AI in Real Estate

AI is reshaping the global real estate industry with smarter valuations, automated customer engagement, predictive maintenance, virtual tours, and powerful investment tools. Learn how leading AI platforms like Zillow, HouseCanary, PropStream, and CoreLogic are helping professionals optimize decisions and elevate the property experience.

AI is rapidly transforming real estate worldwide by turning vast property and market data into actionable insights. The numbers tell a compelling story: the AI-in-real-estate market is projected to grow from $222.7 billion in 2024 to $975.2 billion by 2029 (a 34.1% CAGR), while McKinsey estimates AI could add $110–180 billion in value to the sector through productivity gains and new revenue streams.

These trends have sparked hundreds of PropTech startups and new AI capabilities embedded in brokerage and property-management systems. The chart below illustrates the wide range of AI capabilities—from forecasting and natural language processing to computer vision and generative models—being applied across the industry.

Key AI Applications in Real Estate

Market Analysis & Valuation

Customer Engagement

Property Management

Investment Analysis

Market Analysis & Property Valuation

Automated valuation models (AVMs) and predictive analytics process public records, market trends, and local data to estimate home values and forecast prices. These systems speed up appraisals by synthesizing zoning, historical prices, and socio-economic factors in seconds.

Zillow Zestimate

Machine learning on tax records and listings for instant home valuations.

HouseCanary CanaryAI

Large dataset analysis for AI-driven valuations and neighborhood trend insights.

Bayut TruEstimate

Dubai-based tool ingesting property and location data for transparent price estimates.

Customer Engagement & Marketing

AI-driven chatbots, virtual assistants, and content generators are reshaping how properties are marketed and sold. These tools operate 24/7 to engage buyers, qualify leads, and personalize the home-buying experience.

AI Chatbots & Lead Qualification

Software like Roof AI offers AI-powered chatbots that excel at engaging and qualifying website leads, while Structurely uses natural-language voice and text conversations to qualify leads and set appointments almost autonomously. These tools handle initial inquiries instantly, freeing agents to focus on complex sales and relationship-building.

- Answer FAQs and property questions 24/7

- Qualify buyer intent and budget automatically

- Schedule showings without agent intervention

- Negotiate initial terms and gather preferences

Generative AI for Marketing

Generative AI automates marketing content creation, writing or personalizing listing descriptions, blog posts, and ad copy for each property. According to McKinsey, listing descriptions can be customized to match specific buyer preferences, and homes can be virtually staged with modern designs in marketing materials.

- Auto-generate personalized listing descriptions

- Create targeted ad copy for different buyer segments

- Produce blog content and market insights

- Hyper-personalize photos and staging to buyer tastes

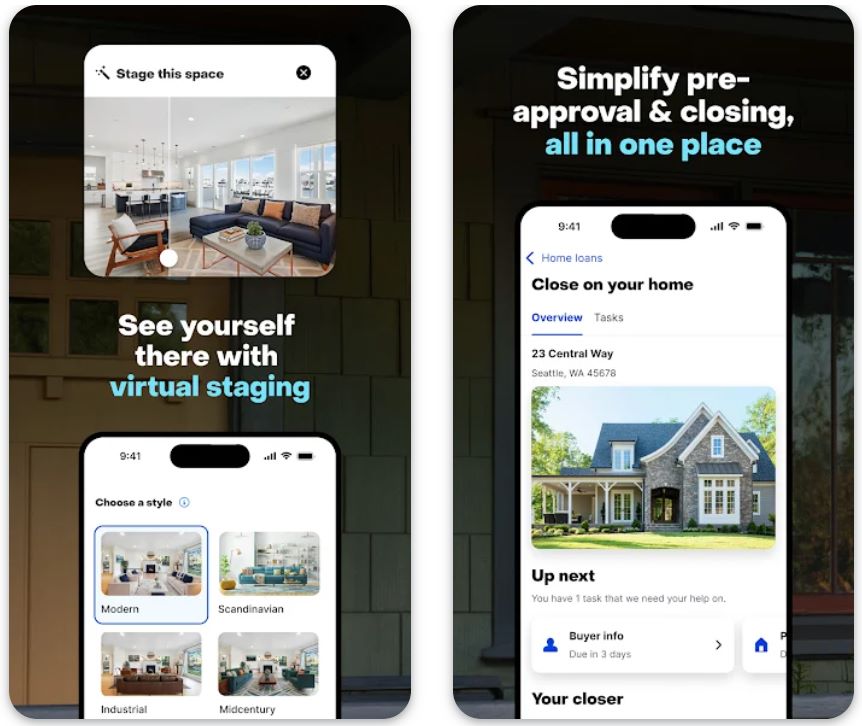

AR/VR & Virtual Tours

Augmented and virtual reality tours—now often AI-enhanced—let customers walk through unfurnished or remote properties in 3D, exploring different finishes or layouts. Deloitte cites virtual tours, AI staging, and intelligent chatbots as critical for improving customer experience and engagement.

- Explore properties remotely in immersive 3D

- Visualize different design and layout options

- Reduce need for in-person showings

- Increase buyer confidence and engagement

By implementing AI-driven solutions such as virtual property tours, smart property management, and intelligent chatbots, companies can significantly improve the customer experience.

— Deloitte

Property & Facility Management

In occupied buildings, AI optimizes operations and maintenance through predictive analytics and smart automation. These applications deliver measurable cost savings and improved tenant satisfaction.

Predictive Maintenance

By analyzing sensor data (vibrations, temperatures, usage patterns) from HVAC, elevators, and other equipment, AI models forecast failures before they happen. Early adopters report dramatic results:

Reactive Maintenance

- Equipment fails unexpectedly

- Emergency repairs are costly

- Downtime disrupts operations

- Higher overall maintenance costs

Predictive Maintenance

- Failures predicted in advance

- Planned maintenance reduces costs

- Minimal operational disruption

- Up to 25% lower repair costs

Energy Optimization & Sustainability

Smart IoT platforms drive energy efficiency by learning from building sensor data to adjust HVAC, lighting, and power use dynamically. Buildings become "smarter" as AI forecasts usage peaks, automates controls, and flags anomalies.

- Forecast energy usage peaks and adjust automatically

- Optimize HVAC and lighting based on occupancy

- Detect equipment anomalies early

- Reduce energy waste and carbon footprint

Administrative & Tenant Services

Large portfolios of lease and contract documents can be analyzed by AI to extract key terms and risks. GenAI tools summarize leases, highlight unusual clauses, and auto-fill paperwork. In property management, chatbots handle routine tenant requests automatically.

- Analyze and summarize lease documents instantly

- Extract key terms and flag compliance issues

- Auto-fill routine paperwork and contracts

- Handle tenant requests 24/7 (rent inquiries, service tickets, amenity booking)

Investment Analysis & Portfolio Management

Investors use AI to process market data and identify opportunities with greater speed and accuracy. AI platforms analyze local economic indicators, neighborhood trends, and alternative data sources to predict demand and spot undervalued properties.

Opportunity Identification

AI platforms like Skyline AI use deep learning on thousands of property records to recommend promising assets and deliver faster, more comprehensive commercial real estate analysis.

- Scour local economic indicators

- Analyze neighborhood trends

- Process alternative data (social media, school ratings, crime stats)

- Predict demand and spot undervalued properties

Risk Assessment & Due Diligence

AI overlays geospatial data with tenant credit info and lease performance to flag high-risk assets and simulate stress scenarios.

- Overlay flood zones and climate models

- Analyze tenant credit and lease performance

- Flag high-risk assets automatically

- Simulate market stress scenarios

AI-driven portfolio tools continuously re-balance holdings and alert managers to changing market signals, helping investors underwrite deals faster, price portfolios more accurately, and adapt to market changes with data-driven agility.

Design, Construction & Urban Planning

AI is extending into development stages, enabling architects and developers to visualize options instantly and helping cities plan infrastructure more intelligently.

- Generative design: Rapidly create building models based on budget, site shape, and style criteria—enabling architects to visualize dozens of layouts and materials options instantly.

- Marketing new developments: AI-powered imagery and 3D models let buyers virtually walk through yet-to-be-built projects before construction begins.

- Urban planning: Some governments (e.g., Dubai) are exploring AI to analyze population growth, traffic, and land-use data for smarter zoning and infrastructure planning.

- Construction risk management: Predictive analytics on schedules and budgets forecast overruns and suggest mitigations to keep projects on track.

Leading AI Tools & Platforms

A range of specialized AI products and services now serve real estate professionals. Key examples include:

Zillow Zestimate

Application Information

| Developer | Zillow Group, Inc. |

| Supported Platforms |

|

| Coverage | United States only — based on U.S. public records and MLS data |

| Pricing | Free — no charge for valuations |

What is Zestimate?

Zestimate® is Zillow's free real-estate valuation tool that provides data-driven estimates of a home's market value. Using machine learning and neural network algorithms, it analyzes hundreds of data points — including public records, MLS listings, home characteristics, and market trends — to estimate property values for over 100 million U.S. homes. While useful as a starting point, Zestimate is not a professional appraisal.

Key Features

Neural network-based algorithm examines hundreds of data points per property for accurate valuations.

Zestimates available for over 100 million U.S. properties with continuous database updates.

Provides both sale-value estimates and rental value estimates (Rent Zestimate) where applicable.

Automatically updates with new sales data, public records, and market trends for improved accuracy.

Access Zestimate

How to Use Zestimate

Visit Zillow via web browser or open the Zillow mobile app on Android or iOS.

Search for the property you want to evaluate by entering its address.

Zillow displays the estimated market value if available for that property.

Review and update home details (square footage, bedrooms, bathrooms, lot size) if inaccurate — this improves estimate accuracy.

Compare the Zestimate with recent comparable home sales in the area to validate reasonableness before making pricing or purchase decisions.

Important Limitations

- Data Quality Dependent: Accuracy varies significantly based on availability and quality of public records and recent sales data in your area

- Missing Improvements: Home renovations, upgrades, or unique features not in public records may not be reflected, causing over- or undervaluation

- Off-Market Limitations: Zestimate is less reliable for homes not currently listed; accuracy improves with comparable recent sales data

- U.S. Only: Zestimate does not provide valuations for properties outside the United States

Frequently Asked Questions

No. Zestimate is an automated valuation model based on data analysis, while a professional appraisal involves an in-person inspection by a licensed appraiser. Zestimate should not be used as a substitute for a formal appraisal.

Reliability depends on data availability in your area. Properties in regions with robust public records and numerous recent sales typically have more accurate Zestimates. Use it as a starting point for valuation, not a definitive assessment.

Zestimate updates whenever new data becomes available, including new property sales, updated public records, and user-submitted home facts. This ensures valuations reflect current market conditions.

You can edit your home facts directly in Zillow, including square footage, number of rooms, lot size, and other details. Correcting inaccurate information typically results in a more accurate Zestimate.

No. Zestimate relies on U.S. public records, MLS data, and tax information. Zillow does not provide valuations for properties located outside the United States.

HouseCanary CanaryAI

Application Information

| Developer | HouseCanary, Inc. |

| Supported Platforms |

|

| Coverage | United States (all 50 states) — 136+ million residential properties |

| Language Support | English |

| Pricing Model | Paid subscription required |

Overview

CanaryAI is an AI-powered real estate assistant by HouseCanary that delivers rapid, data-driven property insights and analytics. Launched in 2024, it leverages a conversational interface to help real estate professionals — investors, agents, lenders, and servicers — access instant valuations, market forecasts, rental potential, and neighborhood analytics across 136+ million U.S. residential properties.

Key Features

Instant property analysis using conversational AI — ask questions in plain English and get immediate answers.

Automated Valuation Model (AVM) provides both sale and rental value predictions for comprehensive property assessment.

Neighborhood-level data, ZIP-code trends, MSA forecasts, and market pulse for informed investment decisions.

Generate comparative market analyses (CMAs), custom valuation reports, and track multiple properties in real-time.

Real estate data APIs for scalable access — property analytics, bulk data export, market pulse, and property estimates.

Access CanaryAI

Getting Started

Visit the HouseCanary website and select a subscription plan that fits your needs.

Access CanaryAI through your HouseCanary account dashboard.

Enter a property address, ZIP code, or ask a question in plain English (e.g., "What is the estimated sale price of 123 Main St, Anytown, USA?").

Access property valuations, rental estimates, comparable properties, market analytics, and forecasts instantly.

Use portfolio-monitoring tools to track multiple properties and export or integrate data via API as needed.

Important Limitations

- U.S. Only: Coverage limited to U.S. residential real estate; international properties are not supported.

- Data Accuracy: AVM estimates depend on data quality and availability; areas with limited public records may have less reliable valuations.

- Advanced Features: Large-scale bulk data export, API usage, and portfolio monitoring may require technical expertise or additional costs.

Frequently Asked Questions

CanaryAI covers residential real estate across the United States, with data on more than 136 million properties.

No. Access to CanaryAI requires a paid subscription.

Yes. CanaryAI provides both sale-value estimates (AVM) and rental-value predictions, making it ideal for investors and landlords assessing rental potential.

Yes. HouseCanary offers APIs for property analytics, bulk data exports, market pulse, and more — designed for institutions and large-scale users.

No. CanaryAI focuses exclusively on U.S. residential real estate and does not support international properties.

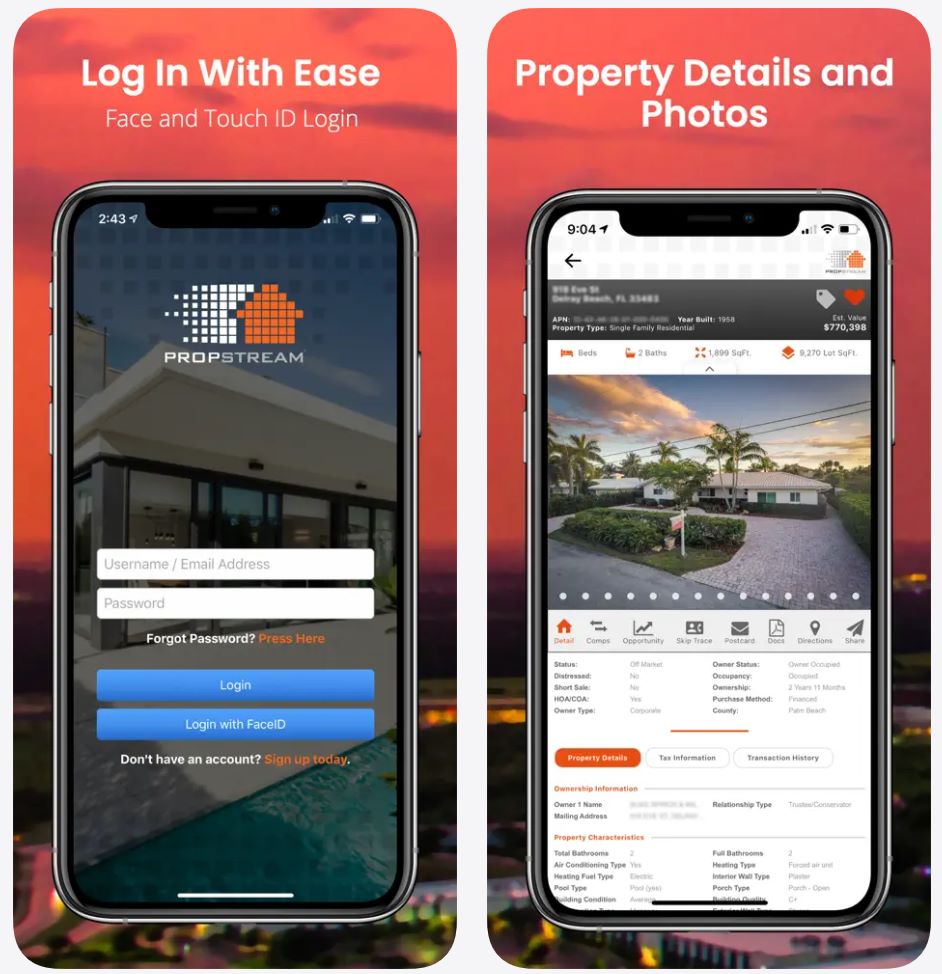

PropStream

Application Information

| Developer | PropStream LLC |

| Supported Platforms |

|

| Coverage | United States — English language; 160+ million properties nationwide |

| Pricing Model | Paid subscription required after 7-day free trial (starting at $99/month) |

What is PropStream?

PropStream is a comprehensive real estate data and analytics platform designed for investors, agents, and brokers to discover on-market and off-market property leads across the U.S. By combining public records, MLS data, ownership information, and market history with AI-enhanced analytics, PropStream delivers detailed insights for property valuation, investment analysis, marketing, and lead generation. Its nationwide coverage and advanced filtering make it ideal for streamlining property research and outreach.

Key Features

Access to 160+ million U.S. properties with comprehensive public records, MLS data, tax records, liens, foreclosures, and mortgage history.

165+ filters and 20 built-in lead lists (pre-foreclosure, vacant, bank-owned, failed listings) for targeted on-market and off-market opportunities.

Comparable market analysis (comps), rehab and ADU cost calculators, property value estimates, sales history, and map-based property search.

Skip tracing for contact information, automated lead updates, email campaigns, direct mail postcards, and team collaboration support.

Scout properties on the go with "Driving for Dollars," manage leads, and run searches directly from iOS or Android devices.

Download or Access

Getting Started

Visit the PropStream website and select a subscription plan. Start with the optional 7-day free trial to explore the platform.

Log in through the web browser or download the mobile app for iOS/Android to access your account anytime, anywhere.

Find properties by address, parcel number, ZIP code, or other criteria. Apply advanced filters or select pre-made lead lists to narrow results.

Use comps analysis, sales history, rehab calculators, and market data to evaluate selected properties for investment potential.

Contact prospects using skip tracing, email campaigns, postcards, or export lead lists for external outreach and follow-up.

(Optional) Invite team members to collaborate on lead management, marketing campaigns, and property evaluation.

Important Considerations

- Data Accuracy Varies by Region: Public records and MLS data may be outdated or incomplete in certain areas, affecting lead reliability and property information accuracy.

- Additional Costs for Premium Tools: Some features like rehab calculators, skip tracing, and marketing tools may require extra credits or fees beyond the base subscription.

- Steep Learning Curve: The platform's extensive data and features can overwhelm beginners. Mobile app users have reported usability challenges compared to the desktop version.

- Residential Focus: PropStream is optimized for residential and investor-use cases. Commercial real estate or specialized property types may have limited data coverage.

Frequently Asked Questions

PropStream is ideal for real estate investors, wholesalers, landlords, agents, and brokers who need comprehensive nationwide data, marketing tools, and lead generation capabilities in a single integrated platform.

Yes — PropStream provides a 7-day free trial that allows you to explore all platform features before committing to a paid subscription plan.

Yes — PropStream offers dedicated mobile apps for iOS and Android, enabling property searches, lead management, and on-the-go property scouting (e.g., "Driving for Dollars").

Some marketing tools (skip tracing, postcards, email campaigns) may come with additional costs or require credits even with a base subscription. Check your plan details for included features.

While PropStream aggregates extensive data from multiple sources, accuracy depends on the completeness and currency of public records and MLS information. In some regions, data may be outdated or incomplete, which can lead to discrepancies. Always verify critical information independently.

CoreLogic

Application Information

| Developer | CoreLogic, Inc. |

| Supported Platforms |

|

| Coverage | U.S. residential real estate with global operations via sister divisions |

| Pricing Model | Paid subscription/licensing for business, institutional, and professional users |

Overview

CoreLogic is a leading real estate data and analytics company providing advanced property information, automated valuations, and risk assessment tools for lenders, insurers, real estate professionals, and investors. By aggregating extensive public records, geospatial data, sale history, hazard data, and market trends, CoreLogic enables stakeholders to make informed decisions based on comprehensive, timely, and AI-driven property insights.

Core Technology

CoreLogic's flagship valuation model — Total Home ValueX (THVx) — uses AI, machine learning, and cloud-based analytics to produce automated valuations (AVMs) and comprehensive property reports. Built on a vast dataset of over 5.5 billion property records updated daily, THVx offers consistent, high-accuracy valuations across multiple use cases: lending origination, marketing, risk management, portfolio monitoring, and more.

Key Features

THVx delivers consistent, AI-powered home valuations across the property lifecycle.

- Lending origination

- Underwriting

- Portfolio management

Billions of records covering ownership, mortgage history, tax and lien data, hazard risk, and more.

- Ownership records

- Mortgage history

- Hazard risk assessment

Home-price indices, trend analysis, neighborhood insights, and risk assessment tools.

- Price trend analysis

- Neighborhood insights

- Risk forecasting

APIs, bulk data feeds, and enterprise platforms for seamless system integration.

- API endpoints

- Bulk data exports

- Custom workflows

Comprehensive modules for lien analysis, equity analysis, and loan portfolio monitoring.

- Lien analysis

- Equity assessment

- Portfolio monitoring

Download or Access

Getting Started

Visit CoreLogic's official website to subscribe or license the desired data and analytics services for your organization.

Choose required services such as AVM valuations (THVx), property data feeds, hazard risk assessment, lien analysis, or market analytics.

Connect via CoreLogic's enterprise web portal, API endpoints, or bulk data exports based on your integration requirements.

Submit property identifiers (address, parcel number, property ID) or bulk lists to retrieve valuations, property history, hazard reports, and analytics.

Use valuations, equity estimates, risk flags, and market trends for underwriting, portfolio management, investment decisions, insurance, or property research.

Important Considerations

- Data Dependency: Valuations and analytics rely on available public records, hazard data, and property history. Outdated or incomplete data may affect accuracy.

- Subscription Required: Advanced features and full data access require licensing or subscription. Free or low-cost plans are generally not offered.

- Unique Properties: For properties with unusual conditions, recent renovations, or nonstandard features, automated models may require manual appraisal or inspection for complete accuracy.

- Regional Variations: Data coverage and quality may vary outside primary markets or in regions with less robust public records infrastructure.

Frequently Asked Questions

CoreLogic serves lenders, insurers, mortgage brokers, real estate firms, investors, and enterprises requiring large-scale property data, valuations, risk assessments, or portfolio analytics.

Generally no. CoreLogic's tools are designed for professional and institutional users. Individual consumers rarely have direct access to the platform.

While THVx offers accurate, AI-driven valuations that many lenders use, unique properties or cases requiring detailed inspection may still benefit from a traditional appraisal for comprehensive assessment.

Yes. CoreLogic maintains large datasets updated frequently through their Smart Data Platform, delivering refreshed property valuations and risk analytics with over one million additional usable AVMs regularly made available.

CoreLogic provides comprehensive property history, ownership records, mortgage and lien data, hazard and risk assessments, market-trend analytics, loan portfolio monitoring, and property-level risk scores.

Skyline AI

Application Information

| Developer | Skyline AI (acquired by JLL in 2021) |

| Supported Platforms | Web-based platform for institutional and enterprise users |

| Language & Market | English; focused on United States commercial real estate (CRE) market |

| Pricing Model | Enterprise licensing required; no free or consumer-tier plan available |

Overview

Skyline AI is an advanced AI-powered analytics platform designed for commercial real estate investors and asset managers. It leverages machine learning and multi-decade datasets to analyze property value, performance, and risk. By converting fragmented market data into actionable insights, Skyline AI enables smarter, faster investment decisions while uncovering hidden value in institutional-grade assets.

About Skyline AI

Founded in 2017, Skyline AI pioneered the integration of data science, software engineering, and real estate expertise to bring predictive analytics to commercial real estate. The platform aggregates data from over 300 sources and tracks up to 10,000 attributes per asset — including ownership, property characteristics, demographics, debt, and historical transactions. Through proprietary AI and machine-learning models, Skyline AI delivers fast assessments of current value, future performance, and identifies market anomalies and investment opportunities. Since its 2021 acquisition by JLL, Skyline AI's technology has been integrated into JLL's broader suite of CRE advisory and analytics services.

Key Features

Automated valuations and projections for commercial assets with institutional-grade accuracy.

Forecast future property performance including rent, occupancy, value appreciation, and IRR under various scenarios.

Draws from 300+ data sources tracking 10,000+ attributes per asset including ownership, debt, demographics, and historical sales.

Scan large datasets to identify undervalued or high-potential assets matching specific investment criteria.

Monitor assets throughout their entire lifecycle with ongoing market analysis and risk evaluation.

Download or Access

How to Use Skyline AI

Contact Skyline AI or JLL to set up an enterprise licensing agreement for your institution.

Provide property identifiers or investment criteria including asset class, location, and target returns.

The platform aggregates relevant data and runs AI/ML analysis to generate valuations, forecasts, and recommendations.

Examine outputs including present value, projected returns, risk indicators, and comparable asset analysis.

Use insights for underwriting, acquisition decisions, portfolio monitoring, or to identify investment opportunities.

Important Limitations

- Designed exclusively for institutional and enterprise clients in commercial real estate

- Enterprise licensing required; no free or consumer-tier plan available

- Predictions rely on historical and aggregated data — accuracy may vary for unusual properties or niche markets

- Does not capture qualitative factors like property condition or management quality

- Not suitable for residential real estate or casual users

Frequently Asked Questions

Skyline AI is tailored for institutional investors, asset managers, commercial real estate firms, and large-scale landlords seeking data-driven tools for underwriting, acquisition, and portfolio management.

No — the platform focuses exclusively on commercial real estate (multifamily, institutional-grade assets) and is not intended for residential homebuyers or consumer use.

No — Skyline AI operates under enterprise-level licensing agreements. Free or consumer-level plans are not available.

The platform aggregates data from over 300 sources, tracking up to 10,000 attributes per asset including ownership, debt, property characteristics, historical transactions, demographics, and market context.

Skyline AI provides powerful data-driven valuations and forecasts, but qualitative factors and on-site inspections remain important. Combine AI outputs with expert judgment and comprehensive due diligence for best results.

Roof AI

Application Information

| Developer | Roof AI (RoofAI) |

| Supported Platforms |

|

| Language & Region | English; primarily targeted at U.S.-based real estate brokerages |

| Pricing Model | Paid enterprise solution — contact sales for pricing details |

What is Roof AI?

Roof AI is an AI-powered real estate assistant designed to help brokerages, agents, and real estate teams automate lead generation, qualify prospective clients, and engage with website visitors 24/7. The platform uses natural language processing and intelligent chatbots to handle inquiries, recommend properties, and manage client outreach — streamlining customer engagement without manual intervention.

Key Features

Engages website visitors in real time and qualifies leads automatically with intelligent conversations.

Natural language search allows users to describe their needs and receive matching property recommendations instantly.

Captured leads are automatically segmented, assigned, and nurtured by your brokerage team with intelligent workflows.

Ensures inbound website visitors receive immediate responses anytime, maximizing lead capture potential.

Tailors responses based on user preferences and behavior to improve engagement and conversion rates.

Get Started

How to Use Roof AI

Reach out to Roof AI to establish a subscription and obtain your access credentials.

Embed Roof AI's chatbot on your real estate website or lead portal.

Set up property listing data and user-preference filters to enable accurate recommendations.

The chatbot handles queries, suggests properties, collects contact information, and qualifies leads automatically.

Leads are automatically routed to agents or teams for follow-up; the system tracks responses and assists with outreach.

Important Limitations

- Custom Pricing: Pricing and access are not publicly listed; interested users must contact sales directly — may be cost-prohibitive for small operations.

- Data Quality Dependent: Recommendation accuracy depends heavily on the quality and completeness of listing data and integrations; incomplete data may reduce effectiveness.

- Complex Cases Require Humans: Unusual client requirements, legal questions, or nuanced negotiations still require human agent involvement.

Frequently Asked Questions

Roof AI is best suited for real estate brokerages, agents, and teams seeking automated lead generation, 24/7 client engagement, and efficient lead management workflows.

No — Roof AI operates on a paid, enterprise-level model. Contact the provider directly for pricing and subscription details.

Generally no — Roof AI is marketed towards brokerages and real estate businesses. Individual homebuyers typically do not have direct access to the platform.

No — while Roof AI handles lead qualification, initial engagement, and routing, human agents remain essential for property showings, negotiations, and managing complex client needs.

Each of the tools and platforms highlighted above illustrates how AI is becoming integral to real estate operations. By leveraging AI for data analysis, customer engagement, and automation, the industry is streamlining workflows and gaining competitive advantage.

Key Takeaways

- Data-driven valuations and market analytics

- Enhanced marketing and customer service

- Smart operations and predictive maintenance

- Strategic investment tools and portfolio management

As AI technology matures, these tools will only become more powerful. Firms that invest in AI—from basic chatbots and automated valuation models to advanced generative design and predictive asset management—are likely to see substantial efficiency gains and better client outcomes. The result is a rapidly evolving real estate ecosystem where technology augments human expertise at every turn.

No comments yet. Be the first to comment!