AI sa pamamahala ng personal na pananalapi

Tuklasin kung paano binabago ng artificial intelligence (AI) ang pamamahala ng personal na pananalapi: mula sa matalinong pagba-budget at awtomatikong pag-iipon hanggang sa mga robo-advisor at virtual na katulong. Nagbibigay ang artikulong ito ng malinaw, kumpleto, at praktikal na mga pananaw upang matulungan kang gumastos nang mas matalino.

Ang makabagong pamamahala ng personal na pananalapi ay binabago ng artificial intelligence (AI) at machine learning. Pinapagana ng mga teknolohiyang ito ang mga app at plataporma na awtomatikong nagba-budget, nag-iipon, namumuhunan at pati na rin sa pagtuklas ng pandaraya, na nagbibigay ng personalisadong gabay sa pera na parang may digital na financial coach.

Ipinapahiwatig ng pagtanggap na ito na ang AI ay nagiging karaniwang bahagi ng personal na pamamahala ng pera, na humahawak mula sa pagsubaybay ng paggastos hanggang sa pag-optimize ng mga pamumuhunan.

- 1. AI-Pinapagana ang Pagba-Budget at Pagsubaybay ng Gastos

- 2. Awtomatikong Pag-iipon at Pamamahala ng Paggastos

- 3. Robo-Advisors at Pagpaplano ng Pamumuhunan

- 4. Chatbots at Virtual na Payo sa Pananalapi

- 5. Mga Benepisyo ng AI sa Pamamahala ng Pera

- 6. Mga Hamon at Mga Dapat Isaalang-alang

- 7. Tumingin sa Hinaharap

- 8. Nangungunang AI-Pinapaganang Mga App sa Personal na Pananalapi

AI-Pinapagana ang Pagba-Budget at Pagsubaybay ng Gastos

Mahusay ang AI sa pagsusuri ng datos pinansyal. Matalinong mga app sa pagba-budget tulad ng Mint, PocketGuard o Copilot Money ay awtomatikong nag-uuri ng iyong mga transaksyon at natututo sa iyong mga gawi. Gamit ang machine learning, inaayos ng mga tool na ito ang mga gastos sa real time at natutukoy ang mga pattern na maaaring hindi mo mapansin.

Awtomatikong Pag-uuri

Binabasa ng AI ang mga transaksyon at nag-aassign ng mga kategorya (pagkain, renta, paglalakbay, atbp.) nang walang manu-manong input, natututo mula sa bawat transaksyon.

Mga Pananaw sa Real-Time

Sa sandaling gumastos ka, ina-update ng app ang iyong budget, na nagpapadali upang makita ang mga trend o hindi kailangang gastos agad-agad.

Patuloy na Pagkatuto

Habang mas madalas mong gamitin ang app, mas nagiging matalino ito. Pinapino ng mga algorithm nito ang budget base sa iyong natatanging mga gawi sa paggastos.

Mga Predictive Alert

Nagbibigay babala ang mga tampok sa forecasting kung malapit ka nang maubusan ng pera o nagmumungkahi ng pinakamainam na oras para sa malalaking pagbili.

Awtomatikong Pag-iipon at Pamamahala ng Paggastos

Higit pa sa pagba-budget, tinutulungan ng AI na awtomatikong mag-ipon at bawasan ang pag-aaksaya. Kayang tuklasin ng mga modernong app sa pera ang mga lugar na nasasayang ang pera at kumilos para sa iyo, tinatanggal ang hindi kailangang gastos at ina-optimize ang iyong mga pattern sa paggastos.

Tradisyunal na Paraan

- Manwal na pagsubaybay ng mga subscription

- Hindi napapansin ang mga nakalimutang paulit-ulit na singil

- Matagal na pagsusuri ng mga bill

- Hindi napapansin ang mga oportunidad sa pag-iipon

Awtomatikong Solusyon

- Awtomatikong natutukoy ang lahat ng subscription

- Kanselahin ang mga hindi nagagamit na serbisyo

- Awtomatikong naghahanap ng mas magagandang deal

- Makakatipid ng $80-$500 taun-taon

Pangunahing Mga Tampok ng Awtomasyon

- Pamamahala ng subscription: Ginagamit ng mga app tulad ng Rocket Money ang AI upang ilista ang lahat ng paulit-ulit na singil at kaya pang makipag-negosasyon o kanselahin ang mga hindi mo ginagamit

- Pag-optimize ng deal: Sinusuri ng AI ang mga bill at transaksyon para sa posibleng pag-iipon, nag-aaplay ng mga cash-back offer o nagrerekomenda ng mas murang plano

- Adaptive na mga budget: Base sa mga pattern ng paggastos, inaayos ng app ang iyong mga layunin sa pag-iipon at nagmumungkahi ng paglalagay ng dagdag na pera sa ipon o pamumuhunan

Kayang makatipid ng mga AI-powered na kasangkapan sa pag-iipon ang mga gumagamit ng average na $80 hanggang $500 taun-taon sa pamamagitan ng awtomatikong pamamahala ng subscription at paghahanap ng mas magagandang deal.

— Bankrate Financial Research

Sa katunayan, gumagana ang mga tool na ito bilang awtomatikong "financial autopilot," na nagpapatupad ng mga estratehiya sa pag-iipon na angkop sa iyong lifestyle. Tahimik silang gumagana sa likod ng eksena – naglalaan ng maliliit na halaga sa ipon bawat linggo o nire-reallocate ang mga bill – kaya unti-unti kang nakakabuo ng emergency fund nang hindi mo iniisip.

Robo-Advisors at Pagpaplano ng Pamumuhunan

Umaabot ang epekto ng AI sa pamumuhunan. Ang robo-advisors ay mga plataporma na gumagamit ng mga algorithm upang lumikha at pamahalaan ang mga portfolio ng pamumuhunan na may kaunting o walang gabay ng tao. Kinukuha nila ang iyong mga layunin at tolerance sa panganib bilang input, pagkatapos ay awtomatikong bumubuo ng diversified na portfolio ng mga stock, bond o ETF.

Awtomatikong Pamamahala ng Portfolio

Sinusuri ng AI ang mga kondisyon ng merkado at ang iyong personal na profile upang i-optimize ang alokasyon ng asset. Halimbawa, kung umaangat ang stock market, maaaring dagdagan nito ang equities; kung inaasahan ang pagbaba, maaaring lumipat ito sa mas ligtas na mga bond.

- Patuloy na pag-rebalance ng portfolio

- Dynamic na alokasyon ng asset base sa kondisyon ng merkado

- Awtomatikong reinvestment ng dividend

- Pag-optimize ng tax-loss harvesting

AI-Pinapagana ang Pagsusuri ng Merkado

Gumagamit ang ilang plataporma ng generative AI upang suriin ang balita at datos pinansyal, hinuhulaan ang mga trend upang gabayan ang mga desisyon sa pamumuhunan. Kaya rin ng mga tool na ito na mag-simulate ng mga "what if" na senaryo.

- Real-time na pagsusuri ng sentimyento ng merkado

- Simulasyon ng makasaysayang performance

- Benchmark comparison (hal. S&P 500)

- Predictive modeling para sa mga hinaharap na kita

Matalinong Pamamahala ng Panganib

Tinutulungan ng AI na bawasan ang panganib sa pamamagitan ng pagdi-diversify ng iyong portfolio sa maraming asset at pagbibigay babala sa iyo tungkol sa mga pagbaba ng merkado nang maaga.

- Awtomatikong diversification ng portfolio

- Maagang babala para sa volatility ng merkado

- Pag-optimize ng return na naka-adjust sa panganib

- Personalized na pagtatasa ng tolerance sa panganib

Mga Tampok para sa Pangmatagalang Pagpaplano

Tinutulungan ng mga serbisyo ng AI ang pagpaplano para sa pagreretiro at pangmatagalang mga layunin sa pamamagitan ng pagtataya kung magkano ang kailangan mong ipunin para sa pagreretiro o malalaking pagbili, na ina-adjust para sa implasyon at kita sa pamumuhunan. Ang ilan ay pinagsasama ang awtomatikong pamumuhunan at mga tagapayo ng tao: maaaring gamitin ng isang app ang AI para sa araw-araw na mga desisyon ngunit pinapayagan ka ring mag-schedule ng tawag sa isang sertipikadong planner para sa mga komplikadong tanong.

Chatbots at Virtual na Payo sa Pananalapi

Lumitaw ang conversational AI (chatbots) bilang bagong paraan upang makakuha ng tulong sa pananalapi. Ang mga virtual assistant tulad ng ChatGPT o mga chatbot na ginawa para sa partikular na layunin (hal. chatbot ng Cleo) ay maaaring sumagot ng mga tanong tungkol sa pagba-budget, utang o pamumuhunan sa demand. Maaari mong tanungin ang iyong telepono, "Magkano ang dapat kong ipunin para sa bakasyon?" o "Mas mabuti bang bayaran ang credit card o magdagdag ng bayad sa utang?", at makakakuha ka ng agarang gabay.

Kasalukuyang Kalagayan ng Pagtanggap

Tiwala at Mga Limitasyon

Kakulangan sa Pag-unawa sa Emosyon

Pabor sa Tao

Pinakamahusay na Praktis sa Paggamit ng AI Chatbots

Gamitin Bilang Unang Tigil na Katulong

Ituring ang AI chatbots bilang panimulang punto para sa mabilisang pananaw o upang matukoy ang mga halatang pagkakamali, tulad ng nakaligtaang interes sa utang.

Beripikahin ang mga Rekomendasyon

Double-check ang anumang payo ng AI, lalo na para sa komplikadong kalkulasyon o detalye sa buwis, gamit ang mapagkakatiwalaang mga sanggunian o propesyonal.

Pagsamahin ang AI sa Ekspertong Tao

Ipasa ang mga tanong sa chatbot upang tuklasin ang mga opsyon, pagkatapos ay kumpirmahin ang mga plano sa isang sertipikadong financial advisor para sa mahahalagang desisyon.

Mga Benepisyo ng AI sa Pamamahala ng Pera

Nagdadala ang AI ng ilang malinaw na benepisyo sa personal na pananalapi, binabago kung paano pinamamahalaan ng mga indibidwal ang kanilang pera gamit ang data-driven na mga pananaw at awtomasyon.

Data-Driven na Pananaw

Kayang salain ng AI ang libu-libong transaksyon sa loob ng ilang segundo, na nagpapakita ng mga trend sa paggastos at mga oportunidad sa pag-iipon na maaaring hindi mapansin ng tao.

- Tuklasin ang mga hindi pangkaraniwang bill o singil

- Tumpak na paghahati-hati ng mga kategorya ng paggastos

- Pagtukoy ng pattern sa iba't ibang panahon

Personalization

Natuto ang mga sistema ng AI mula sa iyong datos, kaya't ang mga payo ay lalong naiaangkop sa iyong natatanging mga gawi at sitwasyong pinansyal.

- Customized na mga plano sa pag-iipon

- Adaptive na mga rekomendasyon sa budget

- Mga estratehiyang ina-adjust ayon sa kita

Kaginhawaan at Bilis

Ang mga paulit-ulit na gawain tulad ng pagsubaybay ng gastos, pamamahala ng subscription o paghahanda ng buwis ay awtomatiko, nakakatipid ng oras at pagsisikap.

- Real-time na mga update sa pananalapi

- 24/7 na pagmamanman sa background

- Agad na pag-uuri ng transaksyon

Mas Mababang Gastos

Hindi tulad ng tradisyunal na mga financial advisor na may mataas na bayad o minimum na account, karamihan sa mga AI-driven na app sa pananalapi ay libre o napakababa ng gastos.

- Karaniwang pagtitipid: $80-$500/taon

- Walang minimum na account

- Demokratikong gabay mula sa eksperto

Ang AI ay nagsisilbing digital na financial coach – laging handa, obhetibo, at batay sa datos. Napapansin nito kung malapit ka nang hindi maabot ang layunin sa pag-iipon at maingat na inaayos ang iyong budget, o nagmumungkahi ng paglipat ng pera sa isang high-yield na account nang awtomatiko.

Mga Hamon at Mga Dapat Isaalang-alang

Sa kabila ng pangako ng AI, may mga mahahalagang paalala na dapat tandaan kapag ginagamit ang mga tool na ito para sa pamamahala ng personal na pananalapi.

Katumpakan at Bias

Hindi perpekto ang AI. Nakadepende ang mga rekomendasyon nito sa kalidad ng datos at mga algorithm. Natuklasan sa akademikong pagsusuri ng mga tool tulad ng ChatGPT na habang kapaki-pakinabang ang payo, madalas itong pangkalahatan at minsan ay mali.

- Maaaring magkamali sa kumplikadong mga pormula sa pananalapi

- Maaaring hindi pansinin ang mahahalagang detalye sa buwis

- Minsan ay nagbibigay ng generic na payo

Privacy at Seguridad ng Datos

Nangangailangan ang mga AI finance app ng sensitibong datos (mga detalye ng bank account, kasaysayan ng paggastos, kita, atbp.) upang gumana nang epektibo. Nagdudulot ito ng malalaking alalahanin sa privacy.

Pinakamahusay na Praktis sa Seguridad

- Pumili ng mga kilalang plataporma na may malakas na encryption

- Maingat na suriin ang mga patakaran sa privacy

- Kumpirmahin kung paano iniimbak at ibinabahagi ang datos

- Paganahin ang two-factor authentication

- Regular na subaybayan ang mga account para sa hindi pangkaraniwang aktibidad

Tiwala at Mga Emosyonal na Salik

Madalas na may kasamang emosyon ang pamamahala ng pera (hal., pagkabalisa tungkol sa utang, kasiyahan sa pagbili). Wala ang AI ng tunay na pag-unawa sa damdamin, kaya may malaking puwang sa tiwala.

Perspektibo ng Canada

Perspektibo ng Amerika

Ibig sabihin ng puwang na ito sa "human touch" ay dapat punan ng AI, hindi palitan, ang personal na paghatol at propesyonal na gabay. Halimbawa, maaaring paalalahanan ka ng AI app tungkol sa mga layunin sa pag-iipon, ngunit ang isang pinagkakatiwalaang tagapayo o miyembro ng pamilya ang maaaring pinakamahusay na makatulong sa pagresolba ng pagkabalisa tungkol sa pagbabawas ng gastos.

Kamalayan at Accessibility

Malaki ang bahagi ng populasyon na hindi pa alam ang tungkol sa mga tool na ito. Ipinapakita ng mga survey na marami ang hindi pa naririnig ang tungkol sa mga robo-advisor o finance chatbot.

Mga Hamon sa Digital Divide

- Maaaring matakot ang mga matatandang gumagamit sa AI app

- Mas kaunting tech-savvy na mga user ang nahihirapan sa pagkatuto

- Ang limitadong kamalayan ay nagpapabagal sa pagtanggap

- Ang pagiging kumplikado ng interface ay maaaring maging hadlang

Inirerekomendang Paraan: Human-in-the-Loop

Sa pag-unawa sa mga limitasyong ito, maaari mong gamitin ang AI nang mas ligtas. Inirerekomenda ng mga eksperto na laging panatilihin ang isang tao "sa loop": ituring ang AI bilang isa sa mga tagapayo.

Pagsusuri ng AI

Gamitin ang AI upang suriin ang iyong budget para sa mabilisang pananaw

Pagsusuri ng Tao

Mag-schedule ng tawag sa isang financial counselor

Pinagsamang Estratehiya

Bumuo ng pangmatagalang mga plano gamit ang gabay ng eksperto

Ang pagsasama ng kahusayan ng AI at pangangalaga ng tao ang kasalukuyang pinakaepektibong paraan sa pamamahala ng personal na pananalapi.

Tumingin sa Hinaharap

Ang papel ng AI sa personal na pananalapi ay inaasahang lalago nang malaki. Inaasahan ng mga analyst ng merkado ang patuloy na paglawak ng mga AI-fintech tool sa mga susunod na taon, habang nagiging mas matalino ang mga algorithm at umuunlad ang mga regulasyon.

Mga Lumilitaw na Tampok ng AI Finance

Kontrol sa Boses

Pagsasama-sama ng Plataporma

Awtomatikong Negosasyon

Predictive Cash Flow

Mas Matalinong Algorithm

Pag-unlad ng Regulasyon

Ang Daan Pasulong

Sa huli, nangangako ang AI na gawing mas proaktibo at personalisado ang pamamahala ng pera. Kayang hatiin nito ang mga kumplikadong layunin sa pananalapi sa maliliit, awtomatikong gawain, na nagtutulak sa atin patungo sa mas magagandang gawi. Gayunpaman, mananatiling mahalaga ang elementong pantao.

Karamihan sa mga consumer, lalo na ang mga mas bata, ay tinitingnan ang AI bilang makapangyarihang kasangkapan upang palakasin ang kanilang mga desisyon sa pananalapi, hindi bilang kapalit ng kanilang paghatol. Sa paggamit ng AI nang matalino—pinapakinabangan ang kakayahan nitong magproseso ng datos at awtomasyon habang nananatiling kritikal—maaari kang magtamasa ng mas matalinong pagba-budget, mas matalinong pag-iipon, at mas matalinong pamumuhunan, lahat na nakaangkop sa iyong buhay.

Nangungunang AI-Pinapaganang Mga App sa Personal na Pananalapi

Cleo - AI Money Coach

Application Information

| Developer | Developed by Cleo AI Ltd, a UK-based fintech company founded in 2016, specializing in AI-driven personal finance management tools. |

| Supported Devices | Available for iOS and Android devices, plus web access via official platform. |

| Languages / Countries | Primarily supports English | Available in United Kingdom, United States, and Canada with expanding global reach. |

| Pricing Model | Free Premium — Basic budgeting and tracking free | Cleo Plus and Cleo Builder subscriptions unlock credit-building, cash advances, and cashback rewards. |

General Overview

Cleo is an AI-powered money management app that helps users take control of their finances through intelligent budgeting, expense tracking, and personalized financial education. Acting as your AI financial assistant, Cleo delivers actionable insights, savings strategies, and spending advice through an engaging conversational chat interface.

The app gamifies personal finance by using humor and interactive challenges, making budgeting less stressful and more enjoyable. With features like cashback offers, overdraft protection, and credit score monitoring, Cleo empowers users to build lasting financial confidence.

Detailed Introduction

Cleo revolutionizes personal finance management through conversational AI that communicates naturally with users. By securely connecting to your bank account, the app analyzes your income, expenses, and spending patterns to deliver personalized insights and actionable recommendations.

The AI chat interface serves as both a financial guide and motivator. Ask Cleo questions like "How much did I spend on food last week?" or "Can I afford this purchase?" and receive instant responses with visual breakdowns and smart suggestions.

For users committed to improving their financial habits, Cleo offers budget challenges, goal tracking, and cashback rewards. The Cleo Plus plan adds powerful tools for credit building, salary advances, and emergency cash — helping you stay financially secure during unexpected situations.

The platform emphasizes financial literacy by providing practical advice, progress tracking, and motivation delivered in an engaging, friendly tone that makes money management accessible to everyone.

Key Features

Interact with Cleo's intelligent chatbot to get instant insights about your spending habits, savings progress, and financial health.

Automatically categorize expenses and track budgets in real time with visual breakdowns and spending alerts.

Access small, interest-free advances to prevent overdraft charges and maintain financial stability.

Build or improve your credit score using Cleo's secured credit-building tools with progress tracking.

Set up smart savings pots with automated transfers and visual progress tracking to reach your financial goals faster.

Earn cashback on purchases made through Cleo's partnered merchants and maximize your savings.

Receive customized recommendations and actionable advice to improve your financial health over time.

Bank-level encryption and read-only access ensure your data and transactions remain completely secure.

Download or Access Link

User Guide

Download the Cleo app from the App Store or Google Play, or access via browser at the official web platform.

Create your Cleo account and securely link your bank accounts using bank-grade encryption for AI-driven financial insights.

Use the AI chat interface to ask questions about spending, set budgets, or get personalized financial advice instantly.

Cleo automatically categorizes transactions and highlights spending trends with visual breakdowns and alerts.

Create custom savings goals or enable automatic savings through Cleo's smart algorithm to build wealth effortlessly.

Unlock advanced tools including salary advances, credit building, and cashback rewards for enhanced financial management.

Receive regular updates and personalized reports to stay on track with your financial goals and celebrate milestones.

Notes / Limitations

- Cash advances and credit builder features are limited to paid subscribers (Cleo Plus/Builder).

- Requires a bank account connection to deliver accurate insights and personalized recommendations.

- Some features, such as cashback or rewards, may vary by region and merchant availability.

- While highly secure, Cleo depends on third-party banking APIs for data access, which may occasionally affect sync times.

Frequently Asked Questions

Yes, Cleo offers a free version with budgeting and AI chat features. However, premium features are available under Cleo Plus and Cleo Builder subscriptions.

Yes, Cleo uses bank-grade encryption and read-only access, ensuring your money and credentials remain completely secure. Your financial data is protected with industry-standard security protocols.

Yes. The Cleo Builder feature helps users build credit through a secured credit account while tracking progress within the app, making credit building accessible and transparent.

Cleo Plus costs around $5.99 per month (pricing may vary by region) and includes credit-building tools, cash advances, and cashback rewards.

Currently, Cleo is only available in these three countries, with potential global expansion planned for the future.

No, Cleo is not a bank. It's a financial assistant app that helps users manage money across multiple bank accounts by providing insights and tools for better financial decision-making.

Cleo uses a friendly, humorous chatbot style and gamified financial challenges to keep users engaged while learning good money habits. The conversational approach makes finance management feel less intimidating and more enjoyable.

Yes. Through the Cleo Cover feature, users can access small, interest-free advances to avoid overdraft fees and maintain financial stability.

Yes, Cleo is also accessible through its web platform, allowing you to manage your finances from any browser.

Yes, Cleo provides customer support through its in-app chat and help center for both free and premium users, ensuring assistance when you need it.

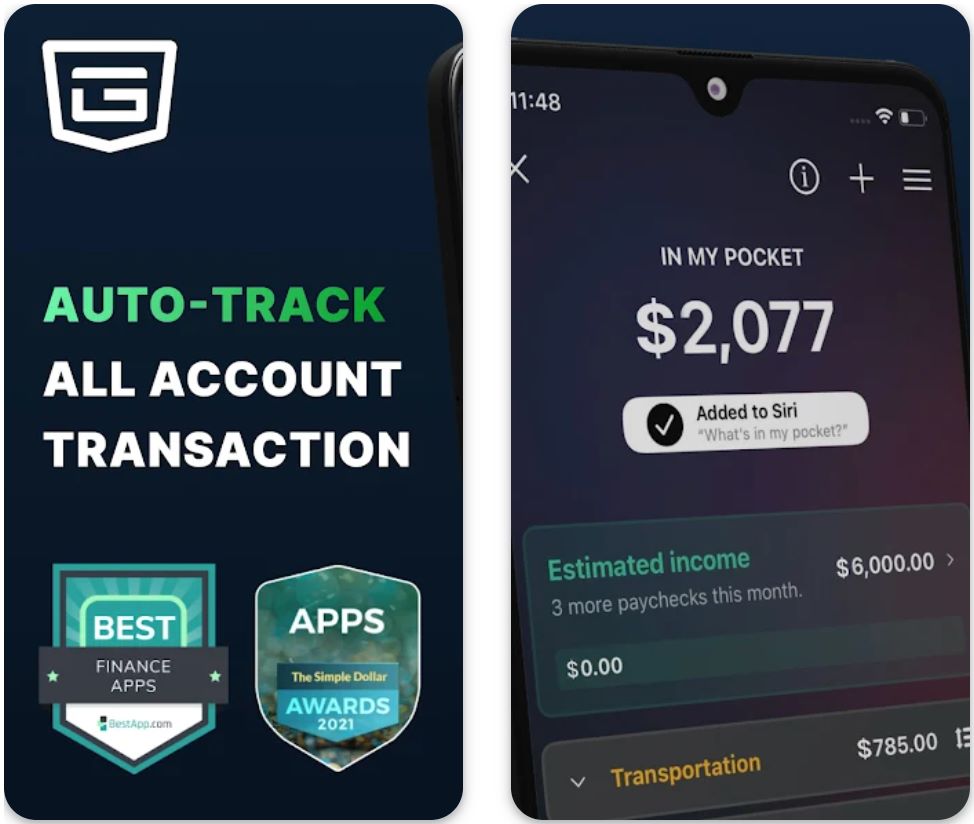

PocketGuard — Simple AI Budgeting

Impormasyon ng Aplikasyon

| May-akda / Developer | PocketGuard, Inc. |

| Sinusuportahang Mga Device | iOS, Android, at mga web browser |

| Mga Wika / Bansa | Ingles (Estados Unidos, Canada, at piling mga rehiyon sa buong mundo) |

| Presyo | Libreng plano na may pangunahing mga kasangkapan sa pagba-budget + PocketGuard Plus premium na subscription |

Pangkalahatang Pagsusuri

PocketGuard — Simpleng AI Budgeting ay isang app para sa pamamahala ng personal na pananalapi na idinisenyo upang gawing mas madali ang pagba-budget at pagsubaybay ng pera gamit ang teknolohiyang AI. Tinutulungan ng app ang mga gumagamit na kontrolin ang kanilang paggastos sa pamamagitan ng awtomatikong pagsusuri ng kita, mga bayarin, at gastusin upang ipakita kung magkano ang ligtas na magastos.

Nilalabanan ng matalinong sistema ng pagba-budget ng PocketGuard ang stress sa pananalapi sa pamamagitan ng awtomatikong paggawa ng mga budget, pagsubaybay sa mga subscription, at pagtukoy ng mga oportunidad sa pag-iipon. Sa malinis na interface at advanced na pagsusuri, nagsisilbi itong all-in-one na kasama sa pananalapi para sa sinumang nagnanais na mas matalinong pamahalaan ang pera.

Detalyadong Panimula

Gumagamit ang PocketGuard ng mga insight sa pananalapi na pinapagana ng AI upang tulungan ang mga gumagamit na maunawaan ang kanilang daloy ng pera at gumawa ng mas mahusay na mga desisyon sa paggastos. Sa pamamagitan ng ligtas na pagkonekta sa iyong mga banko at credit account, nagbibigay ang app ng real-time na pagsubaybay sa iyong kita, mga bayarin, at mga transaksyon.

Ang tampok nitong "In My Pocket" ay agad na kinakalkula kung magkano ang iyong disposable income matapos masakop ang lahat ng mahahalagang gastusin, na tinitiyak na hindi ka lalabis sa paggastos. Awtomatikong inuuri ng app ang mga gastusin, natutukoy ang mga paulit-ulit na bayad, at tinutulungan kang tuklasin ang mga hindi kailangang gastos o dobleng subscription.

Sa PocketGuard Plus, nakakakuha ang mga gumagamit ng access sa mga advanced na tampok tulad ng custom na mga kategorya, pagsubaybay sa pagbabayad ng utang, at detalyadong mga ulat sa paggastos — na nagbibigay kapangyarihan sa mga gumagamit na bumuo ng disiplina sa pananalapi at pangmatagalang mga gawi sa pag-iipon.

Pangunahing Mga Tampok

Awtomatikong lumilikha ng mga personalisadong budget base sa mga pattern ng paggastos at kita.

Kinakalkula ang perang maaari mong gastusin matapos isaalang-alang ang mga bayarin at ipon.

Awtomatikong inaayos ang mga transaksyon para sa mas malinaw na pananaw.

Minomonitor ang mga petsa ng bayaran at mga paulit-ulit na bayad upang maiwasan ang hindi nabayarang bayarin.

Tinutukoy ang mga aktibong subscription at tinutulungan kang kanselahin ang mga hindi nais.

Pinapayagan ang mga gumagamit na magtakda ng mga layuning pinansyal, tulad ng pagbabayad ng utang o pondo para sa emerhensiya.

Nagpapakita ng biswal na pagsusuri kung paano nagagamit ang iyong pera at saan ito maaaring makatipid.

Gumagamit ng encryption na antas-bangko upang protektahan ang data at privacy ng gumagamit.

Nagbubukas ng mga premium na kasangkapan tulad ng custom na budget, pagsubaybay sa cash, at mga ulat na maaaring i-export.

Link para sa Pag-download o Pag-access

Gabay ng Gumagamit

Kunin ang PocketGuard app mula sa App Store, Google Play, o bisitahin ang bersyon sa web.

Mag-sign up gamit ang iyong email address o magpatuloy gamit ang Google/Apple para sa mabilis na access.

Ligtas na ikonekta ang iyong mga financial account upang awtomatikong mai-import ang data ng transaksyon.

Tukuyin ang iyong mga layunin sa pag-iipon, mga kategorya ng budget, at mga limitasyon sa paggastos.

Pahintulutan ang PocketGuard na awtomatikong uriin at subaybayan ang iyong pang-araw-araw na paggastos.

Suriin kung magkano ang ligtas mong magastos na pera na natitira matapos masakop ang mga mahahalaga.

Mag-access sa mga premium na kasangkapan sa pagba-budget para sa detalyadong mga pananaw at advanced na kontrol.

Mga Tala at Limitasyon

- Ilang mga tampok tulad ng custom na mga kategorya at pagsubaybay sa utang ay nangangailangan ng PocketGuard Plus subscription.

- Sa kasalukuyan, sinusuportahan ang mga bank account pangunahin mula sa US at Canada.

- Maaaring tumagal ng 24–48 oras bago ma-sync ang mga transaksyon depende sa iyong bangko.

- Limitado ang suporta sa pera at wika.

- Nangangailangan ng koneksyon sa internet para sa real-time na pagsi-sync ng data.

Madalas Itanong

Oo, nag-aalok ang app ng libreng bersyon na may mahahalagang tampok sa pagba-budget. Ang mga premium na tampok ay available sa pamamagitan ng PocketGuard Plus.

Gumagamit ang PocketGuard ng ligtas at read-only na koneksyon sa pamamagitan ng mga pinagkakatiwalaang financial aggregator, na tinitiyak na nananatiling pribado at protektado ang iyong data.

Oo, maaaring i-link ng mga gumagamit ang maraming checking, savings, at credit account.

Ang tampok nitong AI-driven na "In My Pocket" ay nagbibigay ng real-time na pagsubaybay sa disposable income, na nagpapadali upang maiwasan ang labis na paggastos.

Bagaman pangunahing idinisenyo para sa mga gumagamit sa US at Canada, maaaring may limitadong functionality na magagamit sa ibang bansa.

Gumagamit ang PocketGuard ng bank-level 256-bit SSL encryption at read-only access upang panatilihing ligtas ang data ng gumagamit.

Tinutulungan ng app na tuklasin ang mga aktibong subscription at nagbibigay ng gabay para sa pagkansela, ngunit ang aktwal na pagkansela ay nakadepende sa service provider.

Ang mga premium na gumagamit ay nakakakuha ng access sa custom na mga kategorya, pagsubaybay sa cash, pagpaplano ng pagbabayad ng utang, at mga ulat sa pananalapi na maaaring i-export.

Oo, maaaring subaybayan ng mga gumagamit ang maraming account, kabilang ang mga pinagsama, sa ilalim ng isang dashboard.

Oo. Nagmumungkahi ang app ng mga oportunidad sa pag-iipon at tinutulungan kang maglaan ng pondo para sa iyong mga layuning pinansyal nang epektibo.

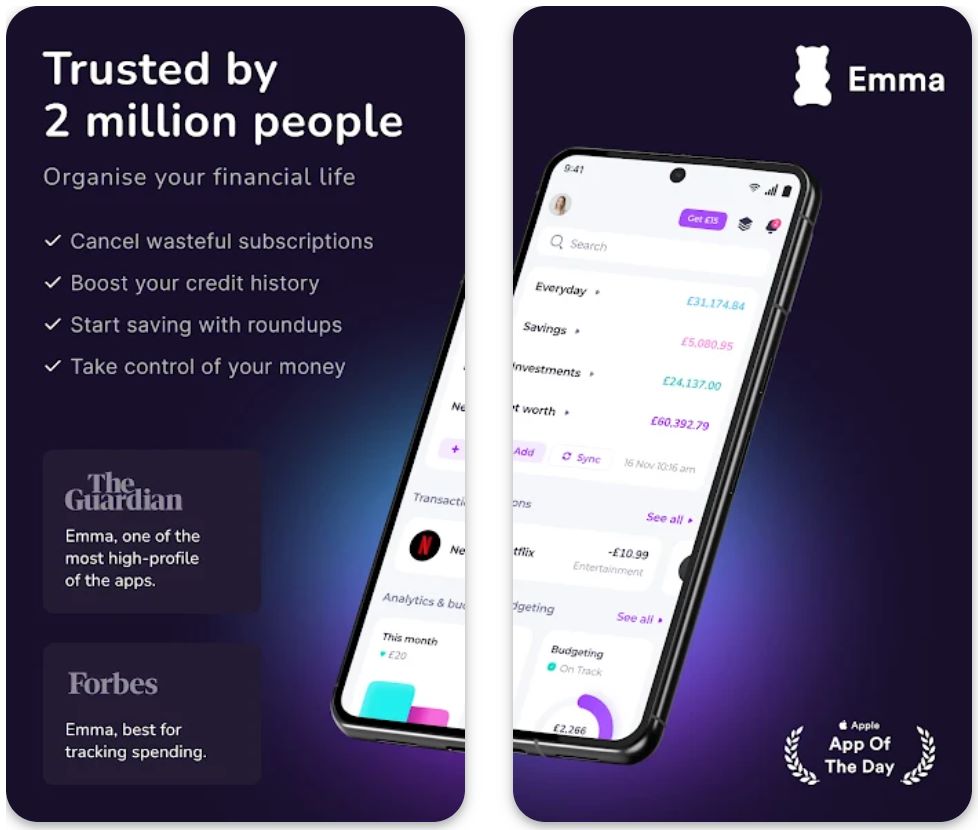

Emma — European Budget & Subscription Manager

Impormasyon ng Aplikasyon

| May-akda / Developer | Emma Technologies Ltd. |

| Sinusuportahang Mga Device | Compatible sa iOS at Android na mga device; maaari ring ma-access sa pamamagitan ng web dashboard |

| Mga Wika / Bansa | Available sa Ingles; sinusuportahan ang mga gumagamit sa UK, EU, US, at Canada |

| Libreng Bersyon o Bayad | Nag-aalok ng libreng bersyon na may mahahalagang tampok at isang premium plan (Emma Pro) para sa mas advanced na pananaw sa pananalapi at pagpapasadya |

Pangkalahatang Pagsusuri

Emma — European Budget & Subscription Manager ay isang matalinong personal finance app na tumutulong sa mga gumagamit na pamahalaan ang pera, subaybayan ang paggastos, at kontrolin ang mga subscription nang madali. Dinisenyo para sa mga modernong gumagamit sa Europa at iba pa, ligtas na nakakonekta ang Emma sa mga bank account, credit card, at mga platform ng pamumuhunan upang magbigay ng iisang pananaw sa iyong kalusugan sa pananalapi.

Gumagamit ang app ng matalinong pananaw upang tuklasin ang mga sayang na paggastos, pigilan ang overdraft, at tukuyin ang mga paulit-ulit na subscription na maaaring nakalimutan mo. Kung sinusubukan mong mag-ipon nang higit pa, magplano ng buwanang budget, o subaybayan ang maraming account, nagbibigay ang Emma ng malinis at awtomatikong solusyon sa pamamahala ng pananalapi.

Detalyadong Panimula

Inilunsad ng Emma Technologies Ltd., ang makabagong budgeting app na ito ay naglalayong gawing simple at malinaw ang personal finance. Nakakonekta ang app sa mahigit 600 financial institutions sa buong Europa, UK, at Hilagang Amerika, na nagpapahintulot sa mga gumagamit na makita lahat ng kanilang account sa isang lugar.

Awtomatikong kinokategorya ng Emma ang mga transaksyon, natutukoy ang mga bayarin at subscription, at nagbibigay ng mga alerto para sa mga hindi pangkaraniwang pattern ng paggastos. Tinutulungan ng AI-based na pagsusuri ang mga gumagamit na maunawaan kung saan napupunta ang kanilang pera at kung paano nila mapapabuti ang mga gastusin.

Sa Emma Pro, maaaring i-unlock ng mga gumagamit ang mga advanced na tampok tulad ng custom categories, pag-export ng data, at mga smart budgeting tool, na ginagawang isang makapangyarihang financial assistant ang app. Pinagkakatiwalaan ng libu-libong gumagamit sa buong Europa, madalas na tinutukoy ang Emma bilang "ang iyong pinakamahusay na kaibigan sa pananalapi" dahil sa magiliw nitong disenyo at katumpakan.

Pangunahing Mga Tampok

Tingnan ang mga bank account, credit card, at investments sa isang pinag-isang dashboard para sa kumpletong pananaw sa pananalapi.

Awtomatikong natutukoy ang mga paulit-ulit na bayad at tumutulong tukuyin ang mga hindi gustong subscription upang makatipid ng pera.

Matalinong pinagsasama-sama ang paggastos sa mga kategorya para sa madaling pagsubaybay at pagsusuri ng budget.

Pinapakita ng AI-based na analytics ang mga oportunidad sa pagtitipid at mga trend sa paggastos upang mapabuti ang iyong pananalapi.

Magtakda ng mga limitasyon sa paggastos kada kategorya at makatanggap ng mga alerto kapag malapit nang maabot ang iyong budget.

Pinipigilan ang sobrang paggastos sa pamamagitan ng pagsubaybay sa balanse ng account nang real time gamit ang mga maagap na alerto.

Maayos na gumagana sa mga account na may iba't ibang pera, perpekto para sa mga gumagamit sa Europa.

I-unlock ang mga advanced na tampok tulad ng custom categories, pag-edit ng transaksyon, at pag-export ng data.

Gumagamit ng 256-bit SSL encryption at read-only access upang protektahan ang sensitibong data sa pananalapi.

Link para sa Pag-download o Pag-access

Gabay ng Gumagamit

Kunin ang app mula sa App Store o Google Play, o gamitin ang web dashboard para sa desktop access.

Mag-sign up gamit ang iyong email o magpatuloy gamit ang Google/Apple para sa mabilis na pagpaparehistro.

Ligtas na i-link ang iyong mga financial account para sa real-time na pagsubaybay at pagsusuri.

Suriin ang mga na-kategoryang paggastos, mga buod ng subscription, at mga insight na ginawa ng AI.

Tukuyin ang mga buwanang budget at subaybayan ang progreso nang awtomatiko.

Tingnan ang mga paulit-ulit na singil, kanselahin ang mga hindi gustong serbisyo, at manatiling updated sa mga bayarin.

I-unlock ang mga premium na kasangkapan tulad ng custom budgets, mga opsyon sa pag-export, at mga filter ng data.

Mga Tala at Limitasyon

- Maaaring limitado ang integrasyon ng ilang bangko o institusyong pinansyal sa ilang rehiyon

- Ang Emma Pro plan ay batay sa subscription at nagre-renew buwanan o taun-taon

- Maaaring bahagyang mag-iba ang conversion ng pera para sa mga multi-currency account

- Kailangan ng aktibong koneksyon sa internet para sa pag-sync ng data sa pananalapi

- Sa kasalukuyan, sinusuportahan lamang ng app ang Ingles

Madalas Itanong

Oo, nag-aalok ang Emma ng libreng plano na may mahahalagang tampok sa pagba-budget at pagsubaybay ng subscription. Maaaring mag-upgrade ang mga gumagamit sa Emma Pro para sa mas pinahusay na mga kasangkapan.

Gumagamit ang Emma ng 256-bit SSL encryption at read-only na koneksyon sa bangko, na tinitiyak na nananatiling pribado at ligtas ang data ng gumagamit.

Available ang Emma sa UK, European Union, United States, at Canada.

Oo, natutukoy ng Emma ang lahat ng paulit-ulit na bayad at tumutulong tukuyin ang mga hindi gustong subscription para sa pagkansela.

Oo. Sinusuportahan ng Emma ang pagkonekta ng maraming account at credit card para sa pinagsamang pagsubaybay.

Nag-aalok ang Emma Pro ng mga advanced na tampok tulad ng custom categories, pag-export ng data, pag-edit ng transaksyon, at mas personalisadong mga opsyon sa pagba-budget.

Oo, nakakonekta ang Emma sa iba't ibang financial platform upang subaybayan ang mga investment account at mga layunin sa ipon.

Sinusuri ng Emma ang iyong mga gawi sa paggastos, tinutukoy ang mga sayang na gastusin, at nagmumungkahi ng mga paraan upang bawasan ang hindi kailangang gastos.

Oo, maaaring i-link ang maraming account sa ilalim ng isang profile para sa komprehensibong pagsubaybay sa pananalapi.

Hindi. Hindi ibinebenta o ibinabahagi ng Emma ang iyong personal o financial data sa mga third party.

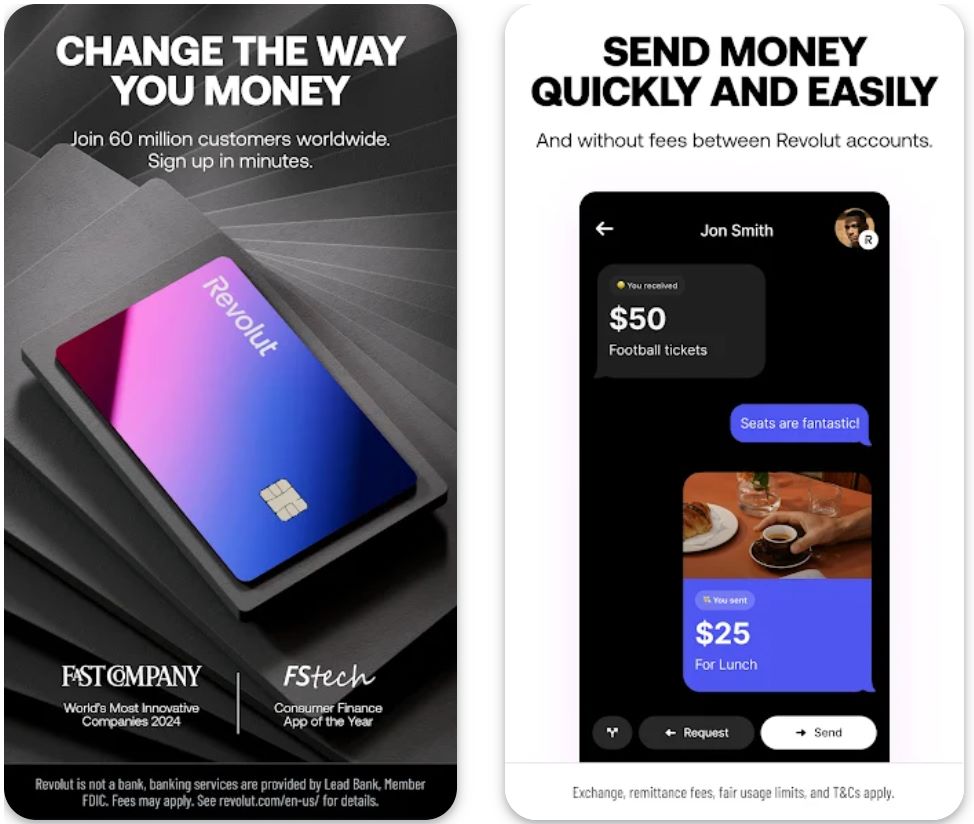

Revolut — Neobank with Expanding AI Assistant

Impormasyon ng Aplikasyon

| May-akda / Developer | Revolut Ltd. |

| Sinusuportahang Mga Device | iOS, Android, at web browsers |

| Mga Wika / Bansa | Sumusuporta sa mahigit 30 wika at available sa mahigit 200 bansa at rehiyon sa buong mundo |

| Libreng o Bayad | May libreng plano, pati na rin ang maraming premium na tier (Plus, Premium, Metal, at Ultra) na may advanced na mga tampok sa pananalapi at AI |

Pangkalahatang Pagsusuri

Revolut — Neobank na may Lumalawak na AI Assistant ay isang makabagong digital banking platform na pinagsasama ang pamamahala ng pananalapi, international transfers, pagtitipid, pamumuhunan, at mga advanced na AI-driven na kasangkapan sa iisang app. Itinatag noong 2015, ang Revolut ay umunlad mula sa simpleng serbisyo ng pagpapalit ng pera tungo sa isa sa mga nangungunang neobank sa mundo, na nagbibigay sa mga gumagamit ng kakayahang pamahalaan ang lahat ng aspeto ng kanilang pananalapi sa buong mundo.

Ang pinakabagong inobasyon ng Revolut ay ang AI-powered assistant, na idinisenyo upang tulungan ang mga gumagamit na suriin ang paggastos, tuklasin ang mga hindi pangkaraniwang transaksyon, at magbigay ng personalisadong pananaw sa pananalapi — ginagawa ang pamamahala ng pera na mas matalino at mas ligtas kaysa dati.

Detalyadong Panimula

Ang Revolut ay hindi lamang isang banking app — ito ay isang buong ecosystem ng pananalapi. Maaaring maghawak at magpalitan ang mga gumagamit ng mahigit 30 pera, magpadala ng international transfers sa kompetitibong mga rate, at ma-access ang mga kasangkapan para sa budgeting, pamumuhunan, at trading.

Ang AI assistant ng platform ay isang malaking hakbang sa automation ng personal na pananalapi. Sa paggamit ng machine learning, maaaring subaybayan ng assistant ang mga gawi sa paggastos ng gumagamit, hulaan ang mga susunod na gastusin, at mag-alok ng mga angkop na rekomendasyon upang mapabuti ang pagtitipid o mabawasan ang hindi kailangang gastos. Nagbibigay din ito ng real-time na pagtuklas ng pandaraya at agad na mga alerto para sa mas pinahusay na kaligtasan ng account.

Sa tuloy-tuloy na mga update, pinagsasama ng Revolut ang makabagong banking at susunod na henerasyon ng AI upang maghatid ng isang seamless, all-in-one na karanasan sa pananalapi na angkop para sa mga indibidwal, freelancer, at negosyo sa buong mundo.

Pangunahing Mga Tampok

Makakuha ng real-time na pananaw sa paggastos, mga suhestiyon sa pagtitipid, at personalisadong mga alerto na pinapagana ng machine learning.

Maghawak at magpalitan ng mahigit 30 pera sa interbank rates na walang nakatagong bayarin.

Awtomatikong ikategorya ang paggastos at subaybayan ang mga budget nang mahusay gamit ang visual analytics.

Mamuhunan sa cryptocurrencies, ETFs, at stocks nang direkta mula sa app na may kompetitibong mga rate.

Magpadala at tumanggap ng pera sa buong mundo na may minimal na bayarin at real-time na exchange rates.

Gumawa ng automated na mga layunin sa pagtitipid at kumita ng interes sa iyong balanse na may flexible na mga termino.

Gumamit ng secure, disposable na mga card para sa online at offline na mga pagbili na may instant card freeze options.

Subaybayan, pamahalaan, at kanselahin ang mga subscription nang madali sa pamamagitan ng intuitive na dashboard.

Minomonitor ng AI ang mga transaksyon para sa hindi pangkaraniwang aktibidad at agad na nag-aalerto sa mga gumagamit para sa pinakamataas na seguridad.

Mas mataas na limitasyon, travel insurance, cashback, at eksklusibong mga benepisyo ng Metal o Ultra para sa mga premium na miyembro.

Link para sa Pag-download o Pag-access

Gabay ng Gumagamit

Kunin ang Revolut app mula sa Google Play, App Store, o i-access sa pamamagitan ng web platform.

Magrehistro gamit ang iyong numero ng telepono at i-verify ang iyong pagkakakilanlan para sa seguridad.

I-link ang iyong bank account o card upang agad na magdagdag ng pera sa iyong Revolut account.

Gamitin ang mga tab para sa pagsusuri ng paggastos, pagpapalit ng pera, pagtitipid, at mga tampok sa pamumuhunan.

Payagan ang built-in na AI assistant upang makatanggap ng personalisadong payo sa budgeting at mga alerto sa transaksyon.

Magpadala ng pera sa buong mundo, hatiin ang mga bayarin, o magbayad gamit ang QR code o virtual card nang madali.

Pumili mula sa Plus, Premium, Metal, o Ultra na mga tier para sa karagdagang mga kasangkapan sa pananalapi at gantimpala.

Mga Tala at Limitasyon

- Ang pagkakaroon ng mga tampok (hal., crypto trading, stock investments) ay maaaring mag-iba depende sa bansa

- Kailangan ang pag-verify ng pagkakakilanlan bago ma-access ang lahat ng serbisyo sa banking

- Ang ilang international transfers ay maaaring magkaroon ng maliit na bayad sa palitan

- Ang AI insights at advanced analytics ay naka-optimize para sa mga premium na gumagamit

- Kailangan ng koneksyon sa internet para sa real-time na pagsi-synchronize ng account

Madalas Itanong

Tinutulungan ng AI assistant ng Revolut ang mga gumagamit na subaybayan ang mga pattern ng paggastos, tuklasin ang hindi pangkaraniwang aktibidad, at makatanggap ng personalisadong pananaw sa pananalapi na pinapagana ng mga algorithm ng machine learning.

Oo, ang Revolut ay nagpapatakbo sa ilalim ng mga lisensya sa pagbabangko sa ilang mga bansa at nagbibigay ng mga regulated na serbisyo sa pananalapi na may buong pagsunod.

Oo, nag-aalok ang Revolut ng libreng plano na may mga pangunahing tampok. Ang mga premium na tier ay nag-aalok ng karagdagang benepisyo tulad ng mas mataas na limitasyon, insurance, at AI-based analytics.

Oo, maaaring bumili, magbenta, at maghawak ang mga gumagamit ng maraming cryptocurrencies nang direkta sa loob ng app na may kompetitibong mga rate at secure na imbakan.

Gumagamit ang Revolut ng bank-grade encryption at AI fraud detection upang matiyak ang pinakamataas na seguridad ng account at protektahan ang iyong pondo.

Oo naman. Sinusuportahan ng Revolut ang paggastos at mga transfer sa mahigit 200 bansa gamit ang interbank exchange rates at minimal na bayarin.

Maaari kang maghawak, magpalitan, at gumastos sa mahigit 30 pandaigdigang pera gamit ang real-time na exchange rates.

Awtomatikong ikinakategorya ng AI assistant ang mga transaksyon, nagtatalaga ng mga budget, at nagbibigay ng mga buod ng paggastos upang matulungan ang mga gumagamit na manatili sa kanilang mga layunin sa pananalapi.

Oo, para sa maraming gumagamit, nagsisilbing kumpletong digital banking na alternatibo ang Revolut, na nag-aalok ng mga pagbabayad, pagtitipid, at mga kasangkapan sa pamumuhunan sa iisang platform.

Nag-aalok ang Revolut ng Plus, Premium, Metal, at Ultra na mga plano, bawat isa ay nagbibigay ng pinahusay na mga benepisyo, AI-powered na mga kasangkapan, at eksklusibong gantimpala.

Plum — Automation-first Saving & Investing (EU/UK focus)

Impormasyon ng Aplikasyon

| May-akda / Developer | Plum Fintech Ltd. |

| Sinusuportahang Mga Device | iOS, Android, at web browsers |

| Mga Wika / Bansa | Ingles — Available sa buong UK at mga bansa sa EU kabilang ang France, Spain, at Ireland |

| Libreng o Bayad | Libreng plano na may opsyonal na mga bayad na tier (Plum Pro, Ultra, at Premium) para sa advanced na pamumuhunan at mga tampok ng awtomasyon |

Pangkalahatang Pagsusuri

Plum — Automation-first Saving & Investing ay isang matalinong AI-powered na financial app na idinisenyo upang tulungan ang mga gumagamit sa EU at UK na awtomatikong mag-ipon, mamuhunan, at pamahalaan ang pera nang mahusay. Ginagamit nito ang matalinong awtomasyon at behavioral analytics upang gawing simple ang personal na pananalapi — mula sa pag-optimize ng pag-iipon hanggang sa pamamahala ng pamumuhunan — lahat sa loob ng isang ligtas at madaling gamitin na interface.

Ang misyon ng Plum ay gawing madali ang pag-iipon at gawing accessible ang pamumuhunan. Natututo ang AI assistant nito ng mga gawi ng gumagamit, minomonitor ang paggastos, at awtomatikong inililipat ang sobrang pera sa pag-iipon o pamumuhunan, na tinitiyak na lumago ang kayamanan ng mga gumagamit nang hindi nangangailangan ng palagiang manu-manong pagsisikap.

Detalyadong Panimula

Itinatag noong 2016, ang Plum ay isa sa mga nangungunang AI-driven money management platforms sa UK, na pinagsasama ang teknolohiya at pananalapi upang tulungan ang mga gumagamit na kontrolin ang kanilang pinansyal na kinabukasan.

Kapag nakakonekta na sa isang bank account, sinusuri ng Plum ang mga pattern ng kita at paggastos gamit ang secure na Open Banking technology. Tinutukoy nito kung magkano ang ligtas na mailalagay at awtomatikong iniipon sa mga customized na layunin. Maaari ring pumili ang mga gumagamit na mamuhunan sa diversified portfolios, kabilang ang stocks, ETFs, at sustainable funds.

Ang automation-first na pamamaraan ng Plum ay nag-aalis ng stress sa pagba-budget habang nagbibigay ng buong transparency at kontrol sa pera ng mga gumagamit. Patuloy na inaangkop ng AI ang lifestyle ng bawat gumagamit, na tinitiyak na ang pag-iipon at pamumuhunan ay nangyayari nang tuloy-tuloy sa background.

Pangunahing Mga Tampok

Sinusuri ng AI ang mga transaksyon at awtomatikong naglalaan ng maliliit na halaga para sa pag-iipon.

Access sa diversified na mga pondo, kabilang ang teknolohiya, sustainable, at global stock portfolios.

Real-time na pagsubaybay sa mga pattern ng paggastos at mga gawi sa pananalapi.

Tuklasin ang mas magagandang deal para sa utilities at kumita ng cashback sa mga pagbili.

Awtomatikong inihahanda ang mga gumagamit para sa hindi inaasahang gastusin.

Ina-round up ang mga pagbili at ini-invest o iniipon ang natitirang sukli.

Pamahalaan ang mga pondo sa iba't ibang pera ng UK at EU.

Regulado ng Financial Conduct Authority (FCA), gamit ang bank-level encryption para sa proteksyon ng data.

Lumikha ng maraming lalagyan ng pag-iipon para sa paglalakbay, emergency, o pangmatagalang mga layunin.

Access sa advanced na mga tool sa pamumuhunan, personalized na pananaw, at mas mataas na limitasyon sa awtomasyon.

Link para sa Pag-download o Pag-access

Gabay ng Gumagamit

I-install mula sa Google Play, App Store, o i-access sa pamamagitan ng web app.

Magrehistro gamit ang iyong email at i-verify ang iyong pagkakakilanlan sa pamamagitan ng secure na Open Banking connections.

Ikonekta ang iyong pangunahing account upang payagan ang Plum na suriin ang paggastos at tuklasin ang mga oportunidad sa pag-iipon.

I-activate ang awtomasyon ng AI upang simulan ang paglilipat ng maliliit na halaga sa iyong mga lalagyan ng pag-iipon.

Pumili mula sa basic o themed investment portfolios ayon sa iyong kagustuhan sa panganib.

Subaybayan ang pag-iipon, kita, at gastusin nang direkta sa dashboard.

Mag-subscribe sa Plum Pro, Ultra, o Premium para sa mga tampok tulad ng budgeting insights, cashback, at diversified investments.

Mahahalagang Tala at Limitasyon

- Ang mga portfolio ng pamumuhunan ay may kasamang panganib sa merkado at pagbabago ng halaga.

- Ilang mga tampok (hal., cashback, access sa pamumuhunan) ay available lamang sa mga bayad na plano.

- Maaaring mag-iba ang availability depende sa bansa ng gumagamit sa loob ng EU o UK.

- Kailangan ang koneksyon sa internet at access sa Open Banking para sa buong functionality.

- Hindi nagbibigay ang Plum ng personalized na payo sa pananalapi — dapat suriin ng mga gumagamit ang mga panganib sa pamumuhunan nang mag-isa.

Madalas Itanong

Ang Plum ay isang AI-powered na app na awtomatikong nag-iipon, namumuhunan, at nagba-budget para sa mga gumagamit sa UK at EU.

Oo, gumagamit ang Plum ng bank-level encryption at awtorisado at regulado ng FCA sa UK.

Sinusuri ng AI ang paggastos at kita, pagkatapos ay awtomatikong inililipat ang maliliit at ligtas na halaga sa mga lalagyan ng pag-iipon.

Oo, nagbibigay ang Plum ng access sa iba't ibang investment funds at stocks & shares ISAs (UK).

Oo, may libreng bersyon, ngunit maaaring mag-upgrade ang mga gumagamit sa Pro, Ultra, o Premium para sa mas maraming tampok.

Kasulukuyan itong available sa UK, France, Spain, at Ireland, na may mga plano na palawakin pa sa EU.

Oo, maaaring mag-withdraw ang mga gumagamit ng kanilang ipon anumang oras nang walang parusa.

Pinagsasama ng Plum ang AI automation, matalinong pamumuhunan, at pagsusuri ng paggastos sa isang pinag-isang platform.

Oo, karaniwang nagsisimula ang minimum na halaga ng pamumuhunan sa £1 o €1, depende sa bansa.

Oo, maaaring tuklasin ng Plum ang mas murang deal para sa mga bayarin sa bahay at tumulong sa awtomatikong pagpapalit ng mga provider.

No comments yet. Be the first to comment!