M&A in the AI Field

Mergers and acquisitions in the artificial intelligence (AI) field are surging worldwide as tech giants and investors race to acquire cutting-edge technology, top talent, and valuable data. This article explores the latest trends, major deals, and strategic moves shaping the future of AI.

In recent years, mergers and acquisitions (M&A) in artificial intelligence have accelerated dramatically as companies race to secure cutting-edge talent and technology. The numbers tell a compelling story: AI-related deals have more than doubled over the past decade, surging from 225 transactions in 2014 to 494 in 2023. Global deal volume has followed an even steeper trajectory—rising from approximately 430 deals in 2020 to 1,277 in 2024.

This unprecedented boom has been fueled largely by the generative AI revolution. The explosive success of ChatGPT and similar technologies has prompted a worldwide flurry of acquisitions as organizations scramble to integrate AI capabilities into their core operations.

Key Trends Shaping AI M&A

The data reveals several powerful trends driving AI dealmaking across global markets. Recent momentum shows no signs of slowing—Q1 2025 alone saw 381 AI-related deals, representing a 21% increase over the same period in 2024. Europe is experiencing particularly rapid growth, with 100 AI startup acquisitions announced in 2025, already surpassing the 85 deals completed in all of 2024.

Deal Volume Doubling

Global Surge

Q1 2025 Growth

Cross-Border Activity

European Exits

Strategic Consolidation

Why AI M&A is Booming

The explosive growth in AI mergers and acquisitions stems from multiple converging forces. Companies across industries recognize that AI capabilities are no longer optional—they're essential for competitive survival and growth. Understanding these drivers helps explain why dealmaking has reached unprecedented levels.

Competitive Advantage

Companies view AI as a critical differentiator to improve products, accelerate innovation, and gain market edge. Acquiring AI startups enables firms to rapidly embed cutting-edge technology into their offerings rather than building from scratch.

Fear of Missing Out

Business leaders worry intensely about "falling behind" in the AI race. This FOMO drives aggressive dealmaking as companies rush to acquire AI capabilities before competitors do, creating a self-reinforcing cycle of activity.

Rapid Innovation Pace

AI technology evolves at breakneck speed—new generative models and capabilities appear frequently. Acquiring established startups is often faster and less risky than internal development, allowing companies to leap ahead technologically.

Talent Acquisition

M&A brings specialized AI teams and researchers on board immediately. Integrating an existing AI team with proven track records is typically faster and more cost-effective than hiring and training staff from scratch in a highly competitive talent market.

Scale and Partnerships

Even well-funded AI startups are pursuing acquisitions to expand capabilities. Leading AI firms like Mistral are reportedly hiring investment bankers to pursue deals, while large tech corporations partner with or buy startups to complement their AI portfolios.

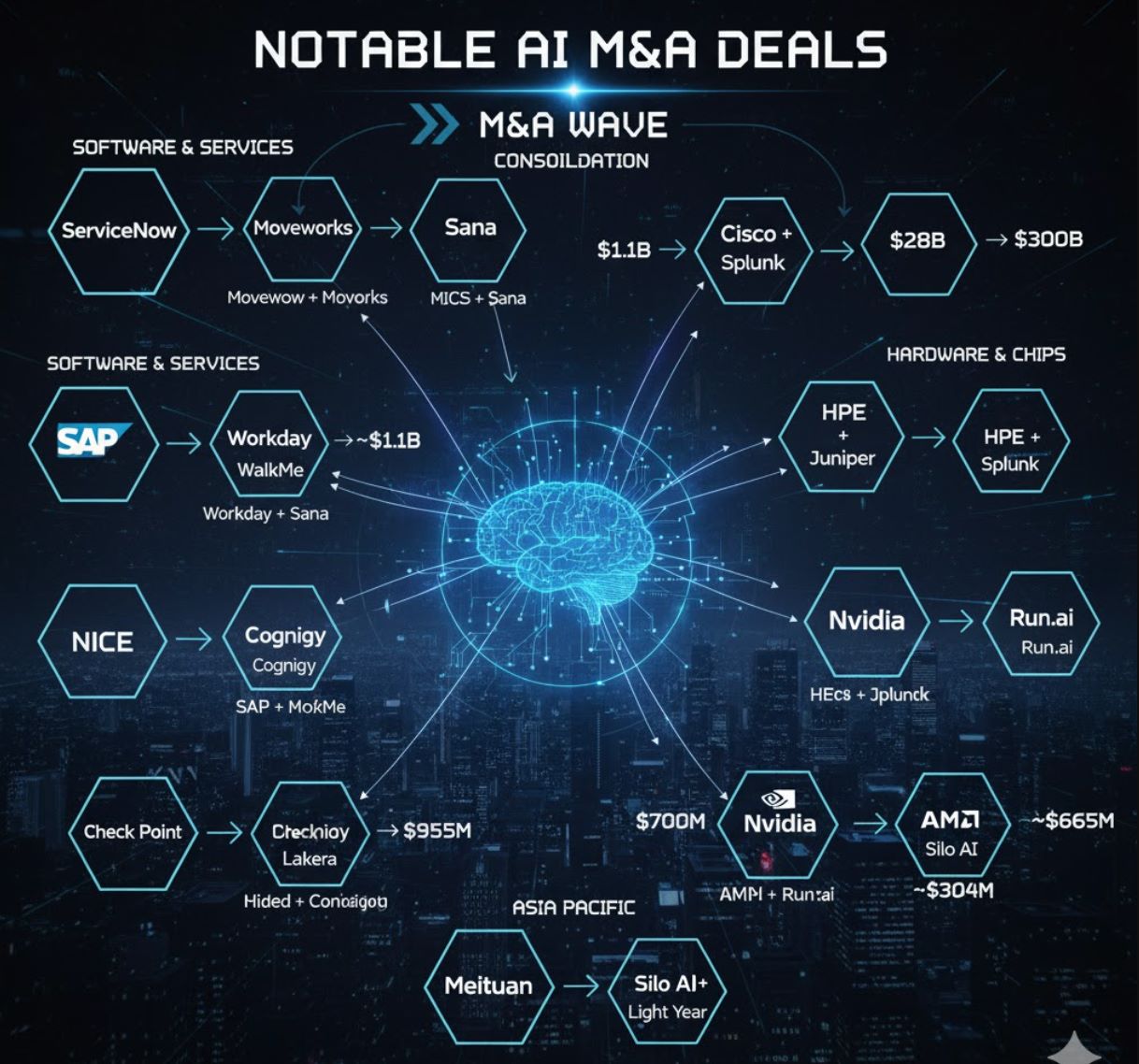

Notable AI M&A Deals

Major transactions across the AI landscape illustrate the trend toward consolidation and the strategic value companies place on AI capabilities. These deals span software, hardware, and services sectors, demonstrating AI's broad impact across the technology ecosystem.

| Acquirer | Target | Deal Value | Strategic Focus |

|---|---|---|---|

| ServiceNow | Moveworks | $2.85B | AI chatbot for IT service automation—ServiceNow's largest-ever acquisition |

| Workday | Sana | ~$1.1B | AI-powered assistant for HR tasks and employee support |

| Cisco | Splunk | $28B | Data analytics and AI capabilities for networking products |

| HPE | Juniper Networks | $14B | AI and automation for networking infrastructure consolidation |

| SAP | WalkMe | $1.5B | AI-based user guidance and copilot tools for enterprise software |

| Nvidia | Run.ai | $700M | Cloud-native AI infrastructure and orchestration tooling |

| AMD | Silo AI | ~$665M | European AI developer specializing in large language models |

| NICE | Cognigy | $955M | Conversational AI for customer engagement platforms |

| Check Point | Lakera | ~$300M | AI security capabilities to defend against emerging threats |

| Meituan | Light Year | ~$304M | Generative AI and large language model development in China |

Legal and Regulatory Considerations

AI deals introduce unique legal and regulatory complexities that extend well beyond traditional M&A due diligence. As regulators worldwide scrutinize the concentration of AI capabilities and the potential societal impacts, acquirers must navigate an evolving landscape of compliance requirements.

Antitrust and National Security

Regulators are watching major AI mergers with heightened scrutiny. Legal analysts warn that consolidation among leading tech firms could trigger extensive antitrust reviews, particularly when deals involve market-leading AI capabilities or foundational models.

- Competition authorities in the U.S., EU, and other jurisdictions are developing AI-specific review frameworks

- Some deals may require national security clearance due to AI's strategic importance in defense and critical infrastructure

- Cross-border transactions face additional layers of review, especially involving Chinese or other strategic foreign investments

- Regulators are examining whether AI acquisitions by dominant platforms could foreclose competition or entrench market power

AI-Specific Due Diligence

Acquirers are developing new due diligence frameworks tailored to AI assets. Traditional technology assessments must be supplemented with AI-specific evaluations that address unique risks and uncertainties.

- Explicit representations that AI models were trained only on properly licensed data

- Documentation of data provenance and training methodologies

- Assessment of model performance, bias, and fairness across different populations

- Evaluation of intellectual property rights in training data and model architectures

- Review of open-source dependencies and licensing compliance

- Analysis of computational infrastructure requirements and costs

The legal landscape around data scraping and copyright for AI training remains unsettled, making contractual protections especially important. Buyers increasingly demand indemnification for IP claims related to training data and model outputs.

Data Privacy and Compliance

AI systems rely on vast datasets that often include personal information, creating complex privacy compliance obligations. M&A teams must ensure adherence to existing privacy laws and anticipate emerging AI-specific regulations.

Privacy Law Compliance

Cross-Border Data Transfers

Emerging AI Regulations

Data Subject Rights

Future Outlook

Market indicators and expert sentiment strongly suggest that AI-related M&A will remain robust in the coming years. The convergence of technological maturation, competitive pressures, and strategic imperatives points toward sustained dealmaking activity, albeit with evolving characteristics.

2024-2025 Market

- Volume-driven growth with many smaller acquisitions

- Focus on acquiring specific AI capabilities and talent

- Relatively light regulatory scrutiny for most deals

- Emphasis on generative AI and large language models

- Cross-border activity with minimal restrictions

2026-2028 Outlook

- Larger strategic consolidations as market matures

- Integration of AI across entire business platforms

- Heightened regulatory scrutiny and longer approval timelines

- Diversification into specialized AI applications and verticals

- Increased geopolitical considerations in deal structuring

In a 2024 survey of technology dealmakers, 47% identified AI/ML as the biggest area for upcoming acquisitions—the highest priority among all technology sectors. Legal commentators likewise note that as the AI ecosystem matures and more startups reach acquisition-ready scale, deal activity "is likely to increase" further.

Strategic Implications

Going forward, companies that effectively integrate AI capabilities—and even leverage AI-driven tools in their own deal processes—may gain significant competitive advantages. However, success will require balancing aggressive acquisition strategies with careful navigation of an increasingly complex regulatory environment.

Strategic Clarity

Define clear AI acquisition criteria aligned with business strategy. Identify capability gaps and prioritize targets that fill specific needs rather than pursuing deals opportunistically.

Enhanced Due Diligence

Develop AI-specific due diligence frameworks covering technical performance, data provenance, IP rights, regulatory compliance, and integration requirements.

Regulatory Navigation

Engage early with regulators on significant deals. Build relationships with antitrust authorities and prepare comprehensive competitive analyses to expedite approvals.

Integration Planning

Develop detailed integration roadmaps before closing. AI talent retention and cultural fit are especially critical—many AI deals fail to deliver value due to post-acquisition talent attrition.

Continuous Monitoring

Track market developments, emerging technologies, and regulatory changes. The AI landscape evolves rapidly—yesterday's strategic acquisition may require complementary deals tomorrow.

No comments yet. Be the first to comment!