AI i personlig ekonomihantering

Upptäck hur artificiell intelligens (AI) förändrar personlig ekonomihantering: från smart budgetering och automatiskt sparande till robo-rådgivare och virtuella assistenter. Denna artikel ger tydliga, fullständiga och praktiska insikter för att hjälpa dig att spendera smartare.

Modern personlig ekonomihantering omformas av artificiell intelligens (AI) och maskininlärning. Dessa teknologier driver appar och plattformar som automatiserar budgetering, sparande, investeringar och till och med bedrägeridetektion, och erbjuder personlig ekonomisk vägledning likt en digital finansiell coach.

Denna användning innebär att AI blir en rutinmässig del av personlig pengahantering, som hanterar allt från att följa utgifter till att optimera investeringar.

AI-driven budgetering och utgiftsspårning

AI är skickligt på att analysera finansiella data. Smarta budgeteringsappar som Mint, PocketGuard eller Copilot Money kategoriserar automatiskt dina transaktioner och lär sig dina vanor. Med maskininlärning sorterar dessa verktyg utgifter i realtid och upptäcker mönster du kan missa.

Automatisk kategorisering

AI läser transaktioner och tilldelar kategorier (mat, hyra, resor etc.) utan manuell inmatning, och lär sig från varje transaktion.

Insikter i realtid

Så fort du spenderar uppdaterar appen din budget, vilket gör det enkelt att omedelbart upptäcka trender eller onödiga utgifter.

Kontinuerligt lärande

Ju mer du använder appen, desto smartare blir den. Dess algoritmer förfinar budgeten baserat på dina unika spenderingsvanor.

Prediktiva varningar

Prognosfunktioner varnar dig om du riskerar att få ont om pengar eller föreslår optimal tidpunkt för större inköp.

Automatiserat sparande och utgiftshantering

Bortom budgetering hjälper AI till att automatisera sparande och minska slöseri. Moderna pengarappar kan identifiera pengaläckor och agera åt dig, eliminera onödiga utgifter och optimera dina spenderingsmönster.

Traditionellt tillvägagångssätt

- Manuell spårning av prenumerationer

- Missar glömda återkommande avgifter

- Tidskrävande fakturagranskning

- Överser sparmöjligheter

Automatiserad lösning

- Automatisk upptäckt av alla prenumerationer

- Avbryt oanvända tjänster

- Hitta bättre erbjudanden automatiskt

- Spara 800–5000 kr årligen

Viktiga automatiseringsfunktioner

- Hantera prenumerationer: Appar som Rocket Money använder AI för att lista alla återkommande avgifter och kan till och med förhandla eller avbryta de du inte använder

- Erbjudandeoptimering: AI skannar räkningar och transaktioner för potentiella besparingar, tillämpar cashback-erbjudanden eller rekommenderar billigare planer

- Anpassningsbara budgetar: Baserat på spenderingsmönster justerar appen dina sparmål och föreslår att extra pengar kanaliseras till sparande eller investeringar

AI-drivna sparverktyg kan i genomsnitt spara användare 800 till 5000 kr årligen genom att automatisera prenumerationshantering och hitta bättre erbjudanden.

— Bankrate Financial Research

Dessa verktyg fungerar i praktiken som en automatiserad "finansiell autopilot" som implementerar sparstrategier anpassade till din livsstil. De arbetar tyst i bakgrunden – avsätter små summor till sparande varje vecka eller omfördelar räkningar – så att du stadigt bygger upp en buffert utan att tänka på det.

Robo-rådgivare och investeringsplanering

AI:s påverkan sträcker sig till investeringar. Robo-rådgivare är plattformar som använder algoritmer för att skapa och hantera investeringsportföljer med liten eller ingen mänsklig vägledning. De tar dina mål och risktolerans som input och bygger automatiskt en diversifierad portfölj av aktier, obligationer eller ETF:er.

Automatiserad portföljhantering

AI bedömer marknadsförhållanden och din personliga profil för att optimera tillgångsfördelningen. Till exempel, om aktiemarknaden går starkt kan den öka aktieandelen; om en nedgång förutspås kan den skifta till säkrare obligationer.

- Kontinuerlig portföljombalansering

- Dynamisk tillgångsfördelning baserat på marknadsförhållanden

- Automatisk återinvestering av utdelningar

- Optimering av skatteförlustutjämning

AI-driven marknadsanalys

Vissa plattformar använder generativ AI för att analysera nyheter och finansiell data, förutsäga trender och vägleda investeringsbeslut. Dessa verktyg kan till och med simulera "tänk om"-scenarier.

- Marknadssentimentanalys i realtid

- Historiska prestationssimuleringar

- Jämförelse med referensindex (t.ex. S&P 500)

- Prediktiv modellering för framtida avkastning

Intelligent riskhantering

AI hjälper till att minska risk genom att diversifiera din portfölj över många tillgångar och genom att varna dig tidigt vid marknadsnedgångar.

- Automatisk portföljdiversifiering

- Tidiga varningssignaler för marknadsvolatilitet

- Optimering av riskjusterad avkastning

- Personlig bedömning av risktolerans

Funktioner för långsiktig planering

AI-tjänster hjälper till med pensionsplanering och långsiktiga mål genom att projicera hur mycket du behöver spara för pension eller större inköp, justerat för inflation och investeringsavkastning. Vissa kombinerar automatiserad investering med mänskliga rådgivare: en app kan använda AI för dagliga beslut men också låta dig boka samtal med en certifierad planerare för komplexa frågor.

Chatbots och virtuell finansiell rådgivning

Konversations-AI (chatbots) har blivit ett nytt sätt att få ekonomisk hjälp. Virtuella assistenter som ChatGPT eller specialbyggda chatbots (t.ex. Cleos chatbot) kan svara på frågor om budgetering, skuld eller investeringar på begäran. Du kan bokstavligen fråga din telefon, "Hur mycket bör jag spara till en semester?" eller "Är det bättre att betala av mitt kreditkort eller göra en extra betalning på mitt lån?" och få omedelbar vägledning.

Nuvarande användningslandskap

Förtroende och begränsningar

Känslomässig förståelse saknas

Mänsklig preferens

Bästa praxis för användning av AI-chatbots

Använd som första hjälpen-assistent

Behandla AI-chatbots som en startpunkt för snabba insikter eller för att flagga uppenbara misstag, som förbisedda låneräntor.

Verifiera rekommendationer

Dubbelkolla alla AI-råd, särskilt för komplexa beräkningar eller skattedetaljer, med pålitliga källor eller yrkespersoner.

Kombinera AI med mänsklig expertis

Ställ frågor till en chatbot för att utforska alternativ, men bekräfta sedan planer med en certifierad finansiell rådgivare för större beslut.

Fördelar med AI i pengahantering

AI medför flera tydliga fördelar för personlig ekonomi och förändrar hur individer hanterar sina pengar med datadrivna insikter och automation.

Datadrivna insikter

AI kan gå igenom tusentals transaktioner på sekunder och avslöja spenderingstrender och sparmöjligheter som människor kan missa.

- Upptäcka ovanliga räkningar eller avgifter

- Exakta uppdelningar av utgiftskategorier

- Mönsterigenkänning över tidsperioder

Personalisering

AI-system lär sig från dina data och gör råden allt mer anpassade till dina unika vanor och ekonomiska situation.

- Anpassade sparplaner

- Flexibla budgetrekommendationer

- Inkomstjusterade strategier

Bekvämlighet och snabbhet

Tråkiga uppgifter som utgiftsspårning, prenumerationshantering eller skatteförberedelser automatiseras, vilket sparar tid och ansträngning.

- Finansiella uppdateringar i realtid

- Övervakning i bakgrunden dygnet runt

- Omedelbar kategorisering av transaktioner

Lägre kostnader

Till skillnad från traditionella finansiella rådgivare med höga avgifter eller kontominimum är de flesta AI-drivna ekonomiappar gratis eller mycket billiga.

- Genomsnittliga besparingar: 800–5000 kr/år

- Inga kontominimum

- Demokratiserad expertvägledning

AI fungerar som en digital finansiell coach – alltid tillgänglig, objektiv och datadriven. Den kan märka när du är på väg att missa ett sparmål och försiktigt justera din budget eller föreslå att flytta pengar till ett högavkastande konto automatiskt.

Utmaningar och överväganden

Trots AI:s löften finns viktiga försiktighetsåtgärder att ha i åtanke när man använder dessa verktyg för personlig ekonomihantering.

Noggrannhet och partiskhet

AI är inte ofelbar. Dess rekommendationer beror på datakvalitet och algoritmer. Akademiska tester av verktyg som ChatGPT har visat att även om råden kan vara användbara är de ofta generella och ibland felaktiga.

- Kan räkna fel på komplexa finansiella formler

- Kan förbise viktiga skattedetaljer

- Ger ibland generiska råd

Integritet och datasäkerhet

AI-ekonomiappar kräver känsliga data (bankkontouppgifter, spenderingshistorik, inkomst etc.) för att fungera effektivt. Detta väcker betydande integritetsfrågor.

Säkerhetsbästa praxis

- Välj välrenommerade plattformar med stark kryptering

- Granska sekretesspolicyer noggrant

- Bekräfta hur data lagras och delas

- Aktivera tvåfaktorsautentisering

- Övervaka konton regelbundet för ovanlig aktivitet

Förtroende och känslomässiga faktorer

Pengahantering involverar ofta känslor (t.ex. oro för skuld, glädje över ett köp). AI saknar verklig förståelse för känslor, vilket skapar ett betydande förtroendegap.

Kanadensiskt perspektiv

Amerikanskt perspektiv

Detta "mänskliga" gap innebär att AI bör komplettera, inte ersätta personligt omdöme och professionell vägledning. Till exempel kan en AI-app påminna dig om sparmål, men en betrodd rådgivare eller familjemedlem kan bäst hjälpa till att hantera oro kring att minska utgifter.

Medvetenhet och tillgänglighet

En betydande del av befolkningen är helt enkelt inte medveten om dessa verktyg ännu. Undersökningar visar att många aldrig hört talas om robo-rådgivare eller ekonomi-chatbots.

Utmaningar med digital klyfta

- Äldre kan uppleva AI-appar som skrämmande

- Mindre teknikkunniga användare möter inlärningskurvor

- Begränsad medvetenhet bromsar användartillväxt

- Komplexa gränssnitt kan vara ett hinder

Rekommenderad metod: Människa i loopen

Genom att förstå dessa begränsningar kan du använda AI säkrare. Experter rekommenderar att alltid ha en människa "i loopen": behandla AI som en rådgivare bland flera.

AI-analys

Använd AI för att analysera din budget för snabba insikter

Mänsklig granskning

Boka ett samtal med en finansiell rådgivare

Kombinerad strategi

Utveckla långsiktiga planer med expertvägledning

Att kombinera AI:s effektivitet med mänsklig tillsyn är för närvarande det mest effektiva tillvägagångssättet för personlig ekonomihantering.

Framåtblick

AI:s roll i personlig ekonomi förväntas växa betydligt. Marknadsanalytiker förutspår fortsatt expansion av AI-fintech-verktyg under de kommande åren, i takt med att algoritmer blir smartare och regelverk utvecklas.

Framväxande AI-ekonomifunktioner

Röststyrning

Plattformsintegration

Automatiserad förhandling

Prediktiv kassaflödesprognos

Smartare algoritmer

Regulatorisk utveckling

Vägen framåt

Slutligen lovar AI att göra pengahantering mer proaktiv och personlig. Den kan bryta ner komplexa ekonomiska mål i små, automatiserade uppgifter som driver oss mot bättre vanor. Ändå kommer den mänskliga faktorn att förbli avgörande.

De flesta konsumenter, särskilt yngre, ser AI som ett kraftfullt verktyg för att förstärka sina ekonomiska beslut, inte ersätta sitt omdöme. Genom att använda AI klokt – utnyttja dess datakraft och automation samtidigt som du förblir kritiskt engagerad – kan du njuta av smartare budgetering, smartare sparande och smartare investeringar, alla anpassade till ditt liv.

Toppappar för personlig ekonomi med AI

Cleo - AI Money Coach

Applikationsinformation

| Utvecklare | Utvecklad av Cleo AI Ltd, ett brittiskt fintech-företag grundat 2016, specialiserat på AI-drivna verktyg för personlig ekonomihantering. |

| Stödda enheter | Tillgänglig för iOS och Android-enheter, samt webbåtkomst via den officiella plattformen. |

| Språk / Länder | Främst stöd för engelska | Tillgänglig i Storbritannien, USA och Kanada med en växande global räckvidd. |

| Prissättningsmodell | Gratis Premium — Grundläggande budgetering och spårning gratis | Cleo Plus och Cleo Builder-prenumerationer låser upp kreditbyggande, kontantförskott och cashback-belöningar. |

Allmän översikt

Cleo är en AI-driven app för pengahantering som hjälper användare att ta kontroll över sin ekonomi genom intelligent budgetering, utgiftsspårning och personlig ekonomisk utbildning. Som din AI-ekonomiska assistent levererar Cleo handlingsbara insikter, sparstrategier och spenderingsråd via ett engagerande konversationsgränssnitt.

Appen gör personlig ekonomi roligare genom humor och interaktiva utmaningar, vilket gör budgetering mindre stressande och mer njutbar. Med funktioner som cashback-erbjudanden, skydd mot övertrassering och kreditpoängsövervakning ger Cleo användarna verktyg att bygga varaktigt ekonomiskt självförtroende.

Detaljerad introduktion

Cleo revolutionerar personlig ekonomihantering genom konverserande AI som kommunicerar naturligt med användare. Genom att säkert koppla till ditt bankkonto analyserar appen din inkomst, utgifter och spenderingsmönster för att leverera personliga insikter och handlingsbara rekommendationer.

AI-chattgränssnittet fungerar både som finansiell guide och motivationskälla. Fråga Cleo saker som "Hur mycket spenderade jag på mat förra veckan?" eller "Har jag råd med detta köp?" och få omedelbara svar med visuella sammanställningar och smarta förslag.

För användare som vill förbättra sina ekonomiska vanor erbjuder Cleo budgetutmaningar, måluppföljning och cashback-belöningar. Cleo Plus-planen lägger till kraftfulla verktyg för kreditbyggande, löneförskott och nödkontanter — som hjälper dig att hålla ekonomin trygg vid oväntade situationer.

Plattformen betonar ekonomisk läskunnighet genom att erbjuda praktiska råd, framstegsuppföljning och motivation i en engagerande, vänlig ton som gör pengahantering tillgänglig för alla.

Nyckelfunktioner

Interagera med Cleos intelligenta chatbot för att få omedelbara insikter om dina spenderingsvanor, sparframsteg och ekonomiska hälsa.

Automatisk kategorisering av utgifter och realtidsspårning av budgetar med visuella sammanställningar och spenderingsvarningar.

Få tillgång till små, räntefria förskott för att undvika övertrasseringsavgifter och behålla ekonomisk stabilitet.

Bygg eller förbättra din kreditvärdighet med Cleos säkrade kreditbyggande verktyg och framstegsuppföljning.

Skapa smarta spargrupper med automatiska överföringar och visuell framstegsuppföljning för att nå dina ekonomiska mål snabbare.

Tjäna cashback på köp gjorda via Cleos samarbetande handlare och maximera ditt sparande.

Få anpassade rekommendationer och handlingsbara råd för att förbättra din ekonomiska hälsa över tid.

Banknivå-kryptering och skrivskyddad åtkomst säkerställer att dina data och transaktioner förblir helt säkra.

Ladda ner eller åtkomstlänk

Användarguide

Ladda ner Cleo-appen från App Store eller Google Play, eller använd webbläsare via den officiella webbplattformen.

Skapa ditt Cleo-konto och koppla säkert dina bankkonton med bankklassad kryptering för AI-drivna ekonomiska insikter.

Använd AI-chattgränssnittet för att ställa frågor om utgifter, sätta budgetar eller få personlig ekonomisk rådgivning direkt.

Cleo kategoriserar automatiskt transaktioner och lyfter fram spenderingstrender med visuella sammanställningar och varningar.

Skapa anpassade sparmål eller aktivera automatiskt sparande genom Cleos smarta algoritm för att bygga förmögenhet utan ansträngning.

Lås upp avancerade verktyg inklusive löneförskott, kreditbyggande och cashback-belöningar för förbättrad ekonomihantering.

Få regelbundna uppdateringar och personliga rapporter för att hålla dig på rätt spår med dina ekonomiska mål och fira milstolpar.

Noteringar / Begränsningar

- Kontantförskott och kreditbyggare-funktioner är begränsade till betalande prenumeranter (Cleo Plus/Builder).

- Kräver bankkontokoppling för att leverera korrekta insikter och personliga rekommendationer.

- Vissa funktioner, som cashback eller belöningar, kan variera beroende på region och tillgänglighet hos handlare.

- Trots hög säkerhet är Cleo beroende av tredjepartsbank-API:er för dataåtkomst, vilket ibland kan påverka synkroniseringstider.

Vanliga frågor

Ja, Cleo erbjuder en gratisversion med budget- och AI-chattfunktioner. Premiumfunktioner finns dock tillgängliga via Cleo Plus och Cleo Builder-prenumerationer.

Ja, Cleo använder bankklassad kryptering och skrivskyddad åtkomst, vilket säkerställer att dina pengar och uppgifter förblir helt säkra. Dina ekonomiska data skyddas med branschstandardiserade säkerhetsprotokoll.

Ja. Funktionen Cleo Builder hjälper användare att bygga kredit via ett säkrat kreditkonto samtidigt som framsteg följs i appen, vilket gör kreditbyggande tillgängligt och transparent.

Cleo Plus kostar cirka 5,99 USD per månad (priser kan variera beroende på region) och inkluderar kreditbyggande verktyg, kontantförskott och cashback-belöningar.

För närvarande är Cleo endast tillgänglig i dessa tre länder, med potentiell global expansion planerad för framtiden.

Nej, Cleo är inte en bank. Det är en finansiell assistent-app som hjälper användare att hantera pengar över flera bankkonton genom att erbjuda insikter och verktyg för bättre ekonomiska beslut.

Cleo använder en vänlig, humoristisk chatbotstil och spelifierade ekonomiska utmaningar för att hålla användare engagerade samtidigt som de lär sig goda ekonomiska vanor. Det konverserande tillvägagångssättet gör ekonomihantering mindre skrämmande och mer njutbar.

Ja. Genom funktionen Cleo Cover kan användare få tillgång till små, räntefria förskott för att undvika övertrasseringsavgifter och behålla ekonomisk stabilitet.

Ja, Cleo är även tillgänglig via sin webbplattform, vilket gör att du kan hantera din ekonomi från vilken webbläsare som helst.

Ja, Cleo erbjuder kundsupport via sin inbyggda chatt och hjälpcenter för både gratis- och premiumanvändare, vilket säkerställer hjälp när du behöver det.

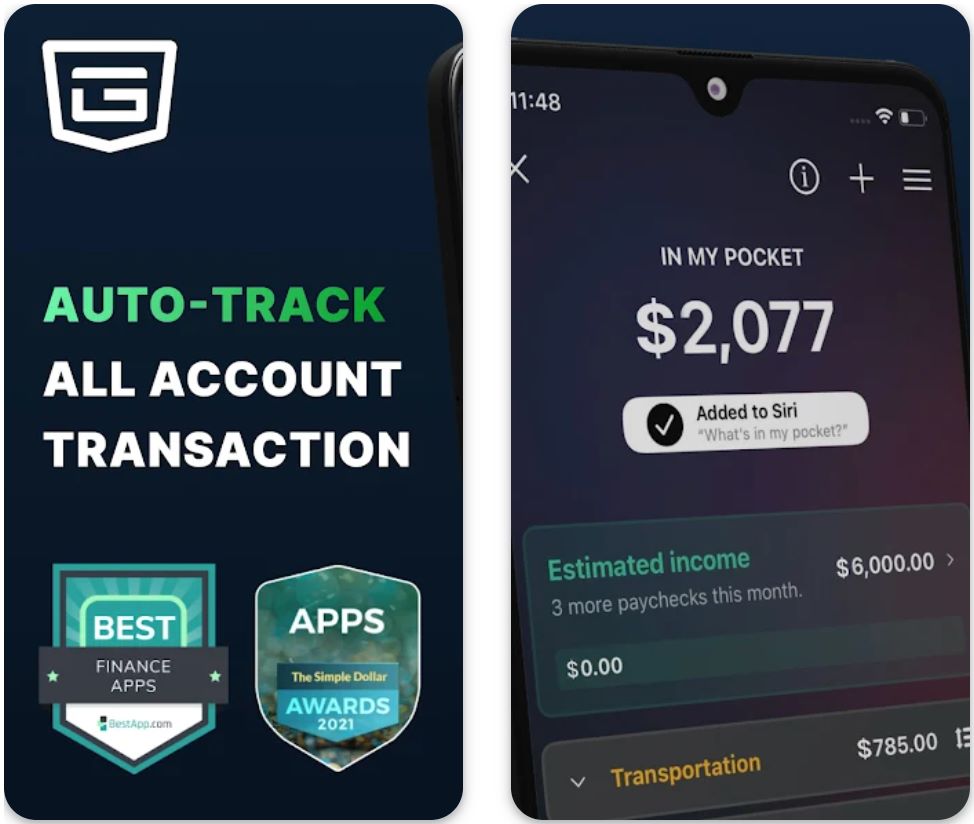

PocketGuard — Simple AI Budgeting

Applikationsinformation

| Författare / Utvecklare | PocketGuard, Inc. |

| Stödda enheter | iOS, Android och webbläsare |

| Språk / Länder | Engelska (USA, Kanada och utvalda globala regioner) |

| Prissättning | Gratisplan med grundläggande budgetverktyg + PocketGuard Plus premiumprenumeration |

Allmän översikt

PocketGuard — Enkel AI-budgetering är en app för personlig ekonomihantering som är utformad för att förenkla budgetering och utgiftsspårning med hjälp av AI-teknik. Appen hjälper användare att få kontroll över sina utgifter genom att automatiskt analysera inkomster, räkningar och utgifter för att visa hur mycket pengar som är säkra att spendera.

PocketGuards intelligenta budgetsystem eliminerar ekonomisk stress genom att automatiskt skapa budgetar, spåra prenumerationer och identifiera sparmöjligheter. Med ett rent gränssnitt och avancerad analys fungerar den som en allt-i-ett ekonomisk följeslagare för alla som vill hantera pengar smartare.

Detaljerad introduktion

PocketGuard använder AI-drivna finansiella insikter för att hjälpa användare att förstå sitt kassaflöde och fatta bättre beslut om utgifter. Genom att säkert koppla till dina bank- och kreditkonton ger appen realtidsspårning av inkomster, räkningar och transaktioner.

Funktionen "In My Pocket" beräknar omedelbart hur mycket disponibel inkomst du har kvar efter att ha täckt alla nödvändiga utgifter, vilket säkerställer att du aldrig spenderar för mycket. Appen kategoriserar automatiskt utgifter, upptäcker återkommande betalningar och hjälper dig att identifiera onödiga kostnader eller dubbla prenumerationer.

Med PocketGuard Plus får användare tillgång till avancerade funktioner som anpassade kategorier, skuldavbetalningsspårning och detaljerade utgiftsrapporter — vilket ger användarna möjlighet att bygga ekonomisk disciplin och långsiktiga sparvanor.

Nyckelfunktioner

Skapar automatiskt personliga budgetar baserade på utgifts- och inkomstmönster.

Beräknar dina tillgängliga pengar att spendera efter att ha tagit hänsyn till räkningar och sparande.

Organiserar transaktioner automatiskt för bättre översikt.

Övervakar förfallodatum och återkommande betalningar för att undvika missade räkningar.

Identifierar aktiva prenumerationer och hjälper dig att avsluta oönskade.

Gör det möjligt för användare att sätta ekonomiska mål, såsom skuldavbetalning eller nödfonder.

Visuella analyser visar hur dina pengar spenderas och var de kan sparas.

Använder banknivåkryptering för att skydda användardata och integritet.

Låser upp premiumverktyg som anpassade budgetar, kassaspårning och exportbara rapporter.

Ladda ner eller åtkomstlänk

Användarguide

Hämta PocketGuard-appen från App Store, Google Play eller besök webbversionen.

Registrera dig med din e-postadress eller fortsätt med Google/Apple för snabb åtkomst.

Koppla säkert dina finansiella konton för att automatiskt importera transaktionsdata.

Definiera dina sparmål, budgetkategorier och utgiftsgränser.

Låt PocketGuard automatiskt kategorisera och övervaka dina dagliga utgifter.

Kontrollera hur mycket säkra pengar du har kvar att spendera efter att ha täckt det nödvändiga.

Få tillgång till premiumbudgetverktyg för detaljerade insikter och avancerad kontroll.

Noteringar & begränsningar

- Vissa funktioner som anpassade kategorier och skuldspårning kräver en PocketGuard Plus-prenumeration.

- Stöder för närvarande främst bankkonton från USA och Kanada.

- Det kan ta 24–48 timmar att synkronisera transaktioner beroende på din bank.

- Begränsat stöd för valutor och språk.

- Kräver internetanslutning för realtidssynkronisering av data.

Vanliga frågor

Ja, appen erbjuder en gratisversion med grundläggande budgetfunktioner. Premiumfunktioner finns via PocketGuard Plus.

PocketGuard använder säkra, skrivskyddade anslutningar via betrodda finansiella aggregatorer, vilket säkerställer att dina data förblir privata och skyddade.

Ja, användare kan koppla flera check-, sparkonto- och kreditkonton.

Den AI-drivna "In My Pocket"-funktionen ger realtidsuppföljning av disponibel inkomst, vilket gör det enklare att undvika överutgifter.

Även om den främst är designad för användare i USA och Kanada kan begränsad funktionalitet finnas internationellt.

PocketGuard använder banknivå 256-bitars SSL-kryptering och skrivskyddad åtkomst för att hålla användardata säkra.

Appen hjälper till att identifiera aktiva prenumerationer och ger vägledning för avbokning, men själva avbokningen beror på tjänsteleverantören.

Premiumanvändare får tillgång till anpassade kategorier, kassaspårning, skuldavbetalningsplanering och exportbara finansiella rapporter.

Ja, användare kan övervaka flera konton, inklusive delade, under en enda instrumentpanel.

Ja. Appen föreslår sparmöjligheter och hjälper dig att effektivt fördela medel till dina ekonomiska mål.

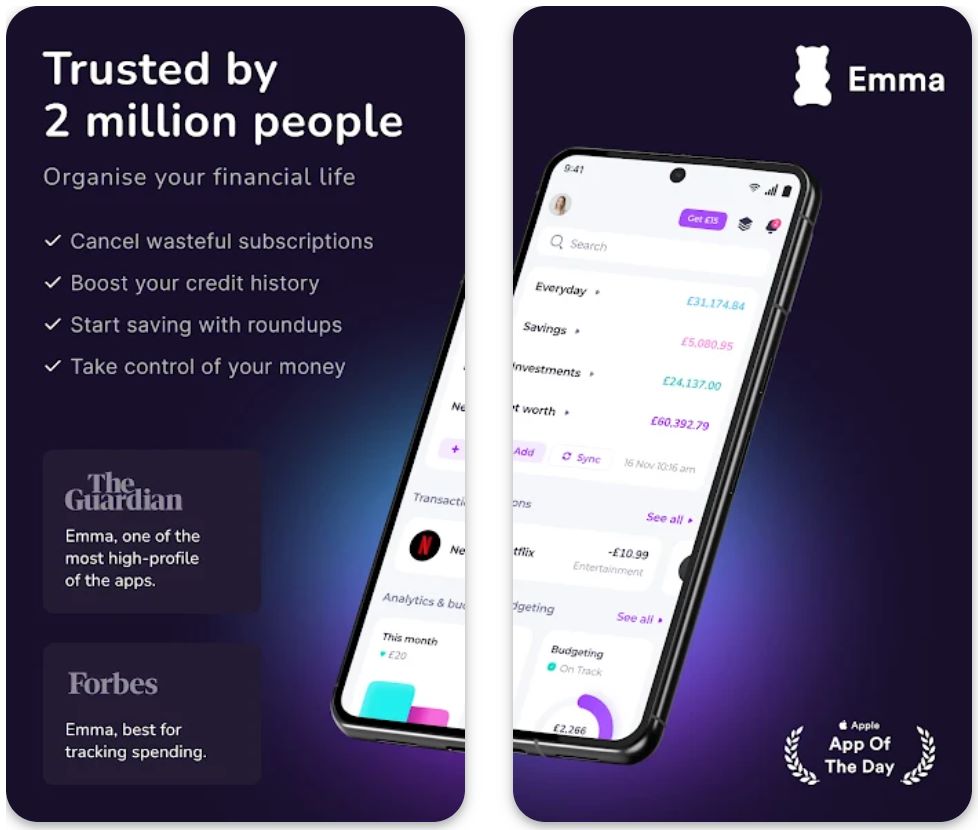

Emma — European Budget & Subscription Manager

Applikationsinformation

| Författare / Utvecklare | Emma Technologies Ltd. |

| Stödda enheter | Kompatibel med iOS och Android-enheter; även tillgänglig via webbpanel |

| Språk / Länder | Tillgänglig på engelska; stödjer användare i Storbritannien, EU, USA och Kanada |

| Gratis eller Betald | Erbjuder en gratisversion med grundläggande funktioner och en premiumplan (Emma Pro) för avancerade ekonomiska insikter och anpassning |

Allmän Översikt

Emma — European Budget & Subscription Manager är en smart app för personlig ekonomi som hjälper användare att hantera pengar, följa utgifter och kontrollera prenumerationer utan ansträngning. Designad för moderna användare i Europa och bortom, kopplar Emma säkert till bankkonton, kreditkort och investeringsplattformar för att ge en enhetlig bild av din ekonomiska hälsa.

Appen använder intelligenta insikter för att upptäcka onödiga utgifter, förhindra övertrasseringar och identifiera återkommande prenumerationer som du kanske glömt bort. Oavsett om du försöker spara mer, planera din månadsbudget eller hålla koll på flera konton, erbjuder Emma en ren och automatiserad lösning för ekonomisk förvaltning.

Detaljerad Introduktion

Lanserad av Emma Technologies Ltd., syftar denna innovativa budgeteringsapp till att göra personlig ekonomi enkel och transparent. Appen integreras med över 600 finansiella institutioner i Europa, Storbritannien och Nordamerika, vilket gör det möjligt för användare att se alla sina konton på ett ställe.

Emma kategoriserar automatiskt transaktioner, upptäcker räkningar och prenumerationer samt ger aviseringar vid ovanliga utgiftsmönster. Dess AI-baserade analys hjälper användare att förstå vart pengarna går och hur de kan optimera sina kostnader.

Med Emma Pro kan användare låsa upp avancerade funktioner som anpassade kategorier, dataexporter och smarta budgetverktyg, vilket förvandlar appen till en kraftfull ekonomisk assistent. Emma är betrodd av tusentals användare över Europa och kallas ofta för ”din bästa ekonomiska vän” tack vare sin vänliga design och noggrannhet.

Nyckelfunktioner

Visa bankkonton, kreditkort och investeringar i en enhetlig panel för fullständig ekonomisk översikt.

Upptäcker automatiskt återkommande betalningar och hjälper till att identifiera oönskade prenumerationer för att spara pengar.

Grupperar intelligenta utgifter i kategorier för enkel budgetuppföljning och analys.

AI-baserad analys lyfter fram sparmöjligheter och utgiftstrender för att optimera din ekonomi.

Sätt utgiftsgränser per kategori och få aviseringar när du närmar dig din budgetgräns.

Förhindrar överutgifter genom att följa kontosaldon i realtid med proaktiva aviseringar.

Fungerar sömlöst med konton i olika valutor, idealiskt för europeiska användare.

Lås upp avancerade funktioner som anpassade kategorier, transaktionsredigering och dataexporter.

Använder 256-bitars SSL-kryptering och läsbehörighet för att skydda känslig ekonomisk data.

Ladda ner eller åtkomstlänk

Användarguide

Hämta appen från App Store eller Google Play, eller använd webbpanelen för skrivbordsåtkomst.

Registrera dig med din e-post eller fortsätt med Google/Apple för snabb registrering.

Koppla dina finansiella konton säkert för realtidsuppföljning och analys.

Granska kategoriserade utgifter, prenumerationssammanfattningar och AI-genererade insikter.

Definiera månadsbudgetar och följ framsteg automatiskt.

Se återkommande avgifter, avsluta oönskade tjänster och håll koll på räkningar.

Lås upp premiumverktyg som anpassade budgetar, exportalternativ och datafilter.

Noteringar & Begränsningar

- Vissa banker eller finansiella institutioner kan ha begränsad integration i vissa regioner

- Emma Pro-planen är prenumerationsbaserad och förnyas månads- eller årsvis

- Valutakonvertering kan variera något för konton med flera valutor

- Kräver en aktiv internetanslutning för att synkronisera finansiell data

- Appen stöder för närvarande endast engelska

Vanliga frågor

Ja, Emma erbjuder en gratisplan med grundläggande funktioner för budgetering och prenumerationsspårning. Användare kan uppgradera till Emma Pro för avancerade verktyg.

Emma använder 256-bitars SSL-kryptering och läsbehörighet till bankkonton, vilket säkerställer att användardata förblir privat och säker.

Emma är tillgänglig i Storbritannien, Europeiska unionen, USA och Kanada.

Ja, Emma upptäcker alla återkommande betalningar och hjälper dig att identifiera oönskade prenumerationer för avslut.

Ja. Emma stödjer att koppla flera konton och kreditkort för samlad uppföljning.

Emma Pro erbjuder avancerade funktioner som anpassade kategorier, dataexporter, transaktionsredigering och mer personliga budgetalternativ.

Ja, Emma integreras med olika finansiella plattformar för att övervaka investeringskonton och sparmål.

Emma analyserar dina utgiftsvanor, identifierar onödiga kostnader och föreslår sätt att minska onödiga utgifter.

Ja, flera konton kan kopplas till en och samma profil för omfattande ekonomisk uppföljning.

Nej. Emma säljer eller delar inte dina personliga eller ekonomiska uppgifter med tredje part.

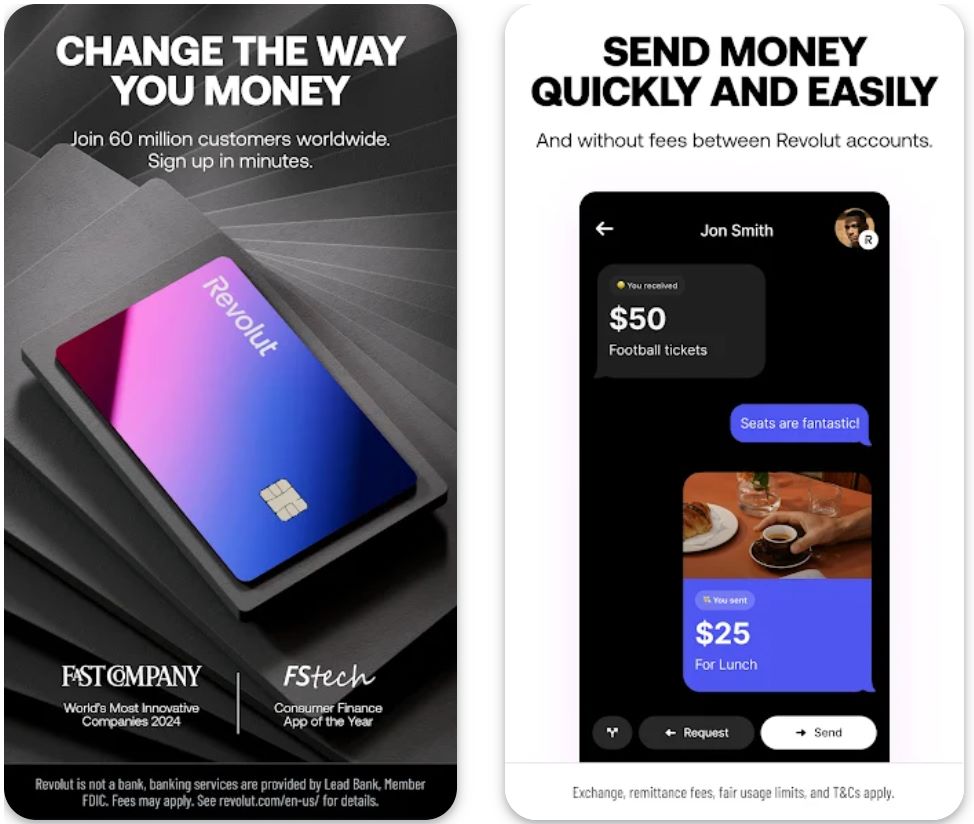

Revolut — Neobank with Expanding AI Assistant

Applikationsinformation

| Författare / Utvecklare | Revolut Ltd. |

| Stödda enheter | iOS, Android och webbläsare |

| Språk / Länder | Stöder över 30 språk och finns tillgängligt i mer än 200 länder och regioner världen över |

| Gratis eller Betald | Gratisplan tillgänglig, plus flera premiumnivåer (Plus, Premium, Metal och Ultra) med avancerade finansiella och AI-funktioner |

Allmän översikt

Revolut — Neobank med Expanderande AI-assistent är en banbrytande digital bankplattform som kombinerar ekonomisk förvaltning, internationella överföringar, sparande, investeringar och avancerade AI-drivna verktyg i en app. Grundat 2015 har Revolut utvecklats från en enkel valutaväxlingstjänst till en av världens ledande neobanker, som ger användare möjlighet att hantera alla aspekter av sin ekonomi globalt.

Revoluts senaste innovation är dess AI-drivna assistent, designad för att hjälpa användare analysera utgifter, upptäcka ovanliga transaktioner och ge personliga finansiella insikter — vilket gör pengahantering smartare och säkrare än någonsin.

Detaljerad introduktion

Revolut är inte bara en bankapp — det är ett komplett finansiellt ekosystem. Användare kan hålla och växla över 30 valutor, skicka internationella överföringar till konkurrenskraftiga priser och få tillgång till verktyg för budgetering, investering och handel.

Plattformens AI-assistent representerar ett betydande steg i automatisering av personlig ekonomi. Genom maskininlärning kan assistenten spåra användarens konsumtionsvanor, förutse framtida utgifter och erbjuda skräddarsydda rekommendationer för att förbättra sparande eller minska onödiga kostnader. Den tillhandahåller också bedrägeridetektion i realtid och omedelbara varningar för ökad kontosäkerhet.

Med kontinuerliga uppdateringar integrerar Revolut modern bankverksamhet med nästa generations AI för att leverera en sömlös, allt-i-ett-finansiell upplevelse som passar privatpersoner, frilansare och företag världen över.

Nyckelfunktioner

Få insikter om utgifter i realtid, sparförslag och personliga varningar drivna av maskininlärning.

Håll och växla över 30 valutor till interbankkurser utan dolda avgifter.

Kategorisera automatiskt utgifter och följ budgetar effektivt med visuella analyser.

Investera i kryptovalutor, ETF:er och aktier direkt i appen med konkurrenskraftiga priser.

Skicka och ta emot pengar internationellt med minimala avgifter och realtidsväxelkurser.

Skapa automatiska sparmål och tjäna ränta på ditt saldo med flexibla villkor.

Använd säkra, engångskort för online- och offlineköp med omedelbara kortfrysningar.

Följ, hantera och avsluta prenumerationer enkelt via den intuitiva panelen.

AI övervakar transaktioner för ovanlig aktivitet och varnar användare omedelbart för maximal säkerhet.

Högre gränser, reseförsäkring, cashback och exklusiva Metal- eller Ultra-förmåner för premiumkunder.

Ladda ner eller åtkomstlänk

Användarguide

Hämta Revolut-appen från Google Play, App Store eller använd via webbplattformen.

Registrera dig med ditt telefonnummer och verifiera din identitet för säkerhetskrav.

Koppla ditt bankkonto eller kort för att omedelbart föra över pengar till ditt Revolut-konto.

Använd flikar för utgiftsanalys, valutaväxling, sparande och investeringsfunktioner.

Slå på den inbyggda AI-assistenten för att få personliga budgetråd och transaktionsvarningar.

Skicka pengar globalt, dela räkningar eller betala via QR-kod eller virtuellt kort enkelt.

Välj mellan Plus, Premium, Metal eller Ultra för fler finansiella verktyg och belöningar.

Noteringar och begränsningar

- Tillgång till funktioner (t.ex. kryptohandel, aktieinvesteringar) kan variera mellan länder

- Identitetsverifiering krävs innan alla banktjänster kan användas

- Vissa internationella överföringar kan medföra mindre växlingsavgifter

- AI-insikter och avancerad analys är optimerade för premiumanvändare

- Internetanslutning krävs för realtidssynkronisering av kontot

Vanliga frågor

Revoluts AI-assistent hjälper användare att övervaka konsumtionsmönster, upptäcka ovanlig aktivitet och få personliga finansiella insikter drivna av maskininlärningsalgoritmer.

Ja, Revolut verkar under banklicenser i flera länder och tillhandahåller reglerade finanstjänster med full efterlevnad.

Ja, Revolut erbjuder en gratisplan med grundläggande funktioner. Premiumnivåer ger ytterligare förmåner som högre gränser, försäkringar och AI-baserad analys.

Ja, användare kan köpa, sälja och hålla flera kryptovalutor direkt i appen med konkurrenskraftiga priser och säker förvaring.

Revolut använder bankklassad kryptering och AI-driven bedrägeridetektion för att säkerställa maximal kontosäkerhet och skydda dina medel.

Absolut. Revolut stöder utgifter och överföringar i över 200 länder med interbankväxelkurser och minimala avgifter.

Du kan hålla, växla och spendera i mer än 30 globala valutor med realtidsväxelkurser.

AI-assistenten kategoriserar automatiskt transaktioner, sätter budgetar och ger sammanfattningar av utgifter för att hålla användare på rätt spår med sina ekonomiska mål.

Ja, för många användare fungerar Revolut som ett komplett digitalt bankalternativ, med betalningar, sparande och investeringsverktyg i en plattform.

Revolut erbjuder Plus, Premium, Metal och Ultra-planer, som alla ger förbättrade förmåner, AI-drivna verktyg och exklusiva belöningar.

Plum — Automation-first Saving & Investing (EU/UK focus)

Applikationsinformation

| Författare / Utvecklare | Plum Fintech Ltd. |

| Stödda enheter | iOS, Android och webbläsare |

| Språk / Länder | Engelska — Tillgängligt i hela Storbritannien och EU-länder inklusive Frankrike, Spanien och Irland |

| Gratis eller Betald | Gratisplan med valfria betalplaner (Plum Pro, Ultra och Premium) för avancerade investerings- och automatiseringsfunktioner |

Allmän Översikt

Plum — Automation-först Sparande & Investering är en smart AI-driven finansiell app designad för att hjälpa användare i EU och Storbritannien att automatiskt spara, investera och hantera pengar effektivt. Den utnyttjar intelligent automation och beteendeanalys för att förenkla privatekonomi — från optimering av sparande till hantering av investeringar — allt inom ett säkert och användarvänligt gränssnitt.

Plums uppdrag är att göra sparande enkelt och investering tillgängligt. Dess AI-assistent lär sig användarens vanor, övervakar utgifter och flyttar automatiskt överskottsmedel till sparande eller investeringar, vilket säkerställer att användarna bygger förmögenhet utan konstant manuellt arbete.

Detaljerad Introduktion

Grundat 2016 är Plum en av Storbritanniens ledande AI-drivna plattformar för pengahantering, som integrerar teknik och finans för att hjälpa användare ta kontroll över sin ekonomiska framtid.

När det är kopplat till ett bankkonto analyserar Plum inkomster och konsumtionsmönster med säker Open Banking-teknik. Därefter avgör den hur mycket som säkert kan sparas och automatiserar sparande till anpassade mål. Användare kan även välja att investera i diversifierade portföljer, inklusive aktier, ETF:er och hållbara fonder.

Plums automation-först strategi eliminerar stressen med budgetering samtidigt som användarna får full transparens och kontroll över sina pengar. Dess AI anpassar sig kontinuerligt till varje användares livsstil, vilket säkerställer att sparande och investering sker sömlöst i bakgrunden.

Nyckelfunktioner

AI analyserar transaktioner och avsätter automatiskt små summor till sparande.

Tillgång till diversifierade fonder, inklusive teknik-, hållbarhets- och globala aktieportföljer.

Spårning i realtid av konsumtionsmönster och finansiella vanor.

Identifiera bättre erbjudanden för hushållstjänster och tjäna cashback på köp.

Förbereder användare automatiskt för oväntade utgifter.

Avrundar köp och investerar eller sparar växeln.

Hantera medel i både brittiska och EU-valutor.

Regleras av Financial Conduct Authority (FCA) och använder banknivå-kryptering för dataskydd.

Skapa flera spargrupper för resor, nödsituationer eller långsiktiga mål.

Få tillgång till avancerade investeringsverktyg, personliga insikter och högre automatiseringsgränser.

Ladda ner eller åtkomstlänk

Användarguide

Installera från Google Play, App Store eller använd via webbappen.

Registrera dig med din e-post och verifiera din identitet via säkra Open Banking-anslutningar.

Koppla ditt huvudkonto för att låta Plum analysera utgifter och identifiera sparmöjligheter.

Slå på AI:ns automatisering för att börja överföra små summor till dina spargrupper.

Välj mellan grundläggande eller tematiska investeringsportföljer enligt din riskpreferens.

Övervaka sparande, avkastning och utgifter direkt i instrumentpanelen.

Abonnera på Plum Pro, Ultra eller Premium för funktioner som budgetinsikter, cashback och diversifierade investeringar.

Viktiga anteckningar & begränsningar

- Investeringsportföljer är föremål för marknadsrisker och värdefluktuationer.

- Vissa funktioner (t.ex. cashback, investeringsåtkomst) finns endast i betalplaner.

- Tillgänglighet kan variera beroende på användarens land inom EU eller Storbritannien.

- Internetanslutning och Open Banking-åtkomst krävs för full funktionalitet.

- Plum ger inte personlig finansiell rådgivning — användare bör själva bedöma investeringsrisker.

Vanliga frågor

Plum är en AI-driven app som automatiserar sparande, investering och budgetering för användare i Storbritannien och EU.

Ja, Plum använder banknivå-kryptering och är auktoriserad och reglerad av FCA i Storbritannien.

AI analyserar utgifter och inkomster och överför sedan små, säkra summor automatiskt till sparfickor.

Ja, Plum ger tillgång till olika investeringsfonder och aktier & aktiesparande ISA (Storbritannien).

Ja, det finns en gratisversion, men användare kan uppgradera till Pro, Ultra eller Premium för fler funktioner.

Plum finns för närvarande i Storbritannien, Frankrike, Spanien och Irland, med planer på att expandera ytterligare inom EU.

Ja, användare kan ta ut sina sparade pengar när som helst utan straffavgift.

Plum kombinerar AI-automation, smart investering och utgiftsanalys i en enhetlig plattform.

Ja, minimibeloppet för investering börjar vanligtvis från £1 eller €1, beroende på land.

Ja, Plum kan identifiera billigare avtal för hushållsräkningar och hjälpa till att byta leverantör automatiskt.

No comments yet. Be the first to comment!