هوش مصنوعی برنامههای پسانداز را پیشنهاد میدهد

هوش مصنوعی روش پسانداز پول را متحول کرده است. با تحلیل عادات خرج کردن و پیشنهاد خودکار استراتژیهای پسانداز شخصیسازیشده، اپلیکیشنهای مالی مجهز به هوش مصنوعی به کاربران کمک میکنند پول خود را هوشمندانهتر مدیریت کنند، بدون زحمت پسانداز نمایند و سریعتر به اهدافشان برسند.

پسانداز پول در دنیای امروز میتواند چالشبرانگیز باشد – افزایش هزینهها و سبک زندگی پرمشغله باعث میشود کنار گذاشتن پول به صورت منظم دشوار شود. خوشبختانه، هوش مصنوعی (AI) از طریق اپلیکیشنها و ابزارهای هوشمند که عادات خرج کردن شما را تحلیل میکنند و استراتژیهای پسانداز شخصیسازیشده ارائه میدهند، در حال تحول امور مالی شخصی است.

پلتفرمهای بودجهبندی مدرن مجهز به هوش مصنوعی به طور مستقیم به حسابهای مالی شما متصل میشوند، الگوهای خرج کردن را به صورت خودکار ردیابی میکنند و میزان بهینه پسانداز ماهانه را پیشنهاد میدهند. با تحلیل جریانهای درآمد و هزینههای شما، این سیستمهای هوشمند اهداف پسانداز پویا تعیین میکنند که با تغییر وضعیت مالی شما تطبیق مییابند.

چگونه هوش مصنوعی امور مالی شما را تحلیل میکند

اپلیکیشنهای مالی مبتنی بر هوش مصنوعی با اتصال امن به حسابهای بانکی و کارت اعتباری شما کار میکنند و سپس تاریخچه کامل تراکنشها را اسکن میکنند. با استفاده از الگوریتمهای پیشرفته یادگیری ماشین، این سیستمها هزینهها را در حوزههای مختلف دستهبندی میکنند و به طور مداوم از الگوهای مالی شما یاد میگیرند.

ادغام حسابها

دستهبندی هوشمند

شناسایی الگو

ابزارهای بودجهبندی هوش مصنوعی با تحلیل الگوهای خرج کردن و ارائه پیشنهادات، ردیابی و بینشهای شخصیسازیشده فراهم میکنند تا به کاربران در مدیریت امور مالی کمک کنند.

— خدمات مالی SoFi

پیشنهادات شخصیسازیشده در عمل

هوش مصنوعی پیشنهادات متناسب با پروفایل مالی منحصر به فرد شما ارائه میدهد. برای مثال، اگر سیستم متوجه هزینههای مکرر در رستوران شود، ممکن است پخت غذا در خانه را برای کاهش هزینهها توصیه کند. همچنین میتواند نشان دهد چگونه کاهشهای کوچک در خدمات اشتراکی به مرور زمان به پسانداز قابل توجهی تبدیل میشوند.

تحلیل مالی پیشبینیکننده

فراتر از تحلیل تاریخی، ابزارهای هوش مصنوعی از مدلسازی پیشبینی برای پیشبینی آینده مالی شما استفاده میکنند. این سیستمها میتوانند پیشبینی کنند که آیا در مسیر رسیدن به اهداف خاص مانند پسانداز برای پیشپرداخت خانه هستید یا نیاز به تنظیمات وجود دارد.

پیشبینی هدف

هوش مصنوعی پیشرفت شما به سمت نقاط عطف مالی را پیشبینی میکند و قبل از وقوع کمبودهای احتمالی به شما هشدار میدهد.

برنامههای پسانداز سفارشی

دریافت توصیههای خاص مانند «این ماه هر هفته ۱۵۰ دلار پسانداز کنید تا تا پایان سال به هدف صندوق اضطراری برسید.»

با پردازش درآمد، صورتحسابهای پیشرو و دادههای تاریخی خرج کردن، هوش مصنوعی اطلاعات مالی خام را به نقشه راه پسانداز پویا و شخصیسازیشده تبدیل میکند که با شرایط زندگی شما تطبیق مییابد.

ابزارهای پسانداز هوش مصنوعی در دنیای واقعی

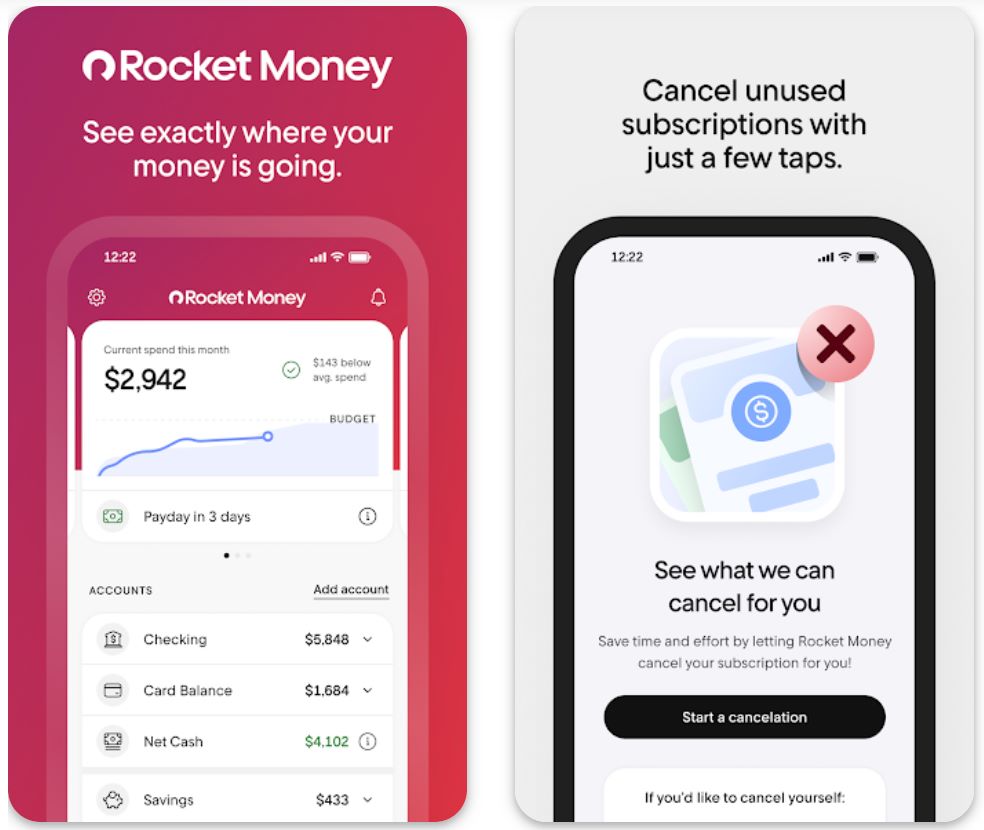

Rocket Money

| توسعهدهنده | Rocket Money, Inc. (بخشی از Rocket Companies) |

| پلتفرمهای پشتیبانیشده |

|

| زبان و دسترسی | فقط انگلیسی — مقیمان ایالات متحده با حسابهای بانکی مستقر در آمریکا |

| مدل قیمتگذاری | دانلود رایگان با اشتراک اختیاری پریمیوم (۳ تا ۱۲ دلار در ماه) برای ویژگیهای پیشرفته |

Rocket Money چیست؟

Rocket Money یک اپلیکیشن مالی شخصی است که به شما کمک میکند کنترل هزینههایتان را در دست بگیرید، اشتراکها را مدیریت کنید، قبوض را مذاکره کنید و پساندازها را خودکار کنید. حسابهای بانکی، کارتهای اعتباری و سرمایهگذاری خود را متصل کنید تا نمای کاملی از وضعیت مالیتان در یکجا داشته باشید. نسخه رایگان هزینهها را پیگیری و هزینههای تکراری را شناسایی میکند، در حالی که پریمیوم به شما امکان دسترسی به کمک لغو اشتراک، مذاکره قبوض، بودجههای نامحدود و انتقالهای خودکار پسانداز را میدهد.

چرا از Rocket Money استفاده کنیم؟

مدیریت هزینههای تکراری و اشتراکهای پنهان میتواند بدون اینکه متوجه شوید بودجه شما را تخلیه کند. Rocket Money مدیریت مالی را ساده میکند با جمعآوری همه حسابهای شما، برجسته کردن پرداختهای تکراری و ارائه ابزارهایی برای هدایت پساندازها به سمت اهداف شما.

با بیش از ۱۰ میلیون عضو و بیش از ۲.۵ میلیارد دلار صرفهجویی ناخالص ایجاد شده، این اپ ارزش خود را ثابت کرده است. پس از اتصال حسابهای جاری، پسانداز، اعتباری و سرمایهگذاری، Rocket Money هزینههای شما را دستهبندی میکند، به پرداختهای تکراری هشدار میدهد و به شما کمک میکند اهداف پسانداز قابل دستیابی تعیین کنید.

ویژگی برجسته، پسانداز خودکار است: هدفی تعیین کنید، حسابهای خود را متصل کنید و برنامه به طور خودکار وجوه را به یک حساب پسانداز بیمهشده توسط FDIC منتقل میکند بدون نیاز به توجه مداوم.

ویژگیهای کلیدی

تراکنشها را در تمام حسابهای متصل به طور خودکار دستهبندی میکند و دید واضحی از محل خرج پول به شما میدهد.

هزینههای تکراری را شناسایی کرده و به لغو اشتراکهای ناخواسته کمک میکند. اعضای پریمیوم از خدمات کنسیرج لغو بهرهمند میشوند.

ویژگی پریمیوم: تیم Rocket Money نرخهای پایینتر قبوض واجد شرایط مانند کابل، اینترنت و تلفن را به نمایندگی از شما مذاکره میکند.

اهداف مالی تعیین کنید و اجازه دهید برنامه بر اساس جریان نقدی شما به طور خودکار وجوه را منتقل کند تا سریعتر به اهداف برسید.

ارزش خالص داراییها (داراییها منهای بدهیها) را پیگیری کرده و تغییرات امتیاز اعتباری را در طول زمان با پریمیوم مشاهده کنید.

بودجههای ماهانه نامحدود برای هر دسته (رستوران، سرگرمی، خرید) ایجاد کنید و هنگام نزدیک شدن به حد بودجه هشدار دریافت کنید.

دانلود Rocket Money

چگونه با Rocket Money شروع کنیم

Rocket Money را از اپ استور یا گوگل پلی نصب کنید، سپس با آدرس ایمیل خود یک حساب رایگان بسازید.

حسابهای جاری، پسانداز، کارت اعتباری و سرمایهگذاری خود در آمریکا را متصل کنید. برنامه از شرکای امنی مانند Plaid برای اتصال بانکی استفاده میکند.

اجازه دهید برنامه هزینههای شما را دستهبندی کرده و اشتراکهای تکراری را شناسایی کند. در تب «اشتراکها» همه هزینههای تکراری را مشاهده کنید.

اعضای پریمیوم میتوانند خدماتی را برای لغو مستقیم درون برنامه انتخاب کنند. تیم کنسیرج فرایند لغو را برای شما انجام میدهد.

به بخش «اهداف مالی» یا «پسانداز هوشمند» بروید، هدفی مانند «صندوق اضطراری — ۳۰۰۰ دلار» ایجاد کنید و فرکانس و مبلغ انتقال را انتخاب کنید.

بودجههایی برای هر دسته (رستوران، سرگرمی، خرید) تعیین کنید و هزینهها را از طریق داشبورد پیگیری کنید. پریمیوم امکان ایجاد دستهبندیهای نامحدود را فراهم میکند.

مشترکان پریمیوم میتوانند برای مذاکره قبوض ثبتنام کنند. Rocket Money قبوض واجد شرایط (کابل، اینترنت، تلفن) را بررسی کرده و تلاش میکند نرخهای پایینتری بگیرد. در صورت موفقیت، شما بخشی از صرفهجویی را پرداخت میکنید.

ارزش خالص داراییها (داراییها منهای بدهیها) را ماهانه پیگیری کنید و اگر پریمیوم هستید تغییرات امتیاز اعتباری را مشاهده کنید.

اعلانهای موجودی امن، هشدار تراکنشهای بزرگ و یادآوری تمدیدهای آینده را تنظیم کنید تا کنترل مالی خود را حفظ کنید.

هر زمان که خواستید اشتراک پریمیوم را از طریق تنظیمات برنامه لغو کنید. حساب رایگان شما با امکانات محدود فعال باقی میماند.

محدودیتهای مهم

- هزینههای پریمیوم: ویژگیهای پیشرفته نیازمند اشتراک ماهانه یا سالانه (۳ تا ۱۲ دلار در ماه) هستند. مذاکره قبوض درصدی از صرفهجویی را به عنوان هزینه خدمات دریافت میکند.

- وابستگی به سرویسهای ثالث: اتصال حسابها به خدماتی مانند Plaid وابسته است. ممکن است با برخی بانکها مشکلات اتصال وجود داشته باشد و همه انواع حسابها پشتیبانی نشوند.

- نتایج متغیر: اگرچه Rocket Money ادعای صرفهجویی قابل توجه برای کاربران دارد، نتایج فردی متفاوت است. برخی کاربران صرفهجویی کمی از مذاکره یا خودکارسازی گزارش کردهاند.

- محدودیت ارزی: این برنامه فقط با دلار آمریکا و در چارچوب قوانین ایالات متحده کار میکند. ارزها و بانکهای بینالمللی پشتیبانی نمیشوند.

سوالات متداول

بله، Rocket Money از رمزنگاری سطح بانکی استفاده میکند و با خدمات امن اتصال بانکی مانند Plaid همکاری دارد تا دادههای مالی شما را محافظت کند. اطلاعات حساب شما هرگز مستقیماً توسط برنامه ذخیره نمیشود.

خیر، Rocket Money فقط برای ساکنان ایالات متحده با حسابهای بانکی مستقر در آمریکا در دسترس است. این برنامه از بانکها و ارزهای بینالمللی پشتیبانی نمیکند.

نسخه رایگان به شما امکان میدهد حسابها را متصل کنید، تجزیه و تحلیل هزینهها را مشاهده کنید، اشتراکها را شناسایی کنید و بودجههای محدودی تعیین کنید. ویژگیهای پریمیوم مانند کنسیرج لغو، انتقالهای خودکار پسانداز، بودجههای نامحدود، مذاکره قبوض و پیگیری اعتباری نیازمند اشتراک پولی هستند.

قیمتگذاری پریمیوم معمولاً بین

شما میتوانید با طرح رایگان تمام اشتراکها را مشاهده کنید. اما خدمات لغو خودکار — که Rocket Money به نمایندگی از شما با ارائهدهنده تماس میگیرد — فقط برای اعضای پریمیوم در دسترس است.

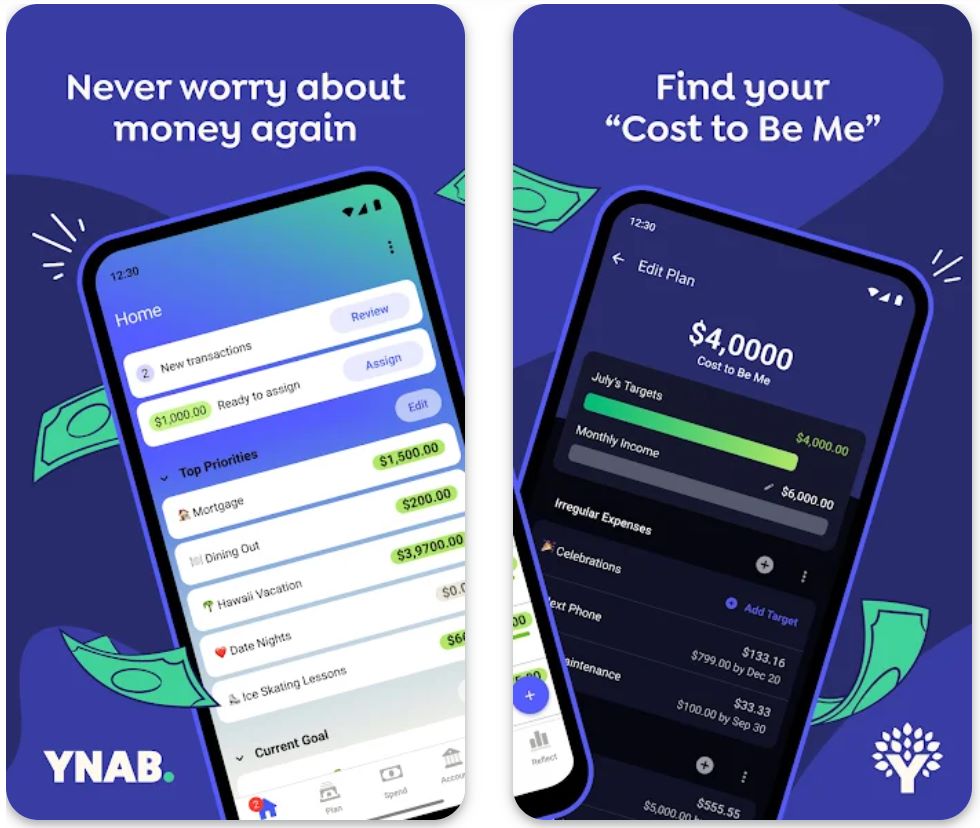

YNAB

اطلاعات اپلیکیشن

| توسعهدهنده | You Need a Budget, Inc.، تأسیس شده توسط جسی مچام |

| پلتفرمهای پشتیبانیشده |

|

| پشتیبانی زبان | عمدتاً انگلیسی؛ در کشورهایی که اتصال بانکی و پشتیبانی ارز دارند در دسترس است |

| مدل قیمتگذاری | دوره آزمایشی رایگان ۳۴ روزه، سپس اشتراک پولی برای دسترسی کامل لازم است |

YNAB چیست؟

YNAB (شما به بودجه نیاز دارید) یک اپلیکیشن بودجهبندی است که بر اصل اختصاص وظیفه به هر دلار بنا شده و با استفاده از روش بودجهبندی صفر-پایه به کاربران کمک میکند درآمد، هزینهها، پسانداز و اهداف خود را بهصورت فعال تخصیص داده و پیگیری کنند. با همگامسازی لحظهای بین دستگاهها و روششناسی اختصاصی بودجهبندی، YNAB هدف دارد کاربران را از هزینههای واکنشی به مدیریت پیشگیرانه پول منتقل کند، استرس را کاهش داده و وضوح مالی را افزایش دهد.

نحوه کار YNAB

در عصری که بسیاری احساس میکنند نمیدانند پولشان کجا میرود، YNAB رویکردی ساختارمند برای کنترل مالی ارائه میدهد نه صرفاً نظارت بر آن. به جای انتظار برای دیدن باقیمانده در پایان ماه، YNAB شما را ترغیب میکند هر دلار ورودی را به هدفی اختصاص دهید: هزینهها، پسانداز، پرداخت بدهی یا ذخیره اضطراری. این باعث میشود هزینهها و پساندازها هدفمند باشند و مالیاتان با اولویتهای زندگی شما هماهنگ شود.

رابط کاربری اپلیکیشن امکان اتصال حسابهای بانکی و اعتباری یا وارد کردن دستی تراکنشها، دستهبندی هزینهها و پیگیری پیشرفت اهداف و بودجهها را فراهم میکند. طبق گفته توسعهدهنده، کاربر متوسط در نظرسنجی آنها پسانداز قابل توجهی دارد و استرس کمتری درباره پول احساس میکند.

ویژگیهای کلیدی

به هر دلار وظیفه مشخصی اختصاص دهید تا درآمد منهای هزینهها صفر شود و هزینهها هدفمند باشند.

بودجه خود را در وب، iOS و اندروید با بهروزرسانی و همگامسازی خودکار در همه دستگاهها در دسترس داشته باشید.

برای هزینههای نامنظم یا بزرگ آینده با ایجاد دستهبندیهای ذخیره برای «هزینههای واقعی» برنامهریزی کنید.

وقتی بیش از حد هزینه میکنید یا اولویتها تغییر میکنند، میتوانید پول را بین دستهبندیهای بودجه جابجا کنید.

کارگاههای داخلی، جامعه پشتیبانی و آموزشها به کاربران کمک میکنند روش بودجهبندی را بهخوبی یاد بگیرند.

لینک دانلود یا دسترسی

چگونه از YNAB استفاده کنیم

از طریق وبسایت یا اپلیکیشن موبایل YNAB برای دوره آزمایشی رایگان ثبتنام کنید و حسابهای بانکی، پسانداز، کارت اعتباری خود را متصل کنید (یا ورود دستی را انتخاب کنید).

موجودی حسابهای فعلی و تراکنشهای اخیر خود را وارد یا وارد کنید تا بودجهتان بهروز شود.

دستهبندیهای بودجه مانند اجاره، خرید مواد غذایی، سرگرمی، پسانداز، بازپرداخت بدهی را ایجاد کنید و هر دلار پول موجود خود را به یک دسته اختصاص دهید.

هنگام خرج کردن، تراکنشها را وارد کنید یا اجازه دهید اپلیکیشن آنها را وارد کند؛ مقادیر «در دسترس» هر دسته را بررسی کنید تا بدانید چقدر میتوانید هزینه کنید.

برای هزینههای آینده مانند بیمه یا اشتراکهای سالانه، دستهبندیهای «هزینه واقعی» ایجاد کنید و ماهانه مبالغ کمی تخصیص دهید تا هزینه هنگام سررسید تأمین شده باشد.

اگر در یک دسته بیش از حد هزینه کردید، از انعطافپذیری اپلیکیشن استفاده کنید و بودجه را از دستهای دیگر منتقل کنید تا از هزینه اضافی کلی جلوگیری شود.

به سمت «افزایش سن پول» کار کنید—هدف این است که پول ماه گذشته را در این ماه خرج کنید نه پول همین ماه، که باعث افزایش ذخیره و ثبات مالی میشود.

بودجه خود را بهطور منظم بررسی کنید (بررسی سریع روزانه، بازبینی کامل ماهانه) تا دستهبندیها هماهنگ بمانند، هزینهها اصلاح شود و برای تغییرات زندگی تنظیم گردد.

پس از پایان دوره آزمایشی، در صورت تمایل برای ادامه استفاده از امکانات کامل اشتراک تهیه کنید؛ در غیر این صورت میتوانید قبل از اعمال هزینهها لغو کنید.

محدودیتهای مهم

- نیاز به رویکرد فعال: این روش بهترین نتیجه را زمانی میدهد که بودجه را فعالانه تخصیص دهید و بهطور منظم بررسی کنید؛ برای استفاده منفعل «تنظیم و فراموش کن» کمتر مناسب است.

- مشکلات اتصال بانکی: برخی کاربران گزارش دادهاند که پشتیبانی وارد کردن خودکار محدود است یا در خارج از بازارهای اصلی مشکلات اتصال بانکی منطقهای وجود دارد.

- ویژگیهای محدود سرمایهگذاری: این اپلیکیشن تمرکز زیادی بر بودجهبندی و هزینهها دارد؛ امکانات کمتری برای پیگیری سرمایهگذاری، نظارت بر امتیاز اعتباری یا مذاکره قبض نسبت به برخی رقبا دارد.

پرسشهای متداول

بله—YNAB دوره آزمایشی رایگان ۳۴ روزه با دسترسی کامل به امکانات ارائه میدهد تا قبل از اشتراک روش را تست کنید.

پس از پایان دوره آزمایشی رایگان، باید اشتراک ماهانه یا سالانه تهیه کنید تا بتوانید از اپلیکیشن با امکانات کامل استفاده کنید.

بله، از وارد کردن مستقیم از بسیاری از بانکها پشتیبانی میکند، اما برخی کاربران ممکن است متوجه شوند اتصال کامل نیست یا هنوز نیاز به ورود دستی وجود دارد.

بله—اما توجه داشته باشید که راهاندازی دستهبندیهای بودجه و آشنایی با روش کمی تلاش میطلبد. اگر ابزار کاملاً خودکار «خلبان خودکار مالی» میخواهید، باید به منحنی یادگیری متعهد شوید.

بسیاری از کاربران گزارش دادهاند که کنترل بهتری روی پول خود دارند، استرس کمتری دارند و عادات پسانداز بهتری از طریق روش بودجهبندی فعال پیدا کردهاند. با این حال، نتایج به میزان مشارکت کاربر بستگی دارد.

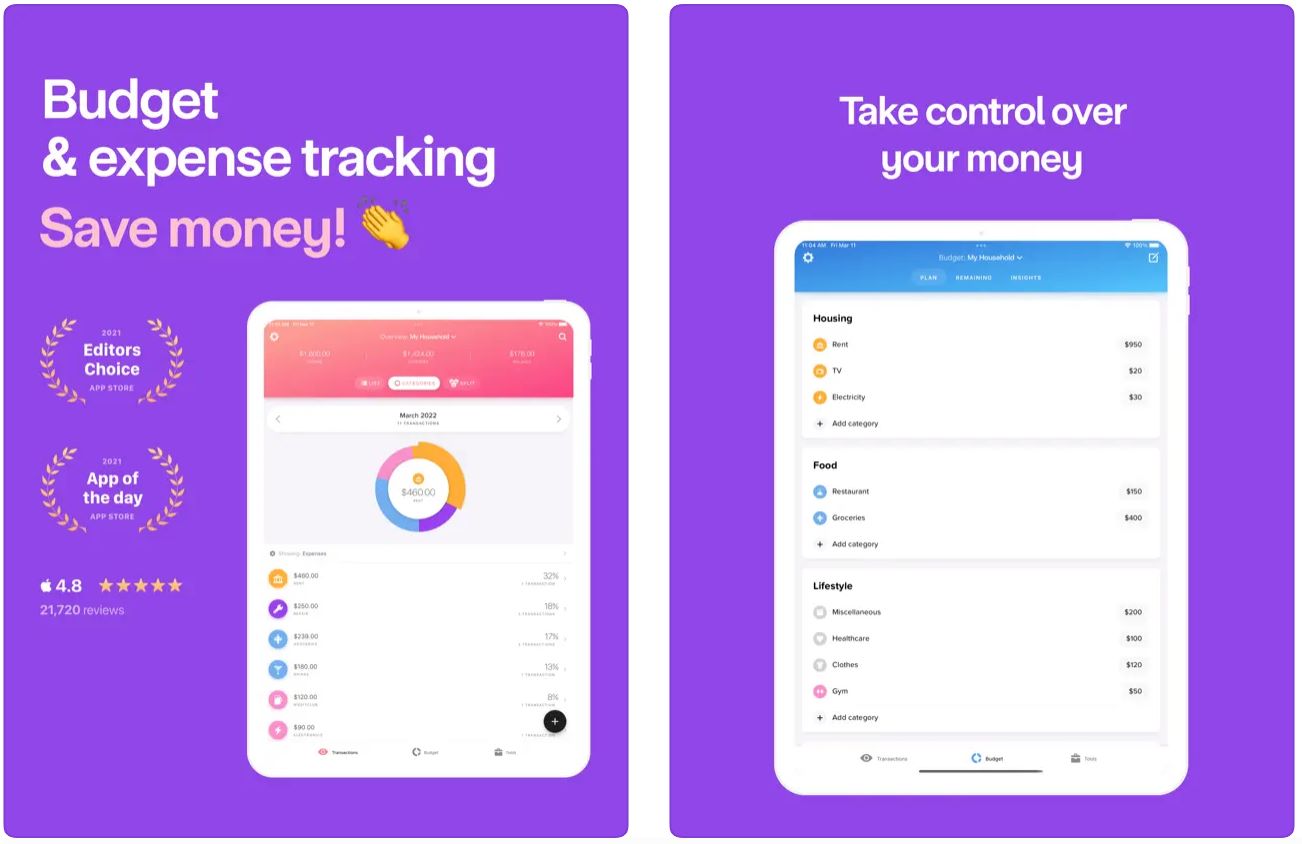

Buddy

| توسعهدهنده | Buddy Budgeting AB |

| پلتفرمهای پشتیبانیشده |

|

| پشتیبانی زبانی | بیش از ۱۲ زبان از جمله انگلیسی، دانمارکی، هلندی، فرانسوی، آلمانی، ایتالیایی، نروژی بوکمال، لهستانی، پرتغالی، روسی، اسپانیایی، سوئدی، ترکی |

| دسترسی | در استرالیا، کانادا، ایالات متحده و بازارهای اروپایی در دسترس است |

| مدل قیمتگذاری | دانلود رایگان با امکانات پایه. اشتراک پریمیوم (ماهانه یا سالانه) برای استفاده کامل لازم است |

| تعداد کاربران | بیش از ۲.۵ میلیون کاربر در سراسر جهان |

باتی بودجهبندی و پسانداز چیست؟

باتی یک اپلیکیشن بودجهبندی و پسانداز شهودی است که امور مالی شخصی و مشترک را از طریق امکانات همکاری، بینشهای بصری هزینهها و ابزارهای آسان برنامهریزی بودجه ساده میکند. طراحی شده به عنوان یک همراه «بودجهبندی شاد»، به افراد، زوجها و همخانهها کمک میکند کنترل پول خود را در دست بگیرند، هزینهها را پیگیری کنند، بودجههای واقعبینانه تعیین کنند و مسئولیت مالی را بهراحتی به اشتراک بگذارند.

بررسی دقیق

مدیریت امور مالی زمانی پیچیده میشود که چندین حساب، هزینههای مشترک یا درآمد نامنظم داشته باشید. باتی این پیچیدگی را با طراحی ساده و کاربرپسند و روند کاری روان، بودجهبندی را برای همه قابل دسترس میکند.

با ایجاد بودجههای سفارشی برای دستهبندی هزینهها، اهداف پسانداز و پیگیری درآمد شروع کنید. سپس تراکنشهای واقعی را نظارت کنید، موجودی باقیمانده را به صورت لحظهای ببینید و تخصیصها را با تغییر شرایط مالی خود در طول ماه تنظیم کنید.

ویژگی متمایز باتی تأکید آن بر بودجهبندی مشترک است—شریک، همخانه یا اعضای خانواده خود را دعوت کنید تا بودجهها را به اشتراک بگذارند، هزینههای مشترک را شفاف پیگیری کنند و مسئولیت مالی را با هم حفظ کنند. با بیش از ۲.۵ میلیون کاربر در بازارهای مختلف، باتی شهرت خود را بر پایه لذتبخش و قابل دسترس کردن بودجهبندی ساخته است، نه پیچیده کردن کاربران با تحلیلهای مالی دشوار.

ویژگیهای کلیدی

بودجههای سفارشی برای هزینهها، پسانداز، درآمد و ارزش خالص در چندین حساب با مدیریت دستهبندی انعطافپذیر ایجاد و تنظیم کنید.

هزینهها را به صورت دستی یا از طریق وارد کردن اطلاعات بانکی (بسته به منطقه) پیگیری کنید و بینش فوری درباره الگوهای هزینه و وضعیت بودجه دریافت نمایید.

شریکها یا همخانهها را دعوت کنید تا در بودجههای مشترک همکاری کنند، هزینههای مشترک را پیگیری کنند و هزینهها را به صورت شفاف تقسیم کنند.

تجربه خود را با تمها، دستهبندیهای سفارشی، حالت تاریک و پشتیبانی از انواع حسابهای مختلف (پسانداز، جاری، بدهی) شخصیسازی کنید.

اهداف پسانداز مشخص تعیین کنید، پیشرفت را با نمودارهای شهودی مشاهده کنید و هشدارهایی برای ماندن در مسیر رسیدن به اهداف مالی دریافت نمایید.

لینک دانلود یا دسترسی

چگونه با باتی شروع کنیم

باتی را از اپ استور یا گوگل پلی (در صورت دسترسی) دانلود کنید و سپس حساب رایگان خود را بسازید.

واحد پول پایه خود را انتخاب کنید و یک یا چند «کیف پول» یا حساب (جاری، پسانداز، بدهی) برای سازماندهی امور مالی خود ایجاد کنید.

دستهبندیهای بودجه را بر اساس درآمد و برنامه هزینه خود بسازید (مسکن، غذا، حملونقل، پسانداز). از دستهبندیهای پیشفرض استفاده کنید یا دستهبندیهای سفارشی متناسب با سبک زندگی خود ایجاد نمایید.

تراکنشها را به صورت دستی وارد کنید یا حساب بانکی خود را متصل کنید (در صورت پشتیبانی). هر تراکنش را به دستهبندی مناسب اختصاص دهید تا هزینهها دقیق پیگیری شوند.

شریک یا همخانه خود را دعوت کنید تا در بودجههای مشترک همکاری کنند و تراکنشها را برای مدیریت شفاف مالی خانوار تقسیم کنند.

به طور منظم داشبورد بودجه خود را بررسی کنید تا موجودی باقیمانده در هر دستهبندی را ببینید و پیشرفت به سوی اهداف پسانداز را پیگیری کنید.

در طول ماه، وجوه را بین دستهبندیها جابجا کنید یا تخصیص بودجه را با تغییر شرایط مالی خود اصلاح کنید.

در پایان ماه، گزارشهای هزینه را مرور کنید تا نقاط هزینه بیش از حد را شناسایی کنید، روندها را بشناسید و بودجه ماه بعد را بهتر برنامهریزی کنید.

با خرید اشتراک درونبرنامهای باتی پریمیوم، حسابهای نامحدود، وارد کردن اطلاعات بانکی (در بازارهای پشتیبانی شده) و امکانات پیشرفته اشتراکگذاری را فعال کنید.

هشدارها را روشن کنید تا بهموقع درباره وضعیت بودجه، هشدارهای هزینه بیش از حد و فعالیتهای بودجه مشترک مطلع شوید.

محدودیتهای مهم برای توجه

- اشتراک پریمیوم برای امکانات کامل: در حالی که بودجهبندی پایه رایگان است، امکانات پیشرفته مانند اشتراکگذاری، حسابهای متعدد و وارد کردن اطلاعات بانکی نیازمند اشتراک پریمیوم پرداختی است.

- محدودیت در تقسیم تراکنشها: برخی کاربران گزارش دادهاند که نمیتوانند یک تراکنش را بین چند دستهبندی بودجه تقسیم کنند که برای خریدهای پیچیده ممکن است مشکلساز باشد.

- تمرکز صرفاً بر بودجهبندی: باتی تخصص خود را در بودجهبندی و پیگیری هزینهها دارد و مدیریت سرمایهگذاری یا مشاوره مالی حرفهای ارائه نمیدهد—کاربرانی که به تحلیلهای عمیق نیاز دارند ممکن است به ابزارهای اضافی نیاز داشته باشند.

- محدودیتهای نسخه رایگان: نسخه رایگان برای بودجههای ساده مناسب است، اما کاربران حرفهای که چندین حساب یا امور مالی خانوار مشترک را مدیریت میکنند احتمالاً برای بهرهوری بهتر به نسخه پریمیوم نیاز خواهند داشت.

سوالات متداول

بله، باتی رایگان دانلود میشود و امکانات پایه بودجهبندی و پیگیری هزینهها را بدون هزینه ارائه میدهد. با این حال، برای دسترسی به مجموعه کامل امکانات—شامل حسابهای نامحدود، وارد کردن اطلاعات بانکی و بودجهبندی مشترک—باید اشتراک پریمیوم (ماهانه یا سالانه) را تهیه کنید.

دسترسی به اتصال بانکی بستگی به منطقه شما دارد. باتی در برخی کشورها از بانکداری باز و وارد کردن خودکار تراکنشها پشتیبانی میکند، اما در بسیاری از بازارها هنوز باید تراکنشها به صورت دستی وارد شوند. برای اطمینان از گزینههای اتصال بانکی، ویژگیهای پشتیبانی شده در منطقه خود را بررسی کنید.

قطعاً! بودجهبندی مشترک یکی از ویژگیهای برجسته باتی است. میتوانید شریک، همخانه یا اعضای خانواده را دعوت کنید تا به بودجه شما بپیوندند، هزینههای مشترک را با هم پیگیری کنند و هزینهها را به صورت شفاف تقسیم کنند. این ویژگی برای مدیریت امور مالی خانوار یا شرایط زندگی مشترک ایدهآل است.

باتی روی iOS (آیفون، آیپد، آیپاد تاچ)، macOS (با تراشه M1 یا بالاتر) و اندروید از طریق گوگل پلی در بازارهای منتخب در دسترس است. این اپلیکیشن بیش از ۱۲ زبان از جمله انگلیسی، دانمارکی، هلندی، فرانسوی، آلمانی، ایتالیایی، نروژی بوکمال، لهستانی، پرتغالی، روسی، اسپانیایی، سوئدی و ترکی را پشتیبانی میکند.

باتی عمدتاً بر بودجهبندی، پیگیری هزینهها و برنامهریزی پسانداز تمرکز دارد و مدیریت سرمایهگذاری یا مذاکره حرفهای صورتحسابها را ارائه نمیدهد. اگر به تحلیلهای جامع سرمایهگذاری، پیگیری پرتفوی یا خدمات خودکار مذاکره صورتحساب نیاز دارید، بهتر است باتی را با یک پلتفرم مدیریت مالی یا سرمایهگذاری تخصصی ترکیب کنید.

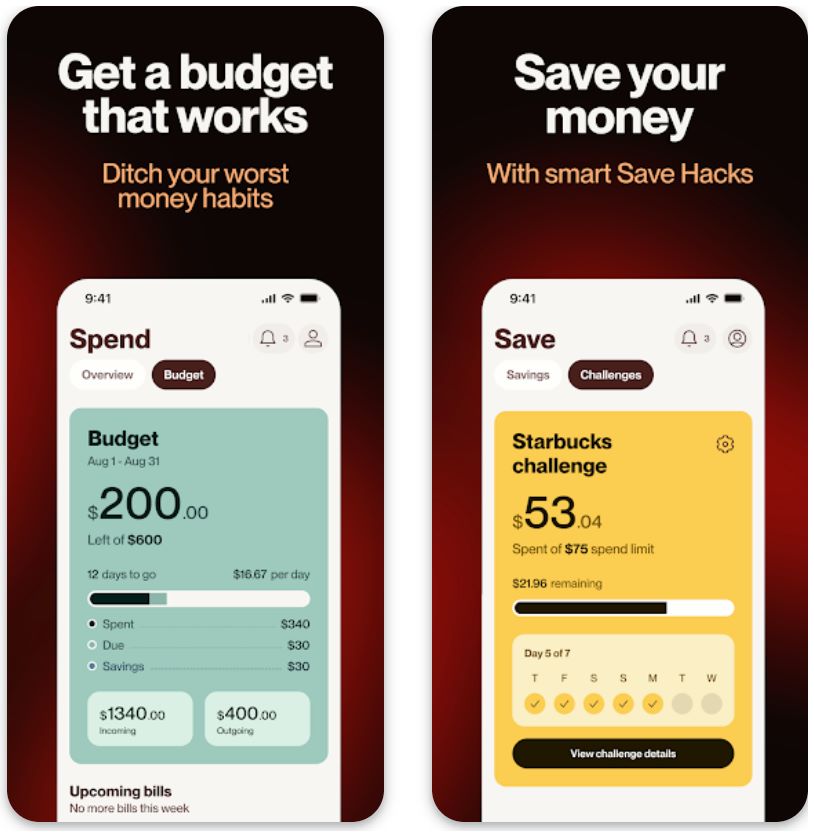

Cleo AI

| توسعهدهنده | کلو ایآی محدود، تأسیسشده توسط بارنابی هاسی-یو |

| پلتفرمهای پشتیبانیشده |

|

| پشتیبانی زبانی | عمدتاً زبان انگلیسی |

| دسترسی | ایالات متحده (قبلاً در بریتانیا موجود بود) |

| مدل قیمتگذاری | نسخه رایگان برای بودجهبندی پایه؛ اشتراک پولی امکانات پیشپرداخت نقدی، ساخت اعتبار و بینشهای پیشرفته را فعال میکند |

کلو ایآی چیست؟

کلو یک اپلیکیشن مالی شخصی مبتنی بر هوش مصنوعی است که بودجهبندی را به یک گفتگوی جذاب تبدیل میکند. با اتصال به حساب بانکی شما، این دستیار هوشمند هزینهها را پیگیری میکند، الگوها را شناسایی مینماید و از طریق چالشهای خودکار و بینشهای شخصیسازیشده به شما کمک میکند پول پسانداز کنید. برخلاف اپلیکیشنهای مالی سنتی، کلو از رابط چتباتی با شخصیت استفاده میکند که مدیریت پول را کمتر ترسناک و تعاملیتر میسازد.

این اپلیکیشن ابزارهای ضروری بودجهبندی را با پیشپرداختهای نقدی کوتاهمدت اختیاری ترکیب میکند و یک پلتفرم همهکاره برای کاربرانی است که هم به دنبال پیگیری مالی و هم تأمین مالی اضطراری گاهبهگاه هستند. چه بخواهید بفهمید حقوقتان کجا میرود و چه بخواهید عادات پسانداز بهتری بسازید، کلو رویکردی مدرن به مدیریت مالی شخصی ارائه میدهد.

چرا کلو را برای مدیریت پول انتخاب کنیم؟

در چشمانداز بانکداری دیجیتال امروز، پرداختهای خودکار و تراکنشهای لمسی باعث میشوند کنترل خرجکرد دشوار شود. کلو این چالش را با ارائه دیدگاه لحظهای به عادات مالی شما از طریق یک دستیار هوش مصنوعی قابل دسترس حل میکند.

رابط گفتگومحور اپلیکیشن پیچیدگیهای معمول نرمافزارهای بودجهبندی را حذف میکند. به جای جستجو در صفحات و نمودارهای متعدد، کافی است سوالاتی مانند «این ماه چقدر برای غذا خوردن بیرون خرج کردم؟» بپرسید و پاسخهای فوری و کاربردی دریافت کنید. این سبک تعامل طبیعی، آگاهی مالی را برای کاربرانی که ممکن است از ابزارهای مالی سنتی دچار سردرگمی شوند، قابل دسترس میسازد.

ویژگیهای کلیدی

سوالات خود را به زبان طبیعی درباره امور مالی بپرسید و بلافاصله بینشهای شخصیسازیشده دریافت کنید.

- مدیریت پول به صورت مکالمهای

- تفکیک خرجکرد بر اساس دستهبندیها

- شخصیتی دوستانه و جذاب

با استفاده از گرد کردن مبالغ، چالشها و ویژگیهای انتقال هوشمند، بهراحتی پسانداز بسازید.

- گرد کردن خریدها به نزدیکترین دلار

- چالشهای پسانداز قابل تنظیم

- پیگیری پیشرفت به صورت تصویری

دستهبندی خودکار درآمد و هزینهها با محدودیتها و اهداف مالی قابل تنظیم.

- دستهبندی خودکار تراکنشها

- محدودیتهای خرجکرد قابل تنظیم بر اساس دسته

- پیگیری درآمد و قبوض

دسترسی به پیشپرداختهای کوتاهمدت تا سقف ۲۵۰ دلار بدون بهره برای مشترکان واجد شرایط.

- حداکثر پیشپرداخت ۲۵۰ دلار

- بدون هزینه بهره

- گزینه انتقال فوری موجود

ویژگی پریمیوم طراحی شده برای کمک به بهبود امتیاز اعتباری شما در طول زمان از طریق استفاده مسئولانه.

- ابزارهای بهبود امتیاز اعتباری

- در دسترس با اشتراک پولی

- دسترسی وابسته به منطقه

حساب پسانداز اختیاری با نرخ بهره رقابتی برای افزایش حداکثری رشد پول شما.

- نرخ بهره رقابتی

- وابسته به منطقه و طرح

- یکپارچه با اپلیکیشن اصلی

دانلود کلو ایآی

چگونه با کلو شروع کنیم

کلو را از فروشگاه گوگل پلی (اندروید) یا اپ استور اپل (آیاواس) دانلود و روی دستگاه خود نصب کنید.

ثبتنام کنید و حساب بانکی اصلی خود را با استفاده از خدمات اتصال امن بانکی مانند Plaid بهصورت ایمن متصل نمایید.

به کلو اجازه دهید الگوهای خرجکرد، درآمد و قبوض دورهای شما را تحلیل کند تا بینشها و توصیههای بودجهبندی شخصیسازیشده ارائه دهد.

از رابط چتبات برای پرسش درباره امور مالی، مشاهده تفکیک خرجکرد بر اساس دستهبندی و تعیین اهداف یا چالشهای پسانداز استفاده کنید.

در صورت نیاز به اشتراک پولی ارتقا دهید، سپس از طریق رابط چت درخواست پیشپرداخت نقدی کنید. برنامه بازپرداخت و روش انتقال (انتقال فوری ممکن است هزینه اضافی داشته باشد) را انتخاب نمایید.

گرد کردن مبالغ یا انتقالهای خودکار به کیف پول پسانداز خود را فعال کنید. پیشرفت خود را به صورت تصویری پیگیری و اهداف پسانداز را در صورت نیاز تنظیم نمایید.

بهطور منظم داشبورد بودجه خود را بررسی کنید، دستهبندیهای خرجکرد را تنظیم نمایید، بینشهای تولیدشده توسط هوش مصنوعی را مرور کنید و به پیشنهادات پاسخ دهید تا عادات مالی خود را بهبود بخشید.

اگر دیگر به امکانات پریمیوم نیاز ندارید، اشتراک خود را لغو یا به نسخه رایگان کاهش دهید و در عین حال از ابزارهای پایه بودجهبندی و پیگیری استفاده کنید.

محدودیتهای مهمی که باید در نظر گرفت

- نیاز به اشتراک برای امکانات پریمیوم: در حالی که نسخه رایگان امکانات مفیدی برای بودجهبندی ارائه میدهد، عملکردهای ارزشمندی مانند پیشپرداخت نقدی، ابزارهای ساخت اعتبار و محدودیتهای بالاتر پیشپرداخت نیازمند اشتراک پولی هستند.

- اتصال اجباری به بانک: عملکرد کامل نیازمند اتصال حساب بانکی است. کاربران با بانکهای پشتیبانینشده یا خارج از مناطق پشتیبانیشده ممکن است با امکانات محدود یا نیاز به ورود دستی دادهها مواجه شوند.

- محدودیتهای نسبتاً کم پیشپرداخت نقدی: مبلغ پیشپرداختها نسبتاً کوچک است (معمولاً تا ۲۵۰ دلار یا کمتر برای کاربران جدید) و نیاز به بازپرداخت دارد. گزینه انتقال فوری هزینههای اضافی دارد که میتواند مزیت پیشپرداختهای بدون بهره را کاهش دهد.

- شخصیت هوش مصنوعی ممکن است برای همه مناسب نباشد: لحن شوخ یا «طعنهآمیز» چتبات برای برخی کاربران جذاب است اما ممکن است برای دیگران نامناسب یا غیرحرفهای به نظر برسد. دستهبندی هزینهها (ضروری در مقابل غیرضروری) گاهی ممکن است نادرست باشد.

- نگرانیهای نظارتی: در مارس ۲۰۲۵، کلو با کمیسیون تجارت فدرال آمریکا (FTC) در خصوص ادعاهای گمراهکننده درباره پیشپرداختهای نقدی و شرایط اشتراک توافق کرد که ممکن است نگرانیهایی درباره شفافیت و شیوههای کسبوکار ایجاد کند.

پرسشهای متداول

بله — کلو یک شرکت فناوری مالی معتبر است که خدمات بودجهبندی، پسانداز و پیشپرداخت نقدی ارائه میدهد. این اپلیکیشن از فناوری اتصال امن بانکی (مانند Plaid) استفاده میکند و توسط منابع مستقل متعددی بررسی شده است. با این حال، کاربران باید از توافق مارس ۲۰۲۵ با FTC درباره ادعاهای گمراهکننده آگاه باشند.

بله — نسخه رایگان دسترسی به ابزارهای پایه بودجهبندی، پیگیری خرجکرد و پسانداز را فراهم میکند. اما امکانات پریمیوم مانند پیشپرداخت نقدی، قابلیت ساخت اعتبار و انتقالهای فوری نیازمند ارتقا به اشتراک پولی هستند.

شرایط و محدودیتها بسته به کاربر متفاوت است. کاربران جدید معمولاً برای مبالغ کمتر (حدود ۲۰ تا ۱۰۰ دلار) واجد شرایط هستند و محدودیتها بر اساس فعالیت حساب و سابقه استفاده افزایش مییابد. برخی کاربران با سابقه، دسترسی به پیشپرداختهایی تا سقف ۲۵۰ دلار دارند که بسته به طرح اشتراک و الگوهای مالی آنها متفاوت است.

خیر — چتبات هوش مصنوعی کلو برای ارائه بینشهای خودکار بودجهبندی و مکانیزمهای پسانداز طراحی شده است، نه برنامهریزی مالی جامع. مشاوره آن مبتنی بر الگوریتم است و ممکن است ظرافتهای لازم برای شرایط مالی پیچیده را نداشته باشد. برای استراتژیهای سرمایهگذاری شخصی یا تصمیمات مالی بزرگ، با مشاور مالی انسانی واجد شرایط مشورت کنید.

کلو عمدتاً بازار ایالات متحده را پشتیبانی میکند. سازگاری با بانکها متفاوت است و کاربران خارج از مؤسسات مالی پشتیبانیشده ممکن است با عملکرد محدود مواجه شوند. این اپلیکیشن قبلاً در بریتانیا موجود بود اما در حال حاضر تمرکز بر بازار آمریکا دارد. پیش از استفاده از امکانات پیشرفته، منطقه و پشتیبانی بانک خود را بررسی کنید.

Copilot Money

| توسعهدهنده | Copilot Money, Inc. |

| پلتفرمهای پشتیبانیشده |

|

| زبانهای پشتیبانیشده | فقط انگلیسی |

| دسترسی | فقط مؤسسات مالی ایالات متحده |

| مدل قیمتگذاری | دوره آزمایشی رایگان موجود است. اشتراک پولی لازم است برای دسترسی کامل به امکانات: حدود ۱۳ دلار در ماه یا ۹۵ دلار در سال |

مدیریت مالی شخصی پیشرفته

Copilot Money یک اپلیکیشن پیشرفته مدیریت مالی شخصی است که هزینهها، بودجهها، اهداف پسانداز و سرمایهگذاریهای شما را در یک داشبورد زیبا متمرکز میکند. این برنامه به هزاران مؤسسه مالی ایالات متحده متصل میشود، تراکنشها را بهصورت خودکار دستهبندی میکند، اشتراکهای دورهای را برجسته میسازد و به شما کمک میکند جریان نقدی و ارزش خالص داراییها را بهصورت بصری مشاهده کنید. Copilot با هدف شفافیت و کنترل، تجربهای ممتاز و بدون تبلیغات ارائه میدهد که به کاربران کمک میکند دید کاملی نسبت به زندگی مالی خود داشته باشند.

چرا Copilot Money را انتخاب کنیم

در دنیای مالی پر از ابزارهای پیگیری منفعل و برنامههای پشتیبانیشده با تبلیغات، Copilot Money به دلیل شفافیت فعال و تجربه ممتاز خود متمایز است. پس از اتصال حسابها، این برنامه با استفاده از یادگیری ماشین هزینههای شما را بهصورت خودکار دستهبندی میکند، هزینههای دورهای که ممکن است فراموش کنید را شناسایی میکند و درآمد در مقابل هزینهها را در داشبوردهای واضح و شهودی نمایش میدهد.

جذابیت آن در تشویق به نظارت فعال مالی به جای صرفاً پایش منفعل است. پشتیبانی چند دستگاهی در آیفون، آیپد و مک تضمین میکند که بودجه شما در هر کجا که باشید بهصورت یکپارچه همگامسازی شود. اگرچه هزینه اشتراک ممکن است برخی را مردد کند، بسیاری از کاربران تجربه کاربری ارتقا یافته و بینشهای کاربردی را ارزشمند میدانند.

ویژگیهای کلیدی

دستهبندی خودکار در بیش از ۱۰,۰۰۰ مؤسسه مالی، شامل حسابهای سرمایهگذاری و اعتباری با استفاده از یادگیری ماشین.

تعیین بودجههای سفارشی، پیگیری پیشرفت بهصورت لحظهای و نمایش مانده هر دستهبندی.

شناسایی خودکار پرداختها و اشتراکهای دورهای، نمایش تعهدات آینده برای کمک به مدیریت هزینههای جاری.

مشاهده داراییها، بدهیها و عملکرد پرتفوی در کنار دادههای بودجهبندی برای تصویر مالی کامل.

همگامسازی بیوقفه در اپلیکیشنهای آیفون، آیپد و مک با حالت تاریک، برچسبها و نمایش پیشرفته جریان نقدی.

لینک دانلود یا دسترسی

راهنمای شروع کار

Copilot Money را از اپ استور روی آیفون، آیپد یا مک خود دانلود کنید.

ثبتنام کنید و مراحل راهاندازی را کامل کنید. حسابهای بانکی، کارتهای اعتباری و حسابهای سرمایهگذاری مستقر در آمریکا را متصل کنید.

اجازه دهید برنامه تراکنشهای اخیر را وارد کند. دستهبندیها را برای دقت بررسی و تأیید کنید.

به تب داشبورد مراجعه کنید تا درآمد، هزینهها، درآمد خالص، بودجههای باقیمانده و پرداختهای دورهای آینده را مشاهده کنید.

بودجههایی برای دستههایی مانند مواد غذایی، سرگرمی و حملونقل ایجاد کنید. اهداف پسانداز برای حسابهای خاص تعیین کنید.

از بخش پرداختهای دورهای برای مشاهده اشتراکها و پرداختهای برنامهریزیشده استفاده کنید. هر موردی که نیاز به تنظیم یا لغو دارد را شناسایی کنید.

ارزش خالص داراییها و عملکرد سرمایهگذاریهای خود را از طریق بخش داراییها و سرمایهگذاریها نظارت کنید. پیشرفت را در طول زمان بررسی کنید.

بودجهها و دستهبندیها را در صورت نیاز تنظیم کنید. برنامه به عادات هزینهای شما سازگار میشود و به بهبود طرح مالی کمک میکند.

بهطور مکرر از برنامه استفاده کنید تا روندها، الگوهای هزینه بیش از حد و فرصتهای صرفهجویی را شناسایی کنید.

اگر طرح پولی نیازهای شما را برآورده نمیکند، قبل از تمدید اشتراک را لغو کنید. امکانات محدودی همچنان در دسترس خواهد بود.

محدودیتهای مهم

- نیاز به اشتراک پولی: پس از دوره آزمایشی رایگان، برای دسترسی کامل به امکانات باید اشتراک تهیه کنید. هیچ نسخه رایگان دائمی با امکانات کامل وجود ندارد.

- قیمتگذاری ممتاز: با هزینه حدود ۱۳ دلار در ماه، ممکن است نسبت به گزینههای رایگان، بهویژه برای نیازهای ساده بودجهبندی، گران به نظر برسد.

- ویژگیهای در حال توسعه: برخی کاربران محدودیتهایی در پشتیبانی از حسابهای مشترک، وارد کردن تراکنشهای تاریخی و امکانات پیشرفته برنامهریزی گزارش کردهاند.

سوالات متداول

بله — Copilot دوره آزمایشی رایگانی ارائه میدهد که قبل از نیاز به اشتراک، امکان تست تمام امکانات را فراهم میکند.

Copilot روی دستگاههای آیفون (iOS 15.6+)، آیپد (iPadOS 15.6+) و مک (macOS 12.5+) کار میکند و همگامسازی بیوقفه بین همه پلتفرمها دارد.

در حال حاضر، Copilot فقط برای کاربران آمریکایی در دسترس است و فقط از مؤسسات مالی ایالات متحده پشتیبانی میکند. پشتیبانی از اندروید و دسترسی بینالمللی هنوز فراهم نشده است.

برخلاف بسیاری از برنامههای رایگان، Copilot تجربهای ممتاز و بدون تبلیغات با رابط کاربری پیشرفته، دستهبندی خودکار تراکنشها، پیگیری سرمایهگذاری و بینشهای مبتنی بر یادگیری ماشین ارائه میدهد — اما با هزینه اشتراک.

اگر چندین حساب (از جمله سرمایهگذاریها) را متصل کنید، به شفافیت در تمام امور مالی اهمیت میدهید و تجربه کاربری پیشرفته را میپسندید، بسیاری از کاربران معتقدند اشتراک ارزش بالایی دارد. با این حال، برای بودجهبندی ساده، گزینههای ارزانتر ممکن است کافی باشند.

مزایای کلیدی برنامههای پسانداز مبتنی بر هوش مصنوعی

ردیابی خودکار و لحظهای

دستهبندی هوشمند

بینشهای شخصیسازیشده

برنامهریزی هدف پیشبینیکننده

تأثیر ترکیبی

این مزایا با هم کار میکنند تا پسانداز را قابل مدیریتتر و کماسترستر کنند. دیگر نیازی به بهروزرسانی دستی صفحات گسترده یا تخمین میزان پسانداز ندارید – هوش مصنوعی محاسبات پیچیده را انجام میدهد. با شناسایی خودکار فرصتهای کاهش هزینه و تسهیل انتقالها، این ابزارها عادات پسانداز مستمر را بدون حدس و گمان یا اصطکاک ترویج میکنند.

تدابیر حفاظتی و بهترین روشها

در حالی که هوش مصنوعی به عنوان یک همیار مالی قدرتمند عمل میکند، کارشناسان بر اهمیت استفاده هوشمندانه و ایمن از این ابزارها تأکید دارند. اپلیکیشنهای هوش مصنوعی باید مکمل – نه جایگزین – قضاوت مالی صحیح و مشاوره حرفهای در مواقع لازم باشند.

ملاحظات امنیتی

هنگام انتخاب اپلیکیشنهای مالی هوش مصنوعی، امنیت باید اولویت اصلی شما باشد. خدمات معتبر را انتخاب کنید – ترجیحاً آنهایی که با بانکهای معتبر یا برندهای شناختهشده فینتک همکاری دارند – و تمام ویژگیهای حفظ حریم خصوصی موجود را فعال کنید.

حفظ حریم خصوصی و امنیت هنگام استفاده از ابزارهای بودجهبندی هوش مصنوعی ضروری است. کاربران باید احراز هویت چندمرحلهای را در حسابهای خود فعال کنند تا از حفاظت دادهها اطمینان حاصل شود و در عین حال دسترسی هوش مصنوعی به اطلاعات مالی لازم فراهم گردد.

— دستورالعملهای امنیتی SoFi

بهترین روشها برای استفاده ایمن و مؤثر

- انتخاب اپلیکیشنهای معتبر: ابزارهای مالی با نظرات مثبت کاربران و تدابیر امنیتی قوی از جمله رمزنگاری و احراز هویت دو مرحلهای را انتخاب کنید

- خودکارسازی استراتژیک: انتقالهای خودکار به حساب پسانداز یا پرداخت بدهی را تنظیم کنید تا ابتدا پسانداز کنید و سپس باقیمانده را خرج کنید

- بازبینی پیشنهادات هوش مصنوعی: مشاوره هوش مصنوعی را به عنوان پیشنهاد در نظر بگیرید نه دستورالعمل قطعی – اطمینان حاصل کنید که نرخهای پسانداز پیشنهادی با بودجه واقعی شما همخوانی دارد و اهداف را در صورت نیاز تنظیم کنید

- ادامه آموزش مالی: سواد مالی خود را از طریق یادگیری مداوم حفظ کنید – هوش مصنوعی راهنمایی میکند، اما درک نیازهای منحصر به فرد شما و مشورت گاهبهگاه با مشاوران انسانی استراتژی کلی شما را تقویت میکند

- نظارت منظم: بینشهای تولیدشده توسط هوش مصنوعی را به صورت هفتگی بررسی کنید تا از دقت آنها مطمئن شوید و هر الگوی غیرمعمول یا خطا را شناسایی کنید

- شروع با مقادیر کم: با خودکارسازی محدود شروع کنید و به تدریج با افزایش اعتماد به سیستم، آن را گسترش دهید

رویکرد پرخطر

- دنبال کردن کورکورانه تمام پیشنهادات هوش مصنوعی

- استفاده از اپلیکیشنهای تأییدنشده با امنیت ضعیف

- عدم نظارت یا بررسی انسانی

- نادیده گرفتن تنظیمات حریم خصوصی

استراتژی امن

- پیشنهادات تأییدشده با منابع معتبر

- اپلیکیشنهای معتبر با رمزنگاری قوی

- نظارت و تنظیمات منظم

- فعالسازی حداکثر ویژگیهای امنیتی

با اجرای این بهترین روشها، شما از مزایای هوش مصنوعی بهرهمند میشوید و در عین حال کنترل کامل بر تصمیمات مالی و امنیت دادههای خود را حفظ میکنید.

نتیجهگیری

هوش مصنوعی به طور بنیادی نحوه برنامهریزی و دستیابی افراد به اهداف پساندازشان را متحول میکند. با تحلیل هر تراکنش مالی، ابزارهای مجهز به هوش مصنوعی برنامههای پسانداز شخصیسازیشده ارائه میدهند و انتقالها را خودکار میکنند – که بخش زیادی از پیچیدگی بودجهبندی را حذف میکند. این دموکراتیزه شدن مشاوره مالی به معنای آن است که کاربران جوانتر و کسانی که به مشاوران مالی پولی دسترسی ندارند، اکنون میتوانند راهنماییهای متناسب با نیاز خود را با هزینه کم یا رایگان دریافت کنند.

دسترسیپذیری

خودکارسازی

بهینهسازی

نگاهی به آینده، این ترکیب فناوری پیشرفته و روشهای مالی محتاطانه وعده میدهد که امور مالی شخصی برای همه قابل دسترستر و مؤثرتر شود. هوش مصنوعی پسانداز را از کاری دشوار به برنامهای سفارشی و تطبیقی تبدیل میکند که با زندگی شما تکامل مییابد.

همه میتوانند با دموکراتیزه شدن ابزارهای مالی مجهز به هوش مصنوعی با اطمینان برای آینده خود برنامهریزی کنند.

— مجمع جهانی اقتصاد

No comments yet. Be the first to comment!