to receive personalized budgeting advice and transaction alerts.

Send money globally, split bills, or pay via QR code or virtual card with ease.

Choose from Plus, Premium, Metal, or Ultra tiers for additional financial tools and rewards.

Notes and Limitations

- Availability of features (e.g., crypto trading, stock investments) may vary by country

- Requires identity verification before accessing all banking services

- Some international transfers may incur minor exchange fees

- AI insights and advanced analytics are optimized for premium users

- Internet connectivity is required for real-time account synchronization

Frequently Asked Questions

Revolut's AI assistant helps users monitor spending patterns, detect unusual activity, and receive personalized financial insights powered by machine learning algorithms.

Yes, Revolut operates under banking licenses in several countries and provides regulated financial services with full compliance.

Yes, Revolut offers a free plan with essential features. Premium tiers offer additional benefits such as higher limits, insurance, and AI-based analytics.

Yes, users can buy, sell, and hold multiple cryptocurrencies directly within the app with competitive rates and secure storage.

Revolut uses bank-grade encryption and AI fraud detection to ensure maximum account security and protect your funds.

Absolutely. Revolut supports spending and transfers in over 200 countries with interbank exchange rates and minimal fees.

You can hold, exchange, and spend in more than 30 global currencies with real-time exchange rates.

The AI assistant automatically categorizes transactions, sets budgets, and provides spending summaries to keep users on track with their financial goals.

Yes, for many users, Revolut serves as a complete digital banking alternative, offering payments, savings, and investment tools in one platform.

Revolut offers Plus, Premium, Metal, and Ultra plans, each providing enhanced benefits, AI-powered tools, and exclusive rewards.

Plum — Automation-first Saving & Investing (EU/UK focus)

Application Information

| Author / Developer | Plum Fintech Ltd. |

| Supported Devices | iOS, Android, and web browsers |

| Languages / Countries | English — Available across the UK and EU countries including France, Spain, and Ireland |

| Free or Paid | Free plan with optional paid tiers (Plum Pro, Ultra, and Premium) for advanced investing and automation features |

General Overview

Plum — Automation-first Saving & Investing is a smart AI-powered financial app designed to help users in the EU and UK automatically save, invest, and manage money efficiently. It leverages intelligent automation and behavioral analytics to simplify personal finance — from optimizing savings to managing investments — all within a secure, user-friendly interface.

Plum's mission is to make saving effortless and investing accessible. Its AI assistant learns user habits, monitors spending, and moves spare money into savings or investments automatically, ensuring that users grow wealth without constant manual effort.

Detailed Introduction

Founded in 2016, Plum is one of the UK's leading AI-driven money management platforms, integrating technology and finance to help users take control of their financial future.

Once connected to a bank account, Plum analyzes income and spending patterns using secure Open Banking technology. It then determines how much can safely be set aside and automates savings into customized goals. Users can also choose to invest in diversified portfolios, including stocks, ETFs, and sustainable funds.

Plum's automation-first approach eliminates the stress of budgeting while giving users full transparency and control over their money. Its AI continuously adapts to each user's lifestyle, ensuring that saving and investing happen seamlessly in the background.

Key Features

AI analyzes transactions and automatically sets aside small amounts of money for savings.

Access to diversified funds, including technology, sustainable, and global stock portfolios.

Real-time tracking of spending patterns and financial habits.

Identify better deals for utilities and earn cashback on purchases.

Automatically prepares users for unexpected expenses.

Rounds up purchases and invests or saves the spare change.

Manage funds across the UK and EU currencies.

Regulated by the Financial Conduct Authority (FCA), using bank-level encryption for data protection.

Create multiple saving pots for travel, emergencies, or long-term goals.

Access advanced investing tools, personalized insights, and higher automation limits.

Download or Access Link

User Guide

Install from Google Play, App Store, or access via the web app.

Register using your email and verify your identity through secure Open Banking connections.

Link your main account to allow Plum to analyze spending and identify saving opportunities.

Activate the AI's automation to begin transferring small amounts to your savings pots.

Select from basic or themed investment portfolios according to your risk preference.

Monitor savings, returns, and expenses directly in the dashboard.

Subscribe to Plum Pro, Ultra, or Premium for features like budgeting insights, cashback, and diversified investments.

Important Notes & Limitations

- Investment portfolios are subject to market risks and value fluctuations.

- Some features (e.g., cashback, investment access) are available only in paid plans.

- Availability may vary depending on the user's country within the EU or UK.

- Internet connection and Open Banking access are required for full functionality.

- Plum does not provide personalized financial advice — users should assess investment risks independently.

Frequently Asked Questions

Plum is an AI-powered app that automates saving, investing, and budgeting for users in the UK and EU.

Yes, Plum uses bank-level encryption and is authorized and regulated by the FCA in the UK.

The AI analyzes spending and income, then transfers small, safe amounts into savings pots automatically.

Yes, Plum provides access to various investment funds and stocks & shares ISAs (UK).

Yes, there's a free version, but users can upgrade to Pro, Ultra, or Premium for enhanced features.

Plum is currently available in the UK, France, Spain, and Ireland, with plans to expand further in the EU.

Yes, users can withdraw their savings at any time without penalty.

Plum combines AI automation, smart investing, and spending analysis in one unified platform.

Yes, the minimum investment amount typically starts from £1 or €1, depending on the country.

Yes, Plum can identify cheaper deals for household bills and assist in switching providers automatically.

No comments yet. Be the first to comment!